Pet Supplements Market Size, Share, Trends and Analysis by Pet Type, Distribution Channel, Region and Segment Forecasts to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

The ‘Pet Supplements Market’ report provides in-depth analysis and market insights that will help you:

- Make informed decisions about market entry, technology adoption, and project planning.

- Assess the competitive dynamics to stay ahead in the market.

- Identify promising segments (pet type and distribution channel), growth trends, regional trends, and markets to expand your regional presence, and product portfolio, as well as discover successful investment opportunities.

- Anticipate changes in market demand and adjust business development strategies.

- Identify ongoing potential projects across regions.

How is our ‘Pet Supplements Market’ report different from other reports in the market?

- The report analyzes historical and forecast market datathat are classified based on the product segments(Dog, Cat, Bird, Fish, & Rodents, and Others ), and distribution channels(Cash & Carries & Warehouse Clubs, Convenience Stores, Direct Sellers, Drug Stores & Pharmacies, Hypermarkets & Supermarkets, E-retailers, Other Specialist Retailers, and Others) across more than 20 countries.

- The report offers valuable insights into the industry value chain and identifies the market drivers and challenges influencing the pet supplements market.

- It also covers consumer survey results highlighting the factors influencing consumer behavior.

- The report further presents an analysis of M&A deals, venture financing deals, and social media trends in the pet care sector.

- The report also gives an insight into the key players and the competitive landscape of top brands in each region along with the brand penetration matrix.

We recommend this valuable source of information to anyone involved in:

- Pet Care Products Manufacturing

- Pet Supplements Manufacturing

- Pharmaceutical Sector

- Regulations and Policy Making

- Independent Research

- BI analysts

- Venture Funding

To Get a Snapshot of the Pet Supplements Market Report

Pet Supplements Market Report Overview

The pet supplements market was valued at $6.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.3% over the forecast period. The pet supplements market comprises a wide range of products, including vitamins, minerals, probiotics, joint support, digestive aids, and more. These products aim to improve the overall health and well-being of pets, addressing issues such as joint health, skin and coat conditions, digestion, and age-related concerns. The market has experienced substantial growth in recent years, driven by increasing pet ownership, changing consumer preferences, and growing awareness of pet health and wellness.

Pet Supplements Market Outlook, 2017-2027 ($ Billion)

Download the Sample Report for Additional Insights on the Pet Supplements Market Forecast

The humanization of pets is a significant factor influencing the demand for pet supplement products. This is characterized by the belief that pets deserve the same level of care, comfort, and attention that humans receive. This shift has led to pet owners taking a more proactive approach to their pets’ health and focusing on preventive measures to ensure their animals lead long and healthy lives. Consequently, pet supplements have become a popular means of addressing specific health concerns and optimizing the overall well-being of pets.

The humanization of pets’ trend is well supported by heightened awareness and education on pet nutrition. The desire to enhance the overall well-being of pets has driven pet owners to explore and learn more about pet supplements. Owing to the high penetration of internet, pet owners today have access to a wealth of information influencing their purchase decisions. As a result, pet owners are more proactive in seeking out supplements to address specific health concerns or deficiencies in their pets.

The influence of veterinarians’ recommendations is another key factor driving the demand for pet supplements. Pet owners trust their veterinarians as experts in pet health and nutrition, making them highly influential in promoting the use of supplements. Thus, manufacturers are developing and marketing supplements with veterinarian endorsements, ensuring that the products meet stringent quality standards and are formulated to address specific health concerns in pets. This trend is likely to continue as pet owners seek to provide the best care for their animals, and veterinarians play a pivotal role in guiding them toward effective supplementation strategies.

Besides the proactive measures undertaken by consumers to seek pet supplement products, manufacturers are also engaging in efforts to ensure their products reach the target customers. Pet owners today have access to a wide array of supplements through various channels, including pet stores, online retailers, and even at their veterinarian’s office. This accessibility means that supplements can be easily obtained, eliminating the need for multiple trips to acquire specific products. This emphasis on convenience is likely to continue shaping the pet supplement market, as pet owners continue to seek ways to provide the best care for their beloved animals.

Despite the rising demand, various challenges affect the growth of the pet care industry. Skepticism about the efficacy of pet supplements is a significant impediment to their demand. To address this challenge, the pet supplement industry must focus on transparency, quality control, and scientific research to provide pet owners with credible information and safe, effective products. This will lead to a better understanding of the potential benefits of pet supplements and, in turn, increase demand. Additionally, educating pet owners and dispelling misconceptions are essential steps in overcoming the challenges impeding market growth.

| Market Size in 2023 | $6.9 Billion |

| CAGR | 3.3% |

| Forecast Period | 2023-2027 |

| Historic Data | 2017-2022 |

| Report Scope & Coverage | Industry Overview, Customer Survey Insights, Revenue Forecast, Regional Analysis, Competitive Landscape, Company Profiles, Growth Trends |

| Pet Type Segment | Dog, Cat, Bird, Fish, & Rodents, and Others |

| Distribution Channel Segment | Cash & Carries & Warehouse Clubs, Convenience Stores, Direct Sellers, Drug Stores & Pharmacies, Hypermarkets & Supermarkets, E-retailers, Other Specialist Retailers, Others |

| Regional Segment | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Country Segment | Australia, China, Japan, Malaysia, South Korea, Thailand, France, Germany, Italy, Netherlands, Russia,

UK, Brazil, Chile, Cuba, Mexico, Israel, South Africa, UAE, US, Canada |

| Key Companies | Beaphar Group, Compana Pet Brands LLC, FoodScience, LLC, Harbin Pharmaceutical Group Holding Co., Ltd., Nutramax Laboratories Veterinary Sciences, Inc., Omega Alpha Pharmaceuticals Inc., Shanghai Chongxing Pet Product Co Ltd, Upfield BV, Virbac Group, Zoetis Inc |

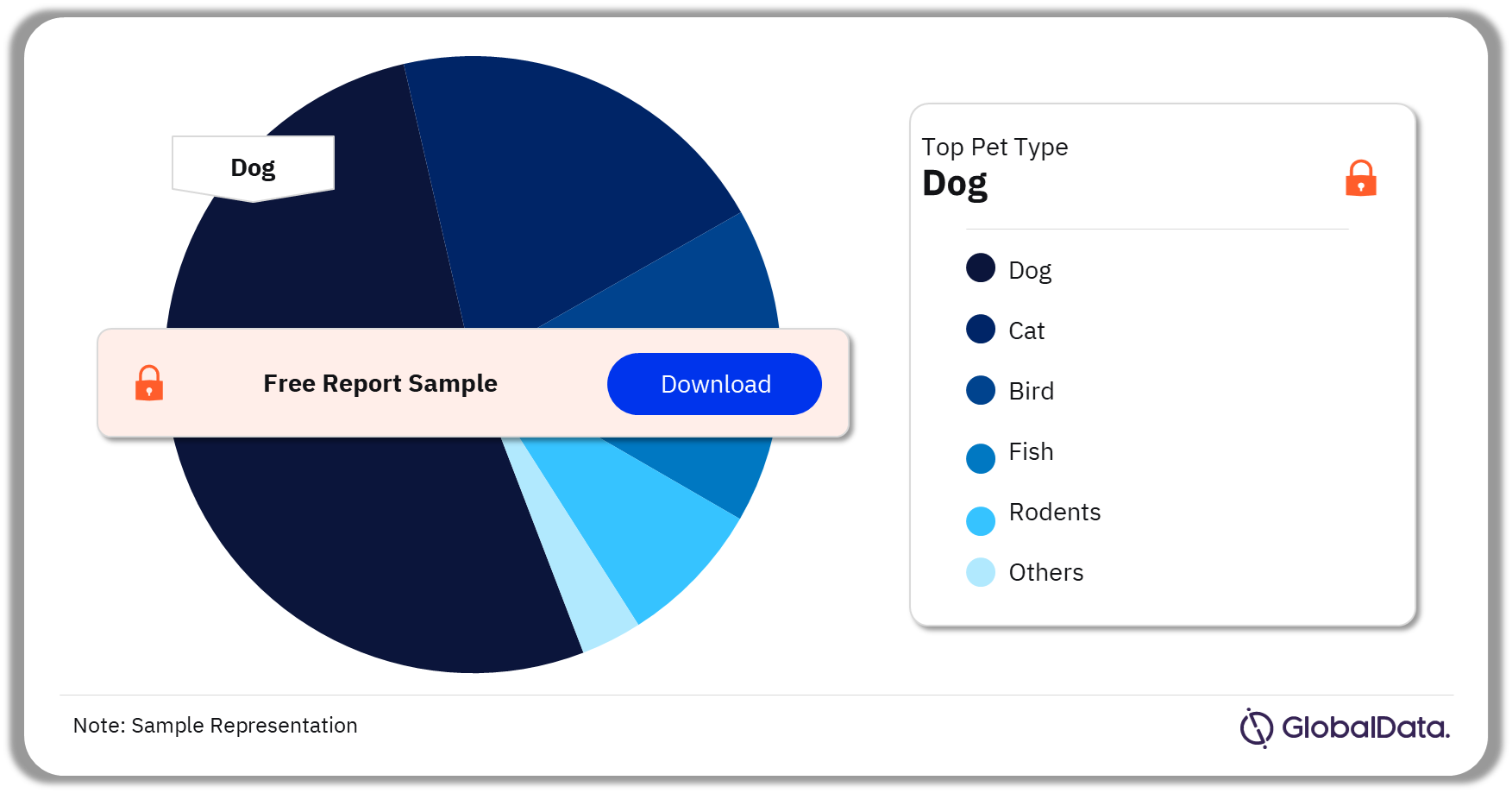

Pet Supplements Market Segmentation by Pet Type

The pet supplements market is categorized based on the type of pet such as dog, cat, bird, fish, rodents, and others. Dog products dominate the overall market and are poised to grow at a healthy CAGR over the forecast period. Dogs are the most preferred pet animal across the globe. According to data published by the American Veterinary Medical Association, 38.4% of households owned a pet dog, whereas cats, birds, and horses cumulatively accounted for only 28.9%.

Pet Supplements Market Analysis by Pet Type, 2023 (%)

Pet Supplements Market Outlook Report with Detailed Segment Analysis is Available with GlobalData Now! Buy the Full Report or Download A Free Sample

Cat products are projected to grow at a CAGR exceeding 3% from 2023 to 2027. This is attributable to the age-related health issues faced by feline animals. As cats age, they are prone to various health issues such as joint problems and dental issues. This has led to an increased demand for supplements targeting these specific concerns, including glucosamine for joint health and dental care supplements. Similarly, cats are known for grooming themselves, leading to hairball issues. Supplements addressing hairball control and promoting coat health have gained popularity among cat owners seeking preventive solutions.

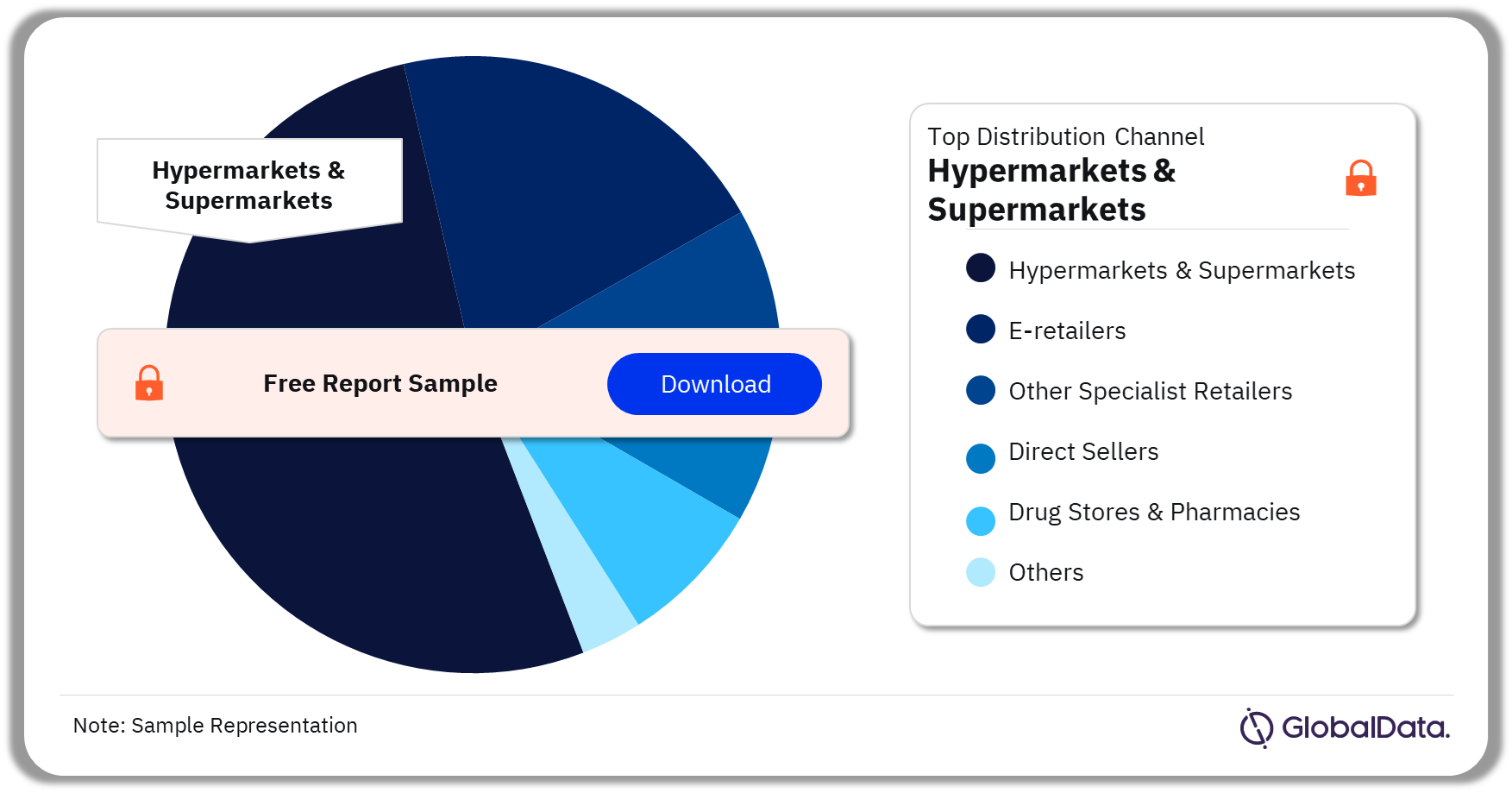

Pet Supplements Market Segmentation by Distribution Channel

The key distribution channels in the pet supplements market are cash & carries & warehouse clubs, convenience stores, direct sellers, drug stores & pharmacies, hypermarkets & supermarkets, e-retailers, other specialist retailers, and others. Hypermarkets & supermarkets accounted for a sizeable revenue share in 2023 owing to the popularity of such stores among customers. The physical presence of products in hypermarkets increases brand visibility and awareness. Shoppers can physically inspect products, read labels, and make informed decisions, contributing to the overall growth of the segment.

Pet Supplements Market Analysis by Distribution Channel, 2023 (%)

Buy the Full Report for Pet Supplements Market Segment-Specific Insights or Fetch A Sample PDF

E-retailers have transformed the shopping experience among pet owners by providing global accessibility to a diverse range of products. They can access a wide variety of supplements, including niche and specialized products, irrespective of their geographical location. Moreover, E-retailers often leverage algorithms to provide personalized product recommendations based on customer preferences and previous purchases. Customer reviews and ratings further contribute to informed decision-making, fostering trust and loyalty among consumers.

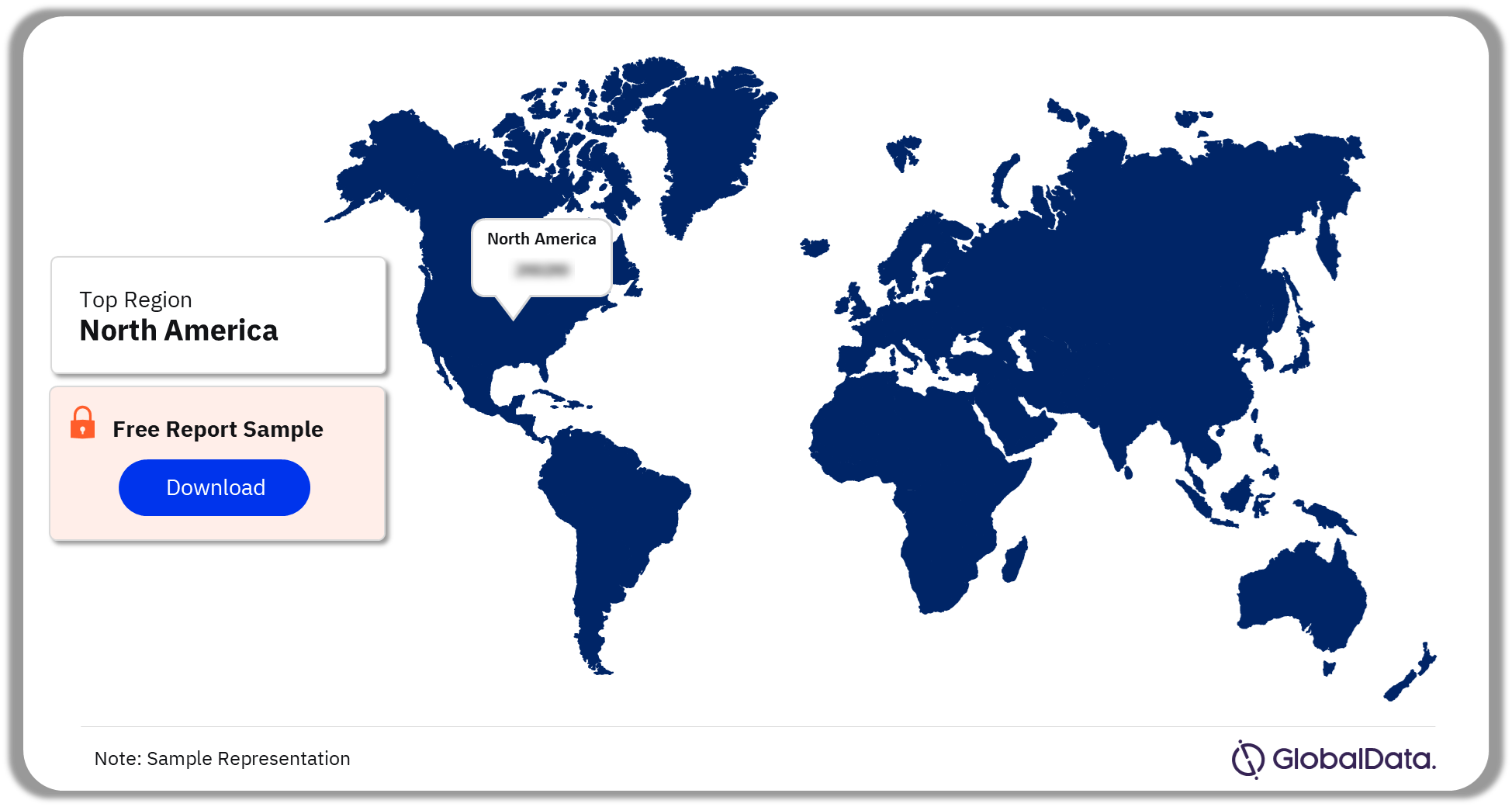

Pet Supplements Market Segmentation by Region

The demand for pet supplements varies across regions, influenced by cultural, economic, and regulatory factors. North American and European regions have mature markets with a focus on premiumization and preventive healthcare, while Asia Pacific, Latin America, and the Middle East & Africa are experiencing growth driven by rising pet ownership and changing consumer attitudes. As the global pet supplement market continues to evolve, understanding the nuances of each region is crucial for manufacturers and retailers aiming to navigate this dynamic and diverse landscape successfully.

North American pet supplements market held the largest revenue share of the overall market in 2022. The region, led by US, is characterized by high pet ownership rates, with 66% households having at least one pet in 2023 (American Pet Products Association). This culture of pet ownership has driven the demand for pet supplements, with owners investing in the health and well-being of their pets. Moreover, there is a growing emphasis on preventive healthcare for pets in the region, and pet supplements are seen as a proactive approach to address specific health concerns. This mindset contributes to sustained demand for a variety of supplement categories.

Pet Supplements Market Analysis by Region, 2023 (%)

Buy the Full Report for Pet Supplements Market Regional Insights Download Sample Report

The burgeoning middle-class population in Asia Pacific has increased disposable income, leading to a rise in pet ownership. Growing pet population translates to an increased demand for pet care product thereby driving pet supplements demand over the forecast period. Additionally, Asia Pacific has witnessed significant growth in e-commerce, making pet supplements more accessible to a broader consumer base. E-commerce platforms such as Alibaba and JD.com have enabled easier access to a wide range of pet products.

Pet Supplements Market – Competitive Landscape

The competitive landscape of the pet supplements market is a dynamic and rapidly evolving space. Established brands with broad product portfolios, strong distribution networks, and research and development capabilities dominate the market. However, there are many opportunities for niche and innovative companies to carve out their niche by addressing emerging trends and fulfilling the evolving needs of pet owners. As pet owners’ commitment to their pets’ health and wellness continues to grow, the pet supplements market will remain a thriving industry with room for both established players and newcomers. Understanding these dynamics and trends is essential for success in this competitive market.

Personalized nutrition and the use of functional ingredients are expected to be major trends that can be leveraged by companies operating in the market. Customized supplements and nutrition plans based on individual pet needs and health conditions will become more prevalent, offering pet owners tailored solutions. For instance, companies such as ChowJoy and This Dog is Unique conduct an online quiz for the customers and to understand their pets. The data is used to offer custom supplements specific to each pet.

Leading Players in the Pet Supplements Market

- Beaphar Group

- Compana Pet Brands LLC

- FoodScience, LLC

- Harbin Pharmaceutical Group Holding Co., Ltd.

- Nutramax Laboratories Veterinary Sciences, Inc.

- Omega Alpha Pharmaceuticals Inc.

- Shanghai Chongxing Pet Product Co Ltd

- Upfield BV

- Virbac Group

- Zoetis Inc

Pet Supplements Market Segments

GlobalData Plc has segmented the pet supplements market report by pet type, distribution channel, and region:

Pet Supplements Pet Type Outlook (Revenue, $ Million; 2017-2027)

- Dog

- Cat

- Bird, Fish, and Rodents

- Other

Pet Supplements Distribution Channel Outlook (Revenue, $ Million; 2017-2027)

- Cash & Carries & Warehouse Clubs

- Convenience Stores

- Direct Sellers

- Drug Stores & Pharmacies

- Hypermarkets & Supermarkets

- E-retailers

- Other Specialist Retailers

- Others

Pet Supplements Regional Outlook (Revenue, $ Million; 2017-2027)

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Netherlands

- Russia

- UK

- Rest of Europe

- Asia-Pacific

- Australia

- China

- Japan

- Malaysia

- South Korea

- Thailand

- Rest of Asia Pacific

- Latin America

- Brazil

- Chile

- Cuba

- Mexico

- Rest of Latin America

- Middle East & Africa

- Israel

- South Africa

- UAE

- Rest of Middle East & Africa

Scope

This report provides overview and value for pet supplements.

It identifies the key trends impacting growth of the market over the next 12 to 24 months, split into four categories: driver & challenges analysis, dashboard analysis, and consumer insights.

It includes global market forecasts for the pet supplements industry and analysis of company filings.

It contains details of M&A and Venture Finaincing deals in the pet care space.

Key Highlights

The pet supplements market will be valued at $6.7 billion in 2023 and is expected to grow at a CAGR of 3.3% during 2023-2027. Increasing pet ownership, changing consumer preferences, and growing awareness of pet health and wellness are the major factors driving pet supplements market growth.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global pet supplements market, key vendor outlook, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in pet supplements market.

With more than 80 charts, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in pet supplements market.

The broad perspective of the report coupled with comprehensive, actionable detail will help pet supplements providers, investors, and other stakeholders succeed in the growing pet supplements market globally.

Key Players

Harbin Pharmaceutical GroupVirbac Group

Nestle Purina PetCare

The Carlyle Group Inc

Zoetis Inc

Versele Laga

Tiernahrung Deuerer GmbH

Spectrum Brands Holdings Inc

Rolf C. Hagen Inc

Hill's Pet Nutrition Inc

Table of Contents

Figures

Frequently asked questions

-

What was the pet supplements market size in 2023?

The pet supplements market size was valued at $6.9 billion in 2023.

-

What is the pet supplements market growth rate?

The pet supplements market is expected to grow at a CAGR of 3.3% over the forecast period (2023-2027).

-

What are the key pet supplements market drivers?

Increasing pet ownership, changing consumer preferences, and growing awareness of pet health and wellness are the major factors driving pet supplements market growth.

-

Which are the leading pet supplement companies globally?

The leading pet supplement products companies are Beaphar Group, Compana Pet Brands LLC, FoodScience, LLC, Harbin Pharmaceutical Group Holding Co., Ltd., Nutramax Laboratories Veterinary Sciences, Inc., Omega Alpha Pharmaceuticals Inc., Shanghai Chongxing Pet Product Co Ltd, Upfield BV, Virbac Group, and Zoetis Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.