India Wind Power Market Analysis by Size, Installed Capacity, Power Generation, Regulations, Key Players and Forecast to 2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

India Wind Power Market Overview

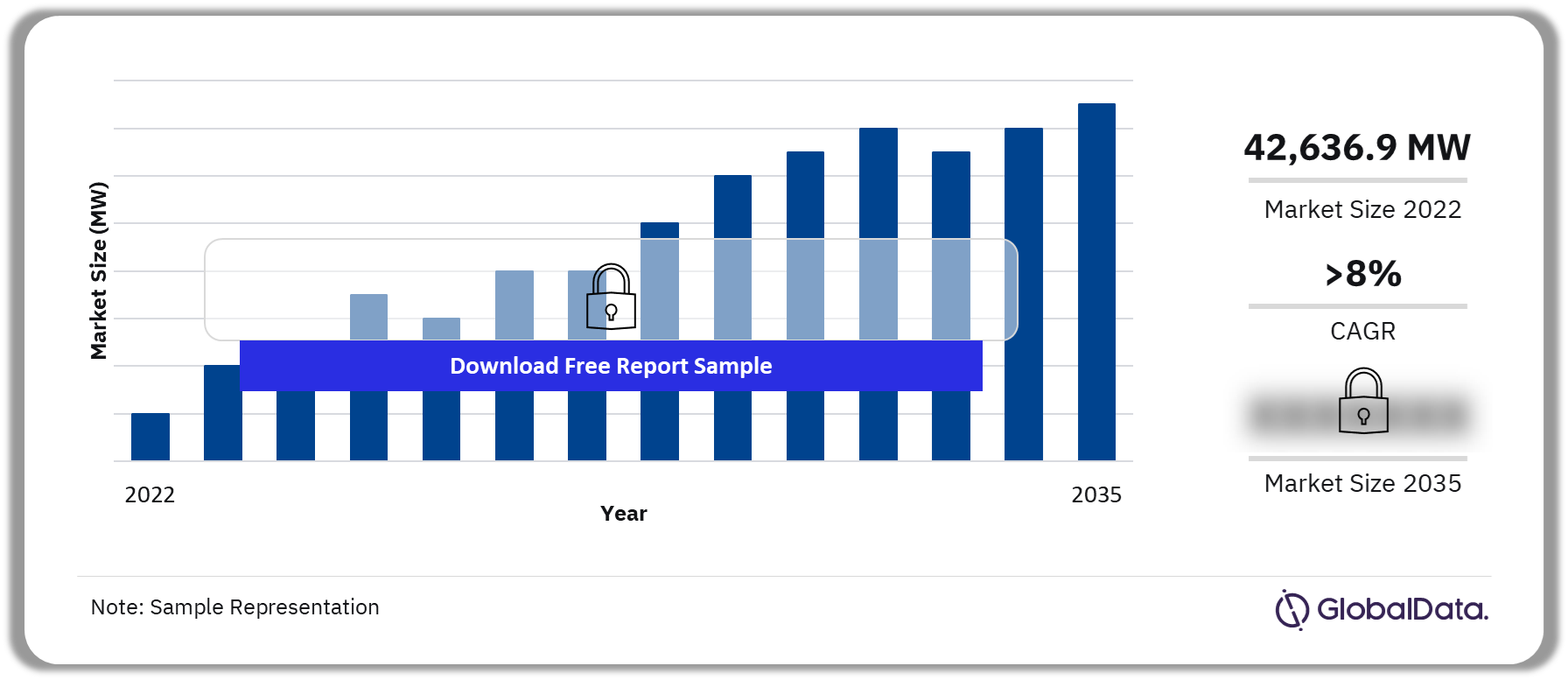

The cumulative installed capacity for wind power in India was 42,636.9 MW in 2022. It is expected to achieve a CAGR of more than 8% during 2022-2035. The India wind power market research report offers comprehensive information and understanding of the wind power market in India. The report discusses the renewable power market in the country and provides forecasts up to 2035.

India Wind Power Market Outlook, 2022-2035 (MW)

Buy Full Report for More Insights on the India Wind Power Market Forecast

The report highlights installed capacity and power generation trends from 2010 to 2035 in the country’s wind power market. Detailed coverage of the renewable energy policy framework governing the market is also provided in the report. The report also provides company snapshots of some of the major market participants.

| Cumulative Installed Capacity (2022) | 42,636.9MW |

| CAGR (2022-2035) | >8% |

| Historical Period | 2010-2022 |

| Forecast Period | 2023-2035 |

| Key Types | · Onshore

· Offshore |

| Key Deal Types | · Debt Offerings

· Asset Transactions · Acquisition · Partnerships · Equity Offerings · Private Equity |

| Key Active Plants | · Dayapar Wind Project

· Rajasthan Wind Farm – RSEPL · Pritam Nagar Wind Farm · Bhuj_Alfanar Wind Farm · Gujarat-Sembcorp |

| Key Companies | · Tata Power Renewable Energy Ltd

· Veritas (India) Ltd · Reliance Power Ltd · NLC India Ltd · Adani Green Energy Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

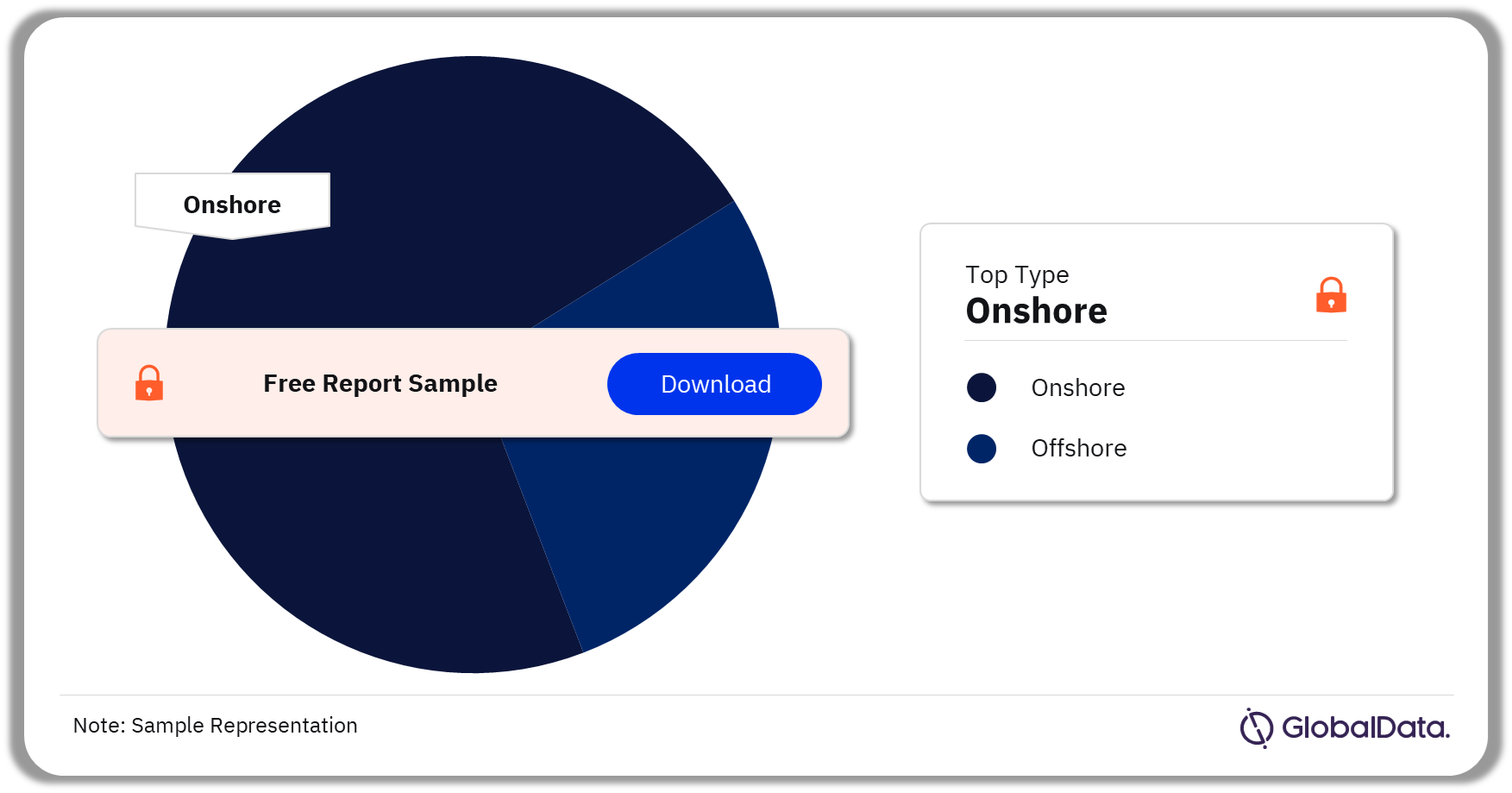

India Wind Power Market Segmentation by Types

The key types in the Indian wind power market are onshore wind and offshore wind. In 2022, onshore wind power generation dominated the Indian wind power market.

India Wind Power Market Analysis by Types, 2022 (%)

Buy Full Report for More Power Type Insights in the India Wind Power Market

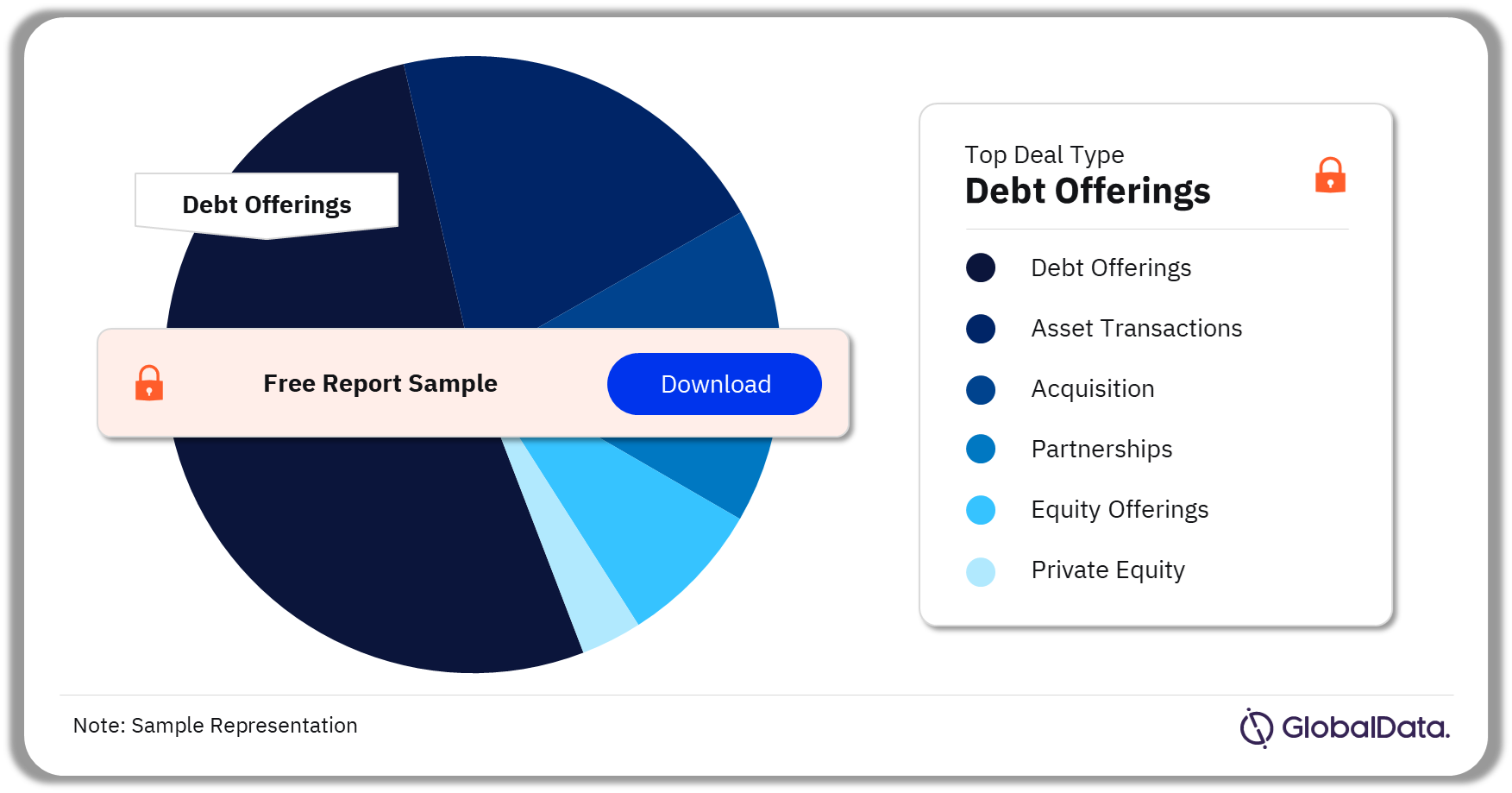

India Wind Power Market Segmentation by Deal Types

The key deal types in the Indian wind power market are asset transactions, debt offerings, acquisitions, equity offerings, partnerships, and private equity. In 2022, most of the deals were debt offerings.

India Wind Power Market Analysis by Deal Types, 2022 (%)

Buy Full Report for More Deal Type Insights on the India Wind Power Market

Major Active Plants in the India Wind Power Market

Some of the major active plants in the India wind power market are Dayapar Wind Project, Rajasthan Wind Farm – RSEPL, Pritam Nagar Wind Farm, Bhuj_Alfanar Wind Farm, and Gujarat-Sembcorp among others. Dayapar Wind Project led the onshore wind power market in India in terms of total capacity contribution in 2023.

India Onshore Wind Power Market Analysis by Active Plants, 2023 (%)

Buy Full Report for More Active Plant Insights on the India Wind Power Market

India Wind Power Market – Competitive Landscape

The key companies in the India wind power market are Tata Power Renewable Energy Ltd, Veritas (India) Ltd, Reliance Power Ltd, NLC India Ltd, and Adani Green Energy Ltd.

Tata Power Renewable Energy Ltd: It is a subsidiary of Tata Power Company Limited is a provider of renewable energy in India. The company generates and sells power to the local distribution companies. It develops, constructs, and operates wind, solar, and waste gas-based power assets. The company has partnerships with ABB, Gamesa, Inox Wind, Kenersys, ReGen Powertech, Suzlon, Tata Power Solar and Wind World.

India Wind Power Market Analysis by Companies

Buy Full Report for More Company Insights on the India Wind Power Market

Segments Covered in the Report

India Wind Power Market Type Outlook (Value, 2010-2035, MW)

- Onshore Wind

- Offshore Wind

India Wind Power Market Deal Type Outlook (Value, 2010-2035, MW)

- Asset Transactions

- Acquisition

- Partnerships

- Debt Offerings

- Equity Offerings

- Private Equity

Scope

The report includes:

- A brief introduction to global carbon emissions and global primary energy consumption.

- An overview of the country’s renewable power market, highlighting installed capacity, generation trends, and installed capacity split by various renewable power sources.

- Detailed overview of the country’s wind power market with installed capacity and generation trends and major active and upcoming wind power projects.

- Deal analysis of the country’s wind power market.

- Key policies and regulatory framework supporting the development of wind power sources.

- Snapshots of some of the major market participants in the country.

Reasons to Buy

- Enhance your decision-making capability in a more rapid and time-sensitive manner.

- Identify key growth and investment opportunities in the country’s wind power market.

- Facilitate decision-making based on strong historical and forecast data for the wind power market.

- Position yourself to gain the maximum advantage of the industry’s growth potential.

- Develop strategies based on the latest regulatory events.

- Identify key partners and business development avenues.

- Understand and respond to your competitors’ business structure, strategy, and prospects.

Veritas (India) Ltd

Reliance Power Ltd

NLC India Ltd

Adani Green Energy Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What was the India wind power market's cumulative installed capacity in 2022?

The cumulative installed capacity for wind power in India was 42,636.9 MW in 2022.

-

What is the India wind power market growth rate?

The India wind power market is expected to achieve a CAGR of more than 8% during 2022-2035.

-

Which was the leading type in the Indian wind power market?

In 2022, onshore wind power generation dominated the Indian wind power market.

-

Which was the leading deal type in the Indian wind power market?

In 2022, most of the deals in the Indian wind power market were closed via debt offerings.

-

Which is the leading active wind power plant in the Indian wind power market?

As of 2023, Dayapar Wind Project had the highest power generation capacity in the Indian wind power market.

-

What are the key companies in the Indian wind power market?

The key companies in the Indian wind power market are Tata Power Renewable Energy Ltd, Veritas (India) Ltd, Reliance Power Ltd, NLC India Ltd, and Adani Green Energy Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.