Saudi Arabia Retail Banking Competitor Benchmarking – Financial Performance, Customer Relationships and Satisfaction

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Saudi Arabia Retail Banking Market Report Overview

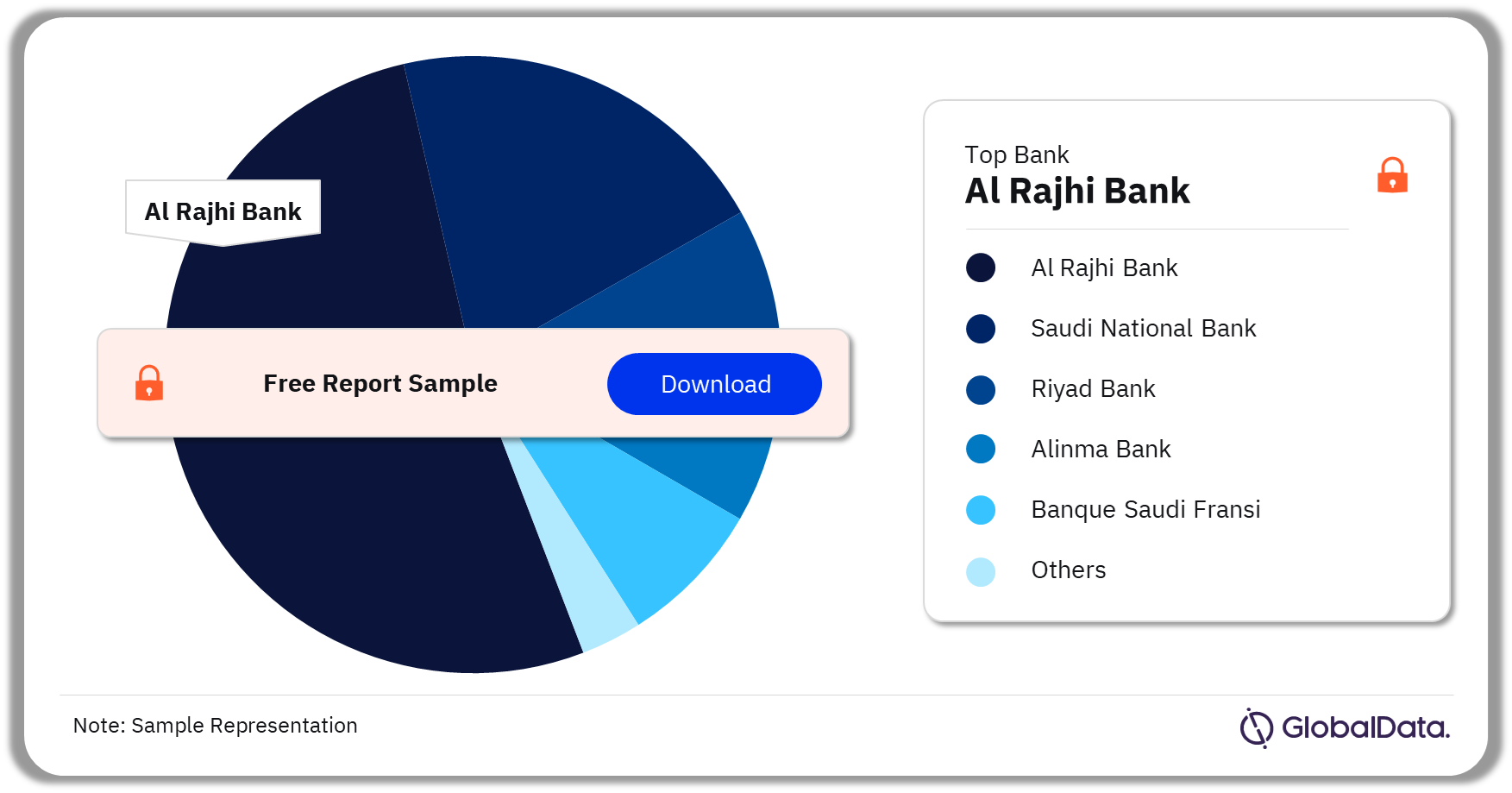

All banks increased their total divisional assets (TDA) between 2021 and 2022. Higher interest rates in Saudi Arabia resulted in increased net interest incomes. Nonetheless, most banks’ net interest margins were squeezed as a result of rate hikes. The level of concentration has increased in the Saudi Arabian retail banking market within the last 10 years, as the two biggest players—Saudi National Bank and Al Rajhi Bank—control over half of the market across all product categories (deposits, loans, mortgages, and credit cards).

The Saudi Arabia Retail Banking Competitor Benchmarking report looks at market performance, retention risk, and market shares across key products within the Saudi Arabia banking space. It also ranks the market’s leading banks across a range of criteria from digital adoption and user experience to rewards and money management tools.

| Key Banks | · Al Rajhi Bank

· Saudi National Bank · Riyad Bank · Alinma Bank · Banque Saudi Fransi |

| Key Retail Banking Products | · Retail Deposits

· Residential Mortgages · Personal Loans · Credit Cards |

| Customer Relationships | · Customer Tenure

· Cross-Selling · Current Account Net Promoter Score · Customer Loyalty |

| Customer Satisfaction | · Satisfaction Drivers of NPS

· Overall Satisfaction · Digital Satisfaction |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Saudi Arabia Retail Banking – Financial Performance

All banks’ assets increased, but net interest margins were down in 2022. Saudi Arabia’s interest rate increased during 2022, which resulted in increased net interest income for most competitors. On the other hand, increased interest expenses have squeezed net interest margins for most. The key banks in the Saudi Arabia retail banking sector are Al Rajhi Bank, Saudi National Bank, Riyad Bank, Alinma Bank, and Banque Saudi Fransi among others. The two largest banks, Al Rajhi and Saudi National Bank improved across nearly all financial indicators and achieved the highest absolute gains of TDA.

Saudi Arabia Retail Banking Market Analysis by Companies (based on TDA), 2022 (%)

Buy the Full Report for More Company Insights on the Saudi Arabia Retail Banking Market

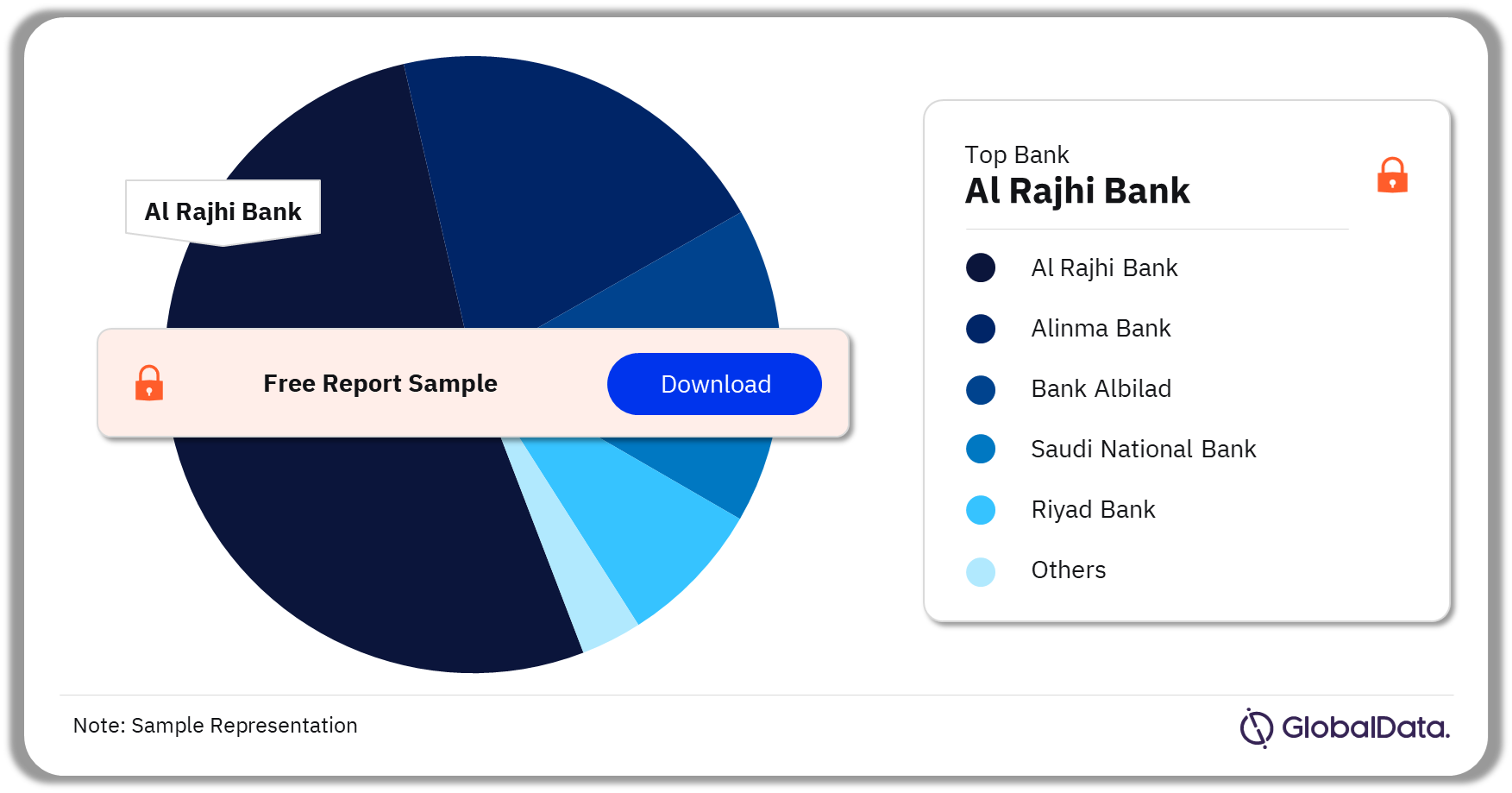

Saudi Arabia Retail Banking - Customer Relationships

The Saudi Arabia retail banking market research report covers key customer relationship parameters including customer tenure, cross-selling, current account net promoter score (NPS), and customer loyalty. In terms of customer tenure, Al Rajhi Bank has the highest proportion of long-term customers. Other banks on the list are Alinma Bank, Bank Albilad, Saudi National Bank, and Riyad Bank among others.

Saudi banks are not strong at cross-selling extra products to their main current account holders. Furthermore, NPSs are quite high across Saudi banks, with considerably more promoters for each bank than detractors.

Saudi Arabia Retail Banking Market Analysis by Net Promoter Score, 2022 (%)

Buy the Full Report for More Insights on the Net Promoter Score in the Saudi Arabia Retail Banking Market

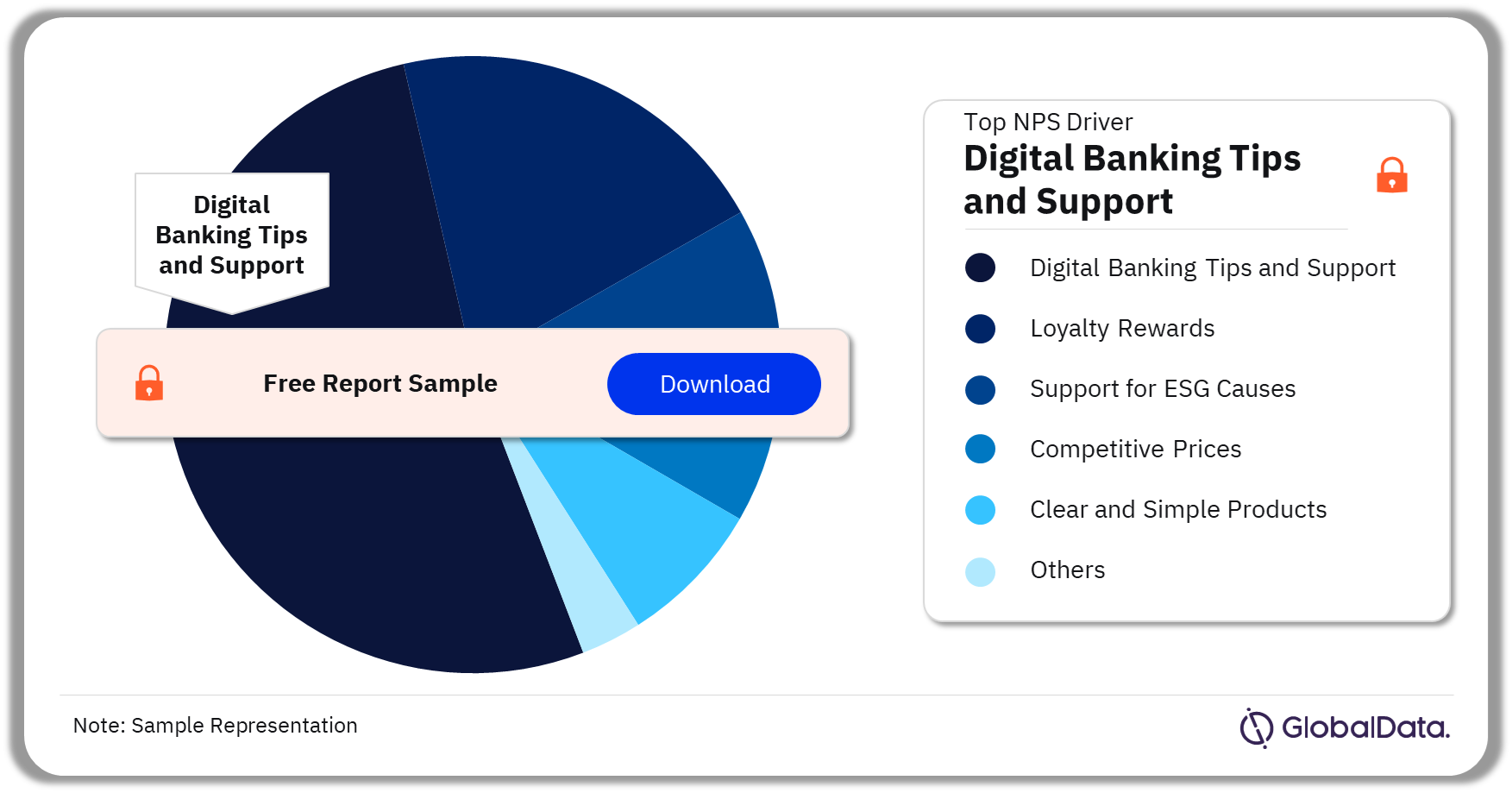

Saudi Arabia Retail Banking - Customer Satisfaction

The customer satisfaction segment of the Saudi Arabia retail banking market report comprises satisfaction drivers of NPS and overall and digital satisfaction drivers for NPS in popular banks. The key factors driving NPS are digital banking tips and support, loyalty rewards, support for ESG causes, competitive prices, the capacity to customize products, and clear and simple products, among others. Digital banking tips and support was the biggest driver of NPS.

Also, in terms of overall satisfaction, customers are generally highly content in Saudi Arabia across all digital satisfaction metrics. Al Rajhi Bank, Riyad Bank, and Saudi National Bank each scored above average for every digital banking satisfaction metric.

Saudi Arabia Retail Banking Market Analysis by NPS Drivers, 2022 (%)

Buy the Full Report for More Insights on the NPS Drivers in the Saudi Arabia Retail Banking Market

Scope

This report looks at market performance, retention risk, and market shares across key products within Saudi Arabia’s retail banking space. It also ranks the market’s leading banks across a range of criteria, from digital adoption and user experience to rewards and money management tools.

Key Highlights

- The level of concentration has increased in the Saudi Arabian retail banking market within the last 10 years, as the two biggest players-Saudi National Bank and Al Rajhi Bank control over half of the market.

- Cross-selling rates are low in Saudi Arabia, which is typical for the region. Nonetheless, Net Promoter Scores (NPS) are quite high, with considerably more promoters than detractors.

- Digital banking tips and support is the biggest driver of NPS, and satisfaction with digital banking metrics is quite high.

Reasons to Buy

- Identify factors affecting growth prospects across the deposit, credit card, personal loan, and mortgage markets.

- Track competitor gains and losses in market share.

- Assess the financial performances of competitors.

- Unlock detailed analysis of the drivers of customer advocacy.

- Discover the actionable steps required to improve and maximize banking performance in Saudi Arabia.

Alinma Bank

Arab National Bank

Bank Albilad

Bank AlJazira

Banque Saudi Fransi

Riyad Bank

Saudi Awwal Bank

Saudi Investment Bank

Saudi National Bank

Table of Contents

Frequently asked questions

-

What do the key customer relationship parameters include?

The key customer relationship parameters include customer tenure, cross-selling, current account net promoter score, and customer loyalty.

-

The customer satisfaction segment of the Saudi Arabia retail banking market includes satisfaction drivers of NPS and overall and digital satisfaction drivers for NPS in popular banks.

-

What are the key factors driving NPS?

The key factors driving NPS are digital banking tips and support, loyalty rewards, support for ESG causes, competitive prices, the capacity to customize products, and clear and simple products, among others.

-

What was the main attribute determining NPS in the Saudi Arabian retail banking market?

Digital banking tips and support was the key driving attribute for NPS in the Saudi Arabia retail banking market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports