Spain Tobacco Products Market Analysis and Forecast by Product Categories and Segments, Distribution Channel, Competitive Landscape and Consumer Segmentation, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain Tobacco Products Market Report Overview

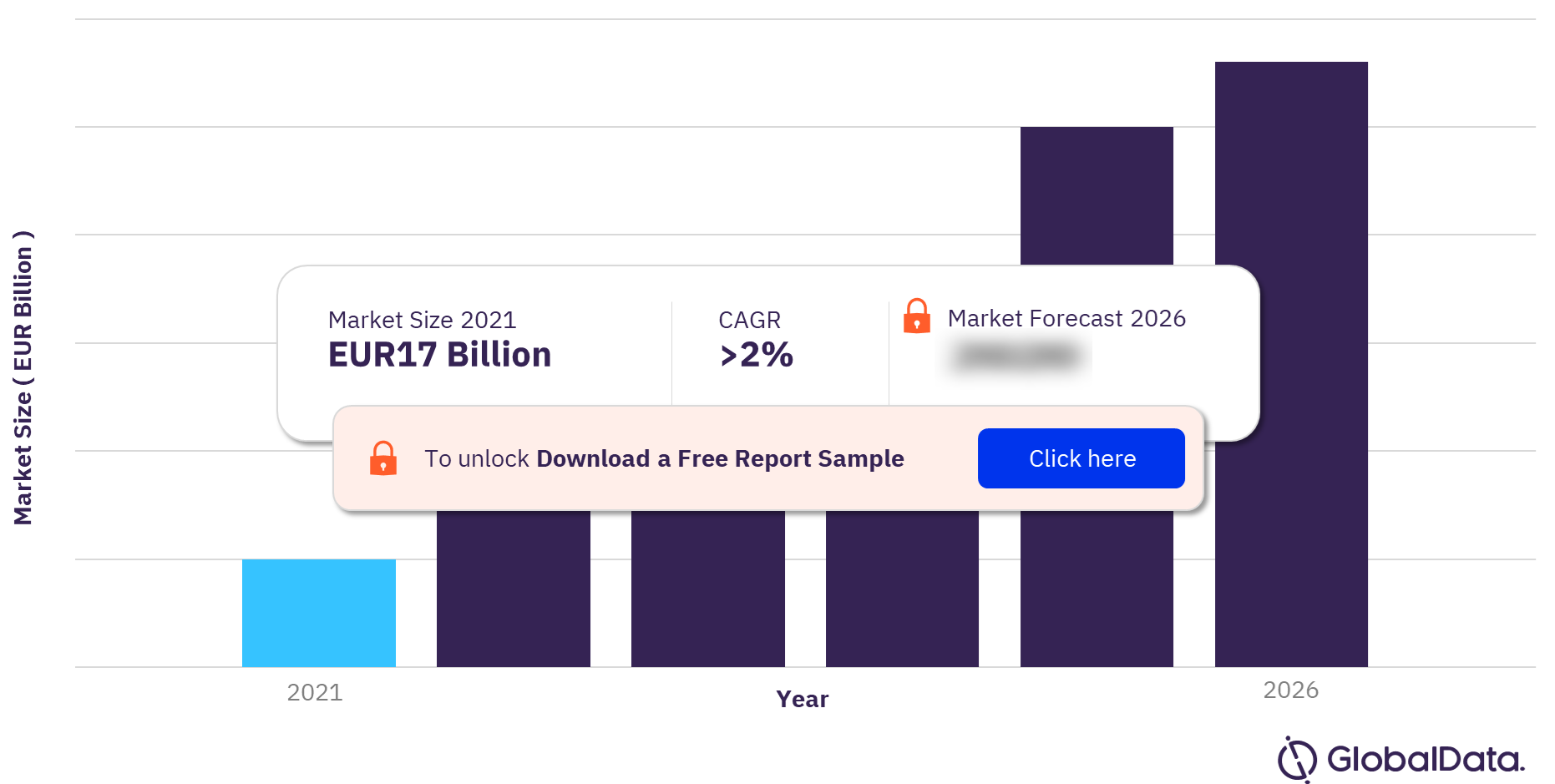

The Spain tobacco market size was EUR17 billion ($20.1 billion) in 2021. The market is expected to achieve a CAGR of more than 2% during 2021-2026. Spain complies with the EU’s regulations on the excise tax on produced cigarettes. An increase in taxes on tobacco products on the proposed prohibition of smoking in public places including beaches and patios will affect cigarette and cigar& cigarillos sales negatively in the next five years. The rising health concerns over smoking will also have a major impact on tobacco products.

The Spain tobacco market research report provides a comprehensive overview of the tobacco sector in Spain.

Spain Tobacco Market Outlook

For more insights on Spain tobacco market forecast, download a free report sample

Spain Tobacco Market Segmentation by Category

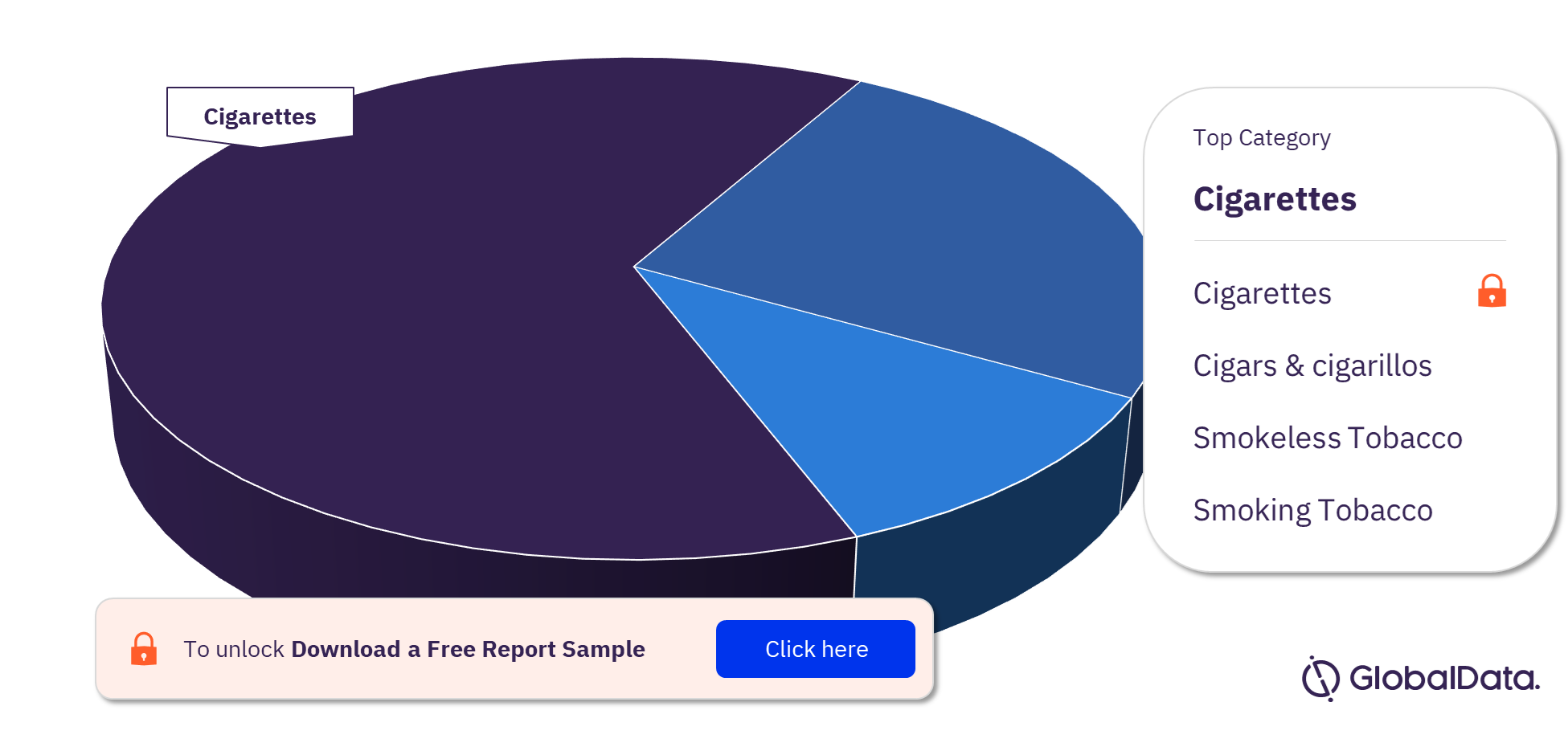

The key categories in the Spain tobacco market are cigarettes, cigars & cigarillos, smokeless tobacco, and smoking tobacco. Cigarettes was the largest category in both value and volume terms in 2021. The smokeless tobacco can be further categorized into chewing tobacco and snuff/snus. Chewing tobacco was the highest sub-segment in the smokeless tobacco category in 2021. Furthermore, smoking tobacco can be classified into FCT and pipe tobacco. FCT was the highest sub-segment in the smoking tobacco category in 2021.

Spain Tobacco Market Analysis, by Categories

For more category insights into the Spain tobacco market, download a free report sample

Spain Tobacco Market Segmentation by Distribution Channel

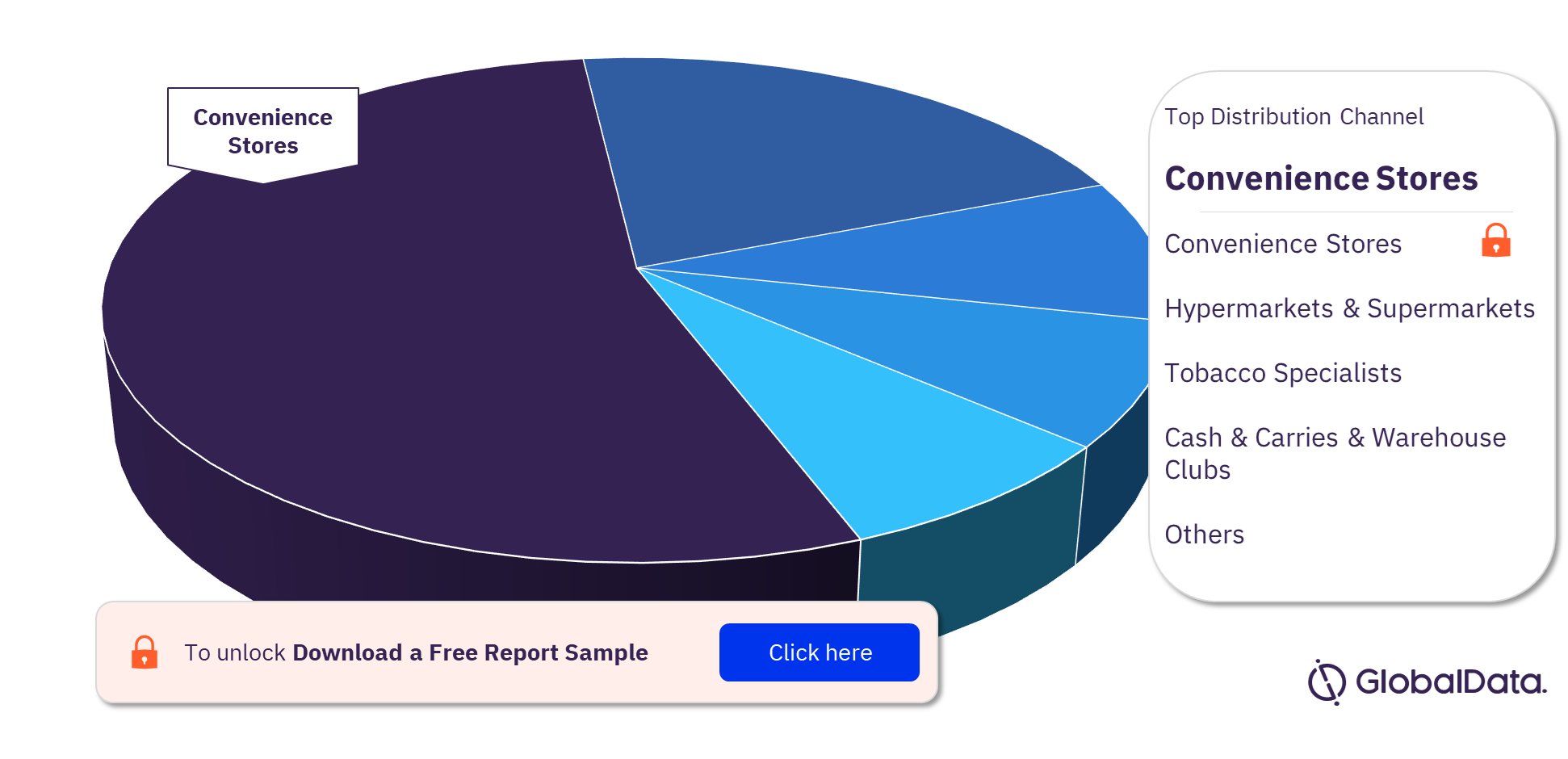

The key distribution channels in the Spain tobacco market are convenience stores, hypermarkets & supermarkets, tobacco specialists, cash & carries & warehouse clubs, and department stores. Convenience stores were the leading distribution channel in the cigarettes category in 2021.

Spain Tobacco Market Analysis, by Distribution Channels in the Cigarettes Category

For more distribution channel insights in the Spain tobacco market, download a free report sample

Spain Tobacco Market - Competitive Landscape

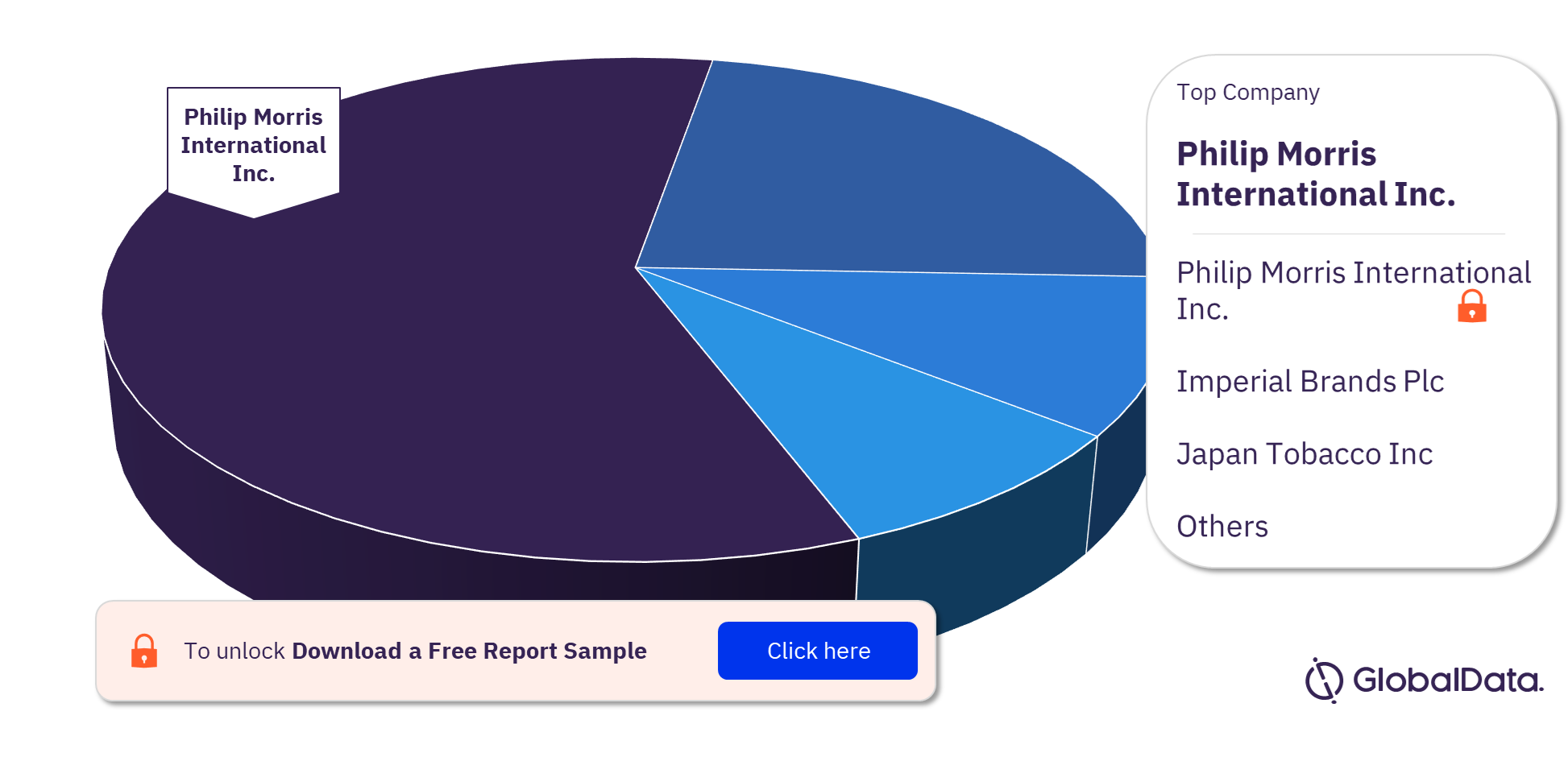

The leading companies in the Spain tobacco market are Philip Morris International Inc., Imperial Brands Plc, Japan Tobacco Inc, British American Tobacco Plc, and Landewyck Group S.a.r.l. Philip Morris International Inc. was the leading company in the cigarettes category in 2021.

