Americas Mobile Broadband Market Trends and Opportunities to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Americas Mobile Broadband Market Trends and Opportunities Report Overview

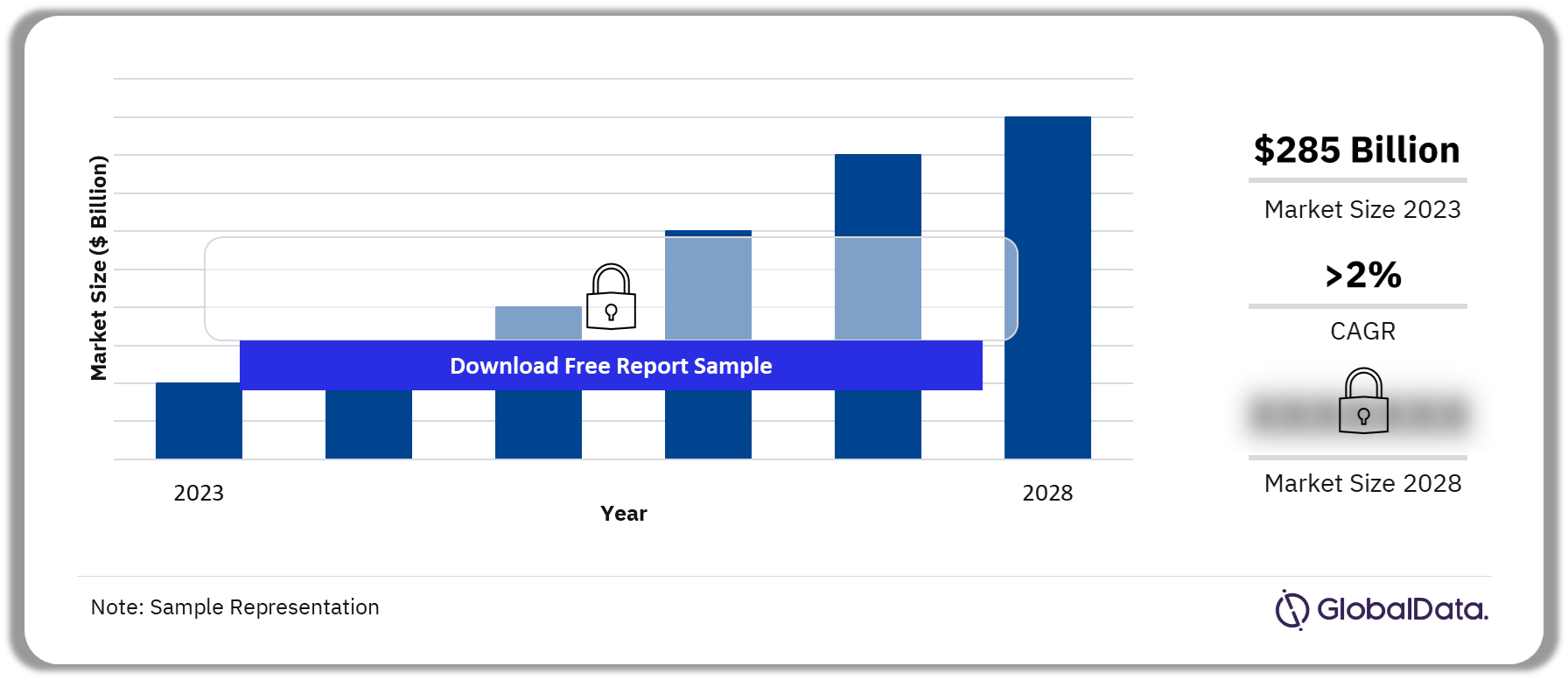

The mobile service revenue in the Americas is estimated to be $285 billion in 2023 and is expected to grow at a CAGR of more than 2% during 2023-2028. 5G network expansion efforts by operators in North America and in Latin America will generate new opportunities for digital service providers, towercos, and infrastructure and telecom equipment vendors. Operators can also drive revenue growth through higher ARPU 5G mobile plans.

Americas Mobile Broadband Market Outlook 2023-2028 ($ Billion)

Buy the Full Report for the Americas Mobile Broadband Market Forecast

“Americas Mobile Broadband Market Trends and Opportunities, 2023 Update”, the new Telecom Insider Report by GlobalData provides an executive-level overview of the mobile broadband market in the Americas. It delivers quantitative and qualitative insights into the mobile market, analyzing key trends, competitive dynamics, and growth drivers in the region.

| Market Size (2023) | $285 Billion |

| CAGR (2023-2028) | >2% |

| Key Device Type | · Handsets

· Connected Data · M2M/IoT |

| Key Countries | · Canada

· US · Bolivia · Dominican Republic · Others |

| Key Service | · Data

· Voice · Messaging |

| Leading Companies | · Telefónica

· Milicom · América Móvil · Megacable · Claro |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Americas Mobile Broadband Subscription Trends

Mobile User Trends in Americas: The total number of mobile users in the Americas will increase moderately by 2028. In Latin America, mobile users will increase at a faster CAGR as compared to North America, driven by mobile network coverage expansion, especially in emerging economies such as Mexico, Brazil, and Colombia. Mobile penetration will rise from 2023 to 2028 supported by a significant rise in penetration levels in the US, Canada, Brazil, Mexico, and Argentina with rising M2M/IoT subscriptions.

