Transformers Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Transformers Market Report Overview

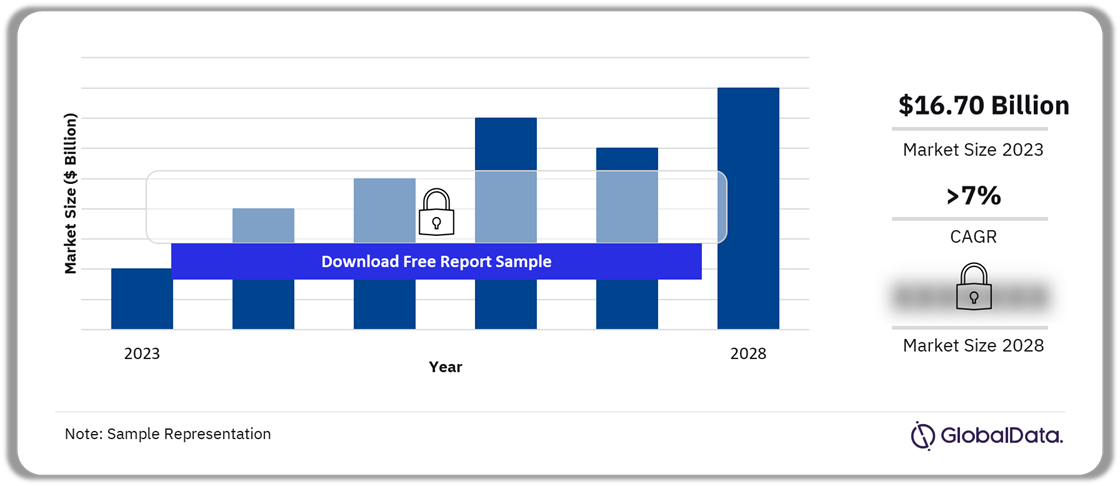

The power transformers market size was $16.70 billion in 2023. The market will grow at a CAGR of more than 7% during 2023-2028. The requirement for safe and reliable power, the rising urban population coupled with the modernization of existing power grids, and increased investments in renewable energy, besides the adoption of smart grid technology, will be the main factors aiding the growth of the global power transformer market.

Power Transformers Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report for More Insights into the Transformers Market, and Download a Free Report Sample

The transformers market research report analyzes the market value ($m) and market capacity (MVA) for the years 2019–2028; split between the historical period (2019–2023) and forecast period (2024–2028) across all levels. The report covers an overview of the existing manufacturers and their market share at the global and country levels. In addition, at the country level, transmission network line lengths (ckm) and substations (units), key policies and regulations, and upcoming substation projects are also presented. Profiles of major global manufacturers are also outlined in the report.

| Market Size 2023 | $16.70 billion |

| CAGR (2023-2028) | >7% |

| Regions | · Asia-Pacific

· The Americas · The EMEA |

| Competitors | · TBEA Co. Ltd.

· Hitachi Ltd. · TWBB · Siemens AG · State Grid Yingda Co. Ltd. · Electric Co. Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Transformers Market Dynamics

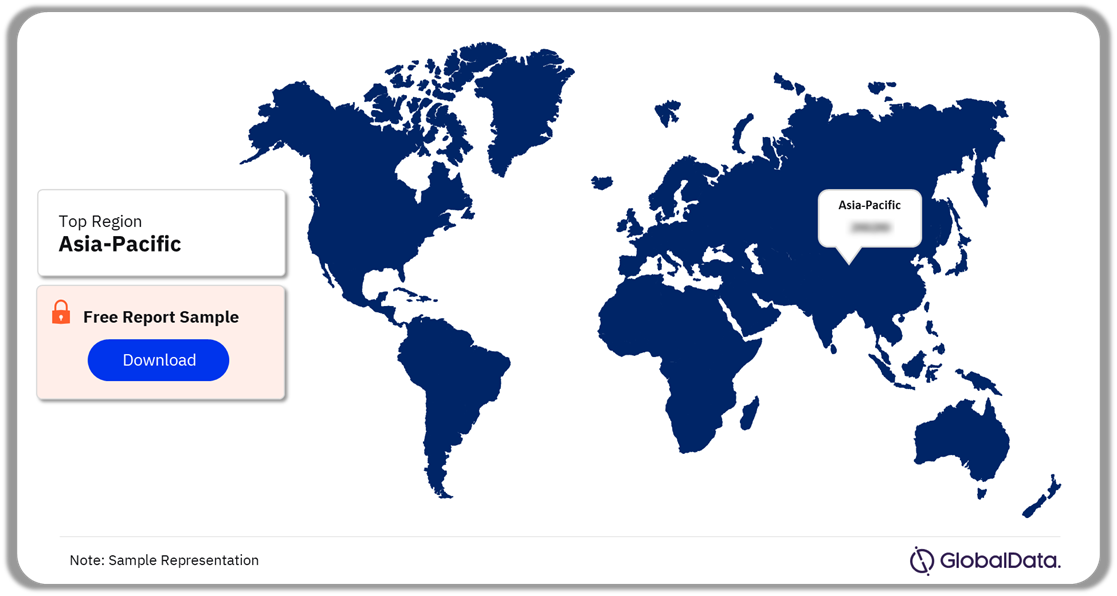

Climate change initiatives and the deployment of modern technologies are resulting in a fundamental transformation in the global electricity sector. Growth in the economy and population is inextricably linked with energy consumption in developing countries. Asia-Pacific is home to two of the largest flourishing economies in the world, China and India, whose governments have initiated various reforms to shore up their faltering markets.

The power sector is changing, owing to various economic and environmental factors. Concerns about global warming, increasing consumer base, rapid urbanization, growing income, and operational efficiency are some of the factors aiding market reforms in the sector. In well-established markets, grid assets are nearing the end of their life or well past their service life, raising questions about efficiency in their performance.

Transformers Market Segmentation by Regions

The Asia-Pacific region led the power transformers and distribution transformers market in 2023.

The key regions in the transformers market are Asia-Pacific, the Americas, and the EMEA.

Asia-Pacific: The growth in population, progressive economy, fuel supply challenges, evolving consumer base, and strong demand from industrial and commercial sectors are a few of the major factors for the growth of the transformers market in the region. Countries such as China and India along with other Southeast Asian countries proposed expanding their grid networks, deploying renewables and other distributed technologies, and improving the operational performance of their power sectors.

Power Transformers Market Analysis, by Regions, 2023(%)

Buy the Full Report for More Regional Insights into the Power Transformers Market, and Download a Free Report Sample

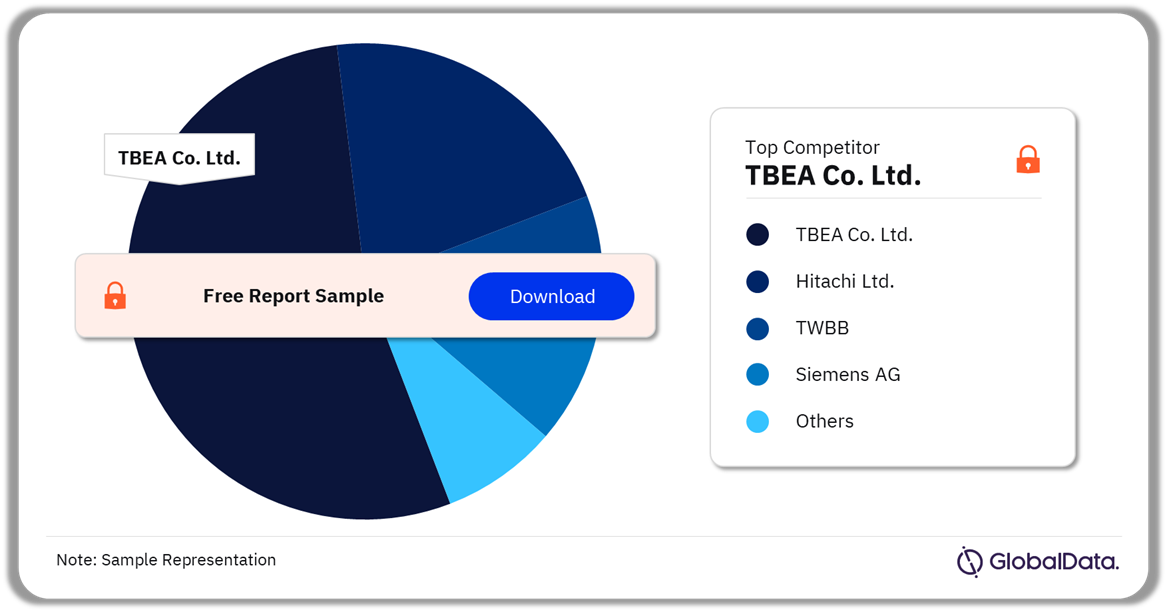

Transformers Market – Competitive Landscape

TBEA Co. Ltd. led the global power transformers market in 2023

A few of the prominent competitors in the power transformers and distribution transformers market are:

- TBEA Co. Ltd.

- Hitachi Ltd.

- TWBB

- Siemens AG

- State Grid Yingda Co. Ltd

- Electric Co. Ltd

Hitachi Ltd.: Hitachi is a multinational conglomerate with a presence in information technology, electronics, power systems, social infrastructure, industrial systems, and construction machinery. The company manufactures and sells information and telecom systems, power systems, social infrastructure and industrial systems, construction machinery, electronic systems and equipment, automotive systems, and smart life and eco-friendly systems. Its products and services find application in manufacturing, communications, finance, healthcare and life science, government, energy, automobile, aerospace, transportation, nuclear, and technology industries.

Power Transformers Market Analysis, by Competitors, 2023(%)

Buy the Full Report for More Competitor Insights into the Power Transformers Market, and Download a Free Report Sample

Segments Covered in the Report

Transformers Market Regional Outlook (Value, $ Billion, 2023-2028)

- Asia-Pacific

- The Americas

- The EMEA

Scope

The report analyses the transformers market. Its scope includes –

- Analysis of the market growth at global and regional levels of Asia-Pacific, Americas, Europe, and Middle East and Africa.

- The report provides market analysis for the key countries of the US, Brazil, India, China, Japan, Vietnam, Germany, the UK, Russia, and Saudi Arabia.

- The report offers market size analysis (value and capacity) for the historical period (2014–2018) and forecast period (2019–2023).

- It provides the competitive landscape at the global and country level for the year 2018.

- Key market drivers and restraints, analysis of their impacts on the transformers market at global and regional levels, upcoming substations, and policies as well as regulations at the country level, and profiles of major equipment manufacturers are also discussed.

Reasons to Buy

The report will enhance your decision-making capability in a more rapid and time-sensitive manner. It will allow you to –

- Facilitate decision-making by analyzing market data on transformers.

- Develop strategies based on developments in the market.

- Identify key business-development avenues, based on an understanding of market trends.

- Respond to your competitors’ business structure, strategies, and prospects.

Hitachi Ltd.

TWBB

Siemens AG

Xi’an XD Transformer Co.Ltd.

General Electric

Hyundai Heavy Industries Co.Ltd.

Toshiba Corporation

Crompton Greaves Limited

JSHP Transformers

Hyosung Corporation

Bharat Heavy Electricals Limited

Mitsubishi Electric Corporation

SGB-SMIT Management GmbH.

Delta Transformers Inc.

Weg Electric Equipment S.A.

Fuji Electric Co.Ltd.

Togliatti Transformer (TTZ)

SVEL

Dong Anh

Best

Iljin Electric

LSIS Co. Ltd.

Wilson

ALMACO

GETRA

Table of Contents

Table

Figures

Frequently asked questions

-

What was the global power transformers market size in 2023?

The global power transformers market size was $16.70 billion in 2023.

-

What will the power transformers market growth rate be during 2023-2028?

The power transformers market will grow at a CAGR of more than 7% during 2023-2028.

-

Which was the leading region in the power transformers market in 2023?

The Asia-Pacific region led the power transformers market in 2023.

-

Which are the major competitors in the power transformers market?

A few of the prominent competitors in the transformers market are TBEA Co. Ltd., Hitachi Ltd., TWBB, Siemens AG, State Grid Yingda Co. Ltd., and Electric Co. Ltd among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.