Cybersecurity in Foodservice – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cybersecurity In Foodservice Market Overview

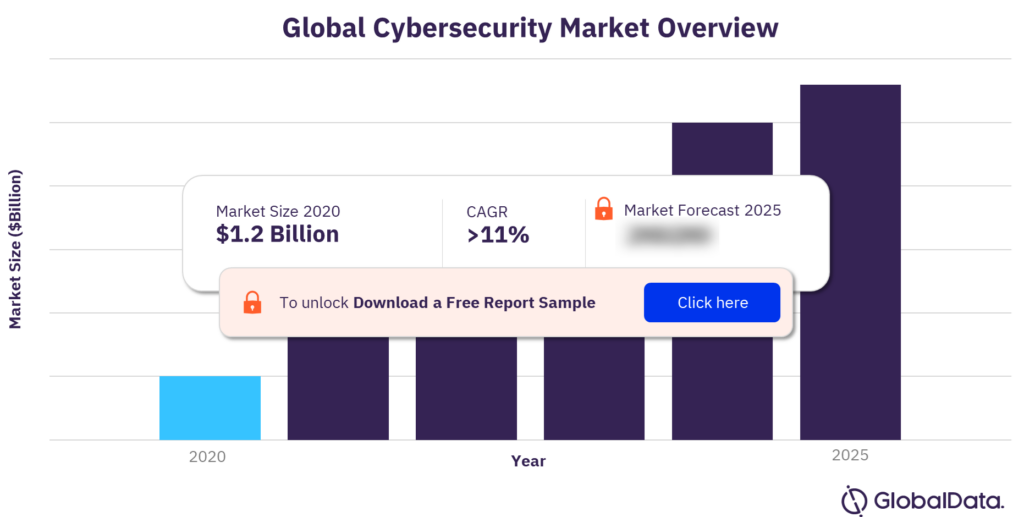

The global cybersecurity revenue in foodservice was $1.2 billion in 2020. The market is expected to grow at a CAGR of more than 11% during the forecast period. The COVID-19 pandemic forced foodservice companies to digitally transform, shifting to online delivery, remote communication with employees, and digitalizing supply chain management.

Foodservice suppliers that neglect the cybersecurity of operational technology (OT) are at risk of increasingly frequent and complex ransomware attacks, as evidenced by JBS’ ransomware attack in 2021. The growth of ransomware as a service (RaaS) will only expedite the importance of OT chip-based cybersecurity.

The Global Cybersecurity Market Overview

For more insights on the global cybersecurity market forecast, download a free report sample

What is the impact of cybersecurity in the foodservice market?

Corporate boards face increasing pressure to adopt more sustainable policies, but companies must assess their impact on society. Human rights violations come in many forms, including data breaches, as every individual has a right to privacy. Foodservice companies process and store a wealth of employee and consumer data. Breaches of security can lead to unauthorized access, use, destruction, loss, alteration, or disclosure of this personal data.

COVID-19 has increased cybersecurity risk and created new opportunities for hackers. New digital strategies implemented during the pandemic can improve the foodservice sector’s operational efficiency. However, companies that digitalize hastily and neglect to expand their cybersecurity capabilities appropriately can expect negative consequences.

Digitalization of the foodservice sector relies heavily on wireless connections and online transactions made by customers. This has increased the attack surface that hackers are presented with, the ease with which they can navigate networks of connected devices, and the wealth of data available.

Before the emergence of widespread remote working, corporate networks that held company data and applications were protected by a firewall and other security tools. However, additional cybersecurity measures have become necessary as companies increasingly adopt VPNs to provide employees remote access to the entire corporate network. Giving employees VPN access to the corporate network exposes the organization to increased threats from hackers and other unauthorized individuals. Network security solutions such as ZTNA and SASE can help address this problem.

What are the key cybersecurity value chains?

The key cybersecurity value chains can be divided into three segments: hardware, software, and services.

Hardware

With chips now being used in mission-critical servers and safety-critical applications, protecting chips from cyberattacks is becoming more critical and more expensive. Systems vendors such as Apple and Amazon are increasingly designing their chips rather than buying commercially developed devices and intellectual property (IP) created by third-party developers.

Software

The software element of the cybersecurity value chain comprises the following areas: identity management, network security, endpoint security, threat detection & response, cloud security, data security, email security, application security, unified threat management, and vulnerability management.

Services

The services element of the cybersecurity value chain comprises the following areas: managed security services, post-breach response services, and risk & compliance services. Services are typically outsourced because of the complexity of addressing cybersecurity-related issues, such as staying on top of vulnerabilities, identifying & responding to threats, and meeting compliance requirements.

Which are the leading foodservice companies deploying cybersecurity?

The leading foodservice companies deploying cybersecurity are Al Hatab Bakery, Favor Delivery, Skylark Group, Starbucks, Swiggy, and Welbilt.

Which are the specialist cybersecurity vendors in the foodservice market?

The specialist cybersecurity vendors in the foodservice market are Auvesy-MDT, Cali Group, Cardonet, Dragos, Eat IT Drink IT, NCR, Netskope, PDI Software, Preciate, Singtel, SonicWall, TitanHQ, and VikingCloud.

Market report scope

| Market size (Year – 2020) | $1.2 billion |

| CAGR | >11% |

| Forecast period | 2020 to 2025 |

| Key value chains | Hardware, Software, and Services |

| Leading foodservice companies | Al Hatab Bakery, Favor Delivery, Skylark Group, Starbucks, Swiggy, and Welbilt |

| Specialist cybersecurity vendors | Auvesy-MDT, Cali Group, Cardonet, Dragos, Eat IT Drink IT, NCR, Netskope, PDI Software, Preciate, Singtel, SonicWall, TitanHQ, and VikingCloud |

Reasons to Buy

- Position yourself for success by understanding the importance of cybersecurity for your company and how major challenges for the foodservice sector will accelerate the need for improved security of both informational technology (IT) and operational technology (OT) systems.

- Source the leading and specialist vendors for cybersecurity for the foodservice industry. Discover what each vendor offers, and who some of their existing clients are.

- Quickly identify attractive investment targets in the foodservice industry by understanding which companies are most likely to be winners in the future based on our thematic scorecard.

- Gain a competitive advantage in the foodservice industry over your competitors by understanding the future trends of cybersecurity and how to be proactive in preventing future attacks which can harm your company both reputationally and financially.

Accenture

Airbus (Stormshield)

Akamai

Al Hatab Bakery

Alert Logic

Alibaba

Alphabet

Alphabet (Google)

Alphabet (Siemplify)

Amazon

AMD

Analog Devices

AnyVision

Appgate

Apple

Aqua Security

Aramark

Arby's

Arcon

AT&T

Atos

Attivo Networks

Autogrill

Auvesy-MDT

Aware

BAE Systems

Baidu

Barracuda

Barracuda Networks

BeyondTrust

Bill Miller Bar-B-Q

BioEnable

Blackberry

BMC Helix

Brinker

Broadcom

BT

Buffalo Wild Wings

Burger King

Cadence Design Systems

Café Zupas

Cali Group

CaliBurger

Capgemini

Cardonet

Cato

CEC Entertainment

CFA Properties

Check Point Software

Checkers Drive-In Restaurants

Checkmarx

Chili's

China Telecom

China Unicom

Chipotle

ChowNow

CipherCloud

Cisco

Clear Secure

Clearview

Cloudcheckr

Cloudera

Cloudflare

CloudPassage

CMITech

Coca-Cola

Code42

Cognitec

Cognizant

Compass Group

Contrast Security

CorFire

Costa Coffee

CrowdStrike

CyberArk

Cyberbit

Cybereason

Cynet

D3 Security

Darden Restaurants

Darktrace

Dashlane

Delinea

Deliveroo

Dell Technologies

Deutsche Telekom

Dickey's Barbeque Pit

Dine Brands Global

Doctor's Associates (Subway)

Domino's

DoorDash

Dragos

Dunkin' Donuts

Duo Security

DXC Technology

Eat IT Drink IT

ekey

Equifax

Ermetic

Exabeam

Expanse

Extreme

EY

Eyelock

F5 Networks

Favor Delivery

Five Guys

Forcepoint

Forescout

ForgeRock

Fortinet

Foxpass

Fugue

Fujitsu

GES Group

GitLab

HCL Technologies

HelloFresh

Helpsystems

Herjavec Group

HID Global

Hitachi

Homeslice Pizza

Horizon Robotics

HPE

Huawei

IBM

IBM (Red Hat)

Idemia

iFlytek

Illumio

Ilumio

Impulse

Informatica

Infosys

Innovatrics

Inspire Brands

Intel

Invicti

iProov

Iris ID

IriusRisk

Ironscales

Ivanti

Ivanti (MobileIron)

Japan Computer Vision

JBS

Jollibee Foods

Juniper Networks

Kairos

KFC

KnowBe4

KPMG

KT

Lacework

LastPass

Lindsay Australia

Little Ceasars

Lockheed Martin

LogMeIn

LogMeOnce

Logrhythm

Lookout

Lumen Technologies

ManageEngine

Marvell

Mastercard

McDonald's

Megvii

Mentor Graphics

Micro Focus

Micron Semiconductor

Microsoft

Mimecast

Navisite

NCC

NCR

NEC

Netskope

Nokia

NordPass

Northrop Grumman

NTT Data

NXP Semiconductors

NXT-ID

Okta

Okta

Onapsis

One Identity

OneLogIn

OneSpan

OneTrust

Oracle

Orange

Orca Security

Palantir

Palo Alto Networks

Panda Restaurant Group

Papa John's

Payface

PDI Software

Perimeter 81

Ping Identity

Pollo Campero

Popeyes

PopID

Portnox

Proofpoint

PwC

Qualys

Rapid7

Raytheon BBN

Raytheon Technologies

RedSeal

Renesas

Resolver

Restaurant Brands International

Rhebo

RSA

Ruckus

SAIC

SailPoint Technologies

Samsung Electronics

Science on Call

SecureAuth

SecureOne

Secureworks

Securonix

SenseTime

SentinelOne

Seven & I

Sift Security

Singtel

Singtel (Trustwave)

Skybox Security

Skyhigh Security

Skylark Group

Smoothie King

Snyk

Sodexo

Softbank (Arm)

SolarWinds

SonicWall

Sophos

Splunk

Starbucks

STMicroelectronics

Sumo Logic

Swiggy

Swimlane

Synopsys

Sysnet

Tanium

Tata Consultancy Services

Tech Mahindra

Tech5

Telstra

Tenable

Tessian

Thales

The Cheesecake Factory

ThreatConnect

Threatmetrix

Threatmodeler

TitanHQ

Trellix

Trellix

Trend Micro

TrueFace.AI

Trustwave

Tumbleweed Restaurants

Untangle

Veracode

Verizon

Versa

VikingCloud

VMware

WatchGuard

Welbilt

Wendy's First Kitchen

Whataburger

Whitbread

WhiteHat Security

Wipro

Yahoo

Yubico

Yum China

Yum! Brands

Zscaler.

Table of Contents

Frequently asked questions

-

What was the global cybersecurity market size in 2020?

The global cybersecurity market size was $1.2 billion in 2020.

-

What is the global cybersecurity market growth rate?

The global cybersecurity market is expected to grow at a CAGR of more than 11% during the forecast period.

-

What are the key cybersecurity value chains?

The key cybersecurity value chains can be divided into three segments: hardware, software, and services.

-

Which are the leading foodservice companies deploying cybersecurity?

The leading foodservice companies deploying cybersecurity are Al Hatab Bakery, Favor Delivery, Skylark Group, Starbucks, Swiggy, and Welbilt.

-

Which are the specialist cybersecurity vendors in the foodservice market?

The specialist cybersecurity vendors in the foodservice market are Auvesy-MDT, Cali Group, Cardonet, Dragos, Eat IT Drink IT, NCR, Netskope, PDI Software, Preciate, Singtel, SonicWall, TitanHQ, and VikingCloud.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports