Gaming Market Analysis by Region, Platform (Smartphone, Console, PC, Tablet, Handheld Controllers, Head-mounted Displays), Gamer Type and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Gaming’ report can help:

- In investigating the demand dynamics of the global gaming industry while highlighting key factors or variables assisting its growth

- In-depth view of the key market segments including platform, gamer type, and type.

- Explore the detailed view of the gaming industry value chain and its key stakeholders

- Potential growth opportunities in terms of revenue ($Million)

- Foresee shift in the gaming industry trends through the lens of social factors and working conditions

- Dedicated dashboard section on mergers and acquisitions, venture financing, social media, patent analysis

- Growth innovation matrix to identify flag bearers, contenders, specialists, and experimenters

How is our ‘Gaming’ report different from other reports in the market?

- The report presents the gaming industry statistics in terms of demand based on platform, gamer type, type, and region.

- The study entails a summarization of key factors or variables responsible for assisting market growth shortly.

- Detailed segmentation by type– Video Games and Cloud Games

- Detailed segmentation by platform– Smartphone, Console, PC, Tablet, Handheld Controllers, and Head-Mounted Displays

- Detailed segmentation by gamer type– Casual Gamers, Avid Gamers, Lifestyle Gamers

- With more than 100+ charts and tables, the report is designed with an easy digestible qualitative content.

- The study presents intelligence around recent mergers & acquisitions venture financing and filed patents.

- The key market participants operating within this market and their respective profiles are laid out with dedicated sections on company overview, financials, products & services, recent developments, and innovations.

We recommend this valuable source of information to:

- Technology Leaders and Startups

- Strategy, Marketing, and Business Development

- Market Intelligence and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A and Investment Consultants

- Management Consultants and Consulting Firms

Get a Snapshot of the Gaming Market, Download a Free Report Sample

Gaming Market Report Overview

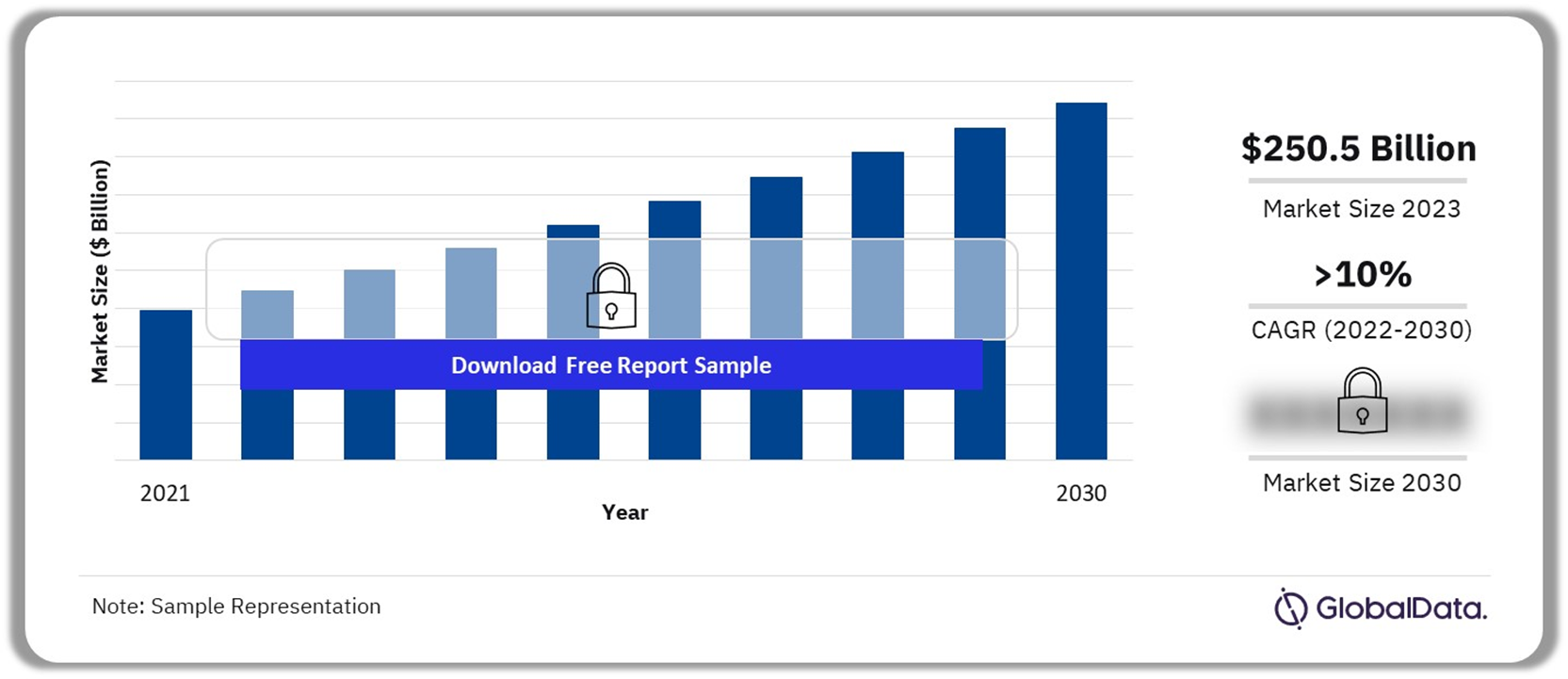

The gaming market size revenue was estimated to be valued at $250.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 10% over the forecast period. Technological advancements in gaming hardware and software, such as enhanced graphics, processing power, and the integration of virtual reality (VR), have facilitated market growth. This growth is further fueled by the rise of digital distribution platforms like Steam, Epic Games Store, and console marketplaces has simplified game access and broadened market reach.

The use of mobile or smartphones for gaming picked up momentum in the post-pandemic era with the growing traction for the freemium model. This model of gaming allows users to explore the basic content for free and more advanced content on a paid basis. The immense popularity gained by PlayerUnknown’s Battlegrounds (PUBG) is an example of freemium gaming content. Going ahead, the industry dynamics suggest a rise in the adoption of subscription-based models for exclusive gaming experiences.

Gaming Market Outlook, 2021-2030 ($Billion)

Buy the Full Report for Additional Insights on the Gaming Market Forecast

The growth momentum of the gaming industry remained strong in the post-pandemic era primarily influenced by steady consumer spending on entertainment channels. However, the yearly growth rates reduced marginally in 2022 as the surge in inflation directly impacted consumer spending on non-essential products during this period.

Various monetization models have emerged in the gaming industry, offering developers and publishers new avenues for generating revenue. Microtransactions, wherein players can purchase virtual goods or in-game currency, have become increasingly prevalent, offering players the option for enhanced customization or progression. Subscription services, such as premium memberships or access to exclusive content, provide players with ongoing benefits and a steady revenue stream for developers. In-game advertising allows brands to integrate their products or messages seamlessly into gaming environments, creating additional revenue opportunities while maintaining immersion for players. These diverse monetization approaches offer flexibility and opportunities for profitability in the ever-evolving gaming market.

The growing internet access, fueled by the rollout of 5G networks, mobile esports, and cloud gaming services, combined with smartphones nearing technical equivalence with PCs and consoles suggests a growing adoption of gaming in the future. For instance, as per the statistics released by the Entertainment Software Association (ESA) in July 2023, the US alone has 212.6 million weekly video gamers.

| Market Size (2023) | $250.5 billion |

| CAGR (2021 – 2030) | 10% |

| Forecast Period | 2022-2030 |

| Historic Data | 2021 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Platform Segment | Smartphone, Console, PC, Tablet, Handheld Controllers, Head-mounted Displays |

| Type Segment | Video Games, Cloud Games |

| Gamer Type Segment | Casual Gamers, Avid Gamers, Lifestyle Gamers |

| Geographies | North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa |

| Countries | US, Canada, Mexico, Germany, the UK, Italy, France, China, Japan, India, Australia, South Korea, Brazil, Argentina, Colombia, Peru, Nigeria, Iran, Saudi Arabia, Morocco |

| Key Companies | Tencent Holdings Ltd., Sony Group Corp., Microsoft Corp., Nintendo Co Ltd., NetEase Inc., Sea Ltd., Activision Blizzard Inc., Bandai Namco Holdings Inc., Electronic Arts Inc., Take-Two Interactive Software Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

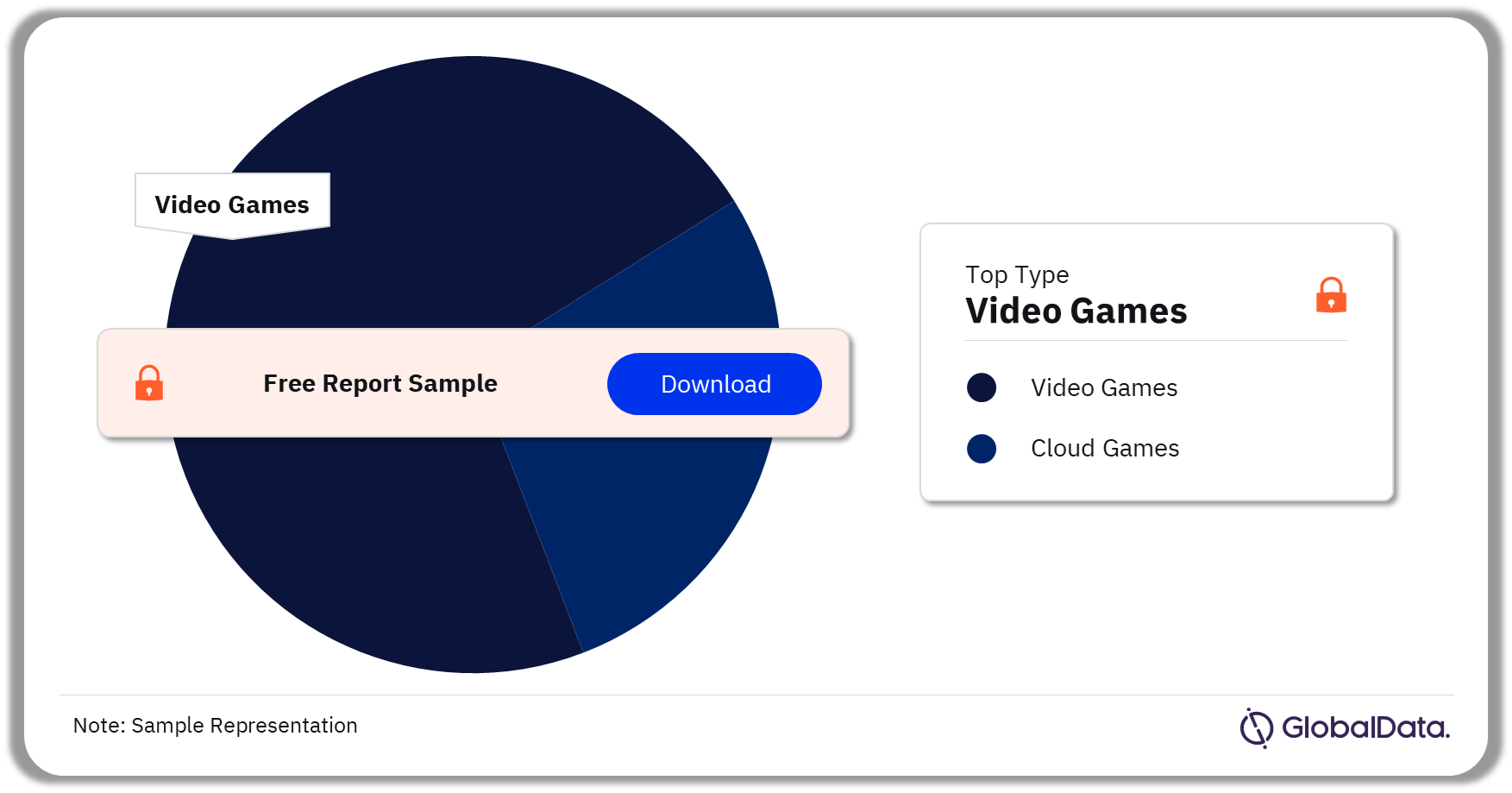

Gaming Segmentation by Type

In terms of type-based segmentation, video games commanded a dominating share in 2023 and are expected to continue their dominance over the forecast period. The segmental growth is to be aided by the uniform participation of players across different age groups. As per the survey by the Entertainment Software Association (ESA) in 2023, the average gamer age in the US is 32 years old, and almost 74% of the total population above the age of 18 to 55 years and older prefer playing video games.

Although video games are expected to remain a dominant category, their share is anticipated to reduce over the projected timeframe. This can be attributed to the rising popularity of cloud gaming services offering freemium models. The free gaming experience allows users to engage in gameplay without spending any monetary investment. This model was popularized by the success of games such as League of Legends, PlayerUnknown’s Battlegrounds (PUBG), and Fortnite.

The cloud games segment is poised to register the fastest-growing compound annual growth rate of over 38% during the forecast period. The numerous advantages that cloud games offer including cost-effectiveness, instant play, accessibility, and scalability will fuel this growth. Among these, instant play, which eliminates the need for installation has been a key driver for the recent surge in popularity of cloud gaming.

Gaming Market Share by Type, 2023 (%)

Buy the Full Report for More Information on Gaming Market Type

Tech giants such as Google, Microsoft, Sony, and Nvidia are increasingly focusing on offering exclusive gaming content based on a subscription model, which serves as a strong driver for cloud games. These companies are leveraging subscription models to position themselves as the “Netflix of gaming”. Microsoft, Sony, and Tencent stand out as potential leaders within the subscription model due to their large libraries of exclusive games.

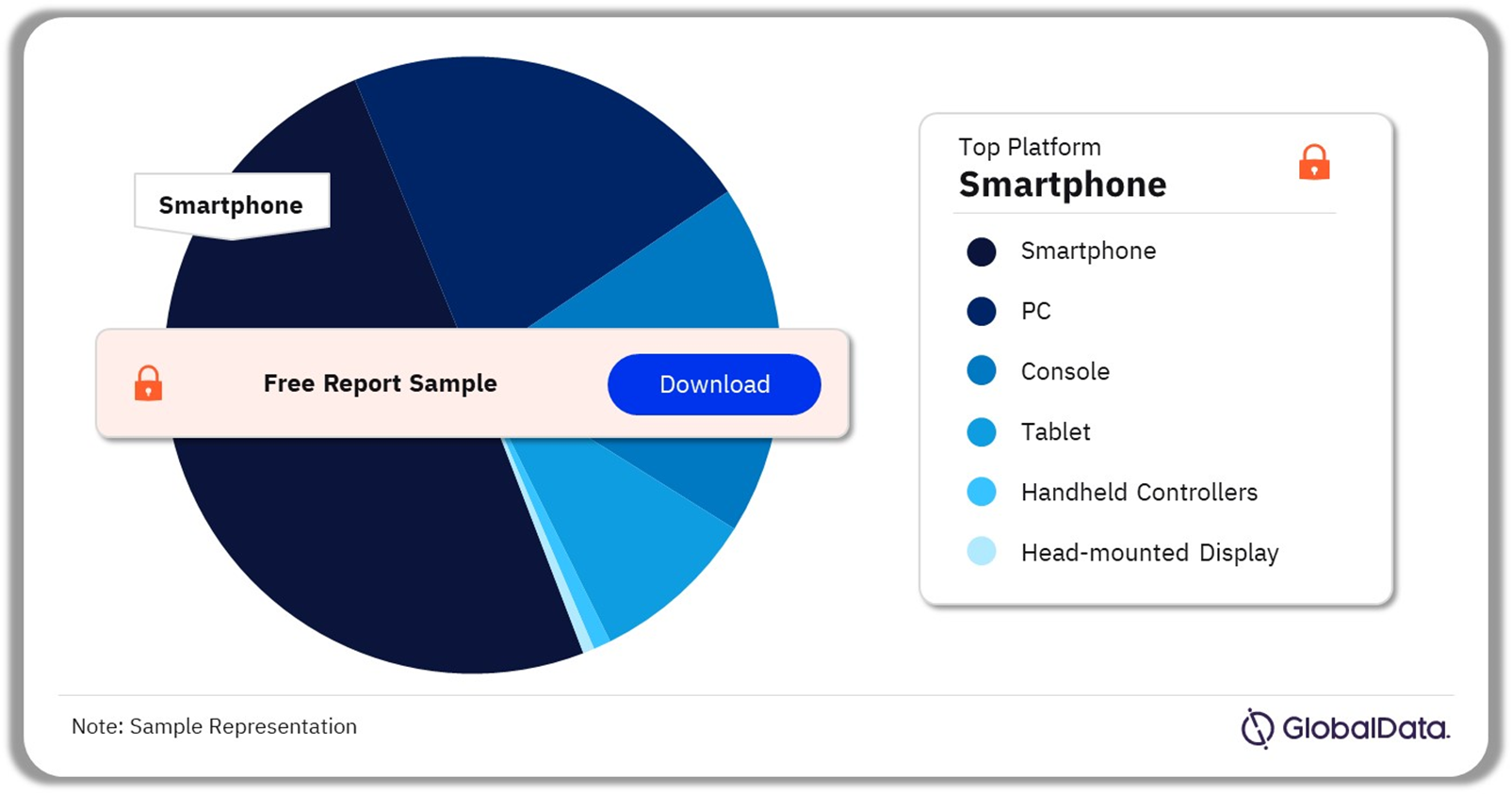

Gaming Market Segmentation by Platform

In 2023, the smartphone category led the market in terms of segmentation by platform. The high share is driven by the global expansion of the mobile phone network over the last decade. The segmental growth over the forecast period is anticipated to remain high, supported by the unique characteristics including easy portability and maneuverability of smartphones. This will be further supported by the growing focus of smartphone manufacturers on the hardware of the device for an effective gaming experience. For instance, Samsung’s Galaxy S24+, released in January 2024, employs a thermal management chip that allows it to keep the device cool during long gaming sessions.

The second largest category is PC as per the estimates of 2023. PC-based games have been popular since the 1990s and have a wide audience base of different age demographics. The segmental growth over the predicted timeline is to be influenced by the launch of dedicated PCs supporting high-graphics games.

Gaming Market Share by Platform, 2023 (%)

Buy the Full Report for More Information on the Gaming Market Platform

The console category is the third largest segment in 2023 and is anticipated to observe steady growth over the predicted timeline. The growth of this segment is primarily driven by the steady sales volume of consoles. For instance, over 50 million units of Playstation5 were sold since its launch in November 2020.

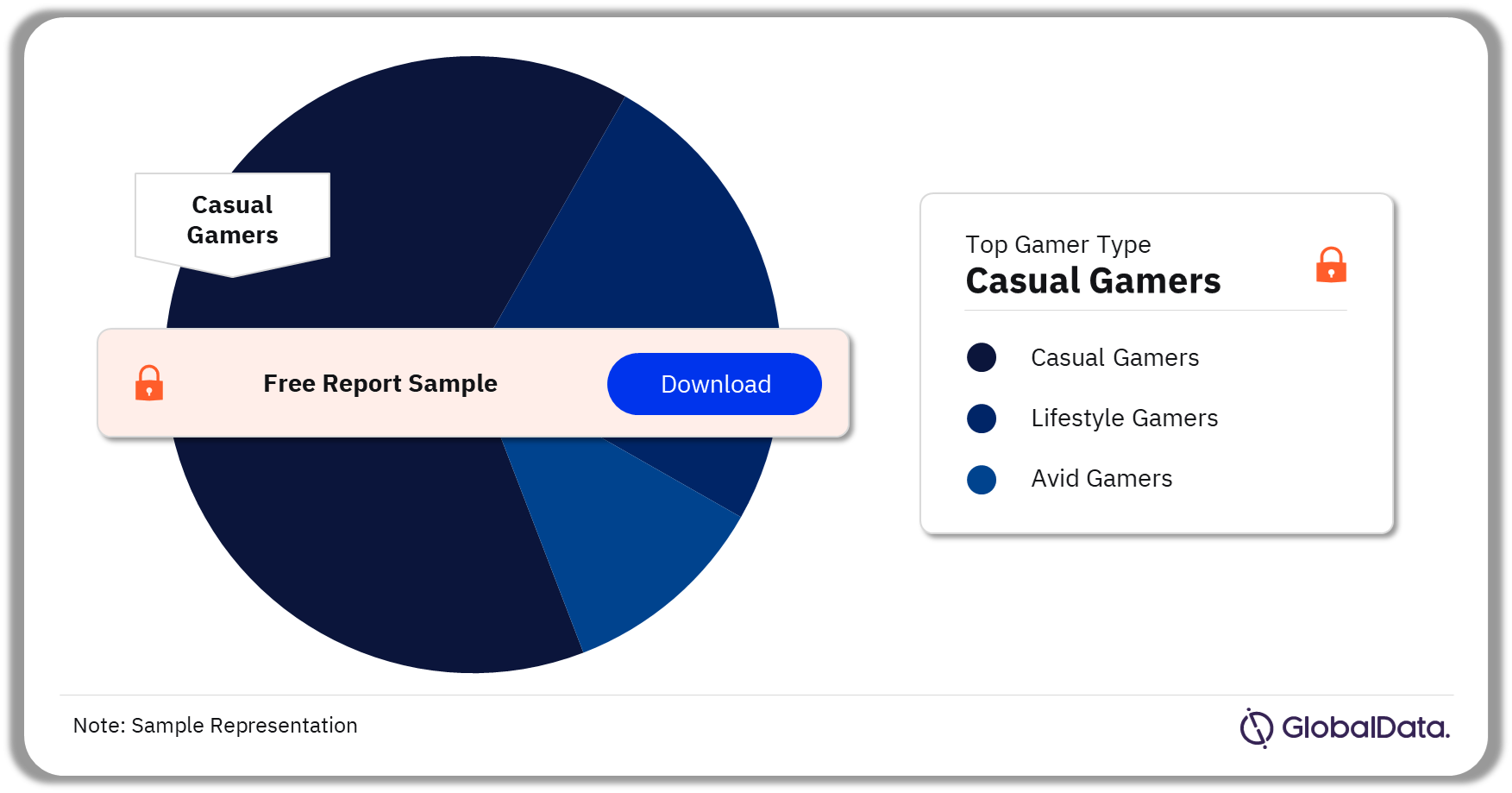

Gaming Market Segmentation by Gamer Type

The casual gamers segment remained the dominating group in 2023 and is projected to remain the largest category over the forecast period. The casual gamers segment is expected to grow slowly as compared to its counterparts over the projected timeframe. The slow growth rate is attributed to a wide number of factors including a growing focus on physical activities, changes in demographics, and limited leisure time among different consumer groups.

The second-largest segment by gamer type is lifestyle gamers. The segmental growth over the forecast period is to be driven increasing number of competitive events in the gaming sector. An example is the World Championship for League of Legends in 2023, which was the largest gaming tournament and garnered a peak viewership of over 6.4 million.

Gaming Market Share by Gamer Type, 2023 (%)

Buy the Full Report for More Information on the Gaming Market Gamer Type

The avid gamers segment, which is the smallest among others, is projected to surpass lifestyle gamers to become the second-largest group by 2027. The growth in this segment is primarily attributed to the growing popularity of esports among young users, thus, transforming casual gamers into avid gamers.

Gaming Market Analysis by Region

Asia Pacific registered the largest regional share in 2023 and is predicted to maintain its position during the forecast period. The users of this region tend to spend more time on gaming as compared to the global average. Moreover, with the rise of gaming content on social media, they are gradually expanding their reach with content videos that discuss tricks and tips. The key countries of the region including China, Japan, Indonesia, Singapore, and South Korea boast some of the largest populations in the world gaming sector.

The second largest region was North America in 2023, comprising the US, Canada, and Mexico. The US, with its advanced domestic gaming industry, accounted for over 90% regional share by revenue and is expected to maintain its regional leadership. The rising popularity of head-mounted displays in the US is likely to pave the way for the development of the gaming sector over the projected timeframe.

Europe’s gaming industry is poised to grow at a compound annual growth rate of more than 9% over the forecast period. The regional trends are influenced by developments in the industry across key countries including Germany, the UK, France, and Italy. Ireland is expected to emerge as a leader in esports development, aided by its strong intellectual property laws.

Gaming Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Gaming Market

The remaining regions including South & Central America and Middle East & Africa accounted for a single-digit market share in 2023. However, both these regions are anticipated to register a strong compound annual growth rate over the forecast period, supported by the expansion of smartphone networks in the regional developing countries.

Gaming Market – Competitive Landscape

The competitive landscape in the gaming market remains fragmented with the presence of numerous market participants worldwide. However, the industry dynamics are predominantly influenced by vendors from the US, Japan, and China. These vendors have higher visibility than others due to large regional markets with the potential for cross-border businesses.

The gaming industry is an ideal example of a hypercompetitive market. The market has low barriers to entry and often attracts new vendors owing to lucrative opportunities in terms of revenue. Thus, the vendor landscape remains competitive due to the continuous entry of new players. This environment also fosters increased acquisition activities in the regional markets.

In October 2023, Microsoft’s acquisition of Activision-Blizzard-King was approved after two years of regulatory challenges. The acquisition, valued at $69 billion, was one of Microsfot’s largest purchases in its history.

Leading Companies in the Gaming Market

- Tencent Holdings Ltd.

- Sony Group Corp.

- Microsoft Corp.

- Nintendo Co Ltd.

- NetEase Inc.

- Sea Ltd.

- Activision Blizzard Inc.

- Bandai Namco Holdings Inc.

- Electronic Arts Inc.

- Take-Two Interactive Software Inc.

Other Gaming Market Vendors Mentioned

Apple Inc., ROBLOX Corp., Ubisoft Entertainment SA, Netmarble Corp., Square Enix Holdings Co Ltd., Konami Group Corp., Alphabet Inc., Nexon Co Ltd., NCsoft Corp., Embracer Group AB, Vivendi SA, Sega Sammy Holdings Inc., and others.

Buy the Full Report to Know More About Leading Gaming Companies

Gaming Market Segments

GlobalData Plc has segmented the Gaming market report by type, platform, gamer type, and region:

Gaming Market Type Outlook (Revenue, $Million, 2021-2030)

- Video Games

- Cloud Games

Gaming Market Platform Outlook (Revenue, $Million, 2021-2030)

- Smartphone

- Console

- PC

- Tablet

- Handheld Controllers

- Head-mounted Displays

Gaming Market Gamer Type Outlook (Revenue, $Million, 2021-2030)

- Casual Gamers

- Avid Gamers

- Lifestyle Gamers

Gaming Market Regional Outlook (Revenue, $Million, 2021-2030)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South & Central America

- Brazil

- Argentina

- Colombia

- Peru

- Rest of South & Central America

- Middle East & Africa

- Nigeria

- Iran

- Saudi Arabia

- Morocco

- Rest of the Middle East & Africa

Key Players

Tencent Holdings LtdSony Group Corp

Microsoft Corp

Nintendo Co Ltd

NetEase Inc

Sea Ltd

Activision Blizzard Inc

Bandai Namco Holdings Inc

Electronic Arts Inc

Take-Two Interactive Software Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What was the gaming market size in 2023?

The gaming market size was valued at $250.5 billion in 2023.

-

What is the gaming market growth rate?

The gaming market is expected to grow at a CAGR of 10.1% during the forecast period.

-

What is the key gaming market driver?

The gaming market growth is primarily driven by the expansion of 5G networks, thereby accelerating the adoption of smartphone gaming.

-

Which was the leading type segment in the gaming market in 2023?

The video game category accounted for the largest gaming market share in 2023.

-

Which are the leading gaming companies globally?

The leading gaming companies are Tencent Holdings Ltd., Sony Group Corp., Microsoft Corp., Nintendo Co Ltd., NetEase Inc., Sea Ltd., Activision Blizzard Inc., Bandai Namco Holdings Inc., Electronic Arts Inc., and Take-Two Interactive Software Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.