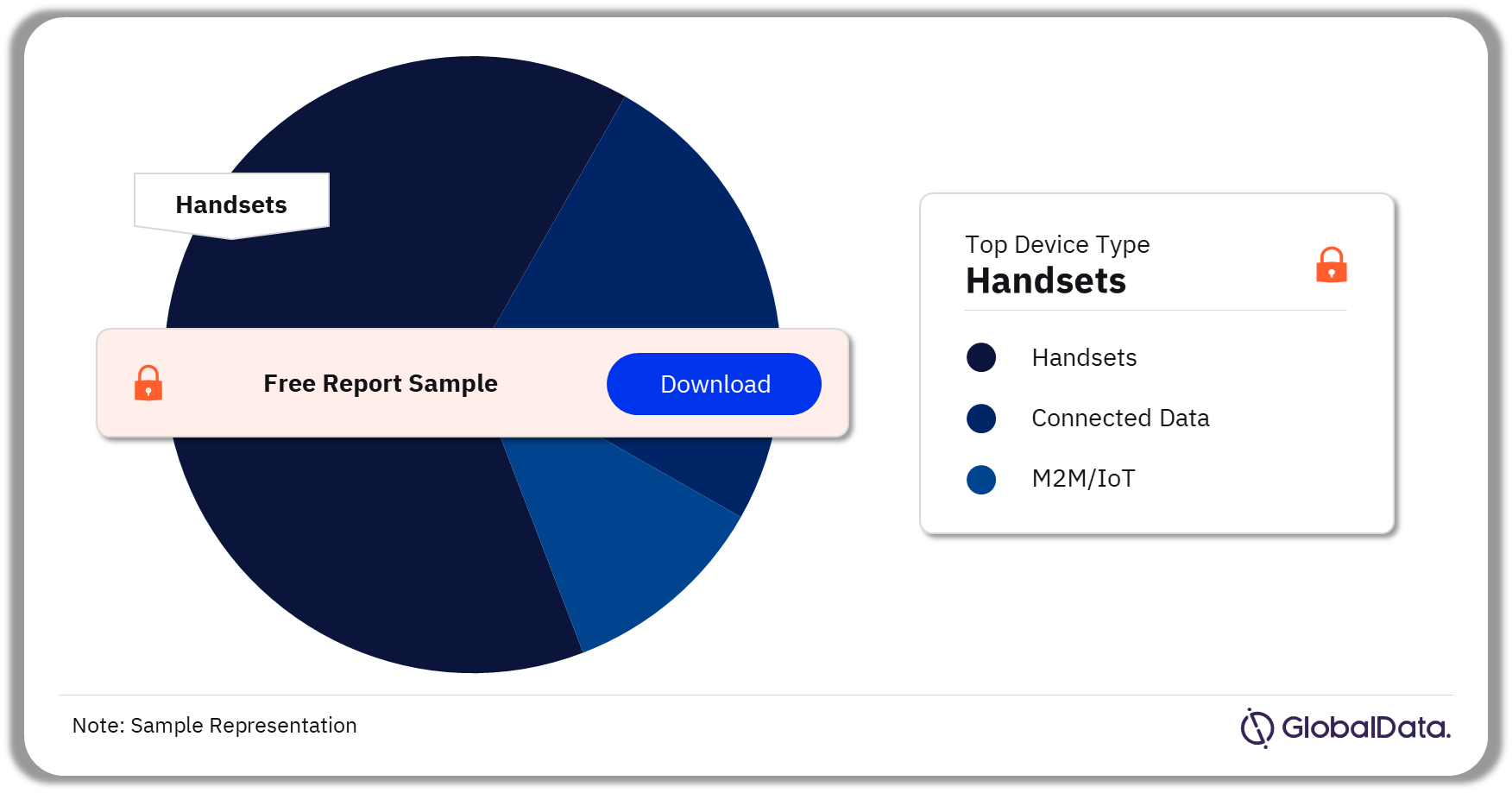

Mobile Device Trends in Americas: Handset mobile subscription revenue will account for more than 95% of total mobile revenue in the Americas in 2023, supported by rising smartphone penetration and growing adoption of 5G services. It is followed by M2M/IoT and connected data devices. M2M/IoT’s growth will be driven by telcos’ focus on expanding M2M/IoT connectivity solutions and services as well as a rising demand for industry-specific M2M/IoT solutions.

Americas Mobile Broadband Subscription Trends Analysis by Device Type, 2023 (%)

Buy the Full Report for Device-Type Insights into the Americas Mobile Broadband Market

Americas Mobile Broadband Revenue Trends

Mobile Average Revenue Per User (ARPU) Trends in North Americas: Data ARPU will grow from 2023 to 2028 driven by an increase in the adoption of 5G plans that have a higher price and/or support higher data consumption. Canada is one of the most expensive countries in North America in terms of the cost of 1GB of mobile data. It is followed by the US.

Mobile Revenue Trends in the Americas: Mobile services revenue in the Americas will increase by 2028. Handset mobile subscription revenue will account for most of the total mobile revenue in the Americas in 2023, supported by rising smartphone penetration and growing adoption of 5G services. M2M/IoT service revenue will grow at the fastest CAGR over the 2023-2028 period driven by growing demand for industry-specific solutions offered by MNOs.

North America Mobile Broadband Revenue Trends Analysis by Country (Cost of 1GB of Mobile Data) 2023 (%)

Buy the Full Report for Country-Wise Insights into the Americas Mobile Broadband Market

Americas Mobile Broadband Market – Competitive Landscape

The key companies in the mobile broadband market in the Americas are Telefónica, Milicom, América Móvil, Megacable, and Claro, among others. Telefónica agreed to sell Central American units in Nicaragua and Panama to Milicom and Guatemala and El Salvador to América Móvil in 2019.

Americas Mobile Broadband Market Players

Download a Free Sample Report for Information about the Americas Mobile Broadband Market Players

Segments Covered in this Report

Americas Mobile Broadband Device Type Outlook (Market Share, %, 2023)

- Handsets

- Connected Data

- M2M/IoT

Americas Mobile Broadband Country Outlook (Market Share, %, 2023-2028)

- Canada

- US

- Bolivia

- Dominican Republic

- Others

Scope

The report provides:

- The Americas in a Global Context: Provides a comparison of the Americas’ macroeconomic KPIs, mobile telecoms market size, and trends with other regions.

- Regional Market Trends and Competitive Dynamics: Analyzes the competitive dynamics that have been shaping the mobile broadband markets in the Americas over the past few years, including market entries, market exits, consolidations, and M&A activities.

- Mobile Broadband Subscription Trends: Provides analysis, historical figures, and forecasts of mobile broadband subscriptions and usage trends in the region as well as their growth drivers.

- Mobile Broadband Revenue Trends: Examines changes in the breakdown of overall revenue and ARPU over 2023-2028.

- Key findings: A summary of key findings and growth opportunities for the Americas’ mobile broadband market.

Reasons to Buy

- This Insider Report provides a comprehensive examination through forward-looking analysis of the Americas’ mobile broadband markets trends in a concise analytical format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the Americas’ mobile broadband markets.

- The report is designed for an executive-level audience, with charts and tables boasting presentation quality.

- The broad perspective of the report coupled with comprehensive actionable insights will help operators, equipment vendors, and other telecom industry players better positioned to seize the growth opportunities in the Americas’ evolving mobile broadband market.

Astound Mobile

Avantel

BAI Communications

Bait

Cable & Wireless Panama

Chip do Cartola

Claro Group

Claro Brazil

Claro Chile

Claro Panama

Deutsche Telekom

Dish Network

Dry Company do Brasil

EchoStar

IZZI Movil

Ka’ena Corporation

Liberty Global

M2M Telemetria

Megacable

Megamovil

Milicom

Mint Mobile

MobileX

Nextel Brazil

Novator Partners

Oi Brazil

Phoenix Tower International

Plum

Qualcomm

Rogers

Shaw Communications

Sprint

Telefónica

Telus Canada

Tigo Panama

TIM Brazil

T-Mobile

TracFone Wireless

Ultra Mobile

Verizon

Verizon Wireless

VTR

Wom

Table of Contents

Figures

Frequently asked questions

-

What is the Americas mobile broadband market size in 2023?

The total mobile service revenue in Americas is estimated at $285 billion in 2023.

-

What is the CAGR in the Americas mobile broadband market during 2023-2028?

The mobile services revenue in Americas is likely to grow at a CAGR of more than 2% during 2023-2028.

-

Which is the leading device type in the American mobile broadband market?

Handsets will account for the majority share of total mobile subscriptions in the Americas in 2023.

-

Which are the leading players in the American mobile broadband market?

The key companies in the American mobile broadband market are Telefónica, Milicom, América Móvil, Megacable, and Claro, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.