Retail Banking Sector Scorecard – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Retail Banking Sector Theme Analysis Overview

The retail banking sector scorecard includes a variety of traditional financial services providers, including global banks, national banks, regional banks, and building societies/mutuals. including global banks, national banks, regional banks, and building societies/mutuals.The retail banking sector scorecard thematic intelligence report identifies the 10 most disruptive themes that will drive market performance in the next 12 months.

Generative AI (Gen AI) is a subset of AI that exploded into the mainstream following the launch of OpenAI’s Chat GPT. Chat GPT reached 1 million users in only five days. We expect Gen AI disruption in banking to be analogous to the mobile device, in that every product and process will have to be revisited and reimagined in light of the new capabilities that Gen AI can bring. While there are significant risks, the ability of a technology to operate with such a diversity of inputs (audio, text, video, code, etc.) towards such a variety of outputs means there are near-limitless applications across enterprises.

The overall leader within the scorecard is DBS, which scored highly in all areas, especially AI, cloud, and cybersecurity. These are the core underlying capabilities that enable the bank to deliver well in other areas such as open banking, digital banking, and personalization. In addition, DBS managed to avoid any compliance violations in the last 12 months, contributing to a leading score in the regulation theme.

Our thematic scoring methodology allows us to identify which companies will do well in the market in the future, as well as the companies that will falter due to their lack of investment in these key themes.

| Report Pages | 22 |

| Top Themes | · Artificial Intelligence

· Cybersecurity · Innovation · IoT · Big Data |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Retail Banking Theme Map

Some of the biggest themes impacting the retail banking sector are artificial intelligence (AI), cloud, cybersecurity, regulation; open banking; digital banking; environmental, social, and governance (ESG); conversational platforms; personalization; and the Internet of Things (IoT). Our theme map for the retail banking industry highlights the big themes driving share prices and is the result of a series of interviews with senior industry executives and investors, reflecting an up-to-date view of the issues that keep them awake at night. Our theme maps cover not only disruptive tech themes but also macroeconomic and regulatory themes.

Retail Banking Sector Theme Map 2023

Buy the Full Report to Unlock the Biggest Themes Driving Growth in The Retail Banking Industry, Download a Free Report Sample

Artificial Intelligence: There is a huge amount of hype around the AI theme across all industries at present, especially in banking. While the technology has enormous disruptive potential, in the near term it likely benefits incumbent banks the most, which can use to it incrementally improve a wide range of processes and structures within existing customer relationships. Alphabet, CommBank, DBS, JPMorgan Chase, Santander, and Westpac are some of the leaders in AI theme in the retail banking sector.

Buy the Full Report to Know More About Other Top Themes Disrupting the Retail Banking Industry, Download a Free Report Sample

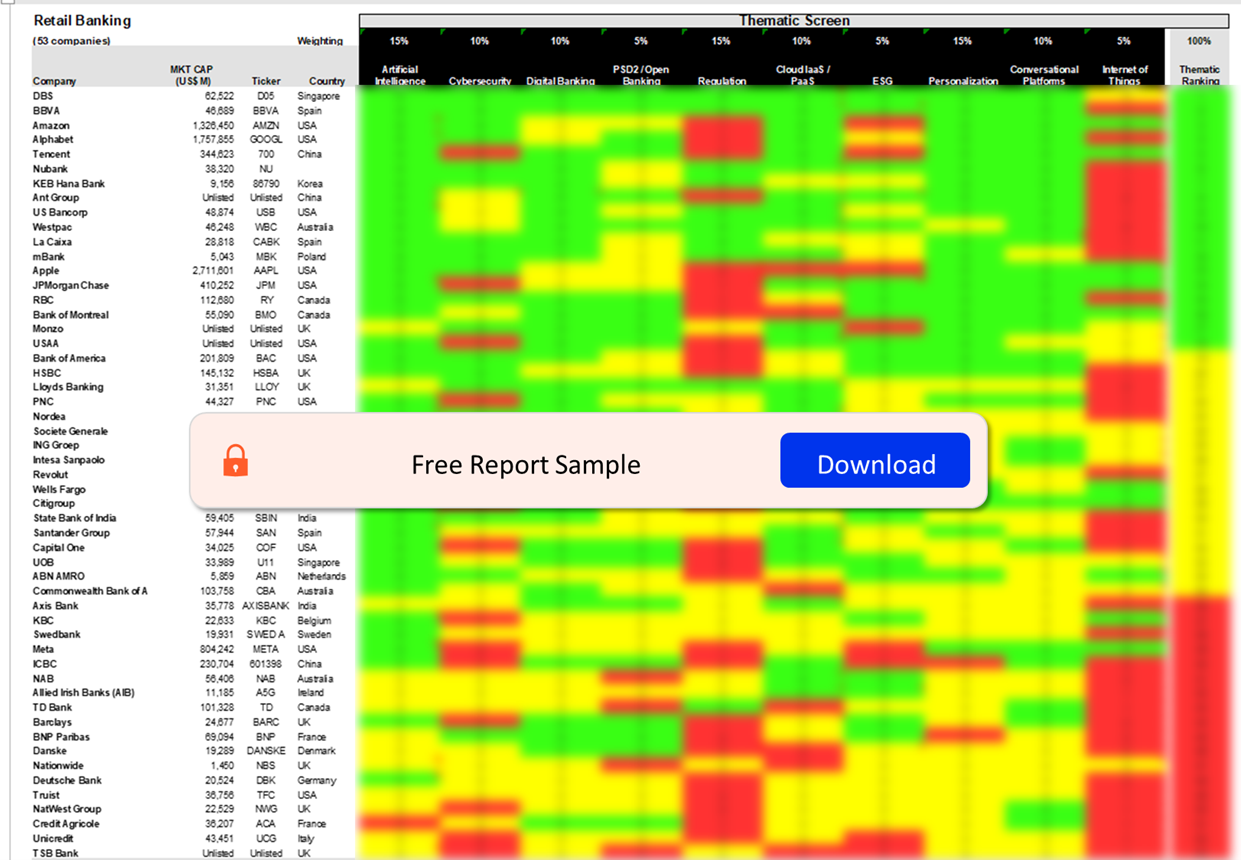

Retail Banking Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The retail banking sector scorecard has three screens:

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Retail Banking Sector Scorecard – Thematic Screen

Buy the Full Report to Know More About the Retail Banking Sector Scorecard

Scope

- This report assesses the 10 key themes that are transforming the banking market right now and scores the world’s leading banking players against these themes.

- Our thematic scoring methodology allows us to identify which companies will do well in the market in the future, as well as the companies that will falter due to their lack of investment in these key themes.

Key Highlights

- DBS was in first place again in 2023. Doing a number of different things well over a period of many years has allowed the bank to harvest the benefits of multiyear tech spend. This has driven cost reductions and increased customer satisfaction, but also operational agility to push forward with other changes more quickly.

- In a more difficult environment, we will see increased pragmatism around cloud migrations. Not all workloads can or need to be moved to the cloud, and certainly not as a first-order priority.

Reasons to Buy

- Understand which banks are best positioned for success within critical themes and why.

- Learn which banks are under-invested in key themes and thus most vulnerable to disruption.

- Understand which themes your institution can address (and how) to drive the share price.

BBVA

Alphabet

Amazon

Tencent

Nubank

KEB Hana Bank

U.S. Bancorp

Westpac

La Caixa

Apple

JPMorgan Chase

RBC

Bank of Montreal

Monzo USAA

Bank of America

HSBC

Lloyds Bank

PNC

Nordea

Societe Generale

Intesa Sanpaolo

ING

Revolut

Wells Fargo

Citigroup

Santander

Capital One

UOB

ABN AMRO

CommBank

KBC

Swedbank

ICBC

AIB

TD Bank

Barclays

BNP Paribas

Danske Bank

Nationwide

Deutsche Bank

NatWest Group

Credit Agricole

UniCredit

TSB Bank

Table of Contents

Frequently asked questions

-

What are the biggest themes impacting the retail banking sector?

Some of the biggest themes impacting the retail banking sector are artificial intelligence (AI), cloud, cybersecurity, regulation; open banking; digital banking; environmental, social, and governance (ESG); conversational platforms; personalization; and the Internet of Things (IoT).

-

In how many days has Chat GPT reached 1 million users?

Chat GPT reached 1 million users in only five days.

-

Which are the leading companies in the retail banking sector in AI theme?

Alphabet, CommBank, DBS, JPMorgan Chase, Santander, and Westpac are some of the leaders in the AI theme in the retail banking sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports