Financial Services Perspectives and Insights from the 2023 Consumer Survey

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Financial Services Perspectives and Insights Overview

The Financial Services Perspectives and Insights report highlights the key findings from GlobalData’s 2023 Financial Services Consumer Survey. It explores customer attitudes and preferences towards their financial services providers in the retail banking, payments, and wealth management spaces. Data is broken down by both regions and generations to highlight the key differences between them. Topics explored include the impact of financial fraud, preferred payment methods, buy now pay later usage, premium accounts, and investment practices, among others.

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Financial Services – Retail Banking

Different generations of consumers have different financial goals concerning their savings. Millennials prioritize growing their savings and investments. Meanwhile, the most common goal of Generation Z is saving for a large purchase. This shows that with age, the financial goals of consumers are increasingly focused on securing a comfortable retirement.

Since Generation Z has been active in the banking market the least, they are most likely to switch banks, followed closely by millennials. However, the switching behavior between millennials and Gen Z is similar so banks should focus on the millennial demographic.

Financial Goals of Consumers by Generation, 2023 (%)

Buy the Full Report for More Retail Banking Insights into the Financial Services Market

Financial Services – Payments

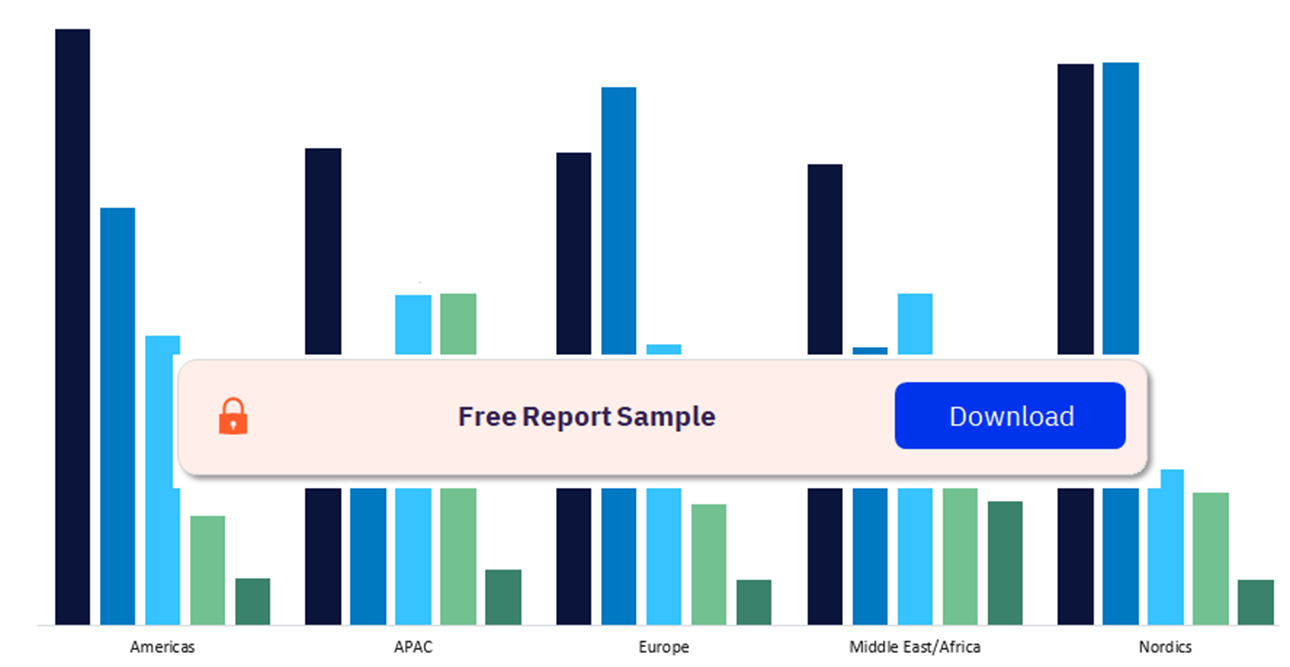

The key in-store payment methods used by consumers are credit cards or credit at POS, debit cards, cash, mobile wallets, and prepaid cards. Credit and debit cards are the most widely used in-store payment methods. In 2023, mobile wallets overtook cash as an in-store payment method in the Asia-Pacific for the first time. The proportion of consumers using cryptocurrency for payments varies considerably by region, with consumers in the Nordic countries the most likely to do so. A minority of consumers use crypto to send money to family and friends.

In-Store Payment Methods by Regions, 2023 (%)

Buy the Full Report for More Payment Insights into the Financial Services Market

Financial Services – Wealth Management

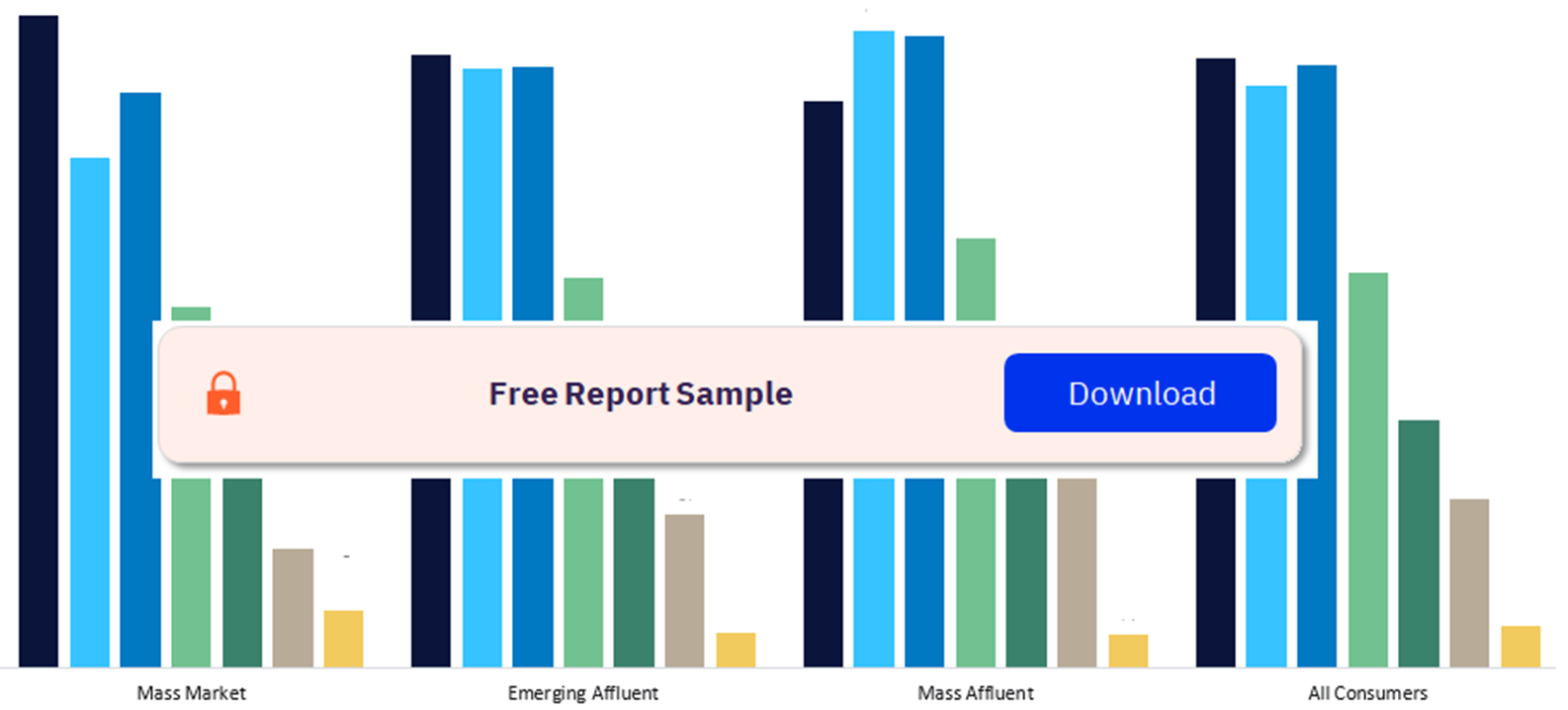

Advisors at a customer’s main bank are the most common provider type when arranging investments. Investors use a variety of communication channels such as online via laptops/desktops or smartphones/tablets, telephone, text or email, video chat, in-person, or in-branch. In-person appointments are consistent across the board. Hence mass-market investors will probably feel more reassured about starting to invest after speaking to someone in person. Additionally, mass affluent customers use slightly more personalized services compared to the lower affluence bands.

Communication Channels for Arranging Investments by Affluence, 2023 (%)

Buy the Full Report for More Wealth Management Insights into the Financial Services Market

Scope

- Financial fraud is extremely detrimental to customer relationships. On average, 24% of customers impacted by financial fraud will leave their provider.

- Access to a wide range of investments is the top reason for selecting an investment provider. Cost-effectiveness is the third-most popular reason, yet robo-advisors are still struggling to gain traction despite their typically lower fees.

- Despite an incredibly challenging period for cryptocurrencies in 2022, there was only a three-percentage-point decrease in the proportion of consumers holding cryptocurrency in 2023.

Key Highlights

- Financial fraud is extremely detrimental to customer relationships. On average, more than 23% of customers impacted by financial fraud will leave their provider.

- Access to a wide range of investments is the top reason for selecting an investment provider. Cost-effectiveness is the third-most popular reason, yet robo-advisors are still struggling to gain traction despite their typically lower fees.

- Despite an incredibly challenging period for cryptocurrencies in 2022, there was only a three-percentage-point decrease in the proportion of consumers holding cryptocurrency in 2023.

Reasons to Buy

- Learn about the key trends shaping the retail banking, payments, and wealth management spaces in 2023.

- Discover the service areas that are critical to customer satisfaction.

- Identify differences in consumer attitudes across regions and generations.

Table of Contents

Frequently asked questions

-

What are the key in-store payment methods used by consumers?

The key in-store payment methods used by consumers are credit cards or credit at POS, debit cards, cash, mobile wallets, and prepaid cards.

-

Which are the leading in-store payment methods in 2023?

Credit and debit cards are the most widely used in-store payment methods in 2023.

-

Who is the leading provider type when arranging investments?

Advisors at a customer’s main bank are the most common provider type when arranging investments.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports