Frictionless Commerce – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Frictionless Commerce Thematic Report Overview

At present, consumers demand instant gratification, and frictionless commerce aims to provide it. Frictionless commerce was pioneered by Amazon. It uses technology to identify the shopper, recognize their chosen objects, and bill them after they leave the store.

The Frictionless Commerce thematic intelligence report provides an overview of the current landscape, as well as key players making a mark within it. The report provides an industry-specific analysis based on GlobalData databases and surveys, along with an overview of the latest trends shaping the market.

| Report Pages | 46 |

| Regions Covered | Global |

| Key Trends | · Technology Trends

· Macroeconomic Trends · Regulatory Trends |

| Value Chain | · Physical

· Connectivity · Data · Apps · Services Layer |

| Leading Public Players | · Alibaba

· Amazon · Carrefour |

| Leading Private Players | · Accel Robotics

· Checkout.com · Hudson |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Frictionless Commerce – Trends

The main trends shaping the frictionless commerce theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

Technology trends: The major technology trends shaping the frictionless commerce theme in the coming years are the rising investment in IoT, innovations in brick-and-mortar stores, and a decline in sensor prices among others.

Macroeconomic trends: The major macroeconomic trends impacting the frictionless commerce theme are the rising inflation, reinvention of the traditional retailer, and the promotion of hustle culture particularly in metropolitan cities.

Regulatory trends: The major regulatory trends impacting the frictionless commerce theme are the concerns around consumer privacy and surveillance society.

Frictionless Commerce – Industry Analysis

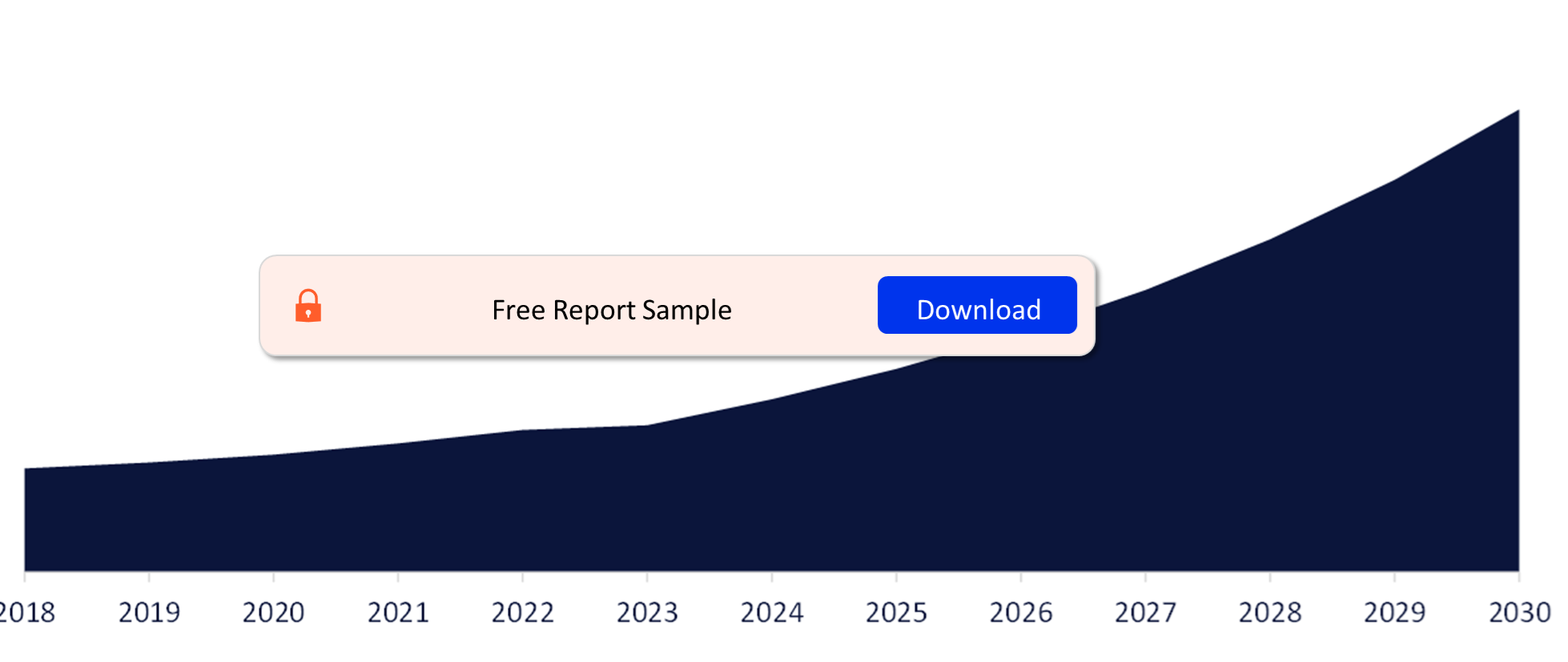

The frictionless commerce global market was worth $375.4 million in 2023. The growth was steady between the launch of Amazon’s first frictionless commerce store in 2018 and 2022 however, it began to plateau between 2022 and 2023 as retailers rethought their strategy and closed several stores, including over half a dozen Amazon locations. The frictionless commerce market will grow at a CAGR of more than 17% between 2023 and 2030. The forecasted growth can be attributed to cheaper sensors making frictionless commerce more affordable to retailers, the opening of planned stores by global retailers such as 7-Eleven, and the expansion of frictionless commerce to encompass categories other than groceries.

The Frictionless Commerce industry analysis also covers:

- Use cases

- Timeline

- Signals

- M&A trends

- Venture financing trends

- Patent trends

Global Frictional Commerce Revenue, 2018-2030

Buy the Full Report for More Industry Insights into the Frictionless Commerce Theme

Frictionless Commerce - Value Chain Analysis

The frictionless commerce value chain is split into physical, connectivity, data, apps, and services layer.

Physical layer: Retail stores must be built or retrofitted with the necessary hardware to operate a frictionless commerce model. This physical layer includes cameras and lenses, sensors and microcontrollers, and microprocessors. Together, these items facilitate the monitoring of customers as they walk around the store and the identification of the items they pick up. This helps in smooth billing and end-to-end procedures.

Frictionless Commerce Value Chain Analysis

Buy the Full Report for More Value Chain Insights into the Frictionless Commerce Theme

Frictionless Commerce – Competitive Landscape

A few of the listed companies making their mark within the frictionless commerce theme are:

- Alibaba

- Amazon

- Carrefour

A few of the private companies making their mark within the frictionless commerce theme are:

- Accel Robotics

- com

- Hudson

Buy the Full Report to Know More About the Leading frictionless commerce Companies

Retail Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens – a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Retail Sector Scorecard – Thematic Screen

Buy the Full Report to Know More about the Sector Scorecards

Scope

- This report provides an overview of the frictionless commerce theme.

- It identifies the key trends shaping the theme over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends.

- It includes a comprehensive industry analysis, including market size and growth forecasts for the global frictionless commerce market, alongside analysis of trends in GlobalData’s proprietary signals data, including M&As, venture financing, and patents.

- The detailed value chain is split into five layers: physical, connectivity, data, apps, and services.

- Also included are profiles of leading players in the frictionless commerce theme, including Alibaba, Amazon, Carrefour, JD.com, and Microsoft.

Key Highlights

While frictionless commerce looked like the future of shopping upon its inception less than a decade ago, a lukewarm response from consumers has dampened retailers’ enthusiasm. Many consumers are put off by requests to download an app to enter a store, stifling footfall. Imperfect technology implementation can also cause delays and errors, alienating shoppers rather than providing convenience. The high costs associated with fitting out a frictionless commerce store and uncertain returns on investment may also deter retailers from adopting this technology.

However, although the frictionless commerce market was worth only $375.4 million in 2023 (less than 0.01% of the global in-store retail market), the industry may still find a way to flourish. It remains to be seen whether society fully embraces this new way of shopping.

Reasons to Buy

- This report will help you understand what frictionless commerce is and its potential impact on the retail industry.

32 Market

7-Eleven

AAC Technologies

Ab Initio

ABB

Accel Robotics

AccelData

Accenture

Accton

Actifio

Adeptia

Adetiq

Adimec

Advantech

AiFi

Airbyte

Akamai

Alation

Aldi Nord

Alibaba

Alkira

Alphabet

Alps Electric

Alteryx

Altibase

Amazon

Ambarella

AMD

AMS

Amundsen

Analog Devices

Anyscale

Apache Foundation

Apple

Arista

Arista Networks

Arm

ASML

Astronomer

Asus

AT&T

Ataccama

Atlan

Atos

Attivio

Aviatrix

Baidu

Bain & Company

Basler

Bigeye

Biz4Group

Blaize

BMC Software

Boomi

Bosch

Broadcom

BT Group

Canon

Caper AI

Carrefour

Cato Networks

CData

CEDQ

Celestica

Celigo

Census

Check Point Software

Checkers

Checkout Technologies

Cheers

Chicony

China Telecom

Ciena

Cisco

Citigroup

ClearBlade

ClickHouse

Cloud Software Group

Cloudera

Cloudics

CloudPick

Cognex

Cognizant

Coherent

Cohesity

Colibra

Comcast

Confluent

Couchbase

CrowdStrike

Cyclr

Dahua

Damco Group

Dangot Computers

Darktrace

Dask

Data Virtuality

Databricks

DataCaptive

DataHub

Dataiku

DataStax

DataTorrent

DataVirtuality

Dbt Labs

Deepmagic

Dell Technologies

Deloitte

Delphix

Delta Lake

Denodo

Denodo Technologies

Deutsche Telekom

Domo

Dremio

DXC Technology

Eastern Jin Tech

Elementl

EnterpriseDB

Equinix

Ericsson

Exasol

Experian

Extreme Networks

EY

F5

Fastly

Fivetran

Flexpoint

Flink

Forcepoint

Fortinet

Fujifilm

Fujitsu

GE

Global Laser

Goertek

GoPro

Grabango

Great Expectations

GS25

HCLTech

Helpsystems

Hightouch

Hikvision

Hitachi

Hive

Holitech Technology

Honeywell

Honor

HPE

HQSoftware

Huawei

Hudson

IBM

Immuta

Imply

Industrial and commercial bank of china

Infineon

Informatica

Information Builders

Infosys

Insource

Inspur

Instacart

Intel

Intenda

InterSystems

Iomniq

JD.com

Jitterbit

Juniper Networks

Kanematsu

Keboola

Keyence

Konica Minolta

KPMG

KT

Kyndryl

Largan Precision

Lawson

Lenovo

LG Electronics

LG Innotek

Libelium

Link Labs

Lite-On

LookML

Lumen Technologies

Lumentum

Make

MariaDB

MarkLogic

Mastercard

Materialize

Matillion

MediaTek

Microchip

Microsoft

Mobeewave

MongoDB

Monte Carlo

Murata

NEC

NetApp

Netgear

Nikon

Nippon Ceramic

Nokia

Nowpet

NTT

NTT Data

NuoDB

Nutanix

Nvidia

NXP

OEM Automatic

Okta

Oppo

OpteamX

Oracle

Orange

Ordr

Ovaledge

Palantir

Palo Alto Networks

Panasonic

Pandas

Panoply

PayPal

Percona

Philips

Pick & Go

Pixevia

PostgreSQL

Precisely

Prefect

Privacera

Profisee

Progress Software

Pulsar

Pure Storage

PwC

PyTorch

Qlik

Qorvo

Q-Tech

Qualcomm

Quanergy

Quanta Cloud Technology

Qubole

Quectel

Rackspace Technologies

Rakuten

RapidMiner

Redis Labs

Renesas

Rewe

Ricoh

Rockset

Rockwell Automation

Rohm

Sainsbury's

Salesforce

Sam's Club

Samsung Electro-Mechanics

Samsung Electronics

SandStar

SAP

SAS

Scality

Schneider Electric

Securonix

Sensata

Sensei

Sensetime

Shimadzu

Siemens

SiLC

SingleStore

Skip

Skyworks

SnapLogici

Snowflake

Softbank

Software AG

Sony

Sophos

Splunk

Standard AI

Starbucks

Starburst

Stemmer Imaging

Stibo Systems

Stitch

STMicroelectronics

Stone Bond Technologies

Stratio

StreamSets

Suning

Sunny Optical

Supergrain

Supermetrics

Tabular

Talend

Tata Communications

Tata Consultancy Services

TDK

TE Connectivity

Tech Mahindra

Teledyne

Telefónica

Telenor Group

Telstra

Tencent

Teradata

Tesco

Tesla

Tessian

Texas Instruments

Theta lake

Thinxtream Technologies

ThirdEye

Toshiba

Transsion

Transwarp

Tray.io

Trellix

Trend Micro

Trigo Vision

Tsinghua Unigroup

TuSimple

Ubiquiti

Upsolver

Vdoo

Venhub

Veritas

Verizon

Visa

Vivo

VMware

Vodafone

VoltDB

Walmart

Wipro

Workato

Xiaomi

Zabka

ZF

Zippin

ZTE

Table of Contents

Frequently asked questions

-

What are the key trends shaping the frictionless commerce theme?

The main trends shaping the frictionless commerce theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

-

What are the main layers of the frictionless commerce value chain?

The frictionless commerce value chain is split into physical, connectivity, data, apps, and services layer.

-

Which are the leading listed companies in frictionless commerce theme?

A few of the leading listed companies making their mark within the frictionless commerce theme are Alibaba, Amazon, and Carrefour among others.

-

Which are the leading listed companies in frictionless commerce theme?

A few of the leading listed companies making their mark within the frictionless commerce theme are Accel Robotics, Checkout.com, and Hudson among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.