Industrial Fasteners Market Trends and Analysis by Region, Product (Nuts, Bolts, Screws, Studs, Rivets), End-Use and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Industrial Fasteners’ report can help:

- Detailed market sizing based on product types, end-use sectors, and regional markets.

- Mapping the entire ecosystem of the value chain and stages associated with it.

- Detailed country-level insights with breakdown provided for key market segments.

- Evaluate potential growth opportunities in product and end-use segments supported by comprehensive qualitative commentary.

- Foresee possible changing dynamics of the sector and align business strategies to capitalize on them.

- List of major industrial fasteners raw material suppliers and prospective end-users

How is our ‘Industrial Fasteners’ report different from other reports in the market?

- The report captures current and futuristic demand for finished industrial fasteners across key sectors and countries/regions from 2020 to 2030 in terms of revenue ($Million)

- Detailed segmentation by product– Nuts & Bolts, Screws & Studs, Rivets, and Others

- The report also highlights segmentation at the end-use sectors– Automotive, Aerospace, Building and construction, Agriculture, Marine and mining, Industrial Machinery, and Others

- The study encompasses the identification of the key variables or factors responsible for influencing the market dynamics of the industrial fasteners market space. These factors are bifurcated based on their positive and negative attributes into the drivers, restraints, and opportunities.

- The timeline of the market is provided covering a historical context concerning the developments made in the industrial fasteners market space

- Competitive landscape of the market depicting the key market participants and different stakeholders of the market value chain along with a list of raw material manufacturers & suppliers and prospective end users

- Detailed company profiles for key vendors of the market with a focus on business overview, financial performance, SWOT analysis, key personnel, and strategic initiatives.

We recommend this valuable source of information to:

- Industrial fasteners Companies

- Automotive Manufacturers

- Aerospace Engineering Companies

- Construction Contractors

- Industrial Machinery Manufacturers

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Buy the Full Report to Get a Snapshot of the Industrial Fasteners Market, Download a Free Report Sample

Industrial Fasteners Market Report Overview

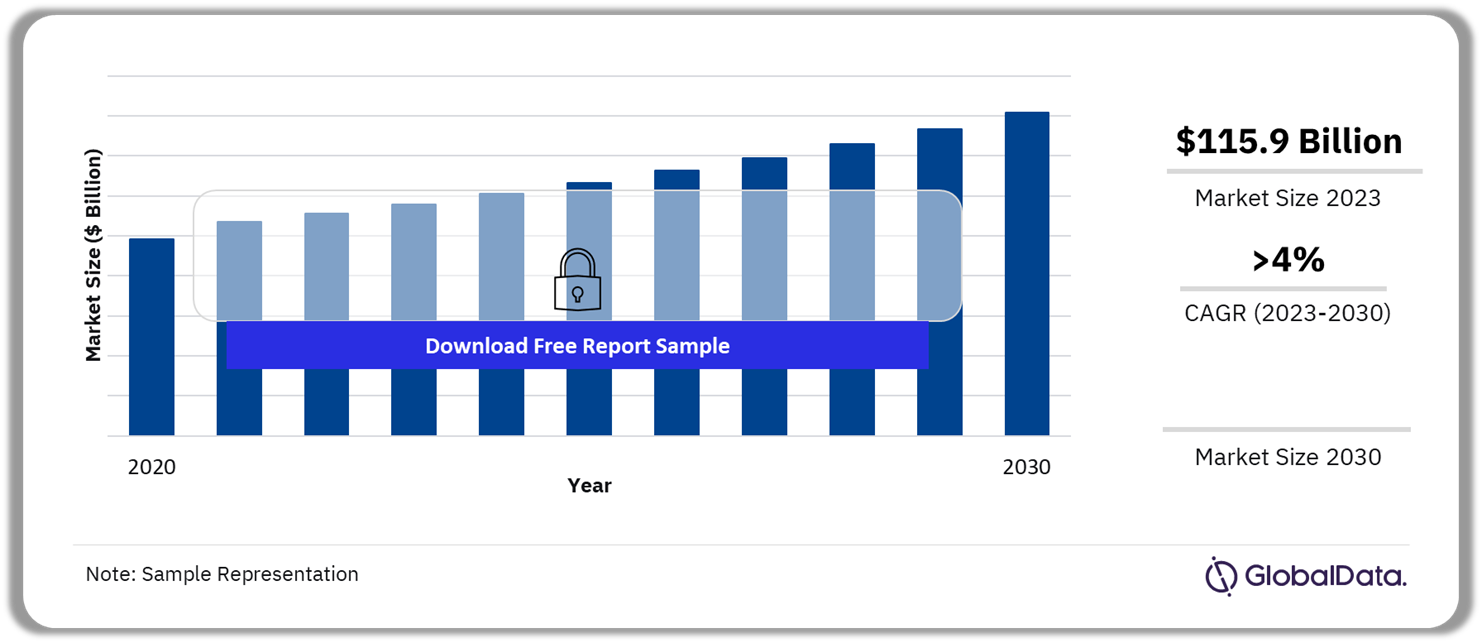

The industrial fasteners market size revenue was valued at $115.9 billion in 2023 and will grow at a CAGR of more than 4% over the forecast period. The surge in demand for fasteners across key end-use sectors including automotive, and agriculture is the primary driver of market growth in the forecast period. In addition, the globalization of supply chains has led to increased demand for fasteners to connect components sourced from various locations, driving the need for efficient and reliable fastening solutions.

The expanding population of vehicle owners, combined with the rising vehicle production rates, particularly in emerging economies like India, China, Indonesia, Kazakhstan, and Malaysia, is expected to drive the demand for fasteners in the automotive industry. According to the European Automobile Manufacturers’ Association (ACEA), global vehicle production reached approximately 85.4 million units in 2022, with passenger cars accounting for 68.7 million units of this total.

Industrial Fasteners Market Outlook, 2020-2030 ($Billion)

Buy the Full Report for Additional Insights on the Industrial Fasteners Market Forecast

Download a Free Report Sample

The technological advancements associated with manufacturing and development across end-use applications are boosting demand for advanced fasteners globally. The growth is further supported by increasing demand from emerging markets of the Asia Pacific and North America including China, the US, Japan, and India. These nations stand out for their robust industrial landscapes, significant investments in infrastructure development, and thriving manufacturing sectors, all of which contribute to the heightened demand for advanced fastening solutions.

The global industrial landscape has witnessed a significant shift towards sustainability. This transition is a strategic move by the industry to align with changing consumer preferences, and regulatory requirements. In addition, these efforts also aid in companies’ environmental goals for reducing their carbon footprints. This increased attention to the environment has led to the evolution of the circular economy concept, where products and materials are reused and recycled across the manufacturing sector.

For instance, industrial fasteners such as nuts, bolts, and screws are essential components across many end-use applications, thus opting for environmentally friendly options manufactured from recycled materials by market players is working as a strong catalyst for the circular economy or the sustainability of the manufacturing process of industrial fasteners. This shift in trend is anticipated to create potential opportunities in the fasteners market over the forecast timeframe.

| Market Size (2023) | $115.9 Billion |

| CAGR (2023-2030) | >4% |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Product Segment | Nuts & Bolts, Screws & Studs, Rivets, Others |

| End-Use Segment | Automotive, Aerospace, Building and Construction, Agriculture, Marine and Mining, Industrial Machinery, Others |

| Geographies | North America, Europe, Asia Pacific, Rest of the World |

| Countries | US, Canada, Mexico, Germany, Italy, Spain, France, Rest of Europe, China, Japan, India, Australia, Rest of APAC, Brazil, UAE, Rest of the World |

| Key Companies | Illinois Tool Works Inc (ITW), Stanley Black & Decker Inc., Johns Manville Corp., LISI SA, National Aerospace Fasteners Corporation (NAFCO), TriMas Corp., MISUMI Group Inc., HILTI, Howmet Aerospace Inc., Böllhoff Group, Ford Fasteners, Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

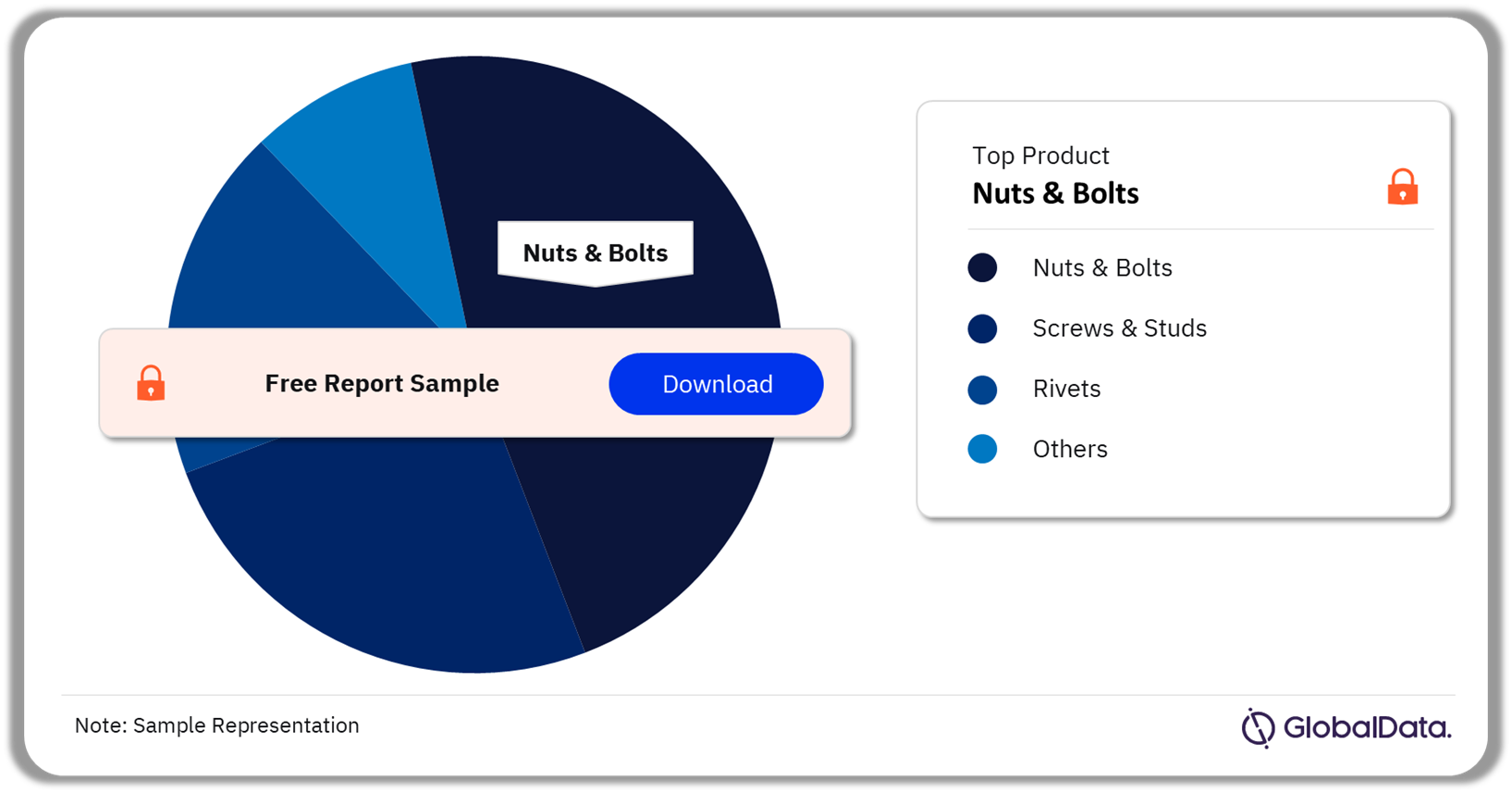

Industrial Fasteners Market Segmentation by Product

Based on the product segment, rivets are anticipated to grow at the fastest CAGR of 5.3% in terms of revenue over the forecast timeframe. One of the key driving features of rivets is their ability to provide a permanent and secure connection between materials. In addition, these are available in various types including solid rivets, pop rivets, drive rivets, tubular rivets, split rivets, shoulder rivets, and flush rivets, which increases its usability in diverse applications. Rivets are gaining demand across applications, where strong & non-reversible joints are required with safety being a top priority, as in the construction of bridges, airplanes, and automotive.

The growing demand for rivets in the industrial sector is prompting manufacturers to reduce their reliance on suppliers for production requirements. Thus, they are upgrading their facilities to become more self-sufficient to comply with the rising demand. For instance, in Jan 2023, Atlas Copco installed an on-site nitrogen generation system to feed the operation system of manufacturing self-piercing rivets and tools. This enables the company to overcome its dependency on vendors for gas supply for manufacture. This will also help in meeting the increasing demand for its self-piercing rivets and tooling for complex automotive assembly applications.

Screws and studs is in the second position, following nuts and bolts. These are essential components in various industrial applications, owing to their ability to provide mechanical stability and structural integrity to end-use applications.The demand for screws and studs in the industrial fasteners market will rise owing to the growing manufacturing sector and the need for reliable, efficient, and superior fastening solutions. As industries continue to advance, the requirements for specialized screws and studs also evolve. Manufacturers in the industrial fasteners market continually innovate, developing new materials and designs to meet the demands of modern applications.

Industrial Fasteners Market Analysis by Product, 2023 (%)

Buy the Full Report for More Product Information on the Industrial Fasteners Market

Download a Free Report Sample

The nuts & bolts products segment leads the market with maximum revenue share while indicating a compound annual growth rate (CAGR) of 4.3% over the forecast period. The major reason supporting its dominance in the global space is its high penetration in almost all end-use sectors including construction, automotive, machinery, aerospace, oil & gas, furniture, and mining.

The continuous development of new products with advanced features required in the changing application space is further contributing to segmental growth. The governments of major manufacturing countries are implementing mandatory quality norms for nuts, bolts, and other fasteners to curb the import of substandard goods as well as to increase the domestic production of such fasteners. For instance, in India, items cannot be imported, stocked, sold, traded, and produced, unless they abide by the Bureau of Indian Standards (BIS) mark.

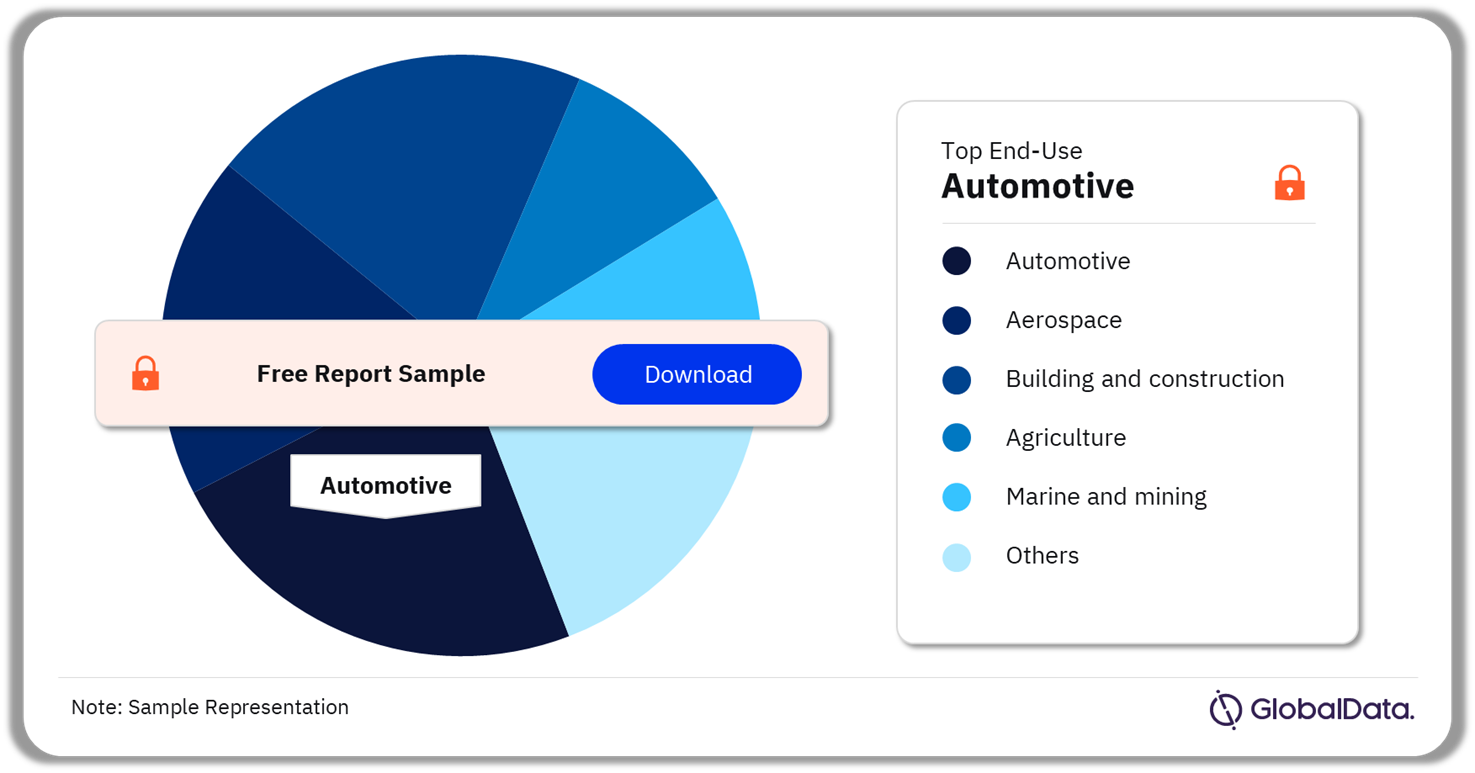

Industrial Fasteners Market Segmentation by End-Use

Based on the end-use segment, the automotive category is expected to capture the dominating revenue share in 2023. The vehicle advancements across the automotive industry in terms of design and operation are anticipated to boost demand for industrial fasteners over the estimated timeframe. For instance, the increasing production of electronic vehicles (EVs) for commercial and personal usage, is bolstering demand for lightweight fasteners to comply with the working mechanism of EVs.

According to the International Energy Agency (IEA), electric car sales exceeded 10 million in 2022 amounting to 14% of all new cars sold were electric in 2022. The production and sales of EVs are projected to grow over the forecast period due to the increased focus on the climate ambitions of countries across the globe. The collaborative efforts by governments and industry participants for lowering carbon footprints with the incorporation of electric vehicles in the transportation system are anticipated to drive the demand for fasteners specially designed for electric vehicles.

Industrial Fasteners Market Analysis End-Use, 2023 (%)

Buy the Full Report for More Information on End-Use of Industrial Fasteners Market

Download a Free Report Sample

The aerospace sector held the third position by market share in the end-use segment. The high penetration of industrial fasteners, especially in the production of aircraft and spacecraft products, is expected to support market growth. The increasing demand for aircraft across developed and developing economies along with their expanding air traffic is projected to support growth over the forecast timeframe. According to the International Air Transport Association (IATA), Asia-Pacific airlines posted a 126.1% rise in full-year international 2023 traffic compared to 2022. The statistics are showcasing a strong post-pandemic rebound in 2023.

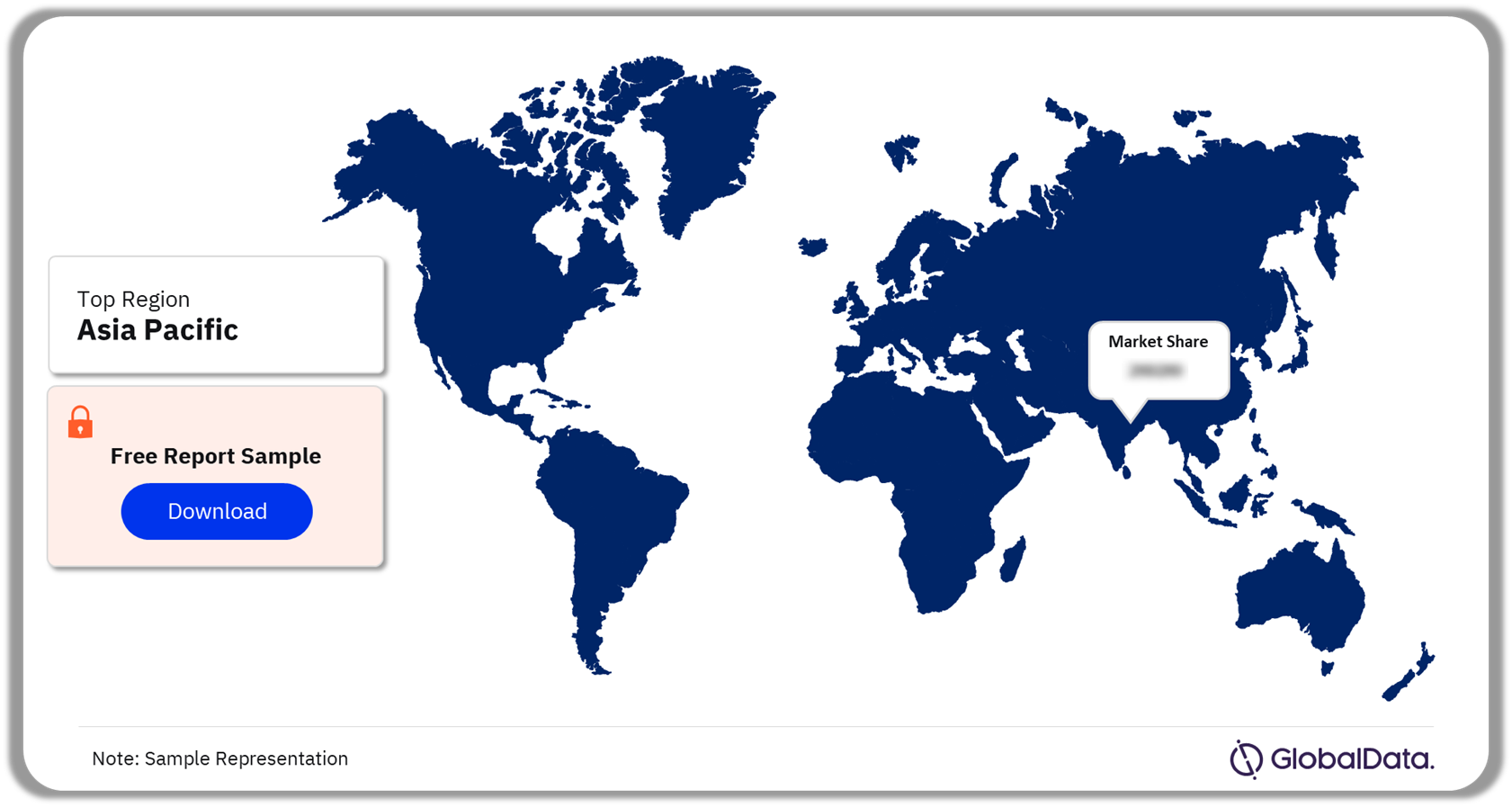

Industrial Fasteners Market Analysis by Region

Asia Pacific accounted for the largest share among regions in the industrial fasteners market in 2023. This regional analysis includes country-level estimates for China, Japan, Australia, India, and the rest of Asia Pacific. China is leading the regional market with maximum revenue share, along with its strong capabilities in the import and export of industrial fasteners globally. The country is also home to many fastener manufacturers, which are contributing to the dominating revenue share through their robust supply network in the domestic as well as international markets.

India is predicted to grow at the fastest pace with a CAGR of 7.3% in terms of revenue over the estimated timeframe. The increasing domestic production across industrial sectors including automotive, aerospace, and building & construction supports the country’s fastest growth. In addition, the Indian manufacturing sector is also exhibiting significant growth through government support and favorable initiatives such as Startup India and Make in India, which are further projected to boost industrial fasteners production over the forecast period.

Industrial Fasteners Market Analysis by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Industrial Fasteners Market

Download a Free Report Sample

Germany is leading the regional market owing to its high production capacity and the presence of advanced manufacturing facilities operated by major global competitors. The market is also influenced by the increased demand from the country’s construction sector, where fasteners made up of metals, plastic, and composite materials play a significant role in joining two or more materials together.

In 2023, Europe is followed by the North America region. The US is projected to dominate the regional market owing to its robust manufacturing sector, which is supporting its dominance and favoring growth over the estimated timeframe. Furthermore, domestic manufacturers such as Howmet Aerospace Inc., Stanley Black & Decker Inc., and Johns Manville Corp, among others, are focusing on new technologies and specialization in the fasteners segment to develop innovative new fasteners for the changing end-use market. This will further support the country’s dominance throughout the forecast period.

Industrial Fasteners Market – Competitive Landscape

Industrial fastener manufacturers are continuously focusing on product advancements and capacity expansion to meet the changing end-use market. This results in strategic collaboration, acquisitions, new product launches, R&D, and facility expansions. For instance, in Nov 2023, a division of Stanley Black & Decker, STANLEY Engineered Fastening announced the launch of a new corporate brand structure including a go-to-market portfolio under the STANLEY Engineered Fastening banner comprising of seven global strategic brands.

Along with this, companies are also focusing on sustainability by advancing their manufacturing units through the incorporation of new technology machinery that can help in reducing waste generation and lowering carbon footprints. The concept of a circular economy, where products and materials are reused and recycled, is gaining prominence in the fastener manufacturing sector. For instance, manufacturers are voluntarily participating in reducing fasteners waste, where customers can return used fasteners for recycling in the supply chain. The collected materials are, in turn, used to produce new fasteners, creating a closed-loop system that minimizes waste and promotes sustainability.

Such initiatives are anticipated to support the environmental goals of the respective countries and players in the market over the forecast period. The key companies leading the market include Stanley Black & Decker Inc., National Aerospace Fasteners Corporation (NAFCO), Johns Manville Corp., Illinois Tool Works Inc (ITW), MISUMI Group Inc., LISI SA, TriMas Corp., Howmet Aerospace Inc., Ford Fasteners, Inc. Hilti Corp., and Böllhoff Group, among others.

Leading Companies in the Industrial Fasteners Market

- Illinois Tool Works Inc (ITW)

- Stanley Black & Decker Inc.

- Johns Manville Corp.

- LISI SA

- National Aerospace Fasteners Corporation (NAFCO)

- TriMas Corp.

- MISUMI Group Inc.

- Hilti Corp.

- Howmet Aerospace Inc.

- Böllhoff Group

- Ford Fasteners, Inc.

Other Industrial Fasteners Market Vendors Mentioned

ATF, Inc., KOVA Fasteners Pvt. Ltd., MW Industries, Inc., Rockford Fasteners, Inc., and Brunner Manufacturing Co., Inc., among others.

Buy the Full Report to Know More About Leading Industrial Fasteners Companies

Download a Free Report Sample

Industrial Fasteners Market Segments

GlobalData Plc has segmented the industrial fasteners market report by product, end-use, and region:

Industrial Fasteners Market Product Outlook (Revenue, $Billion, 2020-2030)

- Nuts & Bolts

- Screws & Studs

- Rivets

- Others

Industrial Fasteners Market End-Use Outlook (Revenue, $Billion, 2020-2030)

- Automotive

- Aerospace

- Building and construction

- Agriculture

- Marine and mining

- Industrial Machinery

- Others

Industrial Fasteners Market Regional Outlook (Revenue, $Billion, 2020-2030)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

- Rest of the World

- Brazil

- United Arab Emirates (UAE)

- Rest of the World (Other Countries)

Scope

The market intelligence report provides an in-depth analysis of the following –

- Industrial fasteners market outlook: analysis as well as historical figures and forecasts of volume and revenue opportunities from product, end-use, and regional segments

- The competitive landscape: an examination of the positioning of leading players in the industrial fasteners market

- Company Analysis: analysis of the market position of leading providers in the industrial fasteners market

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

The global industrial fasteners market demand in terms of revenue is projected to reach $115.9 Billion in 2023, growing at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The growing significance of the fasteners across end-use industries including automotive, aerospace, and building & construction is likely to drive market growth over the forecast period.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global industrial fasteners market by product, end-use, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions, drivers, deals, strategic initiatives, and trend analysis in industrial fasteners markets.

- Detailed segmentation by product level – nuts & bolts, screws & studs, rivets, and others. the second level of segmentation includes at end-use level – automotive, aerospace, building and construction, agriculture, marine and mining, industrial machinery, and others

- The report includes 90+ figures and tables providing in-depth analysis of the market size, forecast, and supporting factors which are tailor-made for an executive-level audience, with enhanced presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in industrial fasteners market.

- The report evaluates the entire value chain of the industrial fasteners market space while highlighting the key players of the industry.

- The report offers a list of key raw material manufacturers and a dedicated list of prospective end-users under competitive landscape.

Key Players

Illinois Tool Works Inc (ITW)Stanley Black & Decker Inc

Johns Manville Corp

LISI SA

National Aerospace Fasteners Corporation (NAFCO)

TriMas Corp

MISUMI Group Inc.

Hilti Corp

Howmet Aerospace Inc

Böllhoff Group

Ford Fasteners, Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Industrial Fasteners market size in 2023?

The industrial fasteners market size was valued at $115.9 billion in 2023.

-

What will Industrial Fasteners market growth rate be during 2023-2030?

The industrial fasteners market will grow at a CAGR of more than 4% during the forecast period.

-

What is the key Industrial Fasteners market driver?

The industrial fasteners market growth is primarily driven by increasing automotive production, growing demand for industrial fasteners in the aerospace industry, and rapid developments in the construction industry.

-

Which was the leading product segment in the Industrial Fasteners market in 2023?

The nuts & bolts accounted for the largest industrial fasteners market share in 2023.

-

Which are the leading Industrial Fasteners companies globally?

The leading industrial fasteners companies are Illinois Tool Works Inc (ITW), Stanley Black & Decker Inc., Johns Manville Corp., LISI SA, National Aerospace Fasteners Corporation (NAFCO), TriMas Corp., MISUMI Group Inc., Hilti Corp., Howmet Aerospace Inc., Böllhoff Group, Ford Fasteners, Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Industrial Goods and Machinery reports