Malaysia Foodservice Market Size and Trends by Profit and Cost Sector Channels, Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Malaysia Foodservice Market Overview

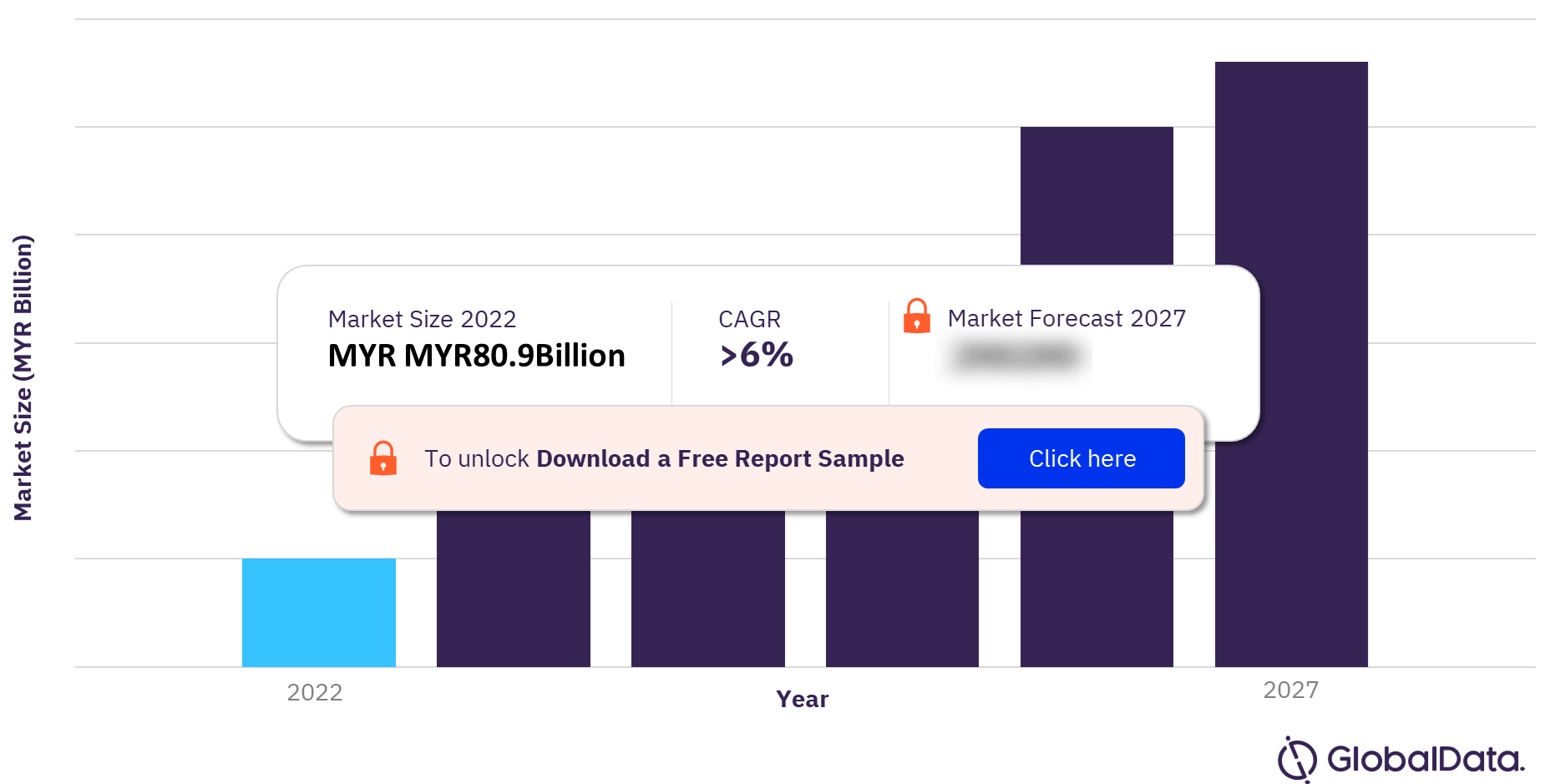

The Malaysia foodservice profit sector generated a revenue of MYR80.9 billion ($18.4 billion) in 2022 and is forecasted to record a CAGR of over 6% during 2022-2027. The foodservice profit sector witnessed a decline during 2017-2022, primarily due to the pandemic-related operational restrictions on restaurants which severely impacted the sector during 2020 and 2021. However, the number of transactions increased after the easing of restrictions followed by the reopening of international borders in 2022.

The Malaysia foodservice market research report provides extensive insight and analysis of the market during the historical and forecast periods and acts as a vital point of reference for operators or suppliers. The report includes the overview of Malaysia’s macro-economic landscape, growth dynamics, customer segmentation, and overview of the market leaders.

Malaysia Foodservice Profit Sector Outlook 2022-2027, (MYR billion)

For more insights on the Malaysia foodservice market forecast, download a free sample report

Malaysia Foodservice Market Dynamics

Revival of the market, value of money and healthier diet are the key trends in the foodservice market that will permeate almost all channels and are the most relevant explanations of consumer behaviour. Consumers who avoided foodservice outlets due to the pandemic restrictions will start visiting restaurants again. Additionally, rising health awareness has led consumers to look for food options that support good health and a strong immune system.

The significant rise in CPI due to the Russia─Ukraine conflict has urged consumers to seek low-cost meal options. Consumers remain highly price-conscious and thus will seek value-for-money offerings while struggling with rising prices.

For more Malaysia foodservice market dynamics, download a free sample report

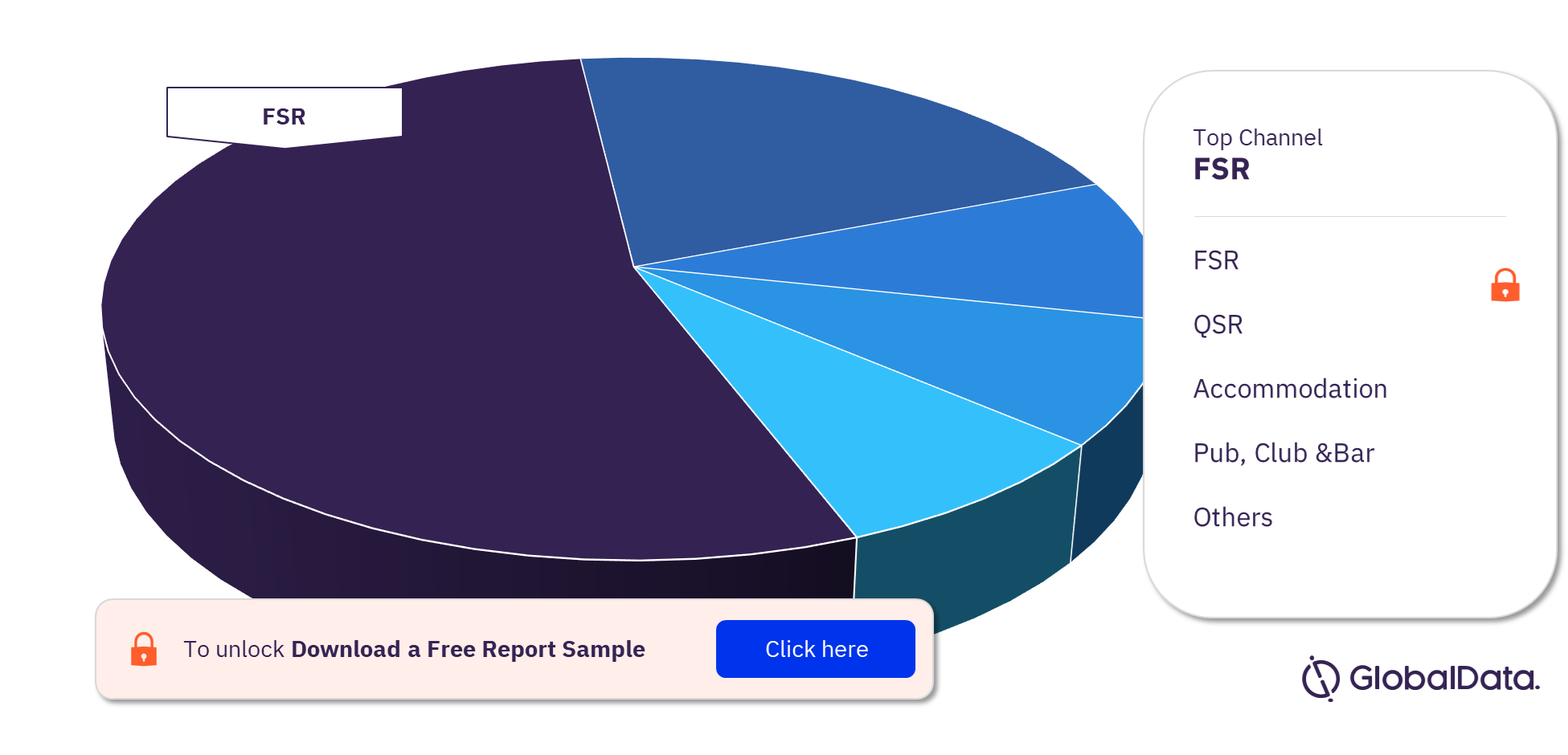

Malaysia Foodservice Market Segmentation by Profit Sector Channel

The key profit sector channels in the Malaysia foodservice market are FSR, QSR, accommodation, pub, club & bar, leisure, retail, travel, coffee & tea shop, workplace, ice cream parlor, and mobile operator. FSR was the largest channel in the profit sector in 2022. This reflects the popularity of traditional fine-dining experiences among Malaysian consumers. QSR was the second-largest channel in the same year. Consumers visit QSRs for convenient and budget-friendly offerings.

Malaysia Foodservice Market Analysis by Profit Sector Channel, 2022 (%)

For more channel insights in the Malaysia foodservice market, download a free sample report

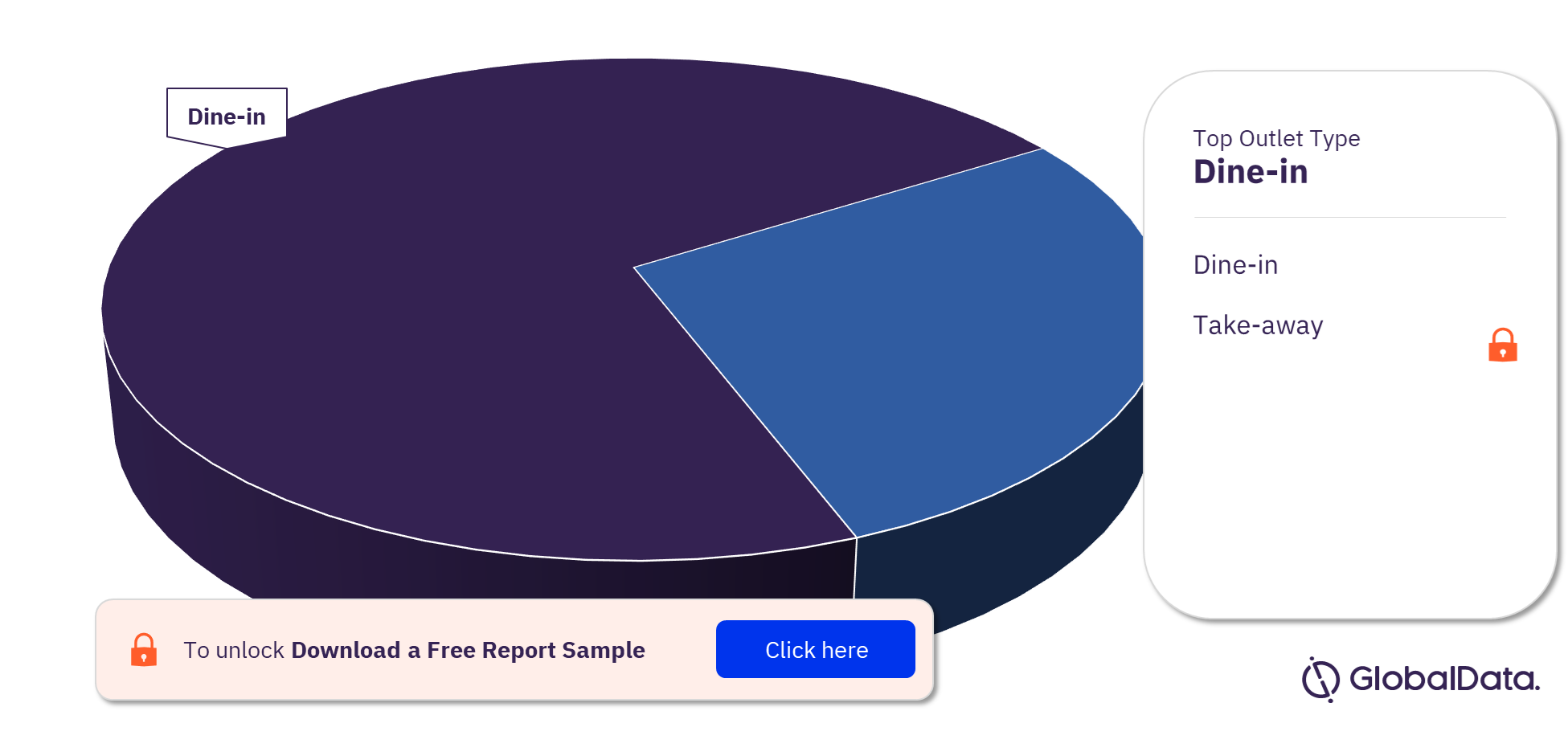

Malaysia Foodservice Market Segmentation by Outlet Type

The key outlet types in the Malaysia foodservice market are dine-in and take-away. Dine-in was the dominant service type in the Malaysian food service market in 2022. Value sales of dine-in services improved as tourism returned to full capacity. However, during 2017-2022, takeaway services performed significantly better than dine-ins.

Malaysia Foodservice Market Analysis by Outlet Type, 2022 (%)

For more outlet type insights in the Malaysia foodservice market, download a free sample report

Malaysia Foodservice Market Segmentation by Owner Type

The key owner types in the Malaysia foodservice market are independent operators and chain operators. The Malaysia foodservice profit sector was dominated by independent operators in 2022. The dominance of independent operators is projected to continue in QSR channel.

Malaysia Foodservice Market Analysis by Owner Type, 2022 (%)

For more owner-type insights in the Malaysia foodservice market, download a free sample report

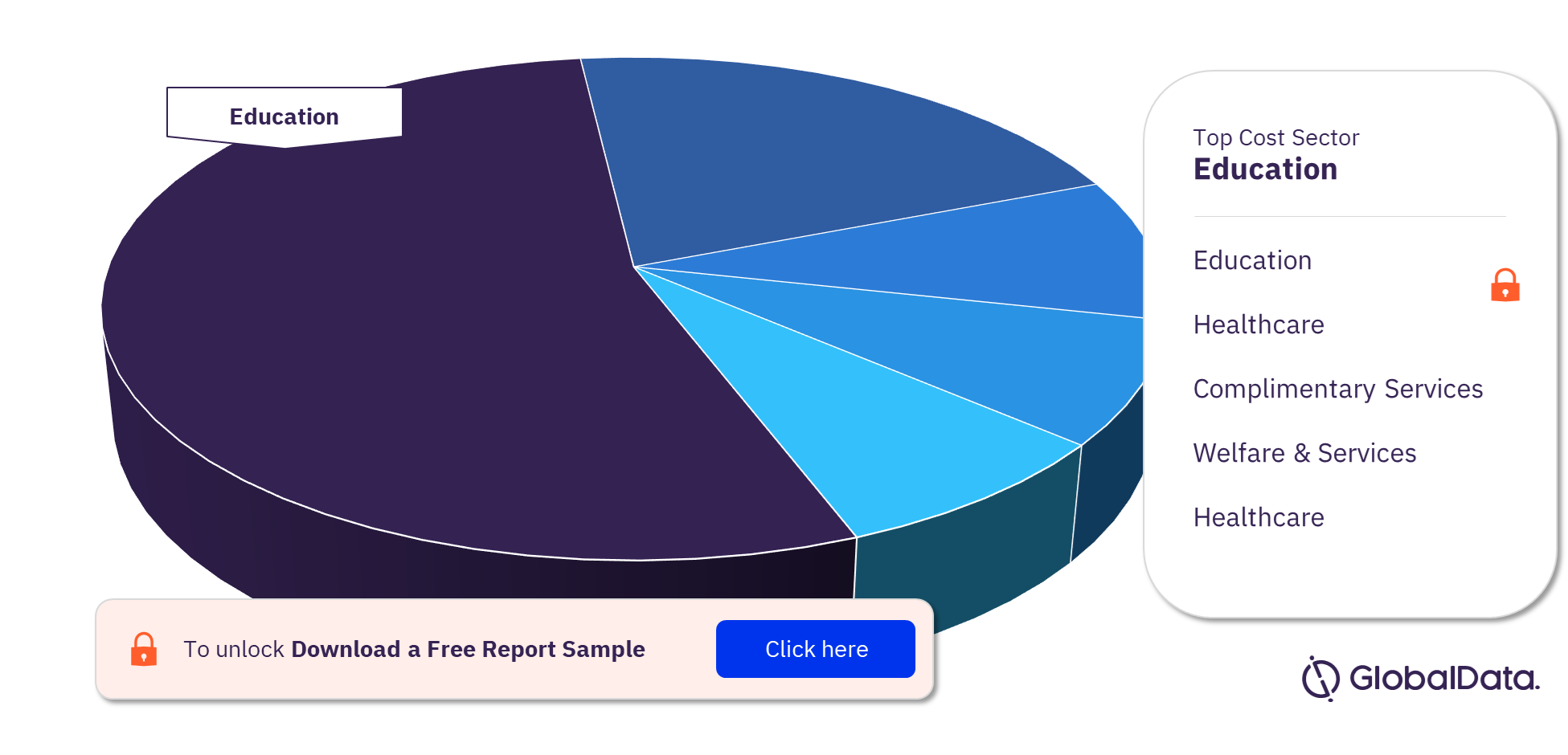

Malaysia Foodservice Market Segmentation by Cost Sector Channel

The key cost sector channels in the Malaysia foodservice market are military & civil defense, healthcare, education, welfare & services, and complimentary services. Education was the largest cost sector in 20222 in terms of OBP value.

Malaysia Foodservice Market Analysis by Cost Sector Channel, 2022 (%)

For more cost sector insights in the Malaysia foodservice market, download a free sample report

Malaysia Foodservice Market – Competitive Landscape

Some of the key foodservice companies in Malaysia are Yum! Brands Inc., Sentinel Capital Partners & TriArtisan Capital Partners, Hard Rock Café International Inc., Din Tai Fung, Orion Group, PappaRich Group, Genesis Co. Ltd, Starbucks Corporation, and Dunkin’ Brands Group Inc.

McDonald’s was the second largest QSR operator in Malaysia. In order to cater to consumers who are looking for convenient and time-saving options McDonald’s Malaysia has opened a new drive-thru restaurant at Batu Kawan in December 2022

For additional insights on leading Malaysia foodservice market players, download a free sample report

Malaysia Foodservice Market Overview

| Market Size (2022) | MYR80.9 billion ($18.4 billion) |

| CAGR (2022-2027) | >6% |

| Historic Period | 2017-2021 |

| Forecast Period | 2022-2027 |

| Key Profit Sector Channels | FSR, QSR, Pub, Club & Bar, Coffee & Tea Shop, Retail, Accommodation, Workplace, Leisure, Ice Cream Parlor, Travel, and Mobile Operator |

| Key Outlet Type | Dine-in and Take-away |

| Key Owner Type | Independent Operators and Chain Operators |

| Key Cost Sector Channels | Military & Civil Defense, Healthcare, Education, Welfare & Services, And Complimentary Services |

Key Segments Covered in the Report

Malaysia Foodservice Market Outlook by Profit Sector Channel (Value KRW million, 2022-2027)

- Full-service Restaurants (FSR)

- Quick-service Restaurants (QSR)

- Pub, Club & Bar

- Coffee & Tea Shop

- Retail

- Accommodation

- Workplace

- Leisure

- Ice Cream Parlor

- Travel

- Mobile Operator

Malaysia Foodservice Market Outlook by Outlet-type (Value, MYR million, 2022-2027)

- Dine-in

- Take-away

Malaysia Foodservice Market Outlook by Owner Type (Value, MYR million, 2022-2027)

- Independent operators

- Chain operators

Malaysia Foodservice Market Outlook by Cost Sector Channels (Value, MYR million, 2022-2027)

- Ministry & Civil Defense

- Healthcare

- Education

- Welfare & Services

- Complimentary Services

Scope

The report includes –

- Overview of Malaysia’s macro-economic landscape: Detailed analysis of current macro-economic factors and their impact on India’s foodservice market including GDP per capita, consumer price index, population growth and annual household income distribution.

- Growth dynamics: In-depth data and forecasts of key channels (QSR, FSR, and Coffee & Tea Shop) within Malaysia’s foodservice market, including the value of the market, number of transactions, number of outlets and average transaction price.

- Customer segmentation: Identify the most important demographic groups, buying habits and motivations that drive out-of-home meal occasions among segments of the Malaysian population.

- Key players: Overview of market leaders within the four major channels including business descriptions and number of outlets.

Reasons to Buy

- Specific forecasts of the foodservice market over the next five years (2022–27) will give readers the ability to make informed business decisions through identifying emerging/declining markets.

- Consumer segmentation detailing the desires of known consumers among all major foodservice channels (QSR, FSR, and Coffee & Tea Shop) will allow readers understand the wants and needs of their target demographics.

Sentinel Capital Partners & TriArtisan Capital Partners

Hard Rock Café International Inc.

Din Tai Fung

Orion Group

PappaRich Group

Genesis Co. Ltd

Starbucks Corporation

Dunkin' Brands Group Inc.

Table of Contents

Frequently asked questions

-

What was the Malaysia foodservice market size in 2022?

The foodservice market size in Malaysia was valued at MYR80.9 billion ($18.4 billion) in 2022.

-

What is the Malaysia foodservice market growth rate during 2022-2027?

The foodservice market in Malaysia will grow at a CAGR of over 6% during 2022-2027.

-

Which is the leading profit sector channel in the Malaysia foodservice market in 2022?

Full-service restaurant (FSR) is the leading profit sector channel in the Malaysia food service market in 2022.

-

What outlet-type had the highest share in the Malaysia foodservice market in 2022?

Dine-in is the dominant outlet-type in the Malaysia foodservice market in 2022.

-

Which is the leading owner type in the Malaysia foodservice market in 2022?

Independent operators are leading owner type in the Malaysia foodservice market in 2022.

-

What cost sector channel had the highest share in the Malaysia foodservice market in 2022?

Education sector had the highest share in the Malaysia foodservice market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports