Western Europe Telecom Operators Country Intelligence Report Bundle

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Western Europe Telecom Operators Country Intelligence Report Bundle

The future of Western Europe Telecom Operators Country depends on dynamic changes to business and operating models. The market is going through significant changes and the next step is to take the strategic initiative to ensure that the operators act as players in the future of the industry and not just mere observers.

As a part of this bundle, you will gain access to in-depth insights available in the following reports:

- Austria Telecom Operators Country Intelligence Report

- France Telecom Operators Country Intelligence Report

- Germany Telecom Operators Country Intelligence Report

- Italy Telecom Operators Country Intelligence Report

- Netherlands Telecom Operators Country Intelligence Report

- Portugal Telecom Operators Country Intelligence Report

- Spain Telecom Operators Country Intelligence Report

- United Kingdom (UK) Telecom Operators Country Intelligence Report

Report 1: Austria Telecom Operators Country Intelligence Report

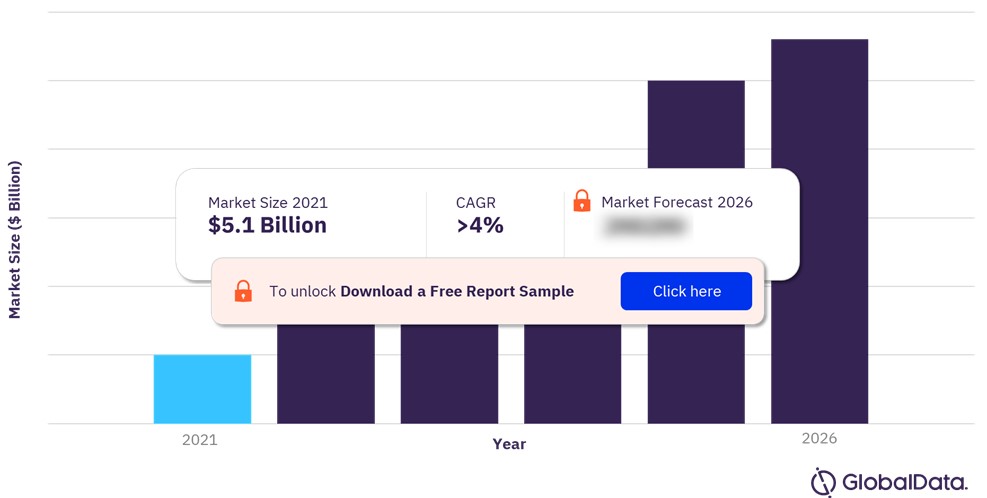

The Austria telecom market size was valued at $5.1 billion in 2021. The market is expected to grow at a CAGR of more than 4% during 2021-26. The ongoing expansion of 5G services across the country by telecom operators will boost the country’s digitalization and will create opportunities for infrastructure vendors and consumers. The Austrian government’s spectrum release plan for the 2022-2026 period will create opportunities for telcos and infrastructure vendors. Magenta Telekom led the mobile services segment of the total mobile subscriptions in 2021, and the operator will remain the leading mobile service provider over the forecast period.

Austria Telecom Market Outlook

For more information on the Austria telecom market forecast, download a free report sample

Report 2: France Telecom Operators Country Intelligence Report

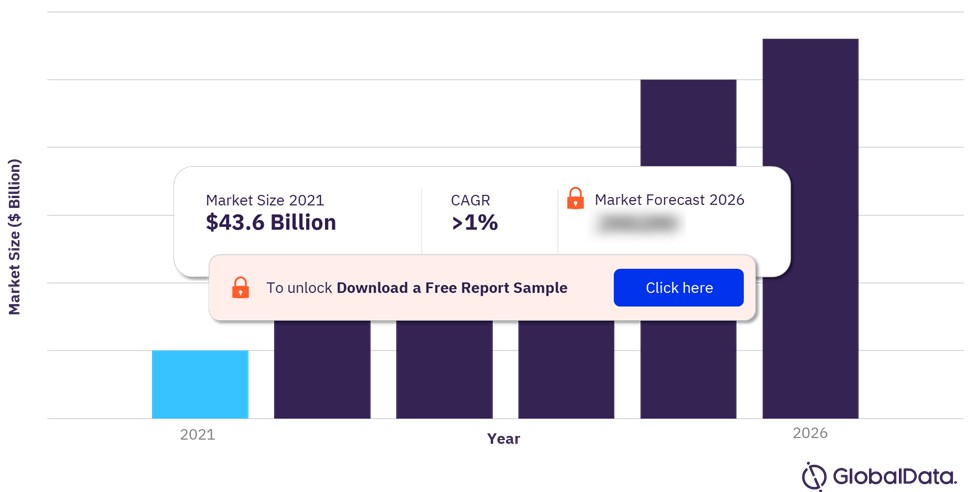

The France telecom market size was valued at $43.6 billion in 2021. The market is expected to grow at a CAGR of more than 1% during 2021-26. The continued expansion of 5G coverage will support customer uptake of 5G plans and provide telcos further opportunities for ARPU-uplift through higher tier data plans and service bundling. The government’s granted authorization to Starlink for the launch of commercial internet services on the 10.95-12.7GHz and 14-14.5GHZ bands will support digitalization opportunities in remote areas. Through this, the government aims to provide access to high-speed broadband services to rural areas across the country. Furthermore, Orange France is leading the mobile service, fixed voice service, fixed broadband service, and pay-TV service segments in France. Orange will also be helped by its focus on fixed-mobile converged packages and ubiquitous FTTH/B networks.

France Telecom Market Outlook

For more information on the France telecom market forecast, download a free report sample

Report 3: Germany Telecom Operators Country Intelligence Report

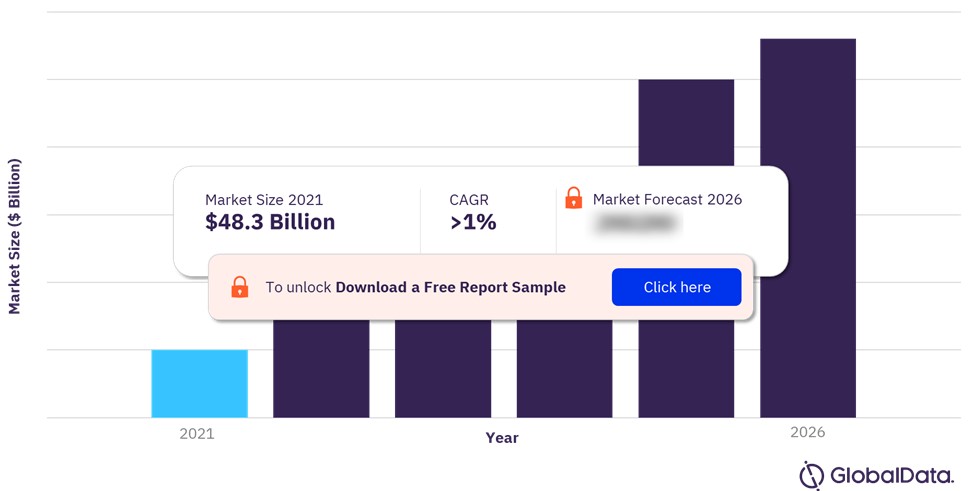

The Germany telecom market size was valued at $48.3 billion in 2021. The market is expected to grow at a CAGR of more than 1% during 2021-26. The continued expansion of 5G services across the country by MNOs will create opportunities for network vendors. 5G rollout will create further opportunities for IoT/M2M in verticals like automotive. Allocation of 5G spectrum for industrial licensing to local operators will enable 5G usage in Industry 4.0. Vodafone will maintain its leadership position in the mobile segment throughout the forecast period, with a strong focus on offering converged offerings, churn reduction, More for More strategies, and 5G network expansion. Moreover, it has increased its focus on the entry-level segment with the launch of the new discounter digital SIM-only brand SIMon.

Germany Telecom Market Outlook

For more information on the Germany telecom market forecast, download a free report sample

Report 4: Italy Telecom Operators Country Intelligence Report

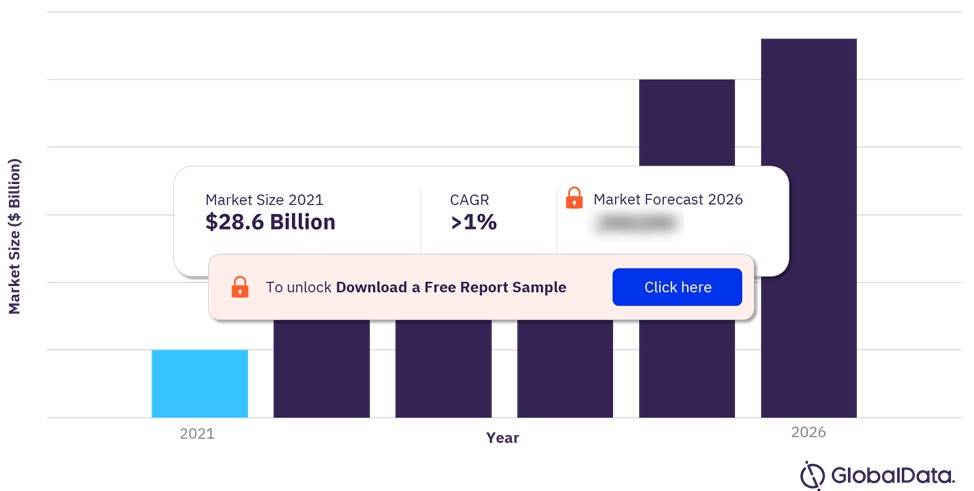

The Italy telecom market size was valued at $28.6 billion in 2021. The market is expected to grow at a CAGR of more than 1% during 2021-26. The continued expansion of 5G networks and 5G services across the country by MNOs will improve 5G adoption and provide opportunities for telcos to offer 5G fixed wireless access services. Significant competition in the market has led operators to consider in-market consolidation and internal restructuring. TIM Italy led the mobile, fixed voice, and fixed broadband segments in 2021. TIM Italy is pursuing a strategy that includes repositioning its brand to a more premium positioning, offering handset financing through TIMFin, focusing on customer experience and retention, utilizing targeted upselling, and promoting convergence.

Italy Telecom Market Outlook

For more information on the Italy telecom market forecast, download a free report sample

Report 5: Netherlands Telecom Operators Country Intelligence Report

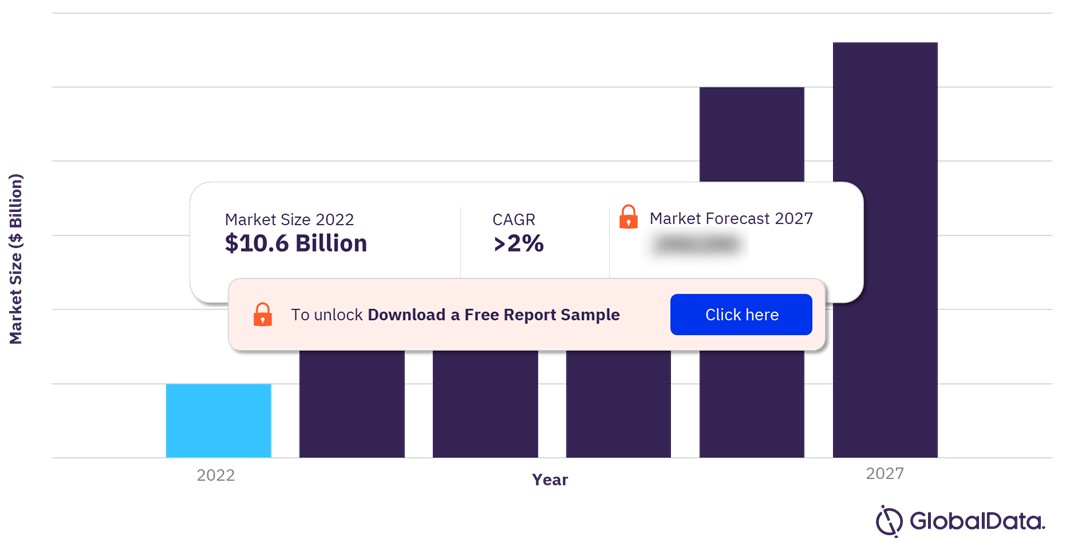

Netherlands telecom services market size is valued at $10.6 billion in 2022 and is expected to increase at a CAGR of more than 2% during the forecast period, 2022-2027. The ongoing expansion of 1 Gbps broadband access by the government and telcos enabling the promotion of premium fiber broadband plans, and 5G expansion, to be facilitated by the planned auction of 3.5 GHz spectrum, allowing telcos to deliver enhanced mobile network performance. will help drive connectivity in the country and growth in the country’s telecom services market.

Netherlands Telecom Market Outlook

For more information on the Netherlands telecom market forecast, download a free report sample

Report 6: Portugal Telecom Operators Country Intelligence Report

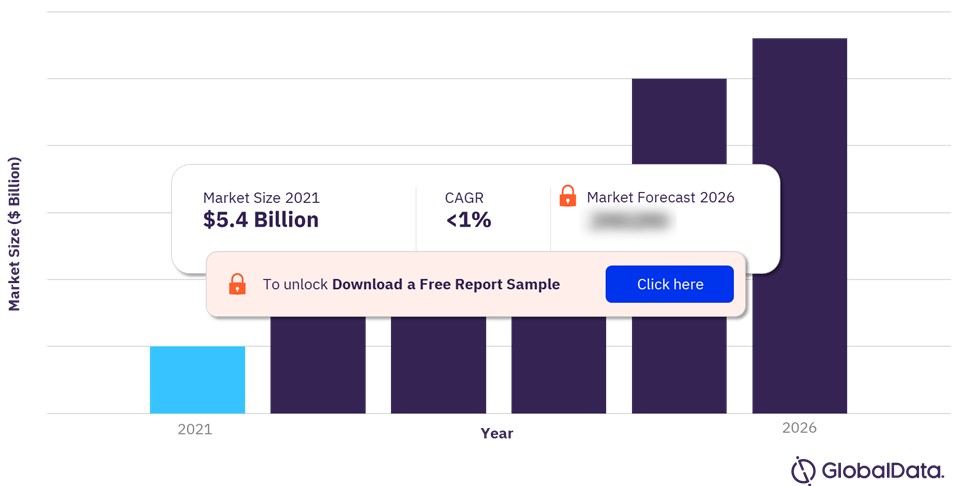

The Portugal telecom market size was valued at $5.4 billion in 2021. The market is expected to grow at a CAGR of less than 1% during 2021-26. The launch of 5G services in Portugal will create opportunities for telcos to upsell higher-ARPU 5G plans, industry vertical solution developers, and consumers to experience higher-quality digital services like 5G cloud gaming. The potential launch of NOWO as an MNO and new entrant Dixarobil will increase competition and provide more telecom service options for consumers. MEO led the mobile, fixed voice, and pay-TV service segments market in 2021. Furthermore, MEO is continuing its convergence strategy to upsell and cross-sell customers to more premium packages and to adopt more services.

Portugal Telecom Market Outlook

For more information on the Portugal telecom market forecast, download a free report sample

Report 7: Spain Telecom Operators Country Intelligence Report

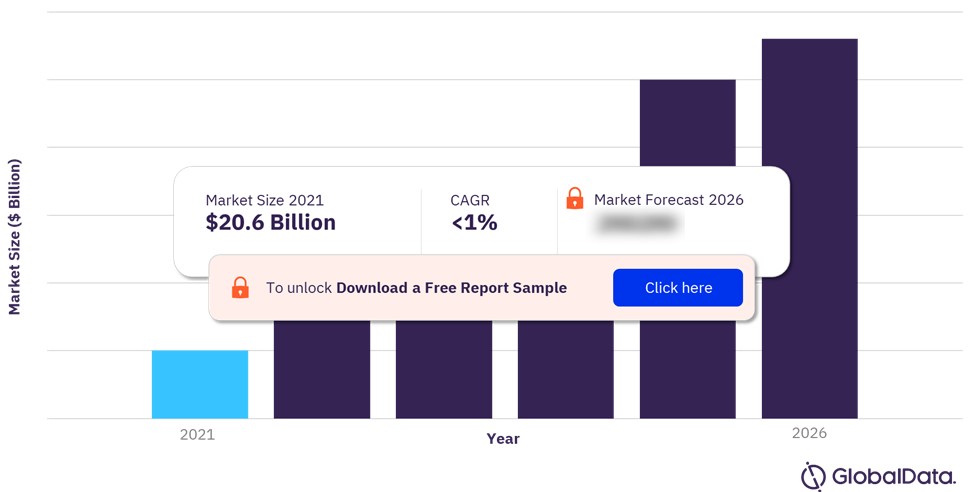

The Spain telecom market size was valued at $20.6 billion in 2021. The market is expected to increase at a CAGR of less than 1% during 2021-26. The ongoing expansion of 5G networks will support the adoption of a host of services such as mobile cloud gaming, cloudification, unified communications, and Industry 4.0 applications. Telcos are presented with opportunities to bundle more digital services and support ARPU levels, in a more-for-more approach. Operators like Movistar Spain are working at attracting new subscribers and increasing customer engagement by cross-selling new services with the launch, for instance, of its miMovistar FMC package in May 2022. In addition to connectivity and pay-TV offerings, customers have the flexibility to add services focused on health, gaming, home security, and finance.

Spain Telecom Market Outlook

For more information on the Spain telecom market forecast, download a free report sample

Report 8: United Kingdom (UK) Telecom Operators Country Intelligence Report

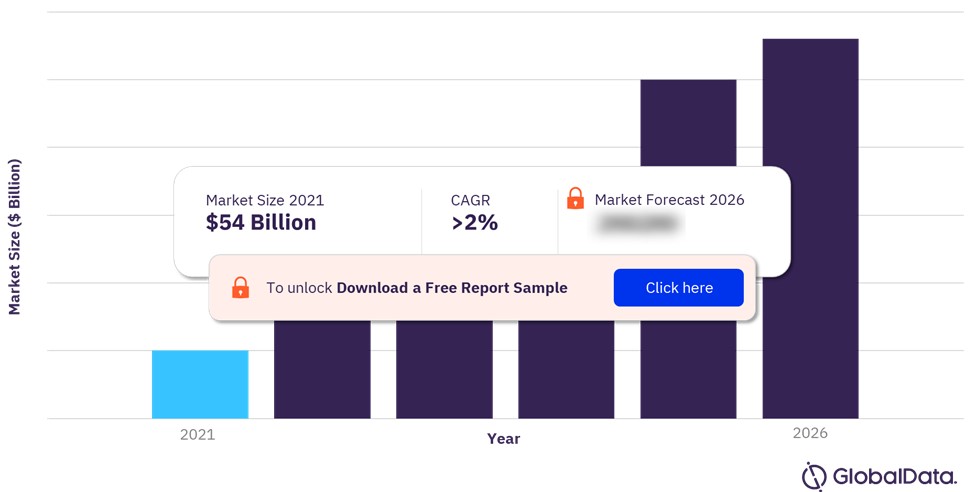

The UK telecom market size was valued at $54 billion in 2021. The market is expected to increase at a CAGR of more than 2% during 2021-26. The government’s plan, aided by telcos and alternative networks (altnets) to achieve 100% fiber-optic coverage nationwide by 2033, will create opportunities for mergers and consolidations and allow operators to increase mobile, pay-TV, and fixed broadband uptake by promoting converged offerings. Operators like Virgin Media O2 are expected to strengthen their leading position in the mobile service market as it doubles down on its 5G expansion, 4G network upgrades, and implementation of network convergence. Most recently, the telco announced a deal with Bai communications, a shared communication infrastructure builder, to roll out high-speed 4G/5G mobile connectivity across the tube networks in London, including the tunnels.

UK Telecom Market Outlook

For more information on the UK telecom market forecast, download a free report sample

Report 1: Austria Telecom Operators Country Intelligence Report

Report 2: France Telecom Operators Country Intelligence Report

Report 3: Germany Telecom Operators Country Intelligence Report

Report 4: Italy Telecom Operators Country Intelligence Report

Report 5: Netherlands Telecom Operators Country Intelligence Report

Report 6: Portugal Telecom Operators Country Intelligence Report

Report 7: Spain Telecom Operators Country Intelligence Report

Report 8: United Kingdom (UK) Telecom Operators Country Intelligence Report

Table of Contents

Frequently asked questions

-

Report 1: Austria Telecom Operators Country Intelligence Report

-

What was the Austria telecom market size in 2021?

The telecom market size in Austria was valued at $5.1 billion in 2021.

-

Report 2: France Telecom Operators Country Intelligence Report

-

What was the France telecom market size in 2021?

The telecom market size in France was valued at $43.6 billion in 2021.

-

Report 3: Germany Telecom Operators Country Intelligence Report

-

What was the Germany telecom market size in 2021?

The telecom market size in Germany was valued at $48.3 billion in 2021.

-

Report 4: Italy Telecom Operators Country Intelligence Report

-

What was the Italy telecom market size in 2021?

The telecom market size in Italy was valued at $28.6 billion in 2021.

-

Report 5: Netherlands Telecom Operators Country Intelligence Report

-

What was the Netherlands telecom market size in 2022?

The telecom services market size in Netherlands was valued at $10.6 billion in 2022.

-

Report 6: Portugal Telecom Operators Country Intelligence Report

-

What was the Portugal telecom market size in 2021?

The telecom market size in Portugal was valued at $5.4 billion in 2021.

-

Report 7: Spain Telecom Operators Country Intelligence Report

-

What was the Spain telecom market size in 2021?

The telecom market size in Spain was valued at $20.6 billion in 2021.

-

Report 8: United Kingdom (UK) Telecom Operators Country Intelligence Report

-

What was the UK telecom market size in 2021?

The telecom market size in the UK was valued at $54 billion in 2021.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.