Spain Tobacco Market Analysis, by Leading Companies in the Cigarettes Category

To know more about the leading tobacco companies in Spain, download a free report sample

To know more about the leading tobacco companies in Spain, download a free report sample

Spain Tobacco Market Overview

| Market Size 2021 | EUR17 billion ($20.1 billion) |

| CAGR (2021-2026) | >2% |

| Key Categories | Cigarettes, Cigars & Cigarillos ,Smokeless Tobacco, and Smoking Tobacco |

| Key Distribution Channels | Convenience Stores, Hypermarkets & Supermarkets, Tobacco Specialists, Cash & Carries & Warehouse Clubs, and Department Stores |

| Leading Companies | Philip Morris International Inc., Imperial Brands Plc, Japan Tobacco Inc, British American Tobacco Plc, and Landewyck Group S.a.r.l. |

Scope

The report provides:

- Market Context: The report provides comparative analysis of the value shares of Spain in the Asia-Pacific and global tobacco sector. Additionally, the per capita expenditure of tobacco in Spain is also compared with the regional and global levels.

- Market Size and Structure : The report offers an overview of the growth at a sector level and provides analysis of four categories: cigarettes. These categories are analyzed by value, volume, and CAGR for the period 2016–2026. The section also includes value analysis of segments, value and volume analysis of sub-segments segments under each category for the period 2016–2026.

- Production and Trade: Provides analysis on per capita expenditure of tobacco in Spain, by category, compared to the regional and global markets. Further, analysis on the leading distribution channels at category level in 2021. The consumer sector reports cover the following eight distribution channels: cash & carries and warehouse clubs, convenience stores, department stores, e-retailers, hypermarkets & supermarkets, tobacco specialists, vending machines, and other general retailers.

- Taxation : It covers taxation landscape in the country and effects in the tobacco sector

- Manufacturers and Brands: The report provides analysis on leading companies by category in 2021 and analyzes the market share and growth of private label in each category.

- The Smoking Population: The report covers consumption of tobacco by gender in Spain.

- Operating Constraints: The report cover the impact of policies and regulation on tobacco sector in Spain.

- Prospects and Forecasts: The report covers forecast analysis of categories in the tobacco sector

- Macroeconomic analysis: The report also provides an outlook on macroeconomic indicators in Spain, with a detailed summary of the economy, labor market, and demographics.

- Exchange rates: Exchange rates used to convert local currency to US dollars are annual average floating exchange rates.

- Time period: The report provides sector value and volume data, including category and sector level data for the period 2016–2026. Distribution channel data is of 2020, and company data is included for 2021.

Reasons to Buy

- Get a detailed understanding of consumption to align your sales and marketing efforts with the latest trends in the market.

- Identify the areas of growth and opportunities, which will aid effective marketing planning.

- The differing growth rates in regional product sales drive fundamental shifts in the market.

- This report provides detailed, authoritative data on these changes – prime intelligence for marketers.

- Understand the market dynamics and essential data to benchmark your position and to identify where to compete in the future.

Imperial Brands Plc

Japan Tobacco Inc

British American Tobacco Plc

Landewyck Group S.a.r.l.

Von Eicken GmbH

Karelia Tobacco Inc

Grand River Enterprises

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Spain tobacco market size in 2021?

The tobacco market size in Spain was EUR17 billion ($20.1 billion) in 2021.

-

What is the Spain tobacco market growth rate?

The tobacco market in Spain is expected to achieve a CAGR of more than 2% during 2021-2026.

-

What are the key categories of the Spain tobacco market?

The key categories in the Spanish tobacco market are cigarettes, cigars & cigarillos, smokeless tobacco, and smoking tobacco.

-

What are the key distribution channels of the Spain tobacco market?

The key distribution channels in the Spanish tobacco market are convenience stores, hypermarkets & supermarkets, tobacco specialists, cash & carries & warehouse clubs, and department stores.

-

Which are the leading companies in the Spain tobacco market?

The leading tobacco companies in Spain are Philip Morris International Inc., Imperial Brands Plc, Japan Tobacco Inc, British American Tobacco Plc, and Landewyck Group S.a.r.l.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.