Spain Power Market Outlook to 2035 – Market Trends, Regulations and Competitive Landscape

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain Power Market Report Overview

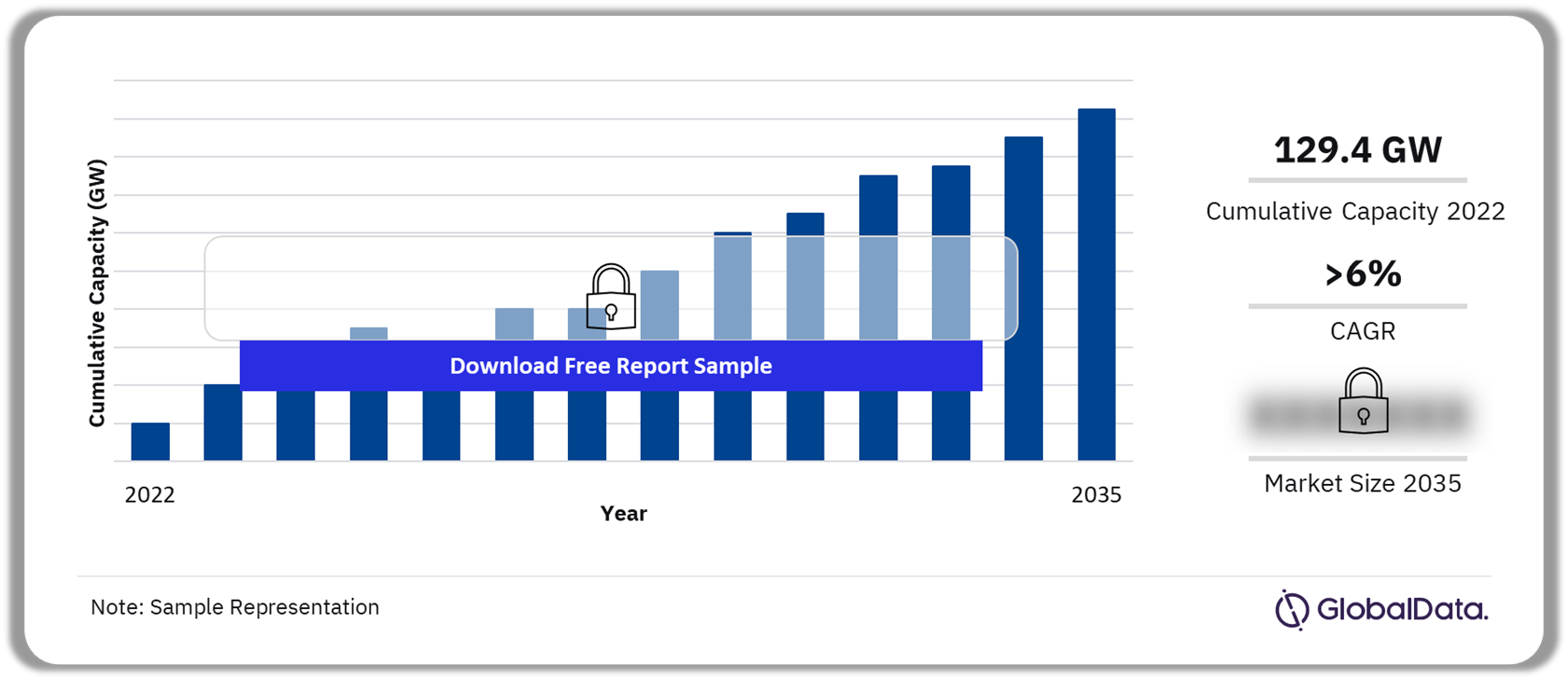

The cumulative installed capacity in the Spain power market was 129.4 GW in 2022. During the year, renewable power dominated the capacity segment, followed by thermal and hydropower. The installed capacity is expected to grow at a CAGR of more than 6% during 2022-2035.

Spain Power Market Outlook, 2022-2035 (GW)

Buy the Full Report for More Insights on the Spain Power Market Forecast

The Spain power market research report discusses the power market structure of Spain and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape, and a list of major power plants are also covered in the report. Furthermore, the report includes a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. Our analysts have also included data on deals in the country’s power sector in the report.

| Cumulative Installed Capacity (2022) | 129.4 GW |

| CAGR (2022-2035) | >6% |

| Historical Period | 2010-2022 |

| Forecast Period | 2023-2035 |

| Key Sectors | · Industrial Sector

· Residential Sector · Commercial Sector · Transport Sector |

| Key Deal Types | · Partnerships

· Debt Offerings · Acquisitions · Venture Financing · Asset Transactions |

| Key Companies | · Iberdrola SA

· Enel SpA · Natural Energy Group SA · Acciona |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

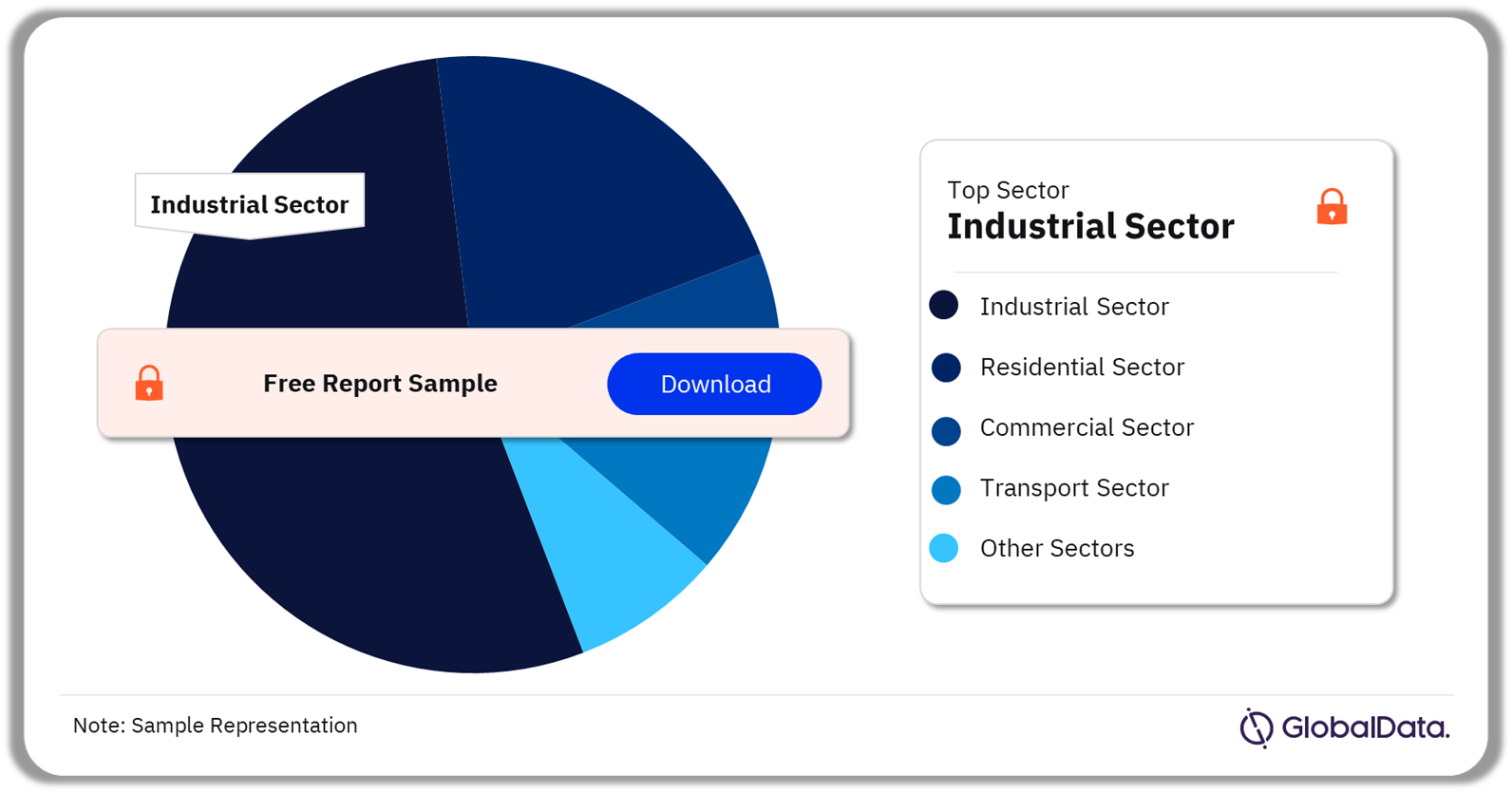

Spain Power Market Segmentation by Sectors

The key sectors in the Spain power market are the industrial sector, residential sector, commercial sector, transport sector, and other sectors. In 2022, the industrial sector accounted for the highest share of power consumption in the Spain power market, followed by the residential sector and the commercial sector.

Spain Power Generation by Sectors, 2022 (%)

Buy the Full Report for More Insights on Sectors in the Spain Power Market

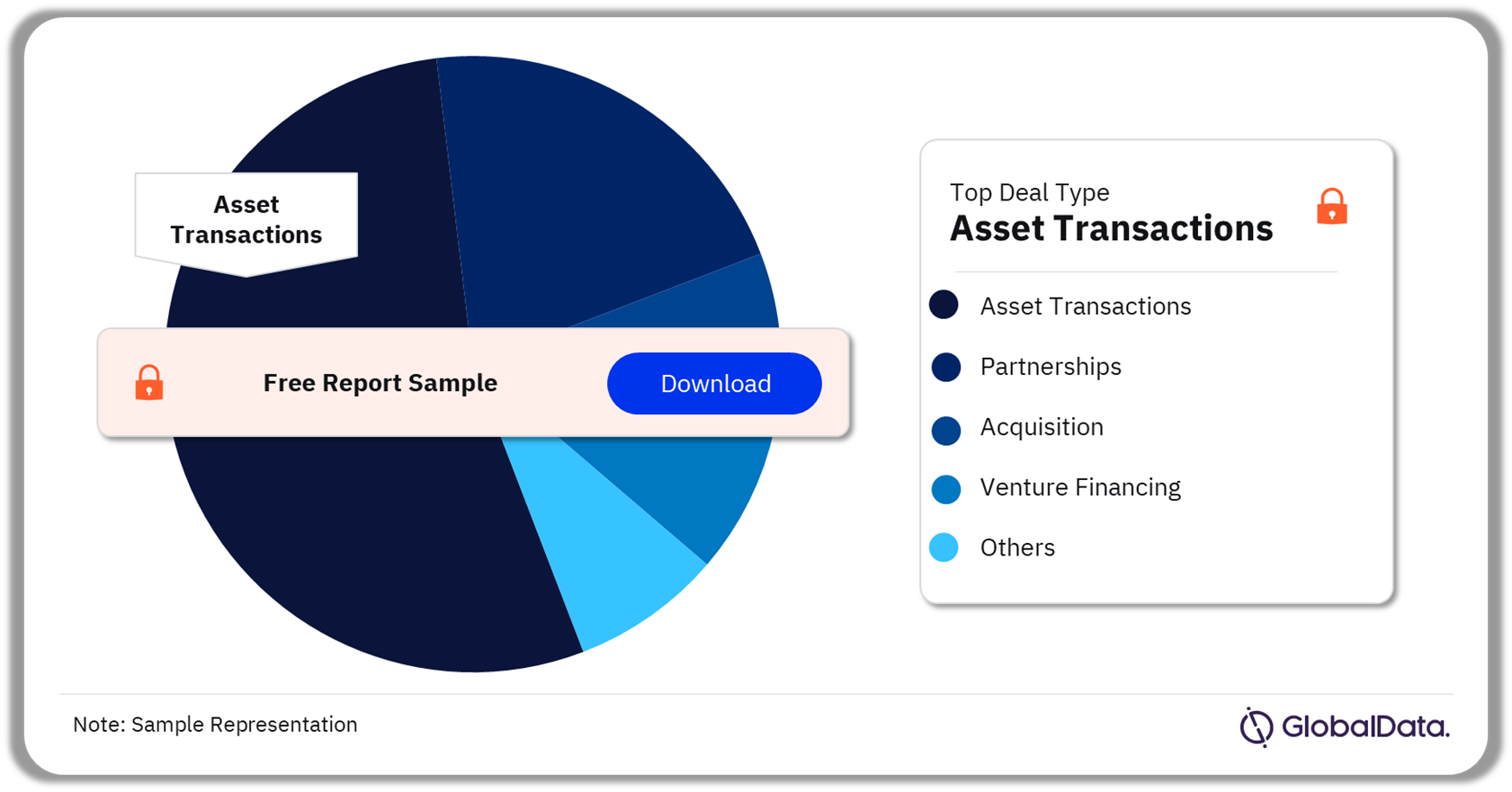

Spain Power Market Segmentation by Deal Types

The key deal types recorded in the Spain power market in 2022 are partnerships, debt offerings, acquisitions, venture financing, and asset transactions, among others. Asset transactions dominated Spain’s power deals market in 2022, followed by partnerships.

Spain Power Market Analysis by Deal Types, 2022 (%)

Buy the Full Report for More Insights on Deal Types in the Spain Power Market

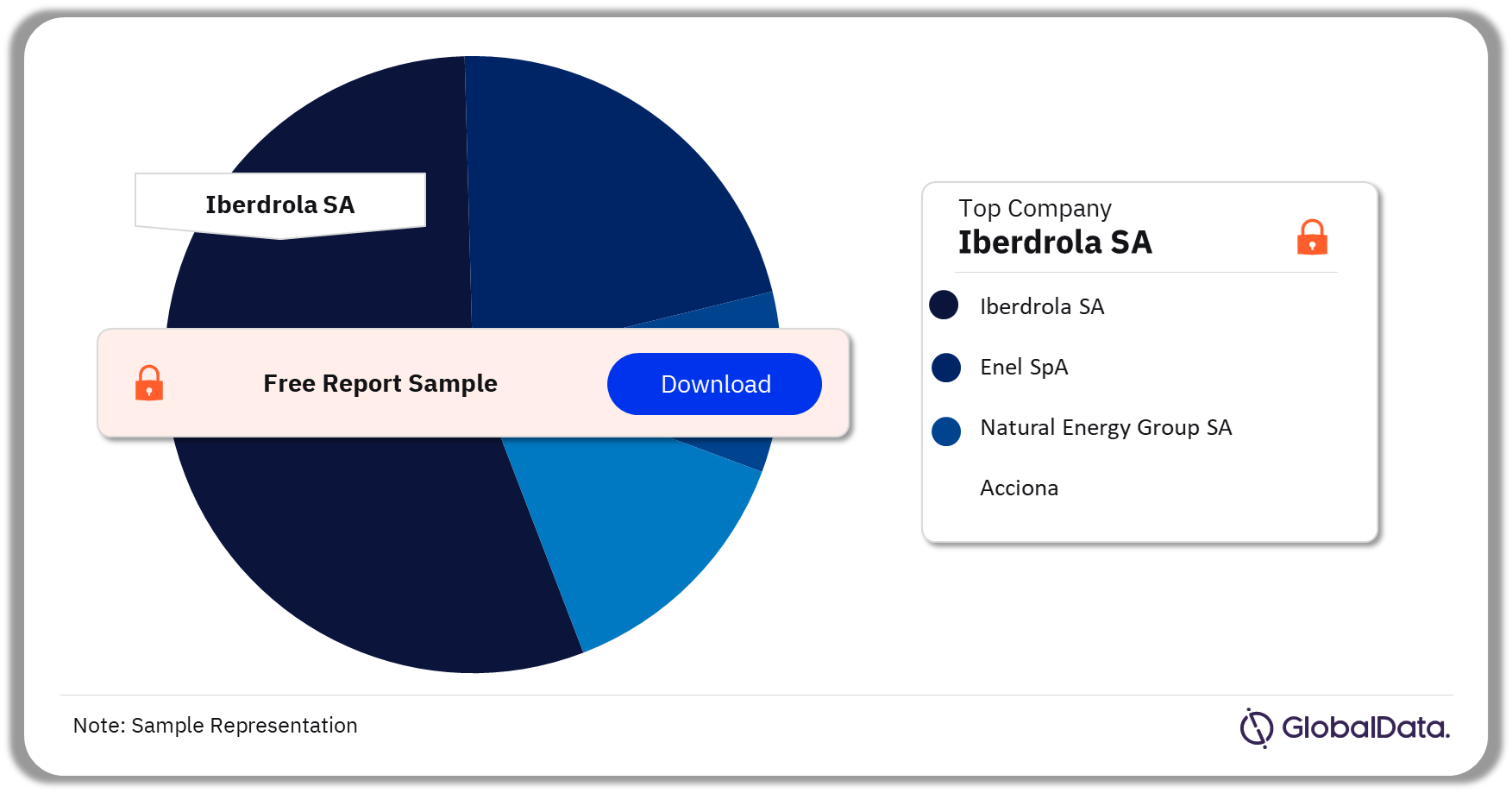

Spain Power Market – Competitive Landscape

A few of the leading companies in the Spain power market are:

- Iberdrola SA

- Enel SpA

- Natural Energy Group SA

- Acciona

In 2022, Spain’s power generation market was dominated by Iberdrola SA.

Iberdrola SA: Headquartered in Vizcaya, Spain, Iberdrola is an energy utility. The company produces electricity using conventional and renewable energy sources. It also trades electricity and gas in wholesale markets and retails electricity, gas, and other related products and services. Iberdrola retails energy to residential, commercial, industrial, institutional, and other customers. In its transition to a sustainable energy model, the company makes considerable investments in smart grids, renewable energy, large-scale energy storage, and digital transformation. Iberdrola operates in Europe, North America, South America, and other regions.

Spain Power Market Analysis by Companies, 2022 (%)

Buy the Full Report for More Company Insights into the Spain Power Market

Segments Covered in the Report

Spain Power Type Outlook (Value, 2010-2035, GW)

- Industrial Sector

- Residential Sector

- Commercial Sector

- Transport Sector

Spain Power Market Deal Type Outlook (Value, 2010-2035, GW)

- Partnerships

- Debt Offerings

- Acquisitions

- Venture Financing

- Asset Transactions

Scope

The Spain power market report includes the following:

- Snapshot of the country’s power sector across parameters, including macroeconomics, supply security, generation infrastructure, transmission infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential of the power sector.

- Statistics for installed capacity, generation, and consumption from 2010 to 2022, and forecast for the next 13 years to 2035.

- Capacity, generation, and major power plants by technology.

- Data on leading active and upcoming power plants.

- Information on transmission and distribution infrastructure, and electricity imports and exports.

- Policy and regulatory framework governing the market.

- Detailed analysis of top market participants, including market share analysis and SWOT analysis.

Reasons to Buy

- Identify market opportunities and business plan strategies through our comprehensive analysis of investment opportunities in the country’s power sector.

- Identify key factors driving investment opportunities in the country’s power sector.

- Optimize strategic decision-making through our historical and forecast data.

- Create accurate data governance by understanding the latest regulatory events.

- Understand the maximum advantage of the industry’s growth potential.

- Identify key partners and business development avenues.

- Identify key strengths and weaknesses of important market participants.

- Respond to your competitors’ business structure, strategy, and prospects.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the cumulative installed capacity of the Spain power market in 2022?

The cumulative installed capacity in Spain’s power market was 129.4 GW in 2022.

-

What will the Spain power market cumulative installed capacity growth rate be during the forecast period?

The Spain power market cumulative installed capacity is expected to grow at a CAGR of more than 6% during 2022-2035.

-

Which sector dominated the Spain power market in terms of consumption in 2022?

In 2022, the industrial sector accounted for the dominant power consumption share in the Spain power market.

-

Which was the preferred deal type in the Spain power market in 2022?

Asset transactions was the preferred deal type in the Spain power market in 2022.

-

Which are the key companies associated with the Spain power market?

A few of the key companies in the Spain power market include Iberdrola SA, Enel SpA, Natural Energy Group SA, and Acciona.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.