South Korea Foodservice Market Size and Trends by Profit and Cost Sector Channels, Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

South Korea Foodservice Market Overview

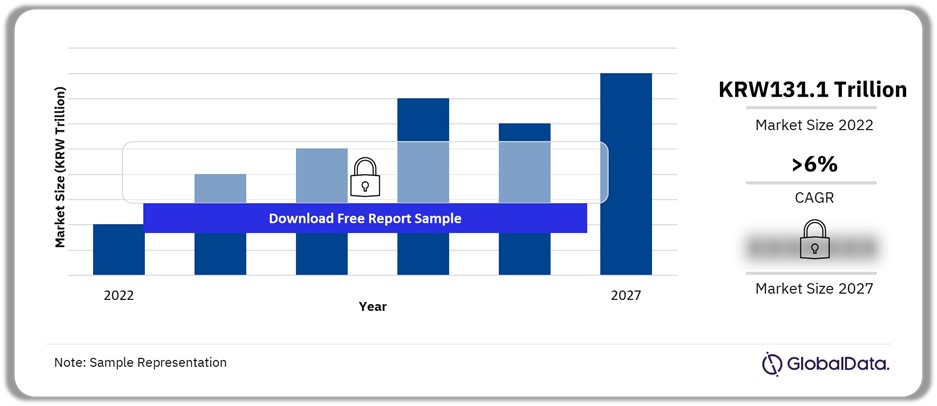

The South Korea foodservice profit sector recorded sales of KRW131.1 trillion ($101.5 billion) in 2022 and is expected to attain a CAGR of over 6% during 2022-2027. This growth can be attributed to the comeback made by the South Korean tourism sector despite pandemic challenges. The South Korean government implemented measures to encourage easy travel through digitalization, by offering financial aid for small and medium enterprises in the form of vouchers. The South Korean government announced that 2023 and 2024 would be “Visit Korea years” as it sought to attract tourists.

South Korea Foodservice Profit Sector Outlook 2022-2027, (KRW Trillion)

Buy the Full Report for More Insights on the South Korea Foodservice Market Forecast

Download A Free Sample Report

The South Korea foodservice market research report offers an in-depth analysis of the key issues impacting the market and presents growth opportunities for the sector participants. The report evaluates the South Korea foodservice market in terms of profit sector channels and cost sector channels for the next five years (2022-27). This report will act as a vital point of reference for business-critical decision-making among the foodservice operators or suppliers in South Korea.

| Market Size (2022) | KRW131.1 trillion ($101.5 billion) |

| CAGR (2022-2027) | >6% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Profit Sector Channels | · FSR

· QSR · Coffee & Tea Shop · Pub, Club & Bar · Accommodation |

| Key Outlet Type | · Dine-in

· Takeout |

| Key Owner Type | · Independent Operators

· Chain Operators |

| Key Cost Sector Channels | · Military & Civil Defense

· Healthcare · Education · Welfare & Services · Complimentary Services |

| Key Companies | · McDonald’s

· BHC Chicken · Restaurant Brands International · Nolboo · Bon IF · Starbucks |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

South Korea Foodservice Market Trends

- Health and Wellness: The consumers in South Korea are increasingly demanding food and drink items that positively impact their health and wellbeing. This is attributed to rising health-consciouness among consumers owing to COVID-19 Pandemic.

- Enjoyability and uniqueness: Consumers in South Korea will prioritize unique products and services that offer them an enjoyable experience, with rising exposure to global cuisines and cultures.

Buy the Full Report for more Insights into the South Korea Foodservice Market Trends

Download A Free Sample Report

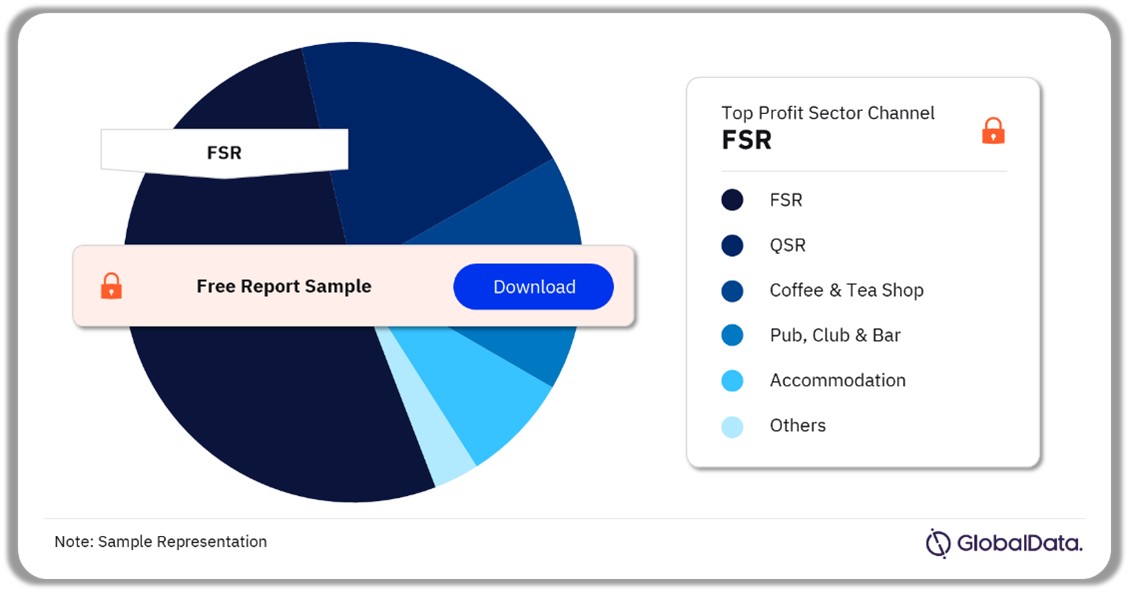

South Korea Foodservice Market Segmentation by Profit Sector Channels

FSR was the largest profit sector channel in 2022 by value sales.

The key profit sector channels in the South Korea foodservice market are FSR; QSR; accommodation; leisure; pub, club & bar; and retail. The FSR was the leading profit sector channel in 2022, followed by QSR and coffee & tea shop. Many South Korean consumers are interested in trying out different types of cuisine and are looking for a premium dining experience. In March 2022, Gucci Osteria da Massimo Bottura, an authentic Italian restaurant, was opened in South Korea to cater to such consumers.

Frequent consumers of the FSR channel are influenced by how the offerings align with their time and money constraints, provide enjoyability or uniqueness, and how they impact their health. Fish & seafood was the most popular cuisine type in 2022, accounting for more than 11% of FSR value sales, followed by steakhouses & grills.

South Korea Foodservice Market Analysis by Profit Sector Channels, 2022 (%)

Buy the Full Report for More Channel Insights into the South Korea Foodservice Market

Download A Free Sample Report

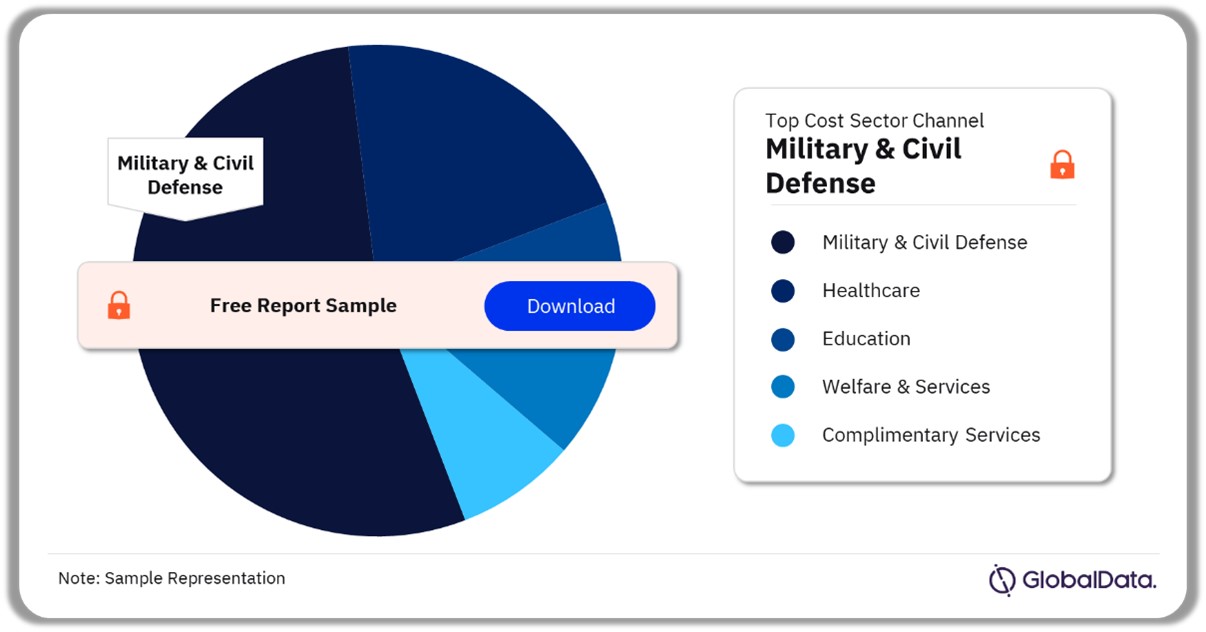

South Korea Foodservice Market Segmentation by Cost Sector Channels

The key cost sector channels in the South Korea foodservice market are military & civil defense, healthcare, education, welfare & services, and complimentary services. In 2022, military & civil defense was the largest cost sector, followed by healthcare, and education.

South Korea Foodservice Market Analysis by Cost Sector Channels, 2022 (%)

Buy the Full Report for More Cost Sector Insights into the South Korea Foodservice Market

Download A Free Sample Report

South Korea Foodservice Market – Competitive Landscape

McDonald’s was the largest FSR operator in the country.

The key foodservice companies in South Korea are:

- McDonald’s

- BHC Chicken

- Restaurant Brands International

- Nolboo

- Bon IF

- Starbucks

South Korea Foodservice Market Analysis by Competitors

Buy the Full Report for Additional Insights into South Korea Foodservice Market Players

Download A Free Sample Report

South Korea Foodservice Market – Latest Developments

- In July 2023, McDonald’s announced an ambitious plan to have 500 McDonald’s locations operational in South Korea by 2030. Additionally, the operator introduced a unique menu exclusively for the South Korean market as part of the festivities marking its 35th anniversary in the country.

- In October 2022, Starbucks Hanok, a distinctive establishment in Daegu, South Korea, was inaugurated. This store is designed to emulate the traditional Korean Hanok houses, drawing inspiration from the city’s historic structures and architectural elements. Spanning approximately 7,000ft.

Segments Covered in the Report

South Korea Foodservice Market Outlook by Profit Sector Channel (Value KRW Billion, 2017-2027)

- McDonald’s

- BHC Chicken

- Restaurant Brands International

- Nolboo

- Bon IF

- Starbucks

South Korea Foodservice Market Outlook by Cost Sector Channels (Value, KRW Billion, 2017-2027)

- Military & Civil Defense

- Healthcare

- Education

- Welfare & Services

- Complimentary Services

Scope

The report includes:

- Overview of South Korea’s macro-economic landscape: Detailed analysis of current macro-economic factors and their impact on the South Korea foodservice market, including GDP per capita, consumer price index, population growth, and annual household income distribution.

- Growth dynamics: In-depth data and forecasts of key channels (QSR, FSR, coffee & tea shop, and pub, club & bar) within the South Korea foodservice market, including the value of the market, number of transactions, number of outlets and average transaction price.

- Customer segmentation: Identify the most important demographic groups, buying habits, and motivations that drive out-of-home meal occasions among segments of the South Korea population.

- Key players: Overview of market leaders within the four major channels, including business descriptions and number of outlets.

Reasons to Buy

- Get specific forecasts of the foodservice market over the next five years will give readers the ability to make informed business decisions through identifying emerging/declining markets.

- Understand the consumer segmentation that details the desires of known consumers among all major foodservice channels (QSR, FSR, coffee & tea shop, and pub, club & bar).

BHC Chicken

Restaurant Brands International

Nonghyup Mokwoochon

Issac Toast

Bon IF

Outback Steakhouse

Nolboo

Starbucks

The Carlyle Group

Dunkin’ Brands

Lotte Group

Table of Contents

Frequently asked questions

-

What was the South Korea profit sector market size in 2022?

The South Korea profit sector market size was KRW131.1 trillion ($101.5 billion) in 2022.

-

What will the South Korea profit sector growth rate be during the forecast period?

The profit sector in South Korea will grow at a CAGR of over 6% during 2022-2027.

-

Which was the leading profit sector channel in the South Korea foodservice market in 2022?

FSR was the leading profit sector channel in the South Korea foodservice market in 2022.

-

What cost sector channel had the highest share in the South Korea foodservice market in 2022?

The military & civil defense sector had the highest share in the South Korea foodservice market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports