Education Technology (EdTech) Market Size, Share and Trends Analysis Report by Region, End User (Pre-K, K-12, Post-Secondary, Corporate Workforce), and Segment Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in the ‘Education Technology (EdTech) Market’ report:

- EdTech market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the payment type segments.

- The competitive landscape: an examination of the positioning of leading players in the EdTech market.

- Porter’s five forces analysis: demonstrates the strength of suppliers and buyers along with market competition in the market.

- Company snapshots: analysis of the market position of leading service providers in the EdTech market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

How is the ‘EdTech Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the report today for valuable insights that will help you to make strategic decisions.

- This market intelligence report offers a thorough, forward-looking analysis of the global EdTech market, its end use, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- The report also highlights key end-use segments (Pre-K, K-12, Post-Secondary, and Corporate/Workforce).

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in EdTech markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help EdTech stakeholders, service providers, and other players succeed in growing the EdTech market globally.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in EdTech markets.

We recommend this valuable source of information to anyone involved in:

- EdTech Device Manufacturers

- EdTech Software & Service Providers

- EdTech Platform Vendors

- Learning Material Providers

- Technology Providers & Enablers

- Learning Platform Providers

- EdTech Platform Vendors

- Academic Institutions

- Professional Services – Investment Banks, PE/VC firms, Consultants, and Consulting Firms

To Get a Snapshot of the EdTech Market Report, Download a Free Report Sample

EdTech Market Report Overview

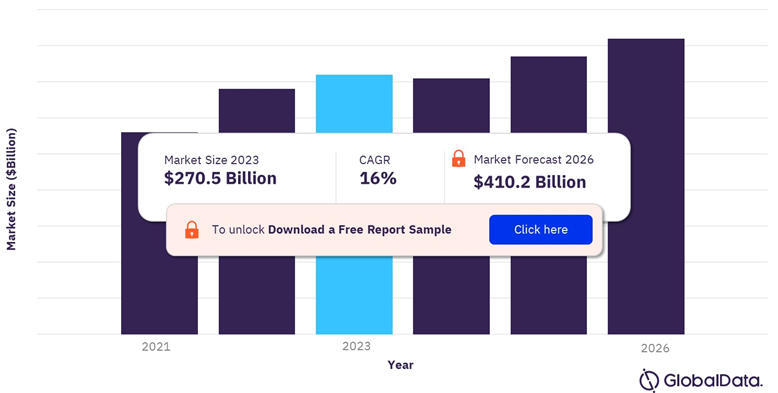

The Education Technology (EdTech) market size will be valued at US$ 270.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.0% over the forecast period. The surge in disposable income of families coupled with government initiatives across economies to provide technically advanced education facilities to students has been the primary driver favoring the market growth. Furthermore, the growing popularity of blended learning along with the soaring adoption of generative Artificial Intelligence (AI) such as ChatGPT, Perplexity AI, BARD, Chatsonic AI, Jasper Chat, and LaMDA, among others in the education sector is also expected to bode well for EdTech market growth over the next five years.

Over the last few years, the EdTech market has gained traction attributed to technological advancements in traditional teaching institutions through the adoption of sophisticated learning tools to improvise classroom-level education. Additionally, the collaborative approach between EdTech companies, educational institutions, and enterprises has transformed the learning process over the last few years. For instance, in October 2021, Anthology, one of the higher education software solution providers completed its merger with Blackboard Inc., one of the globally recognized EdTech software and solutions company to provide enhanced personalized experiences and insights to students and corporates across their learning lifecycle. Further, the adoption of digital devices such as tablets, and software-based assessment tools and game-based learning tools also helps learners enhance visual skills and improve interaction as well as cooperation with peers.

Due to COVID-19, the industry witnessed a tremendous growth in adoption of video-assisted learning enabling students to enhance their comprehension and social-emotional skills. Furthermore, with the adoption of AI-based learning platforms such as Google AI platform and MATHia, teachers and lecturers can identify struggling students. This would further provide personalized attention to students, thereby improving learning experiences. Also, for corporate learners, advancements in AI based learnings through integration of collaborative tools is expected to create the demand for online courses over the next few years.

EdTech Market Overview, 2019-2026 ($ Billion)

View Sample Report for Additional Insights on the EdTech Market Forecast, Download a Free Report Sample

COVID-19 has further accelerated the EdTech market growth as remote learning and blended learning is gaining popularity among corporates and K-12. 2021 witnessed a huge adoption of eLearning and Learning Management Systems (LMS) solutions, a trend expected to continue over the forecast period. Availability of adaptive learning tools and platforms, integration of virtual reality solutions with metaverse, and corporates offering MOOC to their employees are trends that are likely to bode well for the EdTech market growth over the forecast period.

On the contrary, growing concerns for data privacy and cyber fraud are presumed to be long-term challenges hampering market growth. Several countries have banned generative AI tools, such as ChatGPT, that are expected to transform the EdTech industry, due to data privacy and the spread of misinformation concerns. For instance, on March 31st, 2023, Italy raised privacy concerns around the AI platform and the Italian regulator also asked OpenAI to resolve the raised concerns in 20 days. With COVID-19 driving greater adoption of digital learning tools, education boards worldwide are now starting to take a closer look at how they regulate EdTech companies’ privacy practices. Furthermore, the lack of tech-savvy teachers is also one of the crucial factors expected to hamper the market growth.

| Market Size (2023) | US$270.5 billion |

| Market Size (2026) | US$410.2 billion |

| CAGR (2022-2026) | 16.0 % |

| Forecast Period | 2022-2026 |

| Historic Data | 2019-2021 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Market Share, Growth Trends |

| End-use Segment | Pre-K, K-12, Post-Secondary, and Corporate/Workforce |

| Key Companies | Alphabet Inc.; Course Hero Inc.; Coursera Inc.; Duolingo Inc.; Instructure Inc.; Kahoot! AS; Microsoft Corporation; Pearson Plc; Sorting Hat Technologies Pvt Ltd, Udemy Inc., Huawei Investment & Holding Co Ltd., Xiaochuanchuhai Education Technology (Beijing) Co Ltd, YiXue Squirrel AI Learning Inc, and 17ZUOYE Corp. |

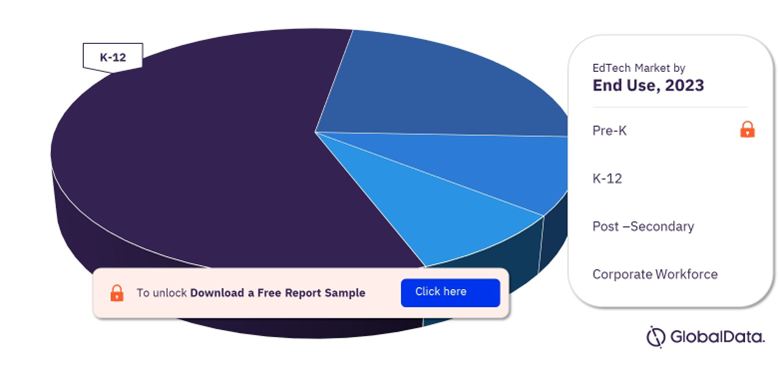

EdTech Market Segmentation by End Use

Based on end use, the EdTech market has been categorized into Pre-K, K-12, Post-Secondary, and Corporate/Workforce. As of 2022, the K-12 segment accounted for over 50% of the overall market share 2022 and is expected to observe significant growth from 2022 to 2026. The market growth is attributed to the rising popularity of game-based learning platforms. Gaming-based learning platforms are known to improve student engagement, improvise visual skills, and interaction & collaboration among their peers. Additionally, reward-based gamification, which incorporates point systems, leaderboards, and achievement badges, enables students to engage actively in the absence of a teacher or course leader.

EdTech Market Share by End Use, 2023 (%)

Fetch Sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

The Corporate/ Workforce segment has been gaining momentum over the last few years. The segment is projected to witness a CAGR exceeding 10% from 2022 to 2026. The growing popularity of online digital certification courses among working professionals is presumed to bode well for market growth. Significant tie-ups between EdTech companies and globally recognized university are expected to create a huge impact on the EdTech market growth over the forecast period.

EdTech Market Analysis by Region

The study analyzes EdTech demand across North America, Europe, Asia Pacific, Middle East & Africa, and Central & South America. The Asia Pacific EdTech market is anticipated to witness substantial growth from 2022 to 2026. China led the regional EdTech market growth, followed by India and Japan. Favorable government initiatives coupled with the increase in number of venture funding by private investment firms are expected to drive regional market growth. Increasing consolidation among EdTech companies in the Asia Pacific region is also expected to impact industry growth during the forecast period. One recent evidence of this was in June 2021, when online learning firm Byju’s became India’s most valuable internet start-up, surpassing fintech firm Paytm.

Asia-Pacific EdTech Market Share by Key Countries, 2023 (%)

View Sample Report for Additional EdTech Market Insights, Download a Free Report Sample

In 2022, the North American EdTech market was the second largest. The regional demand is projected to witness a CAGR of over 15% from 2022 to 2026. Robust technological infrastructure and adopting sophisticated assessment tools are the primary factors expected to drive growth over the forecast period. Product expansion by key EdTech vendors, notably by foreign entities, and adoption of AI to transform elementary and K-12 Education is expected to drive the EdTech market growth in the US. For instance, in April 2022, Atom Learning, a London-based EdTech Company, launched its adaptive learning platform in the US. Through this strategic move, the company intends to enhance the learning experience of elementary-age groups.

EdTech Market – Competitive Landscape

EdTech is an extremely fragmented market characterized by well-known established hardware vendors, and software & services players. EdTech vendors are engaged in strengthening their customer base through M&A. For instance, in In April 2021, Byju’s paid nearly US$1 billion to acquire Aakash Educational Services, a chain of tutorial centers in India. Through this acquisition, the former company is expected to increase its geographical footprint across India.

The EdTech market is gradually shifting from a traditional education stack, epitomized by textbooks, offline course materials, traditional teaching organizations, and in-person teaching methods to a new world of EdTech tools. However, EdTech is unlikely to replace education institutions and teachers, but it is expected to modernize teaching by emphasizing tools, apps, and platforms.

Leading Players in the EdTech Market

- Alphabet Inc.

- Course Hero Inc.

- Coursera Inc.

- Duolingo Inc.

- Instructure Inc.

- Kahoot! AS

- Microsoft Corporation

- Pearson Plc

- Sorting Hat Technologies Pvt Ltd

- Udemy Inc.

- Huawei Investment & Holding Co Ltd.

- Xiaochuanchuhai Education Technology (Beijing) Co Ltd

- YiXue Squirrel AI Learning Inc.

- 17ZUOYE Corp.

Other EdTech Market Vendors Mentioned

2U Inc.; Age of Learning Inc.; Beijing Yuanli Education Technology Co Ltd; Blackboard Inc.; Class Technologies Inc.; Codecademy Inc.; Crimson Education; Khan Academy; Liminex Inc.; Socrative, Inc.; Vedantu Innovations Pvt Ltd; VIPKid; YiXue; and Squirrel AI Learning Inc.

To Know More About Leading EdTech Market Players, Download a Free Report Sample

EdTech Market Segments and Scope

GlobalData Plc has segmented the EdTech market report by end use and region:

EdTech End Use Outlook (Revenue, USD Billion, 2019-2026)

- Pre-K

- K-12

- Post-Secondary

- Corporate/Workforce

EdTech Regional Outlook (Revenue, USD Billion, 2019-2026)

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- South & Central America

- Brazil

- Mexico

- Argentina

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- Kuwait

- Oman

- Qatar

- Rest of Middle East & Africa

The market intelligence report provides an in-depth analysis of the following –

- EdTech market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the payment type segments.

- The competitive landscape: an examination of the positioning of leading players in the EdTech market.

- Porter’s five forces analysis: demonstrates the strength of suppliers and buyers along with market competition in the market.

- Company snapshots: analysis of the market position of leading service providers in the EdTech market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Players

Alphabet IncCourse Hero, Inc.

Coursera Inc

Duolingo Inc

Instructure Inc.

Kahoot! AS

Microsoft Corp

Pearson Plc

Sorting Hat Technologies Pvt Ltd

Udemy Inc.

Zip Co Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the EdTech market size in 2023?

The EdTech market size will be valued at US$270.5 billion in 2023.

-

What is the EdTech market growth rate?

The EdTech market is expected to grow at a CAGR of 16.0% during the forecast period (2022-2026).

-

What are the key EdTech market drivers?

The growing popularity of blended learning, increase in adoption of game-based learning, and the integration of AI-based tools and video-based learning triggered by COVID-19, are stimulating the EdTech market growth worldwide.

-

What are the key EdTech market segments?

Edtech Segments: Pre-K, K-12, Post-Secondary and Corporate/Workforce

-

Which are the leading EdTech market companies?

The leading EdTech companies are Alphabet Inc.; Course Hero Inc.; Coursera Inc.; Duolingo Inc.; Instructure Inc.; and Kahoot! AS; Microsoft Corporation; Pearson Plc; Sorting Hat Technologies Pvt Ltd; Udemy Inc.; Huawei Investment & Holding Co Ltd., Xiaochuanchuhai Education Technology (Beijing) Co Ltd, YiXue Squirrel AI Learning Inc, 17ZUOYE Corp., among others.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.