Plant-Based Food and Beverages Market Size, Share, Trends and Analysis by Region, Product, Source, Distribution and Segment Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Plant-based Food & Beverages Market Report Overview

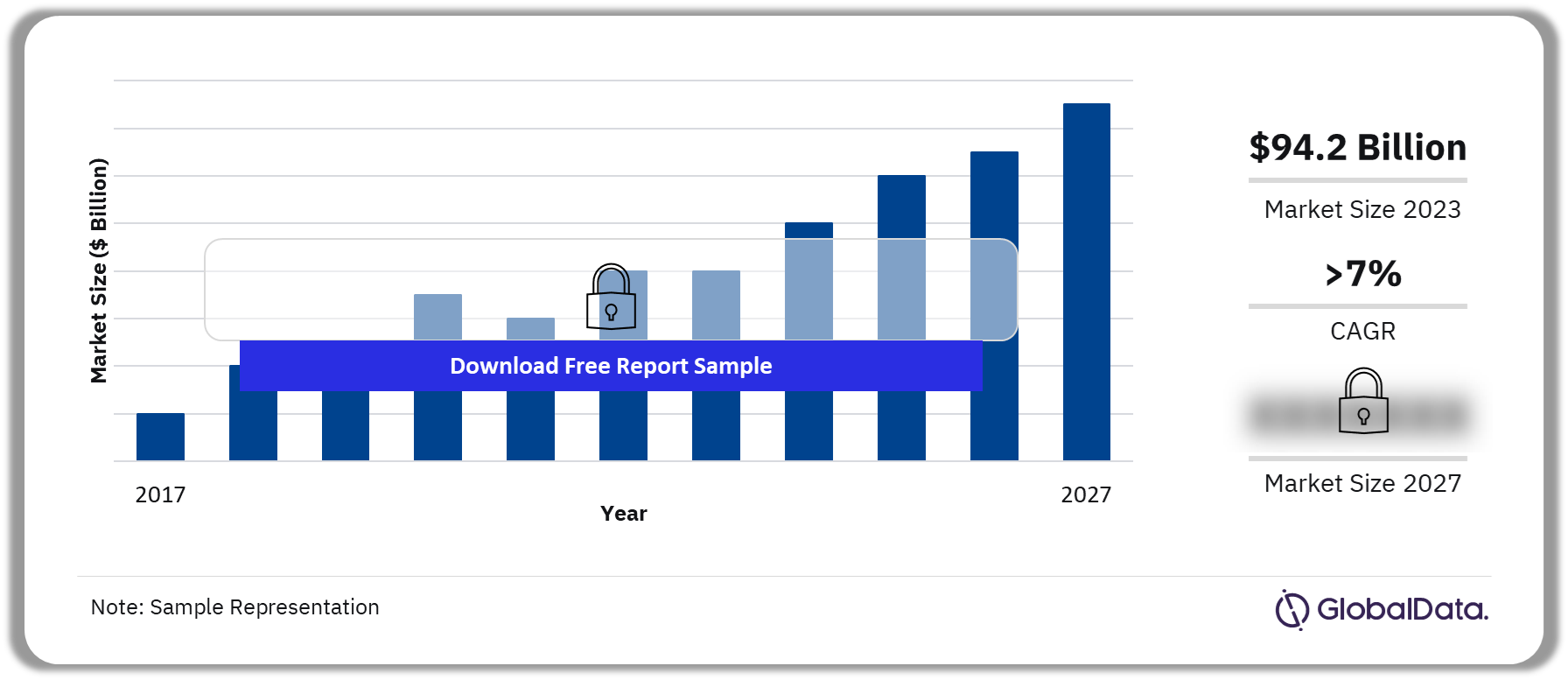

The plant-based food & beverages market was valued at $94.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 7% over the forecast period. Plant-based food and beverages encompass a variety of items made from natural plant-based ingredients such as vegetables, fruits, nuts, whole grains, legumes, and algae/fungi. These products are free from animal and animal-sourced ingredients such as milk, meat, or eggs. As health consciousness grows, consumers are becoming more aware of the chronic health diseases linked to the consumption of animal-derived food and beverages. Consequently, these health-conscious consumers are increasingly shifting towards plant-based food and beverages, such as plant-based meat, plant-based milk, and plant-based snacks, to enhance their overall health and wellness.

Plant-based Food & Beverages Market Outlook, 2017-2027 ($ Billion)

Buy the Full Report for Additional Insights on the Plant-based Food & Beverages Market Forecast

As various theories suggest a connection between the origin of the lethal COVID-19 pandemic and the consumption of animal meat, consumers are increasingly turning to food and beverages prepared from plant-based ingredients. This includes vegetables, nuts, seeds, and single-celled plants, as individuals seek to reduce their consumption of meat. Consequently, the global market witnessed a huge surge following the emergence of the pandemic during 2020-2021.

Recently, there has been a growing concern regarding global climate change that poses a threat to life on the planet. Livestock farming is known to have several adverse environmental impacts, including greenhouse gas emissions that contribute to global warming, deforestation, and extensive use of natural resources. Social media influencers and ecologists have been sharing articles, vlogs, and podcasts highlighting the negative effects of animal farming on the environment, which has motivated consumers to switch to a plant-based diet. Additionally, with the growing use of smartphones and internet access, consumers are becoming more informed and aware of these issues, leading to increasing demand for sustainable plant-based food and beverages.

Consumers are also expressing concerns about the inhumane treatment of animals in the meat and dairy industries, which is driving consumers toward ethical consumption. Plant-based food and beverages offer a cruelty-free alternative to meat-based diets, allowing consumers to align their food choices with their ethical values.

The food processing industry is embracing various emerging technologies to create innovative food and beverages. New technologies such as high-intensity focused ultrasound and nanotechnology are being utilized to produce meat-like textures from plant-based ingredients and enhance their nutritional value to match that of traditional meat products. Further, the industry has recently integrated 3D printing technology to tailor plant-based food products with specific flavors, nutritional profiles, and textures to meet evolving consumer demands, thereby providing momentum to market growth.

| Market size (2023) | $94.2 Billion |

| CAGR (2023 to 2027) | >7% |

| Quantitative units | Revenue in $Billion and CAGR from 2023 to 2027 |

| Forecast Period | 2023 – 2027 |

| Historic Period | 2017 – 2021 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, And Growth Trends |

| Plant-based Food & Beverage Product Type | Meat Substitutes, Dairy Alternatives, and Nuts & Seeds Snacks |

| Plant-based Food & Beverage Source Type | Grain-Based, Soy-Based, Nuts & Seeds-Based, Vegetable-Based, and Single-Cell-Based |

| Plant-based Food & Beverage Distribution Type | Hypermarkets & Supermarkets, Convenience Stores, Food & Drinks Specialists, and eRetailers |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

| Key Companies | Hebei Yangyuan Zhihui Beverage Co.,

Blue Diamond Growers, Danone Group , Three Squirrels Co Ltd ., Coconut Palm Group Co Ltd., PepsiCo, Inc. , The Kraft Heinz Company , Dairy Farmers of America, Inc., Valsoia S.p.A., and Nestle S.A. |

Plant-Based Food and Beverages Market Analysis by Product Type

Plant-based Food & Beverages Market Analysis by Product Type

The plant-based food & beverages market has been categorized by product into nuts & seeds snacks, dairy alternatives, and meat substitutes. Dairy alternatives such as soy milk, rice milk, and almond milk held the highest revenue share in 2023. The increasing number of consumers with lactose intolerance is driving the demand for plant-based milk, thereby aiding overall market growth. Further, the wider availability of dairy alternatives across retail channels is gaining traction among consumers concerned with animal welfare and seeking dairy alternatives.

Plant-based Food & Beverages Market Share by Product Type, 2023 (%)

Buy the Full Report for Additional Insights on the Products Type in the Plant-based Food & Beverages Market Download a Free Report Sample

The meat substitutes segment is poised to witness the fastest growth over the forecast period. The growth can be attributed to effective marketing and branding strategies that have been instrumental in fueling the expansion of the meat substitutes market. Established companies have effectively positioned their products as ethical, sustainable, and healthy alternatives to meat, appealing to a wide range of consumers.

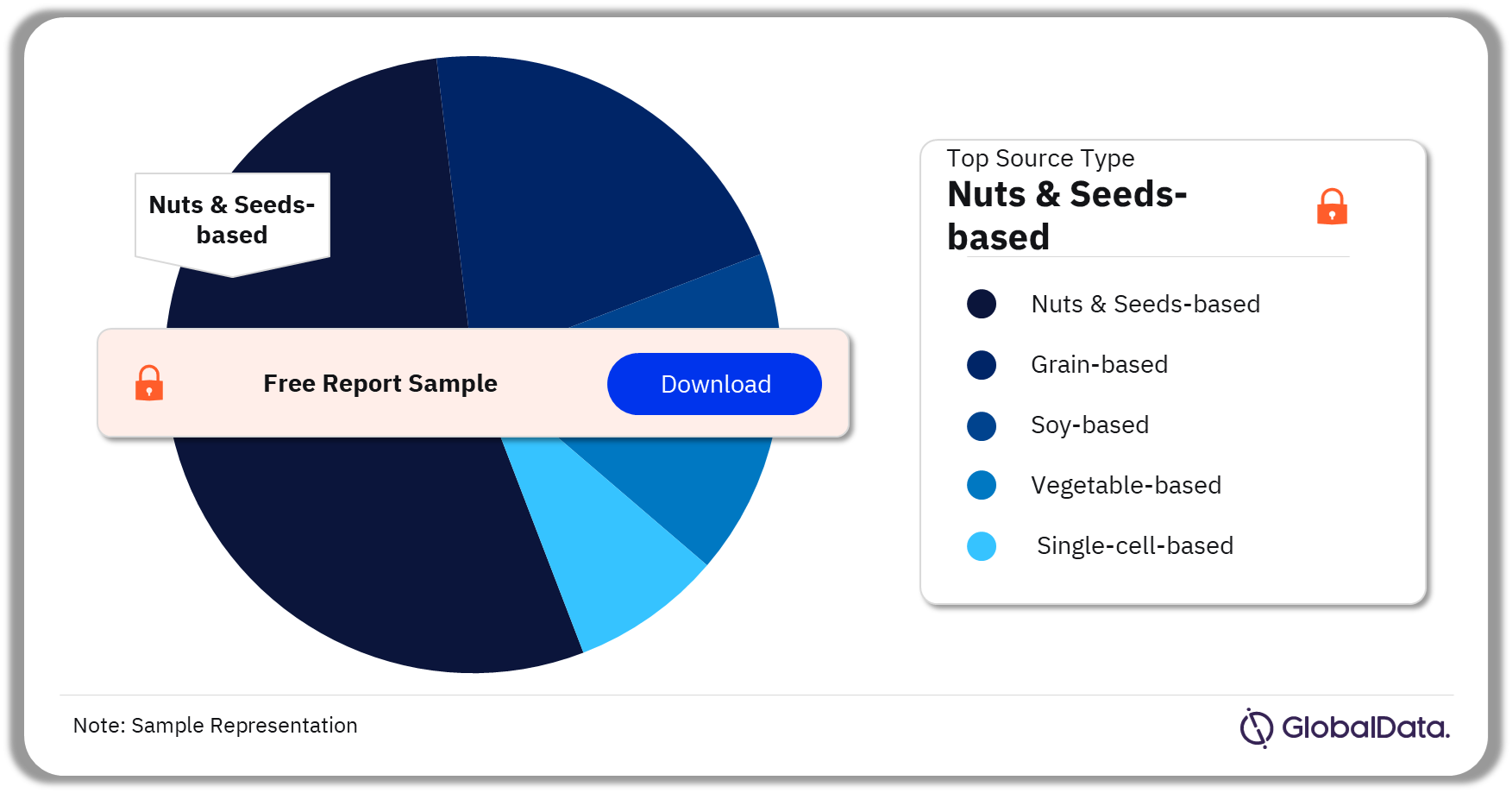

Plant-Based Food and Beverages Market Analysis by Source Type

The plant-based food & beverages market has been categorized by source into grain-based, soy-based, vegetable-based, nuts & seeds-based, and single-cell-based. Nuts & seeds-based products such as almond milk, coconut milk, and peanut milk accounted for the highest revenue share in 2023. Nuts and seeds are rich sources of healthy fats and protein, which are processed at food and beverage manufacturing facilities to enhance the taste, texture, and aroma of the final products, thereby attracting consumers transitioning from an animal-derived diet to a plant-based diet.

Buy the Full Report for Additional Insights on the Products Type in the Plant-based Food & Beverages Market Download a Free Report Sample

The vegetable-based segment is expected to register the fastest growth over the forecast period. As health awareness grows, consumers are positively turning to plant-based food and beverages while reducing their meat intake to enhance their overall health and well-being. Additionally, meat substitutes made from vegetables such as yam and sweet potato can replicate the texture, taste, and nutritional profile of traditional meat products. This has led to a surge in demand, driving momentum in the market’s growth.

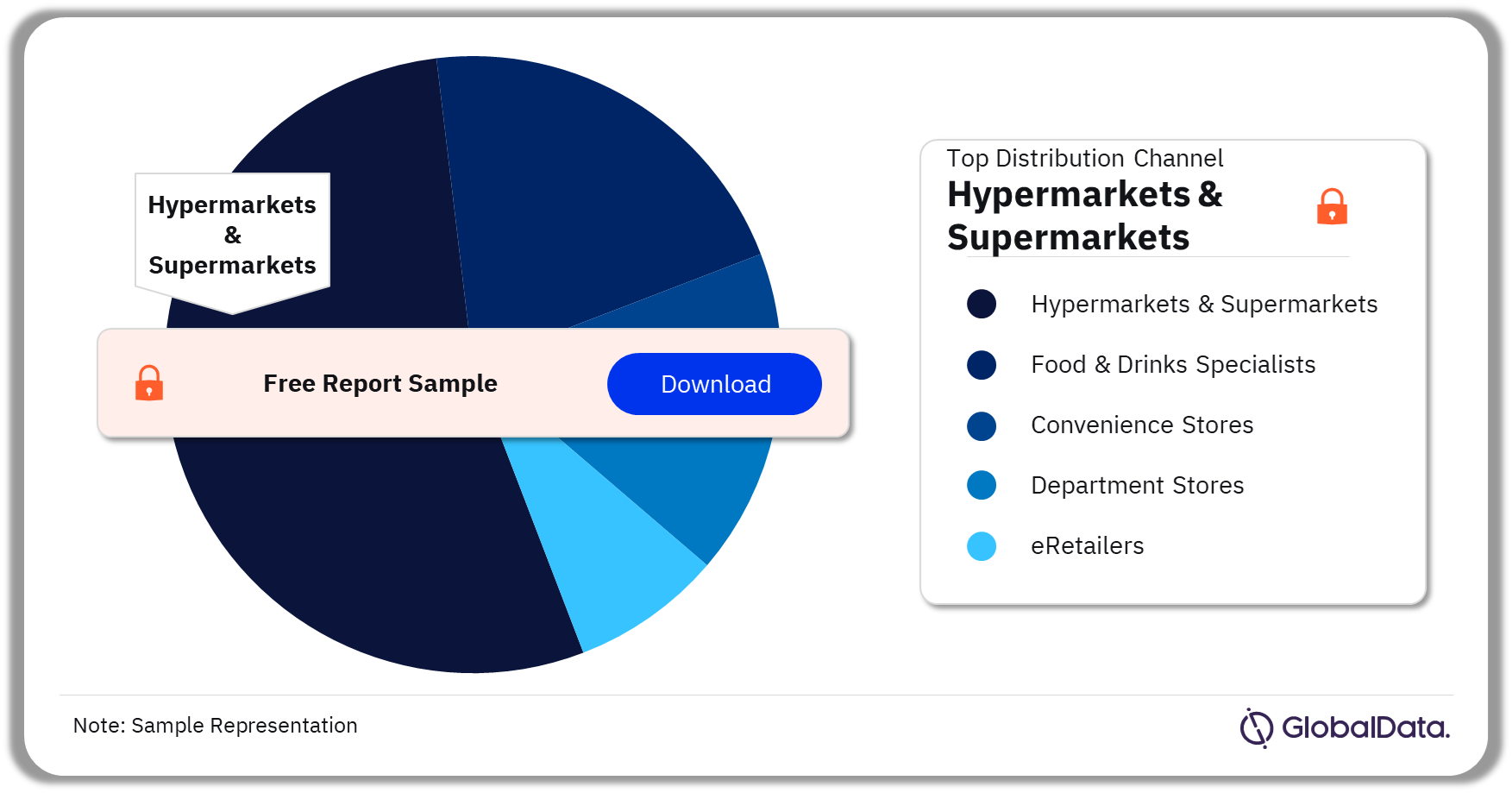

Plant-Based Food and Beverages Market Analysis by Distribution Type

The key distribution channels operating in the plant-based food & beverage market are food & drinks specialists, convenience stores, hypermarkets & supermarkets, department stores, and eRetailers. Hypermarkets and supermarkets emerged as the leading distribution channel in the market accounting for the largest share in 2023. These retail outlets provide a diverse array of plant-based food and beverages, leveraging their extensive space to offer products in various pack sizes, formats, and price ranges. As a result, they have become a favored shopping destination for consumers.

Plant-based Food & Beverage Market Share by Distribution Type, 2023 (%)

Buy the Full Report for Distribution Channel Insights into the Plant-based Food & Beverages Market Download a Free Report Sample

The eRetailers segment is projected to record the fastest growth over the forecast period. The growth is attributed to the rising use of smartphones and internet connectivity, along with changing consumer lifestyles, which is boosting the sales of plant-based products through eRetailers. The working population often has busy schedules and limited time to visit retail stores for grocery shopping, leading them to choose online ordering through grocery delivery mobile applications.

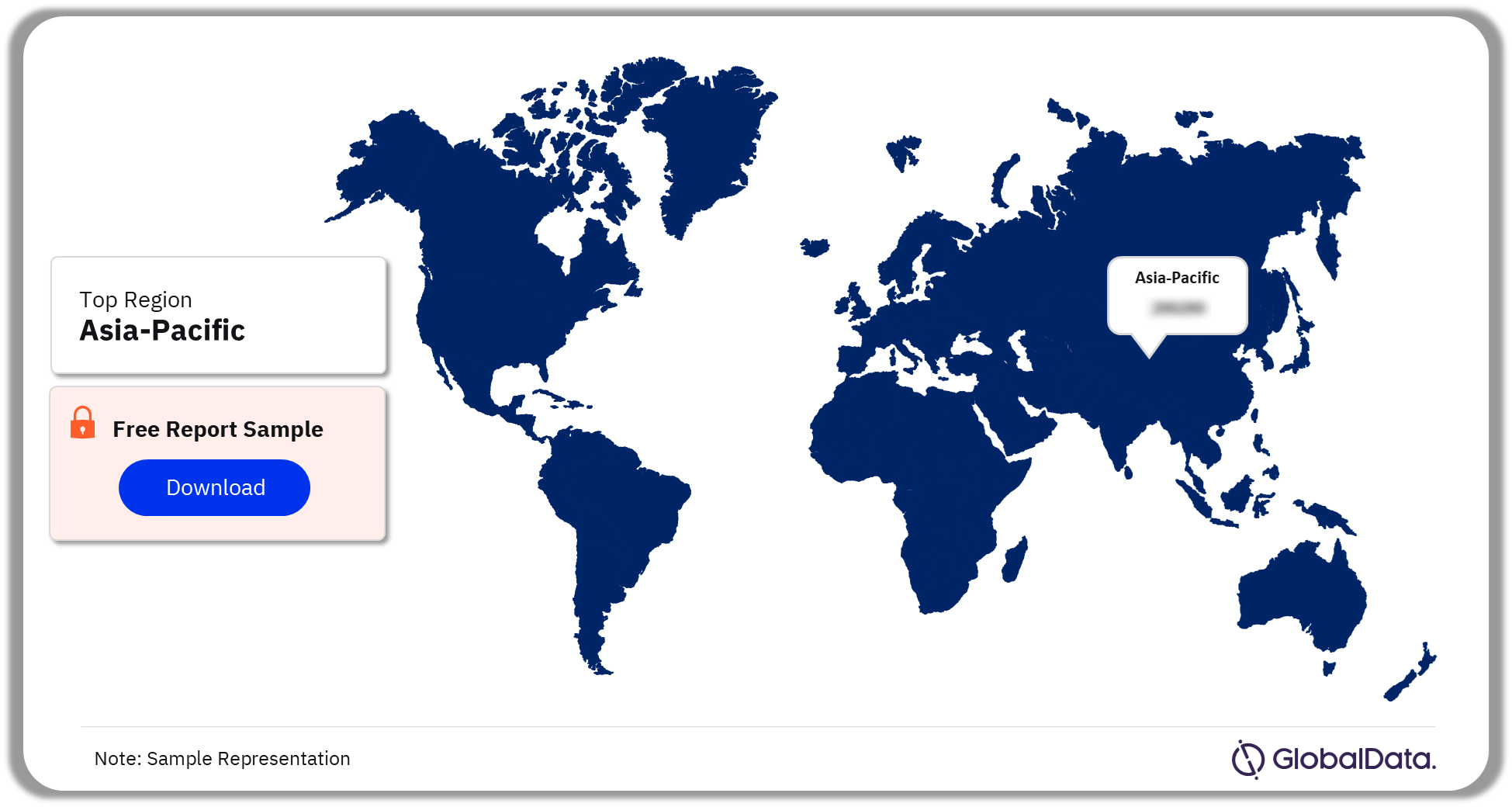

Plant-Based Food and Beverages Market Analysis by Region

The global plant-based food & beverages market was led by the Asia Pacific region in 2023 and is expected to maintain its dominance over the forecast period. The region benefits from a sizable population adhering to Hinduism and Buddhism, cultures that primarily advocate vegetarian diets. This cultural influence is fueling the demand for plant-based products in the area.

The growth of the plant-based diet market in the Asia Pacific region is also being propelled by the expanding middle-class population. As disposable incomes increase, consumers are becoming more health-conscious and are willing to invest more in nutritious and sustainable food choices. This trend has led to a rising demand for plant-based products, which are often seen as high-quality or specialized items.

The plant-based food & beverages market in the region is witnessing growing recognition of the health benefits linked with vegan diets. As sedentary lifestyles and diet-related health problems such as obesity, diabetes, and heart disease become more prevalent, consumers are opting for plant-based food and beverages as a healthier alternative. Plant-based diets are abundant in fiber, vitamins, and minerals, and are lower in saturated fats, making them an appealing choice for health-conscious individuals.

The market in Asia Pacific is led by China which accounted for the highest revenue share in 2023. The Chinese market is experiencing a surge of creativity, as companies create a diverse array of plant-based products customized to suit consumers’ preferences. Also, effective marketing campaigns that emphasize the health, environmental, and ethical advantages of plant-based diets are fueling consumer enthusiasm.

Plant-based Food & Beverage Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Plant-based Food & Beverages Market Download a Free Report Sample

The expansion of the plant-based diet market in North America is a result of various factors, such as rising health awareness, environmental consciousness, cultural impacts, technological advancements, and successful marketing strategies. As these trends progress, the plant-based diet market in North America is poised for further growth, offering substantial opportunities for food manufacturers and retailers.

Plant-Based Food and Beverages Market - Competitive Landscape

The plant-based food and beverages industry is marked by the presence of numerous companies offering a variety of products. Recently, there has been increased competition between brands and private labels, focusing on both quality and pricing strategies. Companies in this market tend to have a strong presence in their specific product categories. For instance, Hebei Yangyuan Zhihui Beverages Co. has a strong hold in the dairy alternatives market, followed by Blue Diamond Growers, and Danone Group, whereas the meat substitutes segment is dominated by Beyond Meat, Inc., Monde Nissin, and Topas GmbH. Similarly, the nuts & seeds snacks segment is led by PepsiCo, The Kraft Heinz Company, and Three Squirrels.

Leading Companies in the Plant-based Food & Beverage Market

- Hebei Yangyuan Zhihui Beverage Co.

- Blue Diamond Growers

- Danone Group

- Three Squirrels Co Ltd.

- Coconut Palm Group Co Ltd.

- PepsiCo, Inc.

- The Kraft Heinz Company

- Dairy Farmers Of America, Inc.

- Valsoia S.p.A.

- Nestle S.A.

Other Plant-Based Food and Beverages Market Companies Mentioned

Monde Nissin, Beyond Meat, Inc., Lulu, Oatly AB, Kikkoman Corporation, Ningbo Hengkang Food Co., Ltd., Want Want China Holdings Limited, Conagra Brands, Inc., The Tofurky Company, Inc., Maple Leaf Foods Inc., and Morinaga Milk Industry Co., Ltd. among others.

Buy the Full Report for Insights into the Leading Companies in the Plant-based Food & Beverages Market Download a Free Report Sample

Plant-Based Food and Beverages Market Scope

GlobalData Plc has segmented the plant-based food & beverages market report by product type, source type, distribution type, and region:

Plant-based Food & Beverages Market Product Type Outlook (Revenue, $Million, 2017-2027)

- Meat Substitutes

- Dairy Alternatives

- Nuts & Seeds Snacks

Plant-based Food & Beverages Market Source Type Outlook (Revenue, $Million, 2017-2027)

- Grain-Based

- Soy-Based

- Nuts & Seeds-Based

- Vegetable-Based

- Single-Cell-Based

Plant-based Food & Beverages Market Distribution Type Outlook (Revenue, $Million, 2017-2027)

- Hypermarkets & Supermarkets

- Convenience Stores

- Food & Drinks Specialists

- eRetailers

Plant-based Food & Beverages Market Regional Outlook (Revenue, $Million, 2017-2027)

- North America

- US

- Canada

- Europe

- UK

- Germany

- Russia

- Spain

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- Vietnam

- Thailand

- Australia

- Rest of Asia Pacific

- South & Central America

- Brazil

- Mexico

- Colombia

- Chile

- Argentina

- Rest of South & Central America

- Middle East & Africa

- South Africa

- Iran

- Israel

- UAE

- Saudi Arabia

- Rest of Middle East & Africa

Scope

- Plant-based food & beverages market outlook: analysis as well as historical figures and forecasts of revenue opportunities for device type, and regional segments.

- The competitive landscape: a market share analysis of leading players and private labels in the plant-based food & beverages market.

- Company profiles: analysis of the market position of leading companies in the plant-based food & beverages market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

The plant-based food and beverages market size will be valued at $ 94.2 billion in 2023. Plant-based diet or food includes a wide range of food items which are made from natural plant-based ingredients. Vegetables, fruits, nuts, whole grains algae/fungi, and legumes are commonly used in these goods, which do not contain any animal and animal-sourced items like milk, meat, or eggs. The market is expected to grow at a CAGR of 7.2% during 2023-2027. The study provides an executive-level overview of the current plant-based food and beverages market worldwide, with detailed forecasts of key indicators up to 2030.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global plant-based food & beverages market device type and their key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the plant-based food & beverages market.

- The report highlights the plant-based food & beverages product type segment (meat substitutes, dairy alternatives, and nuts & seeds snacks), source type segment (grain-based, soy-based, nuts & seeds-based, vegetable-based, and single cell-based), distribution type segment (hypermarkets & supermarkets, convenience stores, food & drinks specialists, and eRetailers) and region.

- With more than 50 figures and tables, the report is designed for an executive-level audience, with enhanced presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in the plant-based food & beverages market.

- The broad perspective of the report coupled with comprehensive, actionable detail will help food & beverages manufacturers, foodservice vendors, food technology stakeholders, and other market players succeed in growing the plant-based food & beverages market globally.

Key Players

Hebei Yangyuan Zhihui Beverage Co.Blue Diamond Growers

Danone Group

Three Squirrels Co Ltd

Coconut Palm Group Co Ltd

PepsiCo, Inc.

Beyond Meat, Inc.

Dairy Farmers Of America, Inc.

Valsoia S.p.A.

Nestle S.A

Table of Contents

Table

Figures

Frequently asked questions

-

What was the plant-based food & beverages market size in 2023?

The plant-based food & beverages market size was valued at $94.2 billion in 2023.

-

What is the plant-based food & beverages market growth rate for the forecast period?

The plant-based food & beverages market is expected to grow at a CAGR of more than 7% during the forecast period.

-

Which product type accounted for the highest share in the plant-based food & beverages market in 2023?

Dairy alternatives such as soy milk, rice milk, and almond milk held the highest revenue share in 2023.

-

Which was the preferred distribution channel in the plant-based food & beverages market in 2023?

Hypermarkets and supermarkets emerged as the leading distribution channel in the market accounting for the largest share in 2023.

-

Which are the leading plant-based food & beverages companies worldwide?

The leading plant-based food & beverages companies are Hebei Yangyuan Zhihui Beverage Co.,Blue Diamond Growers, Danone Group, Three Squirrels Co Ltd, Coconut Palm Group Co Ltd., PepsiCo, Inc., The Kraft Heinz Company, Dairy Farmers of America, Inc., Valsoia S.p.A., and Nestle S.A.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.