United Arab Emirates (UAE) Foodservice Market Size and Trends by Profit and Cost Sector Channels, Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UAE Foodservice Market Report Overview

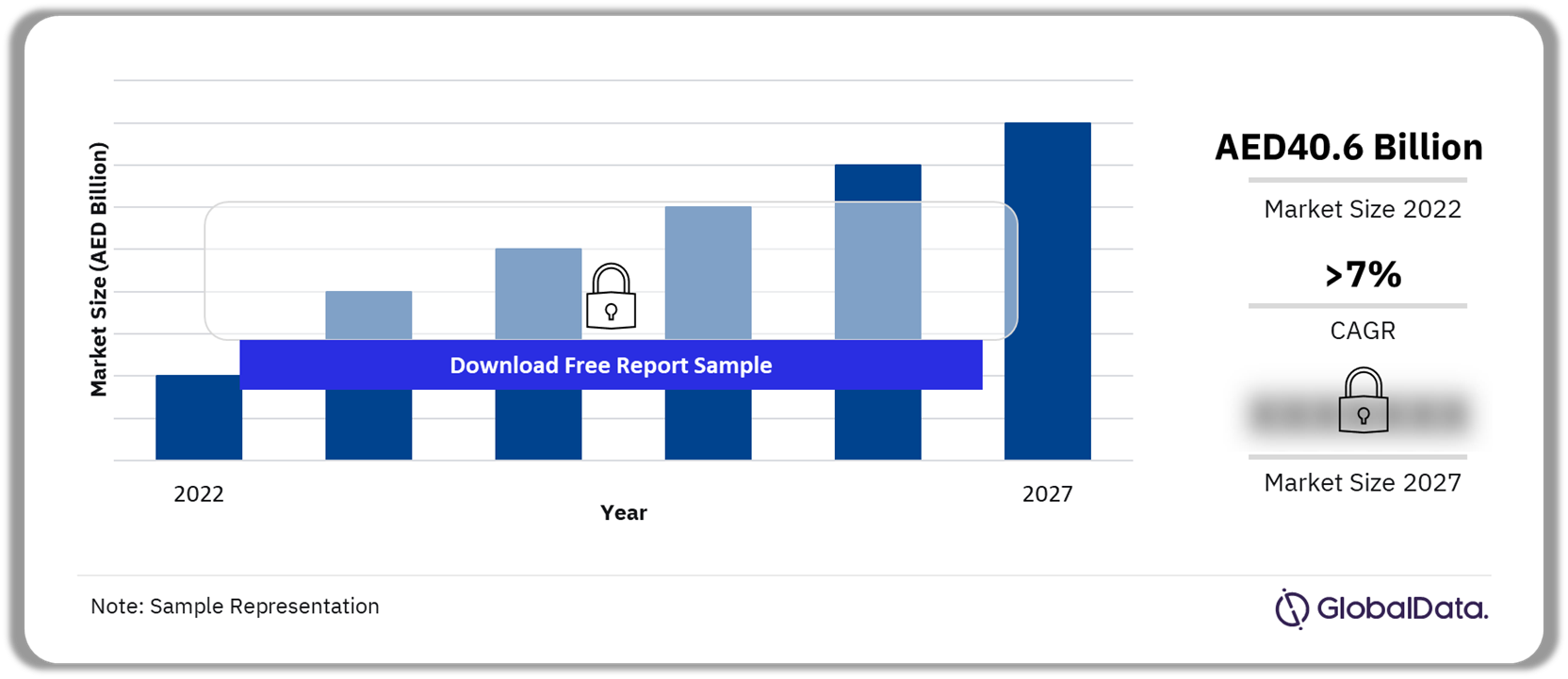

The UAE foodservice profit sector recorded sales of AED40.6 billion ($11.1 billion) in 2022. Rising tourism activities post the COVID-19 pandemic stimulated the growth of the foodservice profit sector in 2022. The UAE foodservice profit sector is anticipated to record a strong CAGR of over 7% during 2022-2027.

UAE Foodservice Profit Sector Outlook 2022-2027, (AED Billion)

Buy the Full Report for More Insights on the UAE Foodservice Market Forecast

Download A Free Sample Report

The UAE foodservice market research report provides an in-depth evaluation of the foodservice market in the country, including an analysis of the key issues impacting the market, and the opportunities this presents for the sector participants. The report includes data and forecast of key channels (QSR, FSR, coffee & tea shop, and pub, club & bar) within the UAE foodservice market and gives an overview of market leaders within the four major channels.

| Market Size (2022) | AED40.6 billion ($11.1 billion) |

| CAGR (2022-2027) | >7% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Profit Sector Channels | · Full-service Restaurant (FSR)

· Quick-service Restaurant (QSR) · Workplace · Accommodation · Pub, Club & Bar |

| Key Outlet Type | · Dine-in

· Takeout |

| Key Owner Type | · Independent Operators

· Chain Operators |

| Key Cost Sector Channels | · Education

· Healthcare · Military & Civil Defense · Welfare & Services · Complimentary Services |

| Key Companies | · Yum! Brands

· CKE Restaurants · Doctor’s Associates · Restaurant Brands International · McDonald’s · Brinker International · Golden Gate Capital |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UAE Foodservice Market Trends

- Revival of the market: An increase in dine-out activities post the easing of COVID-19-induced restrictions.

- Digitalization: Technological advancements have resulted in the increasing use of food-delivery mobile applications among consumers.

Buy the Full Report for more Insights into the UAE Foodservice Market Trends

Download A Free Sample Report

UAE Foodservice Market Segmentation by Profit Sector Channels

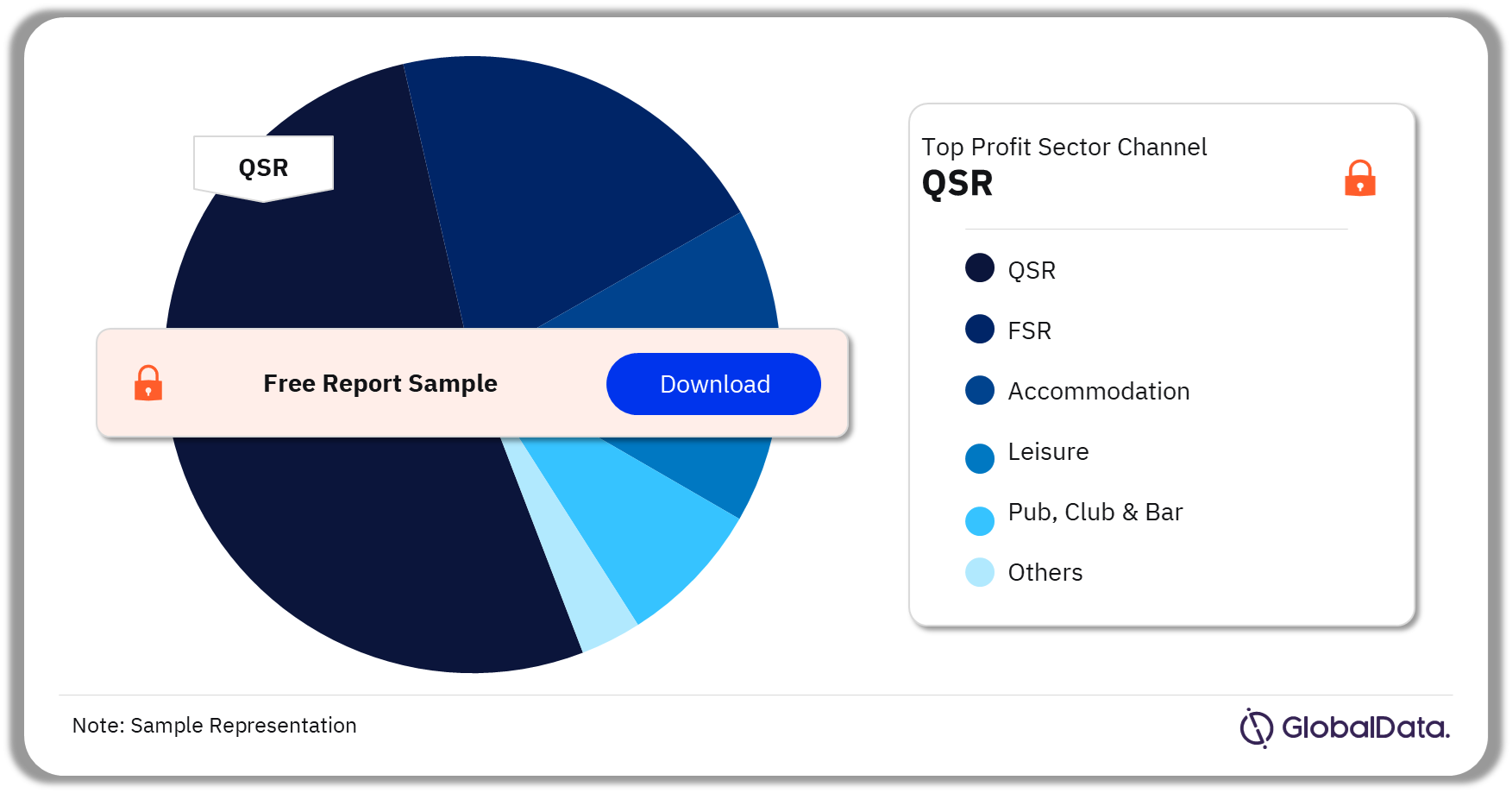

The QSR was the largest profit sector channel in 2022 by value sales

The key profit sector channels in the UAE foodservice market are FSR; QSR; accommodation; leisure; pub, club & bar; and retail. The QSR was the leading profit sector channel, accounting for over 41% revenue share in 2022. The channels’ growth can be attributed to the rising popularity of international fast-food chains among UAE consumers. The FSR channel was the second largest in the UAE foodservice profit sector.

UAE Foodservice Market Analysis by Profit Sector Channels, 2022 (%)

Buy the Full Report for More Channel Insights into the UAE Foodservice Market

Download A Free Sample Report

UAE Foodservice Market Segmentation by Cost Sector Channels

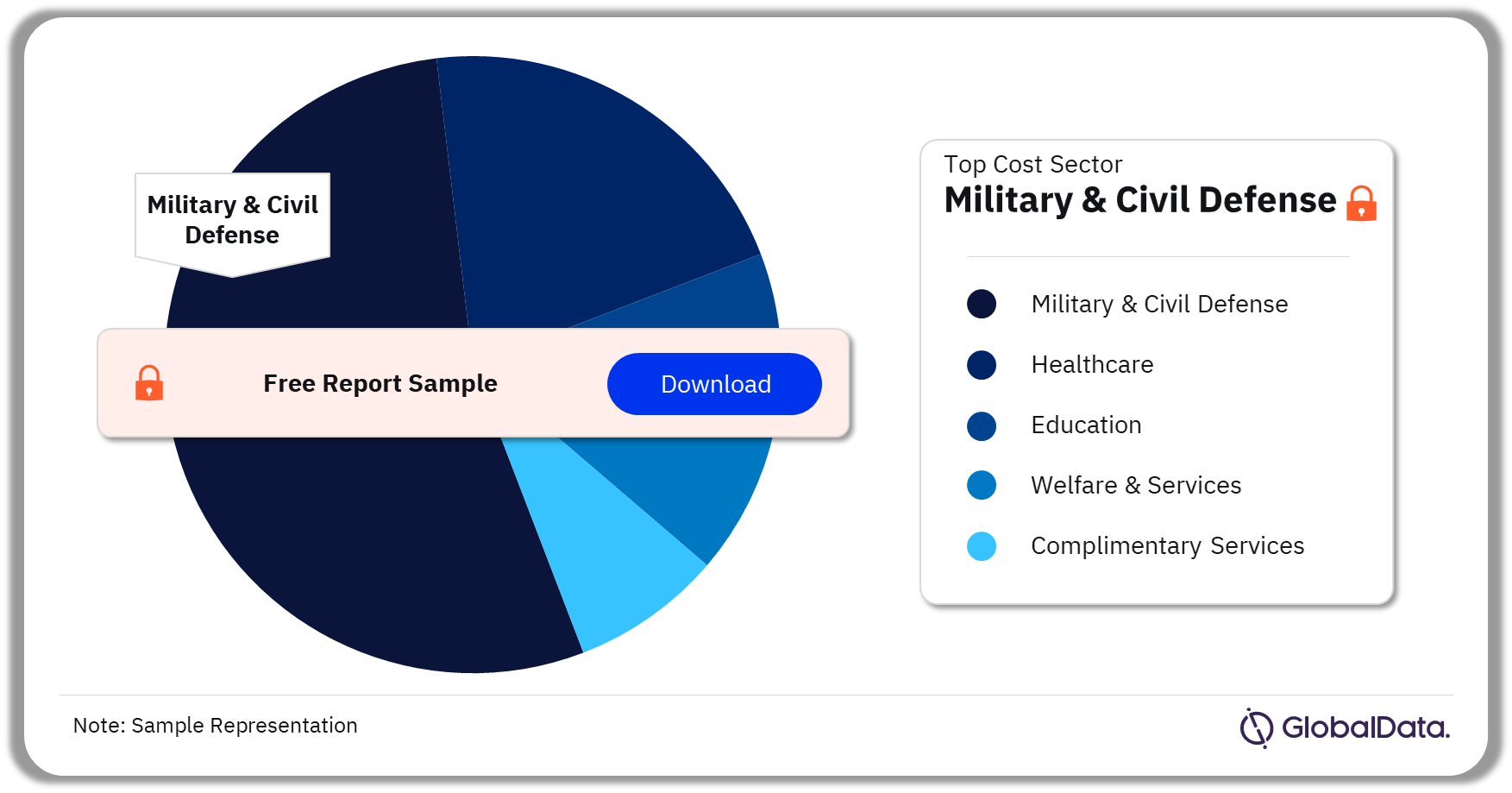

The key cost sector channels in the UAE foodservice market are military & civil defense, healthcare, education, welfare & services, and complimentary services. In 2022, military & civil defense was the largest cost sector, followed by education, and healthcare.

UAE Foodservice Market Analysis by Cost Sector Channels, 2022 (%)

Buy the Full Report for More Information on the Cost Sectors in the UAE Foodservice Market

Download A Free Sample Report

UAE Foodservice Market – Competitive Landscape

McDonald’s was the largest QSR operator in the country in 2022

The key foodservice companies in UAE are:

- Yum! Brands

- CKE Restaurants

- Doctor’s Associates

- Restaurant Brands International

- McDonald’s

- Brinker International

- Golden Gate Capital

McDonald’s was the largest QSR operator by revenue in 2022. The fast-food chain had 194 outlets in the country, all locally owned.

UAE Foodservice Market Analysis by Competitors

Buy the Full Report for Additional Information on UAE Foodservice Market Players

Download A Free Sample Report

UAE Foodservice Market – Latest Developments

- McDonald’s UAE regularly launches new products to attract customers. In September 2022, it introduced six rice meals across 30 restaurants for a limited time. Later that year, McDonald’s launched Little Seeds of Hope, a new initiative in partnership with Emirates Environmental Group and Del Monte Foods, where families purchasing a Happy Meal received a sachet of lettuce seeds along with the usual toy.

Segments Covered in the Report

UAE Foodservice Market Outlook by Profit Sector Channel (Value AED Billion, 2017-2027)

- Full-service Restaurants (FSR)

- Quick-service Restaurants (QSR)

- Pub, Club & Bar

- Retail

- Accommodation

UAE Foodservice Market Outlook by Cost Sector Channels (Value, AED Billion, 2017-2027)

- Military & Civil Defense

- Healthcare

- Education

- Welfare & Services

- Complimentary Services

Scope

The report includes:

- Overview of UAE’s macroeconomic landscape: Detailed analysis of current macroeconomic factors and their impact on the UAE foodservice market, including GDP per capita, consumer price index, population growth, and annual household income distribution.

- Growth dynamics: In-depth data and forecasts of key channels (QSR; FSR; coffee & tea shop; and pub, club & bar) within the UAE foodservice market, including the value of the market, number of transactions, number of outlets and average transaction price.

- Customer segmentation: Identify the most important demographic groups, buying habits, and motivating factors that drive out-of-home meal occasions among segments of the UAE population.

- Key players: Overview of market leaders within the four major channels, including business descriptions and number of outlets.

Reasons to Buy

- Identify emerging/declining markets and understand specific forecasts of the foodservice market over the next five years to make informed business decisions.

- Understand the target audience and changing consumer behavior through a detailed analysis of the consumer segmentation, which elaborates on the desires of known consumers among all major foodservice channels (QSR, FSR, coffee & tea shop, and pub, club & bar).

Yum! Brands

CKE Restaurants

Doctor’s Associates

Restaurant Brands International

Brinker International

Golden Gate Capital

Broccoli Pizza & Pasta

Starbucks

Krispy Kreme

Tim Horton

Costa Coffee

Dunkin

Table of Contents

Frequently asked questions

-

What was the UAE profit sector market size in 2022?

The UAE profit sector market size was AED40.6 billion ($11.1 billion) in 2022.

-

What is the expected UAE profit sector growth rate for the forecast period?

The profit sector in UAE will grow at a CAGR of over 7% during 2022-2027.

-

Which was the leading profit sector channel in the UAE foodservice market in 2022?

QSR was the leading profit sector channel in the UAE foodservice market in 2022.

-

What cost sector channel had the highest share in the UAE foodservice market in 2022?

The military & civil defense sector had the highest share in the UAE foodservice market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Foodservice reports