Insurtech Trends – Report Bundle (7 Reports)

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Insurtech Trends Bundle Report Overview

Advanced analytics technology will essentially serve as the backbone of insurance businesses, allowing them to effectively assess and underwrite risks, control fraud, forecast losses, and resolve claims quickly. Emergence of cyber insurance, rapid growth of inusrtech, and personalization of both life and commercial insurance will enhance the growth of “tech in insurance”.

As a part of this bundle, you will gain access to in-depth insights available in the following reports:

- Thematic Research: Computer Vision in Insurance

- Thematic Research: Connected Cars in Insurance

- Thematic Research: Cyber Insurance

- Thematic Research: Cybersecurity in Insurance

- Thematic Research: Insurtech

- Thematic Research: Personalization in Insurance

- Thematic Research: Robotics in Insurance

Report 1: Thematic Research: Cyber Insurance

Cybersecurity was thrust into the spotlight in 2020 as the COVID-19 pandemic forced businesses to digitize their processes and adopt remote working practices overnight. The pandemic also presented an opportunity for cybercriminals to exploit global panic, with a surge in cyberattacks occurring in 2020. This has made the need for cyber insurance apparent to businesses, but the market is not as easy to navigate as it once was. Cybersecurity was thrust into the spotlight in 2020 as the COVID-19 pandemic forced businesses to digitize their processes and adopt remote working practices overnight. The pandemic also presented an opportunity for cybercriminals to exploit global panic, with a surge in cyberattacks occurring in 2020. This has made the need for cyber insurance apparent to businesses, but the market is not as easy to navigate as it once was.

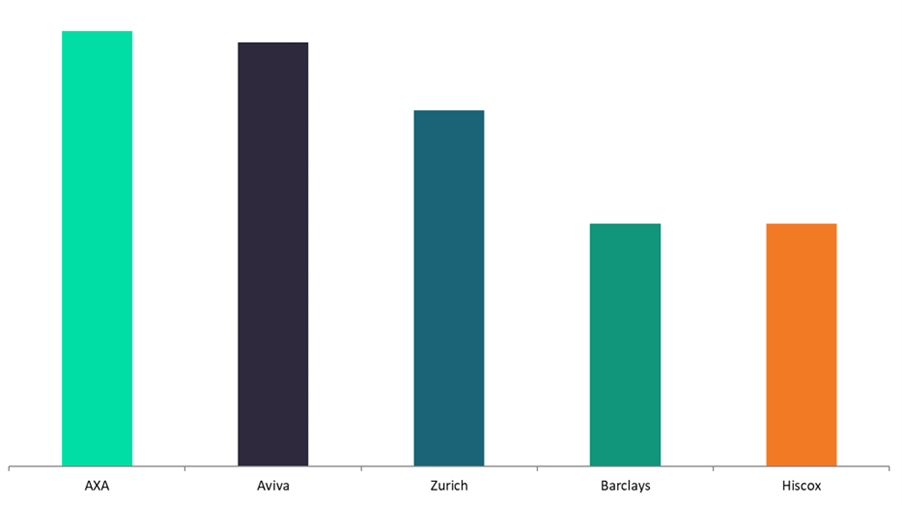

Leading Cyber Insurance Providers

To gain more information on cyber insurance, download our free report sample

Report 2:Thematic Research: Cybersecurity in Insurance (2022)

Cybersecurity revenues in the insurance sector was $6.4 billion in 2020. From 2020 to 2025, the market is anticipated to expand at a CAGR of more than 10%. The insurance sector’s cyber risk increased owing to COVID-19 since more customers were logging into their accounts online and insurance companies were offering their products online. The pandemic accelerated the need for cyber insurance, but insurers are yet to translate this into improved penetration rates. With the cost of cyber insurance rising to reflect increased cyber risk, policy uptake fell between 2019 and 2021 as many SMEs sought to cut costs.

Cybersecurity Software Value Chain

For more insights on cybersecurity in insurance industry, download our free report sample.

Report 3:Thematic Research: Insurtech

It is obvious how the insurtech phenomena is affecting the larger insurance sector. Startups have championed cutting-edge technologies and procedures incorporating AI, blockchain, IoT, and big data, driving incumbents to respond and match the efficiencies these tools have brought about. The most well-known brand among well-known insurtechs in the UK is Marmalade, according to GlobalData’s 2021 UK Insurance Consumer Survey. One of the primary strategies used by insurtechs to differentiate themselves from the established competition is innovative product creation. New technologies and the startup knowledge surrounding them have facilitated the emergence of innovative solutions as well as the advancement of current goods focused on niche market segments.

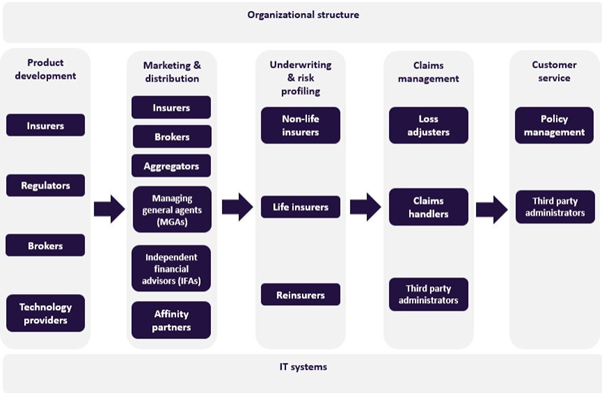

Insurtech Value Chain

To gain more information on the insuretech investments, download our free report sample

Report 4:Thematic Research: Personalization in Insurance

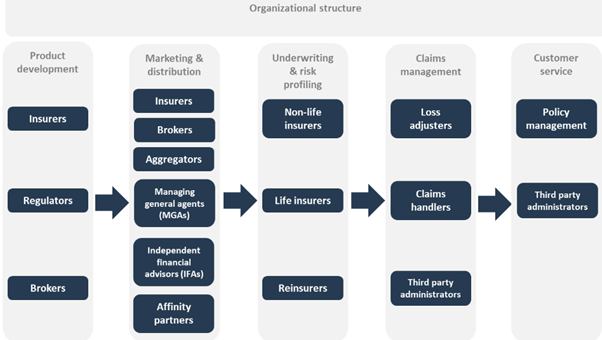

Personalization has emerged as a major theme in the insurance sector. Beyond personal lines, personalization has permeated both life and commercial insurance. This has been caused by the fact that brokers, reinsurers, and insurers are holding an increasing amount of data about their policyholders and are getting better at knowing how to store, process, and use it. This has been largely driven by digitalization, with customised insurance being purchased and managed online. The product development, marketing and distribution, underwriting and risk profiling, claims management, and customer service segments make up the insurance value chain.

Insurance Value Chain

To gain more insights on personalization in insurance, download our free report sample

Report 5:Thematic Research: Robotics in Insurance

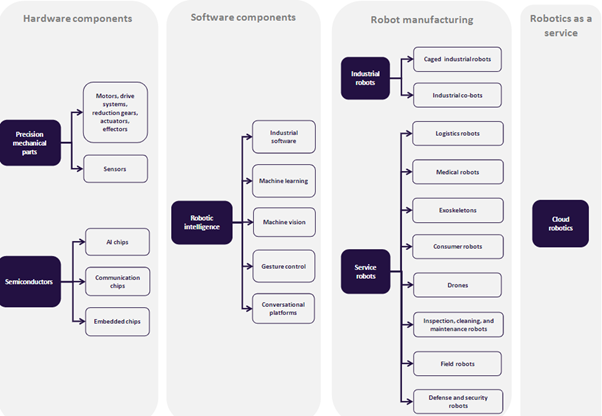

Robotics is a rapidly expanding sector, with an estimated market value of $45 billion in 2020 and a projected CAGR of 29% by 2030. Numerous insurers employed robots to carry out risk and damage analyses for crop fields or difficult-to-access regions like broken roofs. Life insurers are showing an increasing amount of interest in the fields of medical robots and exoskeletons, and they are progressively providing policyholders with access at no additional cost.

Robotics Value Chain

To gain more insights on robotics in insurance, download our free report sample

Report 6:Thematic Research: Computer Vision in Insurance

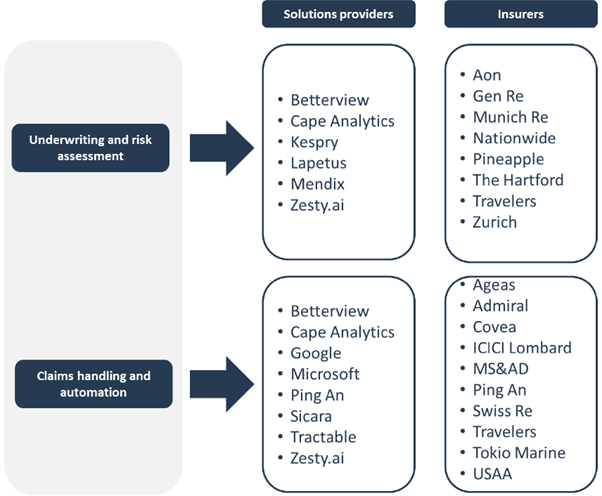

AI is used by computer vision (CV) to analyse photos and videos, recognise objects, and deliver useful information. With CV, insurers may more readily collect underwriting data and make use of previously untapped sources of information. Long-term, as technology replaces human drivers, CV will become a factor in the risk associated with autonomous vehicles, and insurance rates will be set in accordance with the level of underlying technology used by the vehicle. While insurers employ CV technology in their operations, they prefer to do so through partnerships over hiring in-house experts or buying CV technology businesses.

Leading Insurance Players Using Computer Vision

For more insights on computer vision in insurance, download our free report sample

Report 7:Thematic Research: Connected Cars in Insurance

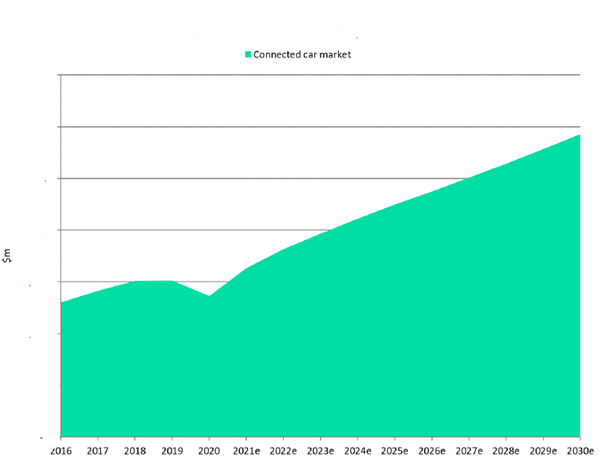

According to GlobalData, the market for connected cars will expand from its estimated value of $27.3 billion in 2020 to $58.5 billion by 2030, at a compound annual growth rate (CAGR) of 7.9%. The expansion of the connected car market flags the potential for insurers to integrate personalized aspects to how motor insurance premiums are priced by utilizing vehicle data. This will be possible because connected vehicles will already have telematics technology as part of their daily functions. As such, connected cars will lay the groundwork for insurers to access millions of data points generated by a vehicle’s ability to engage with other devices through the Internet of Things (IoT). Connected cars will assist insurers in developing increasingly accurate pricing strategies for customers.

Connected Cars Market Value

For more insights on connected cars in insurance, download our free report sample

Key Players: Thematic Research: Cybersecurity in Insurance (2022)

Key Players: Thematic Research: Insurtech

Key Players: Thematic Research: Personalization in Insurance

Key Players: Thematic Research: Robotics in Insurance

Key Players: Thematic Research: Computer Vision in Insurance

Key Players: Thematic Research: Connected Cars in Insurance

Table of Contents

Frequently asked questions

-

Thematic Research: Cyber Insurance

-

What are the different value chains in the cyber insurance market?

The value chains in the cyber insurance market can be divided into five segments: product development, marketing & distribution, underwriting & risk profiling, claims management, and customer service.

-

Thematic Research: Cybersecurity in Insurance (2022)

-

What is the global cybersecurity market growth rate?

The global cybersecurity market is expected to grow at a CAGR of more than 10% from 2020 to 2025.

-

What are the key cybersecurity value chains?

The key cybersecurity value chains can be divided into three segments: hardware, software, and services.

-

Thematic Research: Insurtech

-

Which are the companies leading in insurtech investments?

Alan, DeadHappy, Oscar Health, YuLife, Hedvig, Lemonade, and Marshmallow are some of the major companies leading in insurtech investments.

-

Thematic Research: Personalization in Insurance

-

What are the key value chain segments within insurance?

The insurance value chain is segmented into product development, marketing and distribution, underwriting and risk profiling, claims management and customer service.

-

Thematic Research: Robotics in Insurance

-

What was the robotics market size in 2020?

The robotics industry was valued at $45.3 billion in 2020.

-

Thematic Research: Computer Vision in Insurance

-

Which are the four key computer vision technologies?

The four key computer vision technologies are image recognition, object detection, video recognition, and machine vision.

-

Thematic Research: Connected Cars in Insurance

-

What was the connected cars market size in 2020?

The connected cars market size was valued at $27.3 billion in 2020.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports