France Life Insurance – Key Trends and Opportunities to 2025

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

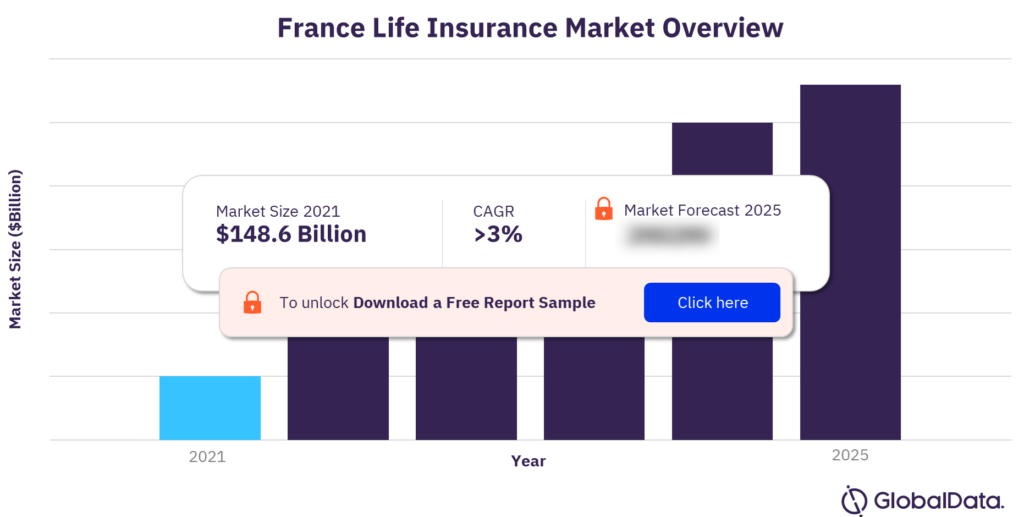

The France life insurance market size was $148.6 billion in 2021. The market is expected to grow at a CAGR of more than 3% from 2020 to 2025. The France Life Insurance market research report provides in-depth market analysis, information, and insights into the French life insurance segment. The report provides a detailed outlook by product category for the French life insurance segment. It provides values for key performance indicators such as gross written premium, penetration, and premium ceded and cession rates during the review period and forecast period.

The report also analyzes distribution channels operating in the segment, gives a comprehensive overview of the French economy and demographics, and provides detailed information on the competitive landscape in the country. The report brings together GlobalData’s research, modeling and analysis expertise, giving insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations, and recent changes in the regulatory structure.

France Life Insurance Market Overview

For more insights on this report, download a free report sample

Key France Life Insurance Market Trends

The French reinsurance major SCOR SE announced restrictions on underwriting oil in a bid to accelerate its transition towards a low-carbon economy. The reinsurer has said it will stop covering new oil field production projects from 2023, unless the client has a plan to achieve net-zero targets by 2050. Additionally, as part of the efforts to strengthen its sustainability strategy, SCOR SE aims to double the coverage for low-carbon energies by 2025. It is the latest insurer to join others in tightening their policies on coverage of fossil fuels.

Generali Vie SA offers a responsible structured product which is available within the main life insurance contracts insured by Generali. The insurer undertakes to donate a percentage of its collection to the ONF-Agir pour la Forêt endowment fund. This investment solution combines diversification, performance potential and capital protection, while contributing to the financing of environmental projects for the preservation of forests.

CNP Assurances SA and La Banque Postale launched their first infrastructure fund, LBPAM Infrastructure September 2030, in partnership with LBP AM for its life insurance clients. This new unit-linked fund provides a percentage of net profitability every year over an investment period of eight years, and diversifies customers’ assets.

Key France Life Insurance Market Lines of Business

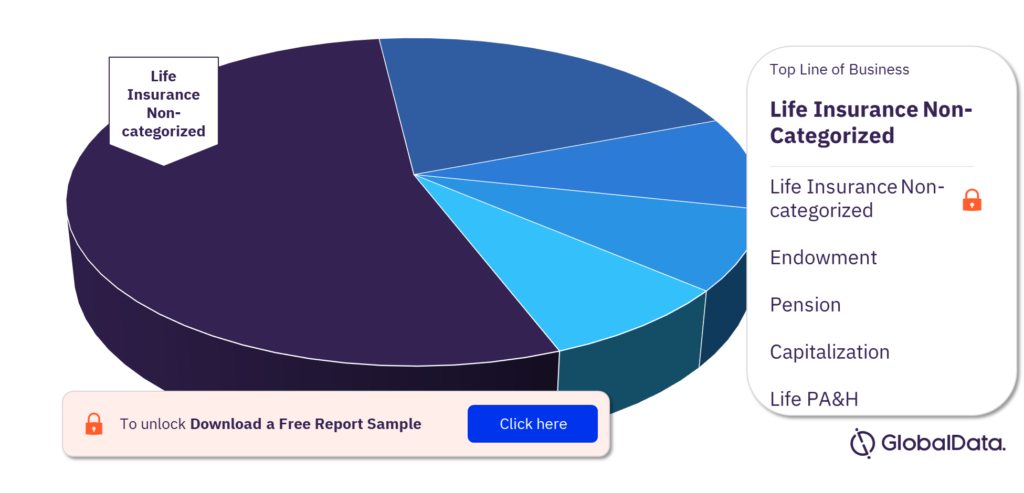

The key lines of business in the France life insurance market are endowment, pension, capitalization, life insurance non-categorized, and life PA&H. Life insurance non-categorized has the highest share in the France life insurance industry followed by endowment and life PA&H.

Pension Insurance

An increasing employment rate will lead to a rise in disposable income, coupled with an increase in the minimum wage, which will aid the growth for pension insurance in the country, and increase the demand for retirement products as they provide a benign alternative investment option over the forecast period.

Endowment Insurance

The popularity of life insurance solutions as saving products and the low interest rate environment in the bonds market, coupled with a robust equity market in the country, is boosting the demand for endowment insurance.

Life PA&H

France was the third-largest health insurance market in Europe region in 2020. In September 2021, the Government announced it would cover the therapy sessions cost for individuals aged above three years as an initiative to address mental health concerns, starting from 2022. Digital health solutions also gained traction in the country due to the pandemic. Additionally, the aging French population and increasing awareness regarding physical and mental wellness will boost the demand for health insurance in the country over the forecast period.

France Life Insurance Market Analysis by Lines of Business

For more lines of business insights, download a free report sample

France Life Insurance Market Leading Companies

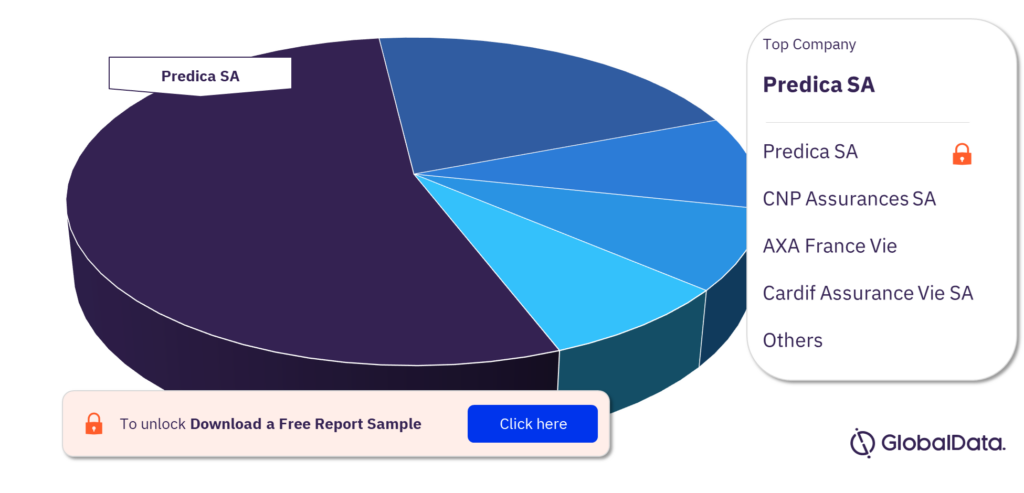

The leading life insurance companies in France are Predica SA, CNP Assurances SA, AXA France Vie, Cardif Assurance Vie SA, Generali Vie SA, Societe anonyme d’assurance sur la vie et de capitalization, BPCE Vie, Assurances Du Credit Mutuel Vie SA, Allianz Vie SA, and La Mondiale. Predica SA was the leading insurer in the market.

France Life Insurance Market Analysis by Companies

To know more about the leading companies, download a free report sample

Market Report Overview

| Market size (2021) | $148.6 billion |

| CAGR (2020 – 2025) | >3% |

| Key lines of business | Endowment, Pension, Capitalization, Life Insurance Non-Categorized, and Life PA&H |

| Leading companies | Predica SA, CNP Assurances SA, AXA France Vie, Cardif Assurance Vie SA, Generali Vie SA, Societe anonyme d’assurance sur la vie et de capitalization, BPCE Vie, Assurances Du Credit Mutuel Vie SA, Allianz Vie SA, and La Mondiale |

Scope

This report provides:

- A comprehensive analysis of the life insurance segment in France.

- Historical values for the French life insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top life insurance companies in France and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the French life insurance segment.

- Understand the demand-side dynamics, key market trends and growth opportunities in the French life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

CNP Assurances SA

AXA France Vie

Cardif Assurance Vie SA

Generali Vie SA

Societe anonyme d’assurance sur la vie et de capitalisation

BPCE Vie

Assurances Du Credit Mutuel Vie SA

Allianz Vie SA

La Mondiale

Table of Contents

Frequently asked questions

-

What was the France life insurance market size in 2021?

The life insurance market size in France was $148.6 billion in 2021.

-

What is the France life insurance market growth rate?

The life insurance market in France is expected to grow at a CAGR of more than 3% from 2020 to 2025.

-

What are the key lines of business in the France life insurance market?

The key lines of businesses in the France life insurance market are endowment, pension, capitalization, life insurance non-categorized, and life PA&H.

-

Which are the leading companies in the France life insurance industry?

The leading companies in the France life insurance industry are Predica SA, CNP Assurances SA, AXA France Vie, Cardif Assurance Vie SA, Generali Vie SA, Societe anonyme d’assurance sur la vie et de capitalization, BPCE Vie, Assurances Du Credit Mutuel Vie SA, Allianz Vie SA, and La Mondiale.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports