Slovakia Baby Food Market Size and Share by Categories, Distribution and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Slovakia Baby Food Market Report Overview

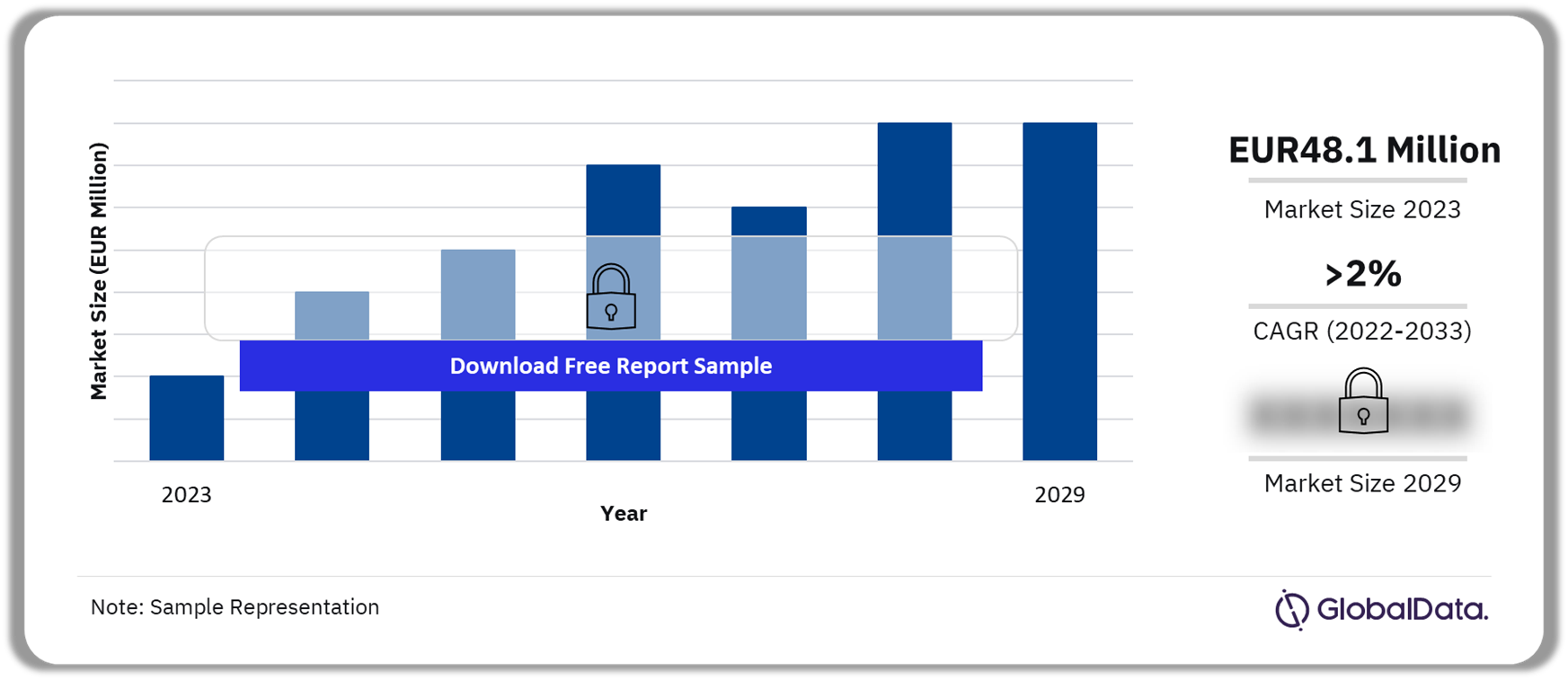

The Slovakia baby food market size was EUR48.1 million ($52 million) in 2023 and will achieve a CAGR of more than 2% during 2023-2029.

Slovakia Baby Food Market Outlook, 2023-2029 (EUR Million)

Buy the Full Report for More Insights on the Slovakia Baby Food Market Forecast

The Slovakia baby food market research report puts together multiple data sources to provide a comprehensive baby food sector overview in the country. The report covers key information about the per capita expenditure (PCE) and per capita consumption (PCC) to help in understanding the baby food market growth trajectory in Slovakia. Furthermore, the Slovakia baby food market analysis offers detailed category-wise, distribution channel-wise, and company-wise insights to understand potential business opportunities.

| Market Size (2023) | EUR48.1 million ($52 million) |

| CAGR (2023-2029) | >2% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2029 |

| Key Categories | · Baby Milks

· Baby Cereals & Dry Meals · Baby Wet Meals & Other · Baby Finger Food · Baby Drinks |

| Key Distribution Channels | · Hypermarkets & Supermarkets

· Drugstores & Pharmacies · Convenience Stores · E-retailers |

| Leading Manufacturers | · Danone

· Hero · Nestlé · HiPP · Humana · Unifarm |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

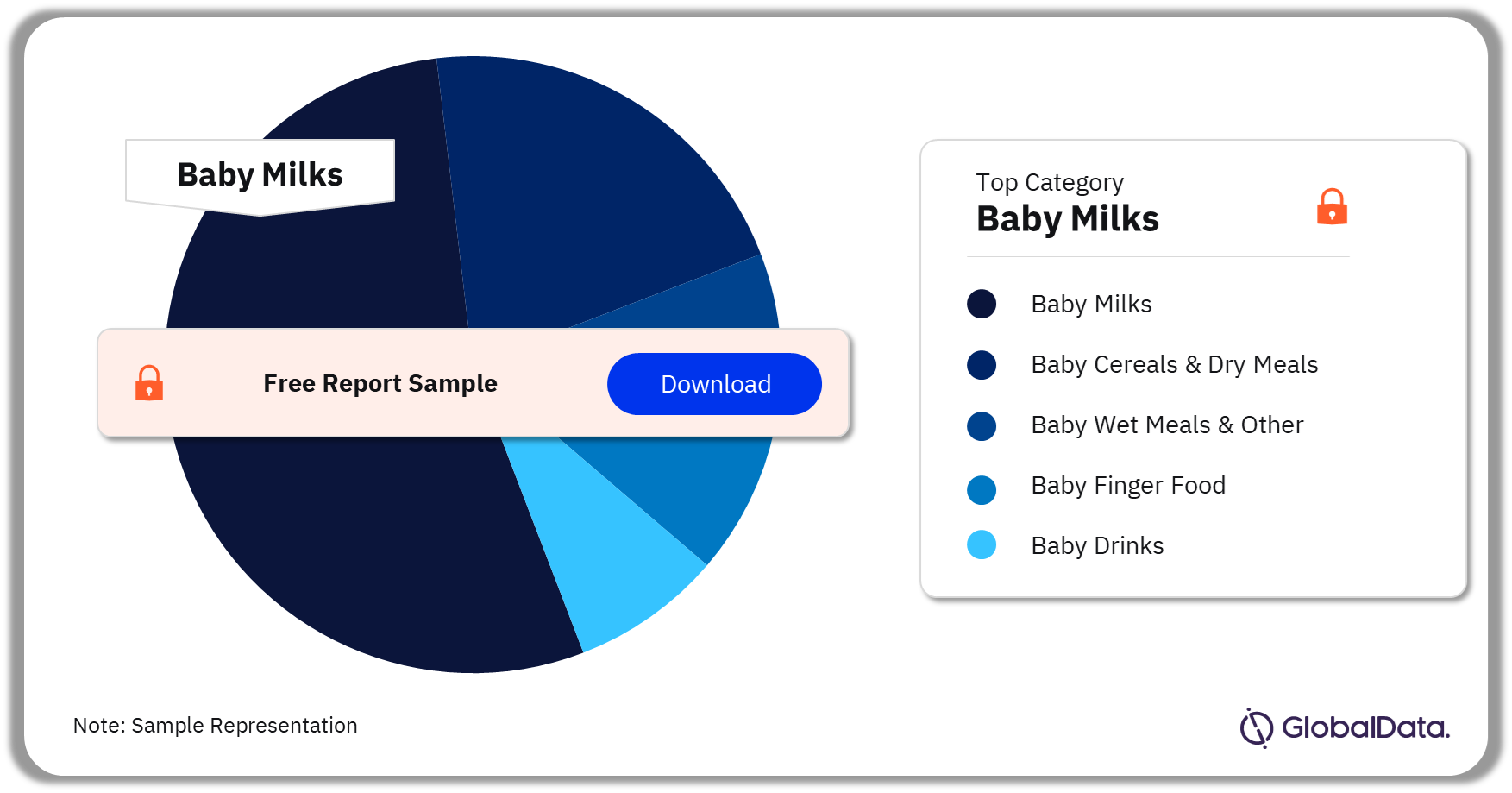

Slovakia Baby Food Market Segmentation by Categories

The baby milks category led the Slovakia baby food market by value in 2023

The key categories in the Slovakia baby food market are:

- Baby Milks

- Baby Cereals & Dry Meals

- Baby Wet Meals & Other

- Baby Finger Food

- Baby Drinks

Danone was the market leader in the baby milks, baby wet meals & others, and baby cereals & dry meals categories.

Slovakia Baby Food Market Analysis by Categories, 2023 (%)

Buy the Full Report for More Category Insights into the Slovakia Baby Food Market

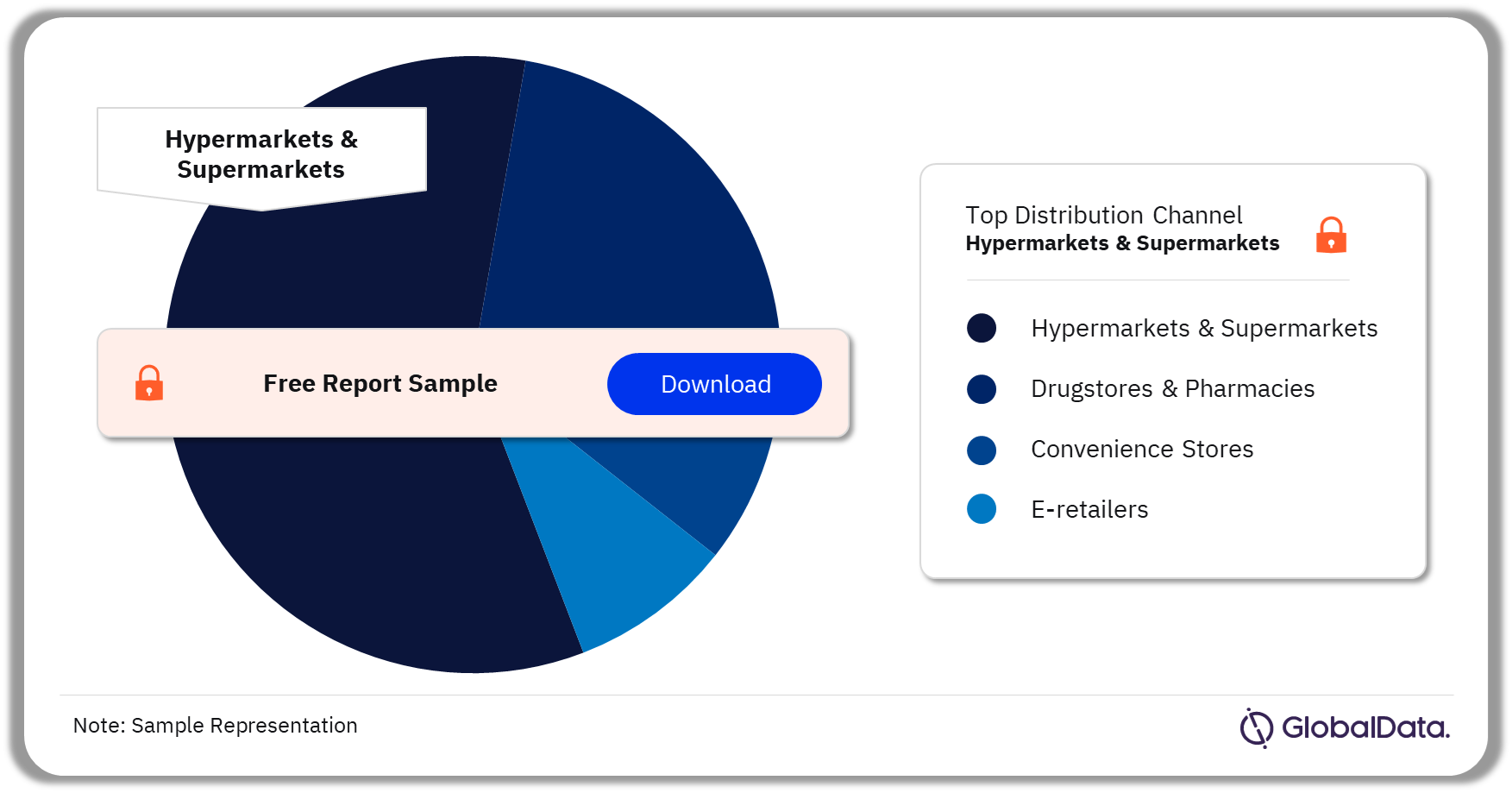

Slovakia Baby Food Market Segmentation by Distribution Channels

Hypermarkets & supermarkets channel accounted for the highest share of the baby food market in 2023

A few of the key distribution channels in the Slovakia baby food market are:

- Hypermarkets & Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-retailers

In 2023, hypermarkets & supermarkets was the leading channel in Slovakia baby food market.

Slovakia Baby Food Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for More Distribution Channel Insights into the Slovakia Baby Food Market

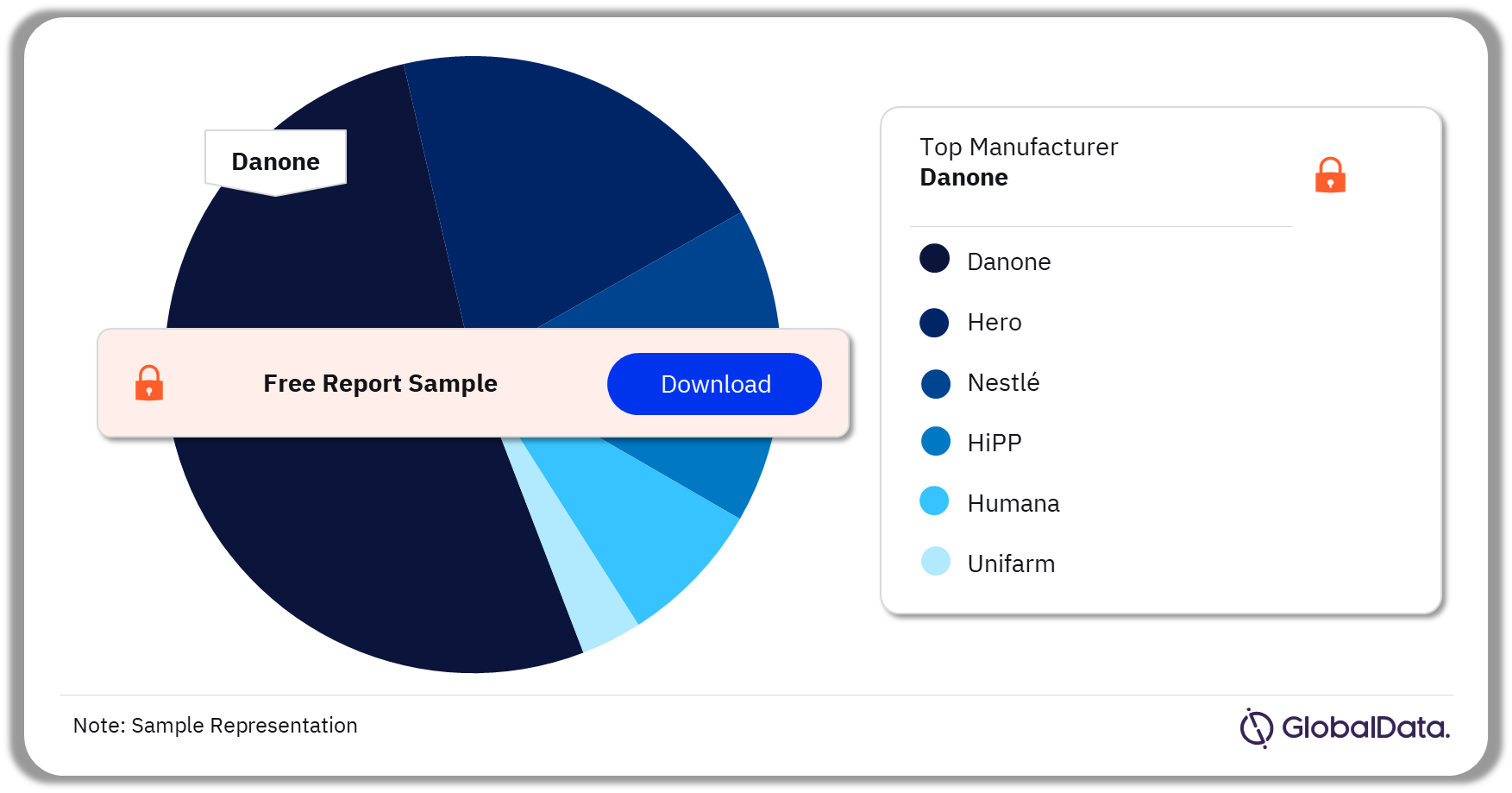

Slovakia Baby Food Market - Competitive Landscape

In 2023, Danone led the Slovak baby food sector in both value and volume terms

A few of the leading manufacturers in the Slovakia baby food market are:

- Danone

- Hero

- Nestlé

- HiPP

- Humana

- Unifarm

Slovakia Baby Food Market Analysis by Manufacturers, 2023 (%)

Buy the Full Report for More Manufacturer Insights into the Slovakia Baby Food Market

Segments Covered in the Report

Slovakia Baby Food Categories Outlook (Value, EUR Million, 2017-2029)

- Baby Milks

- Baby Cereals & Dry Meals

- Baby Wet Meals & Other

- Baby Finger Food

- Baby Drinks

Slovakia Baby Food Distribution Channel Outlook (Value, EUR Million, 2017-2029)

- Hypermarkets & Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-retailers

Scope

This report provides:

- A comprehensive overview of the baby food sector in Slovakia, as part of GlobalData’s global coverage of the sector.

- Market environment: A comparative analysis of the value and volume shares of Slovakia against the Western European and global baby food sectors. Additionally, the per capita consumption (PCC) and per capita expenditure (PCE) on baby food in Slovakia are compared at regional and global levels.

- Background: An overview of births, consumer trends, socio-demographic trends, working women population, and regulations in the Slovakia baby food sector.

- Category coverage and competitive landscape: An overview of growth at a sector level and an analysis of five categories. These categories are analyzed by value, volume, and CAGR for the 2017-2029 period. The analysis also includes baby food per capita consumption and expenditure in Slovakia, by category. The report provides an analysis of leading manufacturers and brands in the Slovakia baby food sector in 2023 and their market shares in each category.

- Production and trade: An analysis of imports and exports in the Slovakia baby food sector.

- Distribution channel: Analysis of the leading distribution channels at both sector and category levels in 2023.

- Economic background: An outlook on macroeconomic indicators in Slovakia, with a detailed summary of the economy and labor market.

Key Highlights

Value sales of baby milks grew from EUR16.1 million ($18.2 million) in 2017 to EUR20.8 million ($22.5 million) in 2023, registering a CAGR of 4.4% during this period.

Volumes of baby cereals & dry meals decreased from 0.31 million kg in 2017 to 0.29 million kg in 2023, at a negative CAGR of 1%.

Value sales of baby wet meals & others rose from EUR11.5 million ($13 million) in 2017 to EUR16.3 million ($17.6 million) in 2023, at a CAGR of 5.9%.

During 2017–23, PCC of baby finger food increased by 0.4%.

During 2017–23, PCC of baby drinks increased by 2.2%.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyze current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Get a detailed understanding of consumption by individual product categories to align your sales and marketing efforts with the latest trends in the market.

- Investigate which categories are performing the best and how this is changing market dynamics.

Hero

HiPP

Nestlé

Hamé

NOVOFRUCT SK

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Slovakia baby food market size in 2023?

The baby food market size in Slovakia was EUR48.1 million ($52 million) in 2023.

-

What will the Slovakia baby food market growth rate be during the forecast period?

The baby food market in Slovakia will achieve a CAGR of more than 2% during 2023-2029.

-

Which was the leading category in the Slovakia baby food market in 2023?

Baby milks was the leading category in the Slovakia baby food market in 2023.

-

Which was the leading distribution channel of the Slovakia baby food market in 2023?

Hypermarkets & supermarkets was the leading distribution channel of the Slovakia baby food market in 2023.

-

Which are the leading manufacturers in the Slovakia baby food market?

A few of the leading manufacturers in the Slovakia baby food market are Danone, Hero, Nestlé, HiPP, Humana, Unifarm among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.