Singapore Meat Substitutes Market Opportunities, Trends, Growth Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Singapore Meat Substitutes Market Report Overview

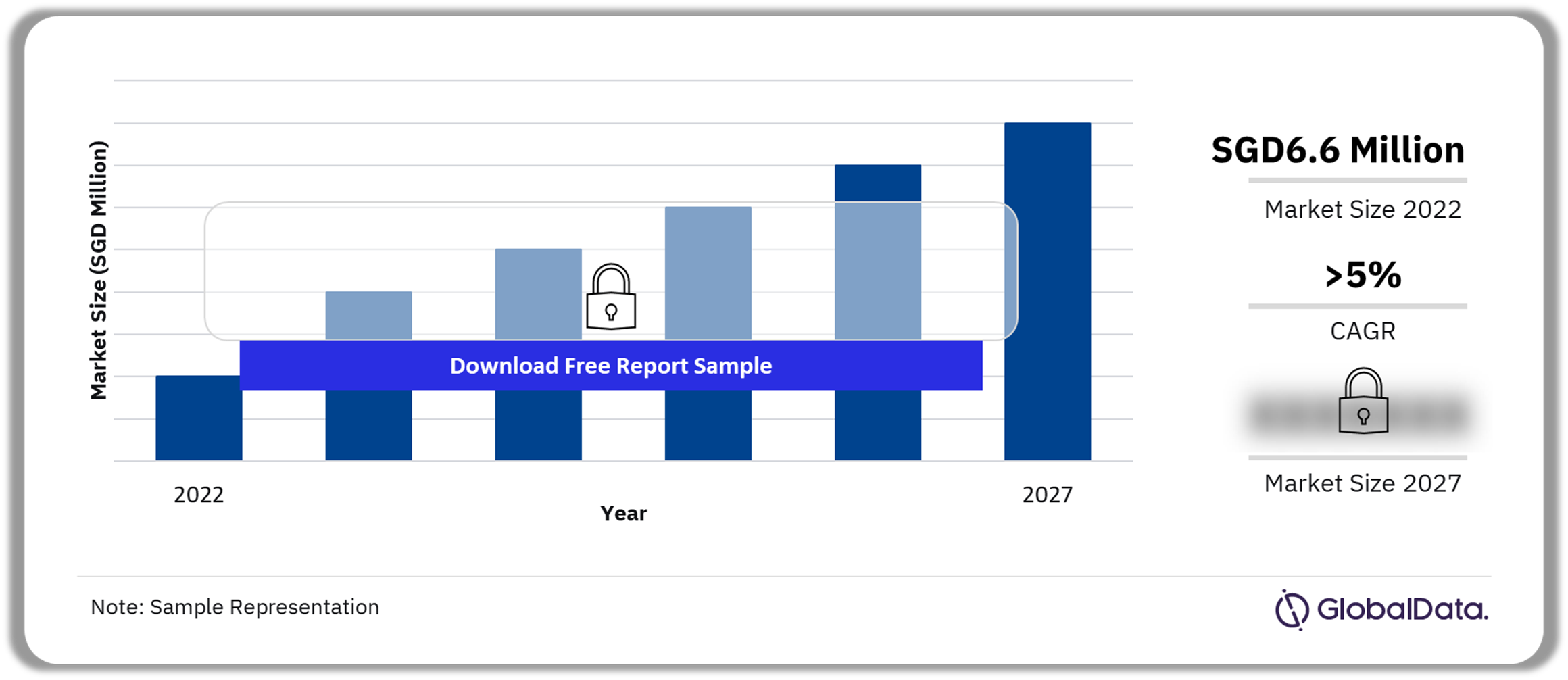

The Singapore meat substitutes market size was SGD6.6 million ($4.9 million) in 2022 and it is likely to grow at a CAGR of more than 5% from 2022 to 2027. The Singapore meat substitutes market analysis report brings together multiple data sources to provide a comprehensive overview of consumer graphics, macroeconomic factors, and city-wise analysis for the forecast period.

Singapore Meat Substitutes Market Outlook 2022-2027 (SGD Million)

Buy the Full Report for More Insights into the Singapore Meat Substitutes Market Forecasts, Download a Free Sample Report

The Singapore meat substitutes market research report offers data that showcase the trends in the market and sectors by value and volume. It provides historical and forecast period data for total meat substitutes sales in the country. The report also reveals the brand leaders by market share in 2022 in Singapore.

| Market Size (2022) | SGD6.6 million ($4.9 million) |

| CAGR (2022-2027) | >5% |

| Key Categories | · Soy Based

· Vegetable/Plant-based proteins · Single-cell protein (Fungi/Algae) · Seitan · Pea based · Fungi (Mycoprotein) |

| Key Distribution Channels | · Hypermarkets & supermarkets

· Convenience stores · E-retailers · Food & drinks specialists · Others |

| Leading Companies | · Vitasoy International Group

· Jia Jia Wang Trading · Monde Nissin · Growth Well Industry · Hanwell Holdings Limited |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let Singapore help you make an informed decision before making a purchase. |

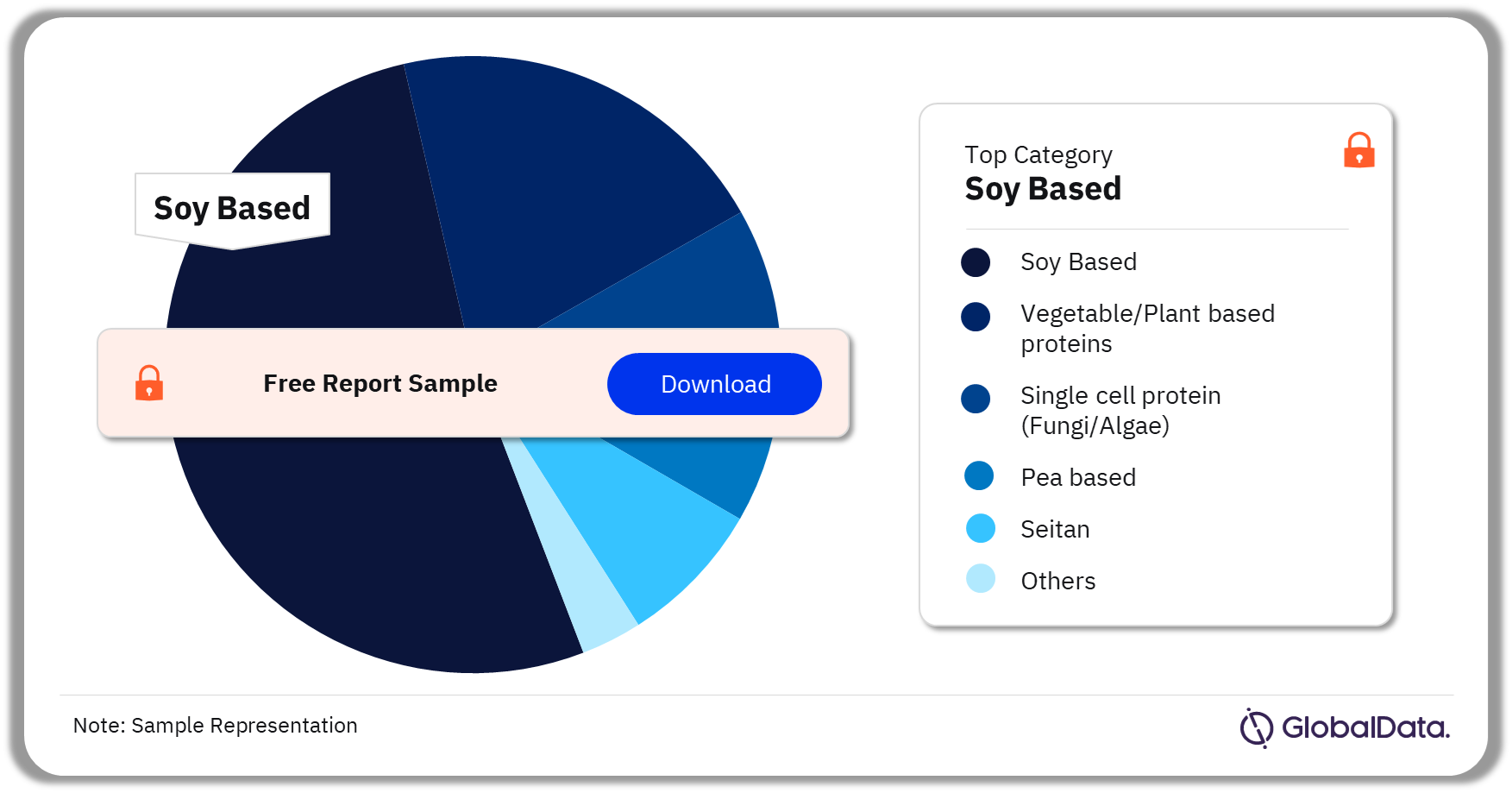

Singapore Meat Substitutes Market Segmentation by Category

The key categories in the Singapore meat substitutes market are soy-based, vegetable/plant-based proteins, single-cell protein (Fungi/Algae), seitan, pea-based, and fungi (mycoprotein).

In 2022, the soy-based category accounted for the highest share of the Singapore meat substitutes market. However, the grain-based category is forecast to register the fastest value growth at a CAGR of over 5% during 2022–27.

Singapore Meat Substitutes Market Analysis by Categories, 2022 (%)

Buy the Full Report for More Insights on the Categories in the Singapore Meat Substitutes Market

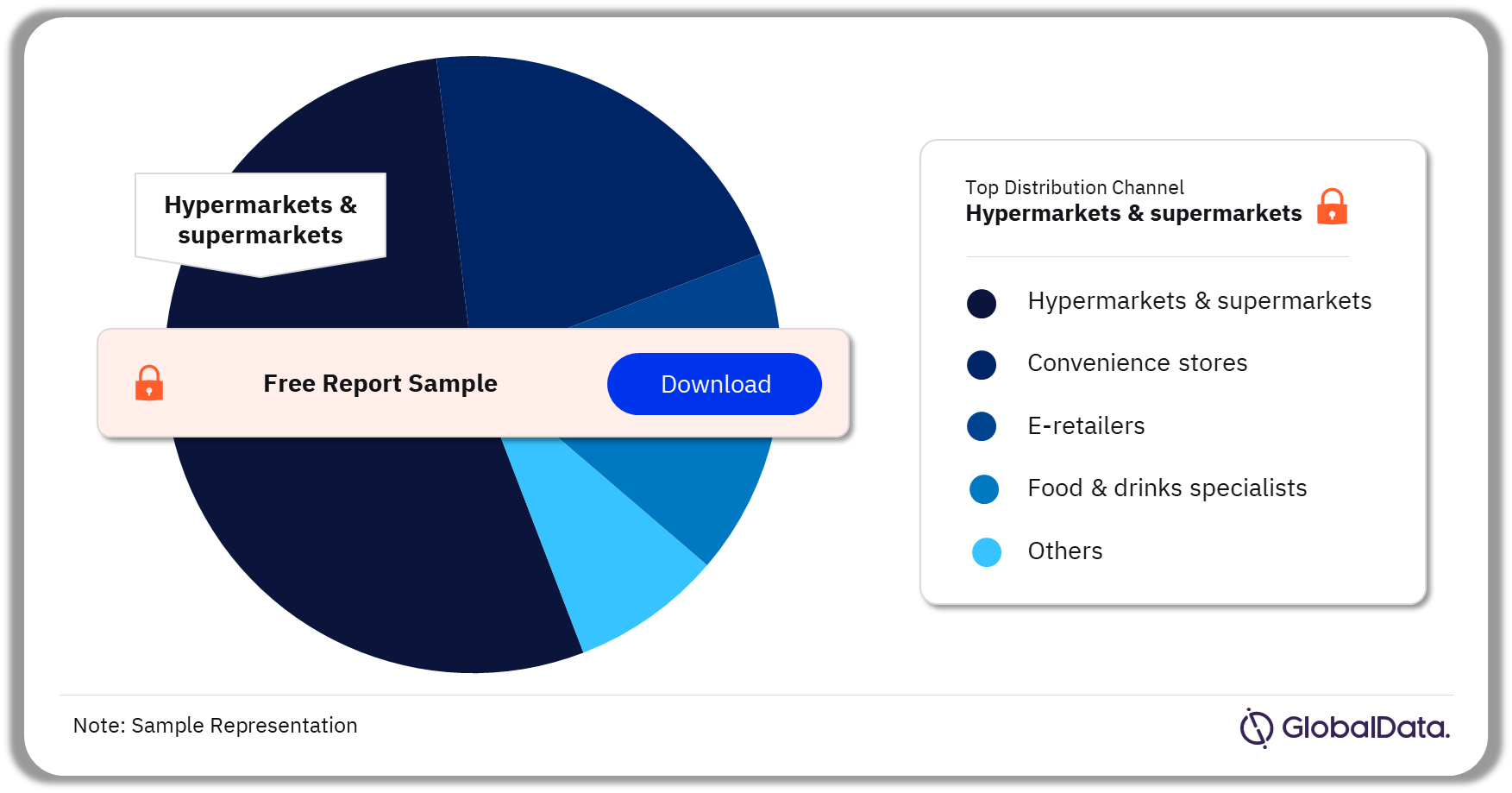

Singapore Meat Substitutes Market Segmentation by Distribution Channels

The key distribution channels in the Singapore meat substitutes market are hypermarkets & supermarkets, convenience stores, e-retailers, and food & drinks specialists among others. Hypermarkets & supermarkets channel was the leading distribution channel in the Singapore meat substitutes market in 2022, followed by convenience stores.

Singapore Meat Substitutes Market Analysis by Distribution Channels, 2022 (%)

Buy the Full Report for More Distribution Channel-Wise Insights in the Singapore Meat Substitutes Market

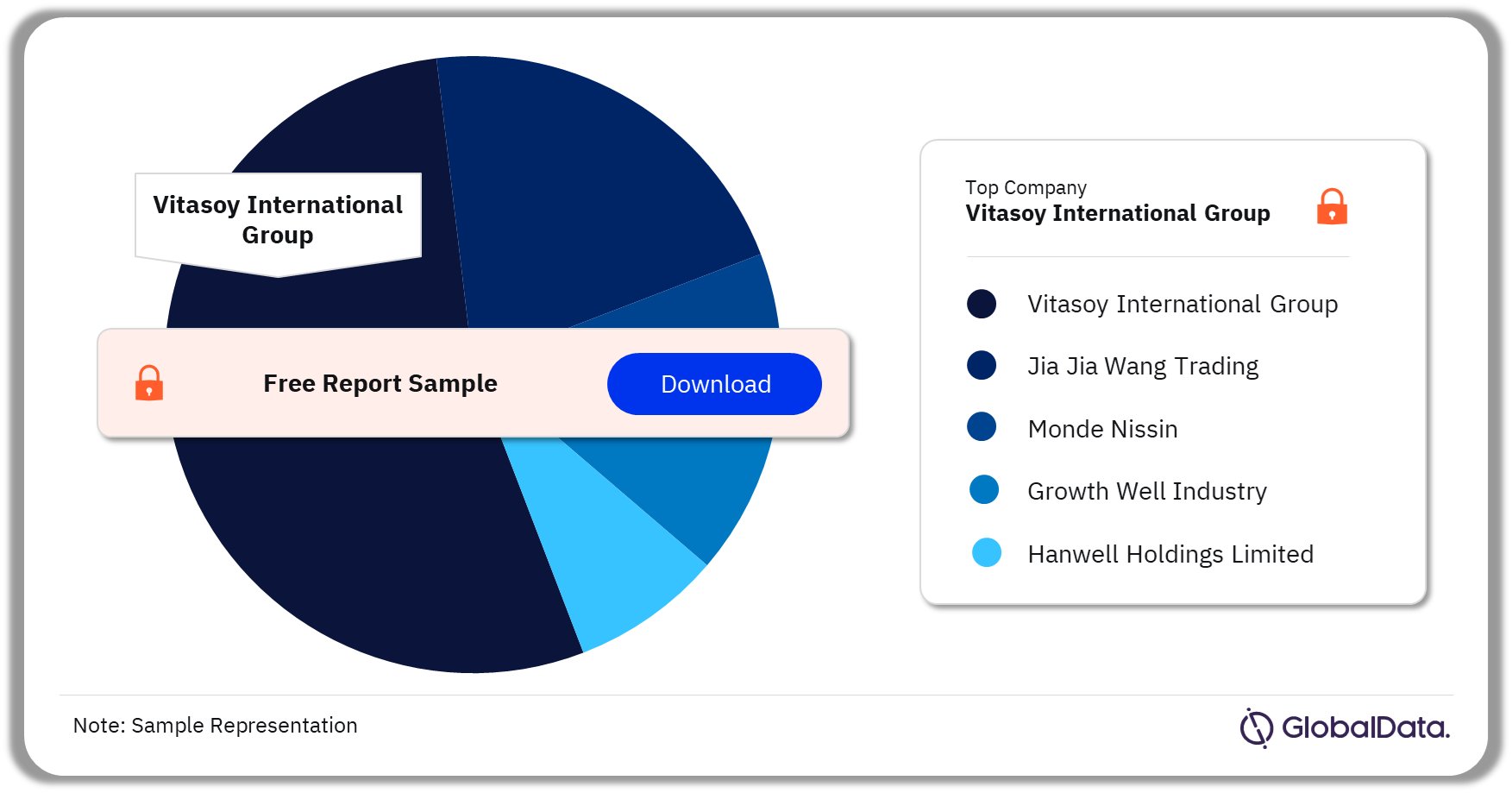

Singapore Meat Substitutes Market - Competitive Landscape

The leading companies in the Singapore meat substitutes market are Vitasoy International Group, Jia Jia Wang Trading, Monde Nissin, Growth Well Industry, and Hanwell Holdings Limited among others. In 2022, Vitasoy International Group held the largest Singapore meat substitutes market share.

The company offers products in soy-based, vegetable/plant-based proteins under brand names such as Unicard, Vitasoy, Sakura, and Jia Jia Wang among others.

Singapore Meat Substitutes Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More About the Leading Companies in the Singapore Meat Substitutes Market

Segments Covered in the Report

Singapore Meat Substitutes Market Category Outlook (Value, SGD Million, 2017-2027)

- Soy Based

- Vegetable/Plant-based proteins

- Single-cell protein (Fungi/Algae)

- Seitan

- Pea based

- Fungi (Mycoprotein)

Singapore Meat Substitutes Market Distribution Channel Outlook (Value, SGD Million, 2017-2027)

- Hypermarkets & supermarkets

- Convenience stores

- E-retailers

- Food & drinks specialists

- Others

Scope

GlobalData’s Country Profile report on the meat substitutes sector in Singapore provides insights on high growth markets to target, category level distribution data, and companies market shares.

What else is contained?

• Sector data: Overall sector value and volume data with growth analysis for 2017–27

• Category coverage: Value and growth analysis for grain based, soy based, single cell protein (fungi/algae), and vegetable/plant based proteins with inputs on individual segment share within each category and the change in their market share forecast for 2022–27

• Leading players: Market share of companies (in value terms) in 2022

• Distribution data: Provides analysis on the leading distribution channels, both at a sector and category level in 2022. The consumer sector reports cover the following five distribution channels: hypermarkets & supermarkets, convenience stores, e-retailers, food & drinks specialists, and other general retailers.

Key Highlights

- Per capita expenditure of meat substitutes in Singapore was higher than both the global and the regional levels in

- Hypermarkets & supermarkets were the leading distribution channel in the Singaporean meat substitutes sector, with the highest volume share in 2022.

- Soy-based was the largest category in 2022, with the highest value sales.

Reasons to Buy

- Identify high-potential categories and explore further market opportunities based on detailed value and volume analysis.

- Analyze key distribution channels to identify and evaluate trends and opportunities for existing and new players.

- Understand the overall competitive landscape based on detailed company share analysis to plan effective market positioning.

- Get a clear picture of the opportunities that can be tapped over the next five years, resulting in revenue expansion.

- Analyze key macroeconomic indicators such as real GDP, nominal GDP, consumer price index, household consumption expenditure, population (by age group, gender, rural-urban split, employed people, and unemployment rate. It also includes an economic summary of the country along with the labor market and demographic trends.

Monde Nissin

Jia Jia Wang Trading

Hanwell Holdings

Amy's Kitchen

Fry Group Foods

Everbest Soya Bean Products

Growth Well Industry

Impossible Foods

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Singapore meat substitutes market size in 2022?

The Singapore meat substitutes market size was SGD6.6 million ($4.9 million) in 2022.

-

What is the Singapore meat substitutes market growth rate for the forecast period?

The Singapore meat substitutes market is expected to register a CAGR of more than 5% during 2022-2027.

-

Which was the leading category in the Singapore meat substitutes market in 2022?

The soy-based category accounted for the highest share of the Singapore meat substitutes market in 2022.

-

Which was the leading distribution channel in the Singapore meat substitutes market in 2022?

Hypermarkets & supermarkets were the leading distribution channel in the Singapore meat substitutes market in 2022.

-

Which are the leading companies in the Singapore meat substitutes market?

The leading companies in the Singapore meat substitutes market are Vitasoy International Group, Jia Jia Wang Trading, Monde Nissin, Growth Well Industry, and Hanwell Holdings Limited among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.