Esports – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Esports are organized multiplayer video game competitions, typically involving professional players. Esports has enjoyed spectacular growth over the last decade, with thousands of fans visiting stadiums to watch live events and millions following them on streaming platforms. Its popularity catapulted during the COVID-19 pandemic as traditional sports were put on hold. Esports monetization models are expanding as the esports teams and players are exploring physical merchandise, loyalty programs, and digital items such as non-fungible tokens (NFTs) to create secondary revenue streams.

The esports thematic intelligence report highlights key technology trends, macroeconomic trends, and regulatory trends impacting the esports theme. Furthermore, it also discusses esports value chains, mergers & acquisitions activities, and major milestones in the journey of the esports theme.

Esports: Key Trends

The key trends associated with the esports theme can be classified into three categories: technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: The key technological trends that will shape the esports theme are growing preference for PC gaming, rise in demand for next-generation gaming consoles, popularity of mobile gaming, advent of 5G, growing pervasiveness of artificial intelligence (AI) technologies, data analytics, in-game purchases, Web3, and non-fungible tokens (NFTs).

Macroeconomic Trends: The key macroeconomic trends that will shape the esports theme are impact of COVID-19 pandemic, aging of many popular games, launch of esports franchise leagues, and viewership.

Regulatory trends: The key regulatory trend impacting the esports theme are the European data privacy laws, Californian data privacy laws, and regulation in Asia.

For more insights on key trends shaping the Esports theme, download a free report sample

Esports – Industry Analysis

The esports market generated $996 million in revenue in 2020. The market is expected to achieve a CAGR of more than 13% over the forecast period. Newzoo identifies six esports revenue streams: sponsorship, media rights, merchandise and tickets, publisher fees, digital, and streaming. Sponsorship is the largest contributor of revenue in 2022.

Esports industry analysis also covers:

- Timeline

Esports Revenue, 2020 to 2025

For more esports market forecast, download a free report sample

Esports- Value Chain Analysis

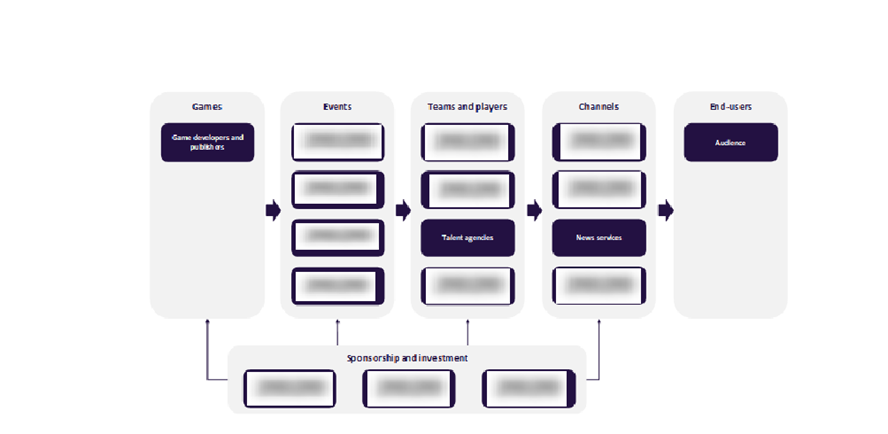

GlobalData’s esports value chain consists of six segments: games, events, teams and players, channels, sponsorship and investment, and end-users.

Games: Games, spanning a range of genres, are driving the popularity of esports. Currently, multiplayer online battle arena (MOBA) games such as Dota 2, and League of Legends, and first-person shooter (FPS) games like Counter-Strike: Global Offensive (CS: GO), Overwatch, Valorant, and Call of Duty (CoD), along with battle royale games like Fortnite and PlayerUnknown’s Battlegrounds (PUBG), are key revenue generators. Real-time strategy (RTS) games such as StarCraft II and the collectible card game (CCG) Hearthstone are also among the top-grossing esports games.

Esports Value Chain Analysis

For more insights into the esports value chain analysis, download a free report sample

Leading Companies Associated with the Esports Theme

The leading companies that are making their mark within the esports theme are Activision Blizzard, Alphabet (parent company of Google), Amazon, ByteDance, Krafton, Meta (formerly Facebook), Savvy Group (parent company of ESL FaceIT Group), Sea, Tencent, and Valve.

To know more about the leading companies associated with the esports theme, download a free report sample

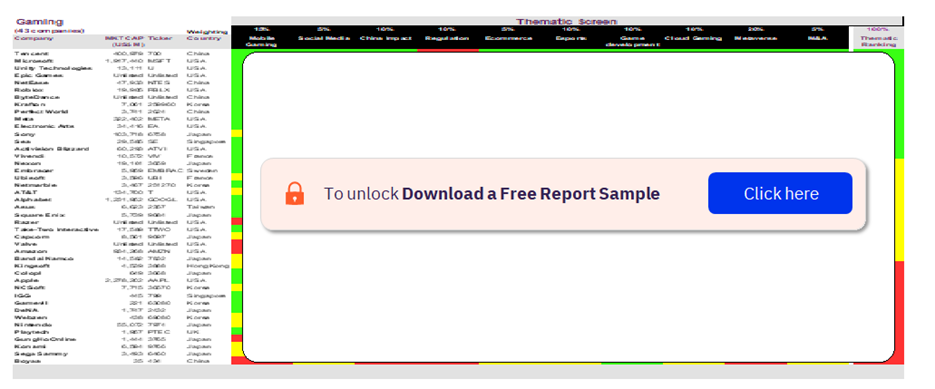

Gaming Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen.

The gaming sector scorecard has three screens:

- Our thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- Our valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- Our risk screen ranks companies within a particular sector based on overall investment risk.

Gaming sector scorecard- Thematic Screen

To know more about the sector scorecards, download a free report sample

Esports Market Overview

| Report Pages | 50 |

| Regions Covered | Global |

| Key Trends | Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Value Chain | Games, Events, Teams and Players, Channels, Sponsorship and Investment, and End-Users |

| Leading Companies | Activision Blizzard, Alphabet (parent company of Google), Amazon, ByteDance, Krafton, Meta (formerly Facebook), Savvy Group (parent company of ESL FaceIT Group), Sea, Tencent, and Valve |

Scope

- This report provides an overview of the global esports market.

- It identifies the key trends impacting growth of the theme over the next 12 to 24 months.

- It includes a comprehensive industry analysis, including market size and growth forecasts, a breakdown of esports’ revenue streams, nd analysis of M&A data.

- The detailed value chain provides a comprehensive analysis of the key segments of the esports industry, as well as identifying leading and challenging companies in each segment.

Reasons to Buy

Esports is an increasingly important theme in the gaming sector. This report is essential reading for anyone with an interest in video games or a desire to learn more about the world of organized multiplayer video game competitions.

A1 Telekom

AB InBev

Acend

Activision Blizzard

Ader

Adidas

Advance Publications

Advanced Info Service

AFK Creators

Afreeca.tv

Aim Lab

AIS Thailand

Allianz

Alphabet

Amazon

Andreessen Horowitz

Aquiline Capital

Ares Management

AT&T

Audi

Audiencly

aXiomatic (Team Liquid)

Axis Esports

Azyt

Bain Capital

Bandai Namco

Battery Ventures

Battlefy Technologies

Bayes Holding

Benchmark Capital

Bessemer Venture

Beyond The Summit

Bharti Airtel

Blast

BT Group

Budweiser

ByteDance

Caffeine

Canaan Partners

Capcom

Cheesecake Digital

China Telecom

China Unicom

Claro

Click Management

Cloud9

Cloutboost

Coca-Cola

Code Red Esports

Comcast

Comscore

Crypto.com

CyberAgent

Daily Dot

DailyMotion

Deutsche Telekom

Dexerto

Digital Creativity

Discord

DLive

DouYu

Ebullient Gaming

Eclat Media (SPOTV)

eFuse

Electronic Arts

ELO Entertainment

Endeavor (IMG)

Enestech Software

Engine Gaming

Epic Games

Esports Charts

Esports Entertainment

Esports Insider

Esports News Asia

Esports.gg

Esportstalk

ESTNN

ETA International

Etisalat by e&

Eurogamer

Evil Geniuses

Evolved

FalconAI

Fanatics

FaZe Clan

Fnatic

Foreseen Media

Fox

FTW Talent

FURIA

G/O Media (Kotaku)

G2 Esports

Galibelum

GameInfluencer

Gamers Net

GamingBuddy

Gemmo.ai

General Catalyst

Gfinity

GGPredict

GGV Capital

GosuGamers

GP Investments

Grid

Gwoop

Harena Data

Heaven Media

Hi-Rez Studios

HP

Hyundai

IBM

ICON Esports (Chiefs)

Instant eSports

Intel

InterTalent

InvenGlobal

JOYY (Bigo)

Kairos Media

Khosla Ventures

Kitamen

Knowscope

KovaaK

Krafton

Level Up eSports

Lightspeed

Liquipedia

Loaded

Logitech

Loud

LVP

Mainline

Matrix Partners

MBC Plus Media

Mediapro (Ubeat)

Mercedes-Benz

Meta

Microsoft

Mobalytics

Morgan Stanley

Natus Vincere

Naver.tv

NetEase

New Enterprise Associates

NewGen Agency

Nicecactus

Nielsen

Nike

Nintendo

Nodwin Gaming

NRG Esports

NTT DoCoMo

OGN

Omnicoach

Omnicom Group (GMR)

One Esports

Ooredoo

OpenRec.Tv

OpTic Gaming

Orange

Pandascore

PepsiCo

PGL

PlayVS

Procter & Gamble

Prodigy Agency

ProSiebenSat.1

Puma

Qwatti

R3PREZ3NT

Rakuten

Red Bull

Reddentes Sports

ReKTGlobal (Rogue)

Reliance Jio

Repable

RevXP

Royal Never Give Up

Rumble Gaming

Saber Esports

SAP

Sapphire Ventures

Saudi Aramco

Savvy Group

Sea (Garena)

SEG Esports

SenpAI

Seoul Broadcasting

Sequoia Capital

Shadow Esports

Shoflo

Sina Weibo

Singtel

SK Telecom

Skillinked

Sky Group

Smash.gg

SoFi

Sony

Spark New Zealand

Sport1 Medien

Square Enix

StarLadder

State Farm Insurance

Super League Gaming

Take-Two Interactive

Team BDS

Team SoloMid

Techstorm

Telefónica

Telenor

Telstra

Tencent

The Gaming Company

The Spacestation

Theta.tv

Thomson Reuters

Tiger Global

T-Mobile

Toyota

Trovo

Ubisoft

United Talent Agency

Upcomer

Valve

Veebit

Verizon

Vimeo

Viral Nation

Visa

Vivendi (Gameloft)

Vodafone

VSPN

Walt Disney

Wanda Group

Warner Bros. Discovery

Webedia

WePlay.tv

Win.gg

WPP

XSET Gaming

Yahoo!

Zain Group

Zhanqi.tv

Table of Contents

Frequently asked questions

-

What was the esports market revenue in 2020?

The esports market generated $996 million in revenue in 2020.

-

What was the esports market growth rate?

The esports market is expected to achieve a CAGR of more than 13% over the forecast period.

-

What key technology trends are impacting the esports theme?

The key technological trends that will shape the esports theme are growing preference for PC gaming, rise in demand for next-generation gaming consoles, popularity of mobile gaming, advent of 5G, growing pervasiveness of artificial intelligence (AI) technologies, data analytics, in-game purchases, Web3, and non-fungible tokens (NFTs).

-

What key macroeconomic trends are impacting the esports theme?

The key macroeconomic trends that will shape the esports theme are impact of COVID-19 pandemic, aging of many popular games, launch of esports franchise leagues, and viewership.

-

What key regulatory trend is impacting the esports theme?

The key regulatory trend impacting the esports theme are the European data privacy laws, Californian data privacy laws, and regulation in Asia

-

What are the components of the esports value chain?

The esports value chain consists of six segments: games, events, teams and players, channels, sponsorship and investment, and end-users.

-

Which leading companies are associated with the esports theme?

The leading companies that are associated with the esports theme are Activision Blizzard, Alphabet (parent company of Google), Amazon, ByteDance, Krafton, Meta (formerly Facebook), Savvy Group (parent company of ESL FaceIT Group), Sea, Tencent, and Valve.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.