United Kingdom (UK) Retail Banking Analysis by Consumer Profiles, 2022 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Retail Banking Analysis Report Overview

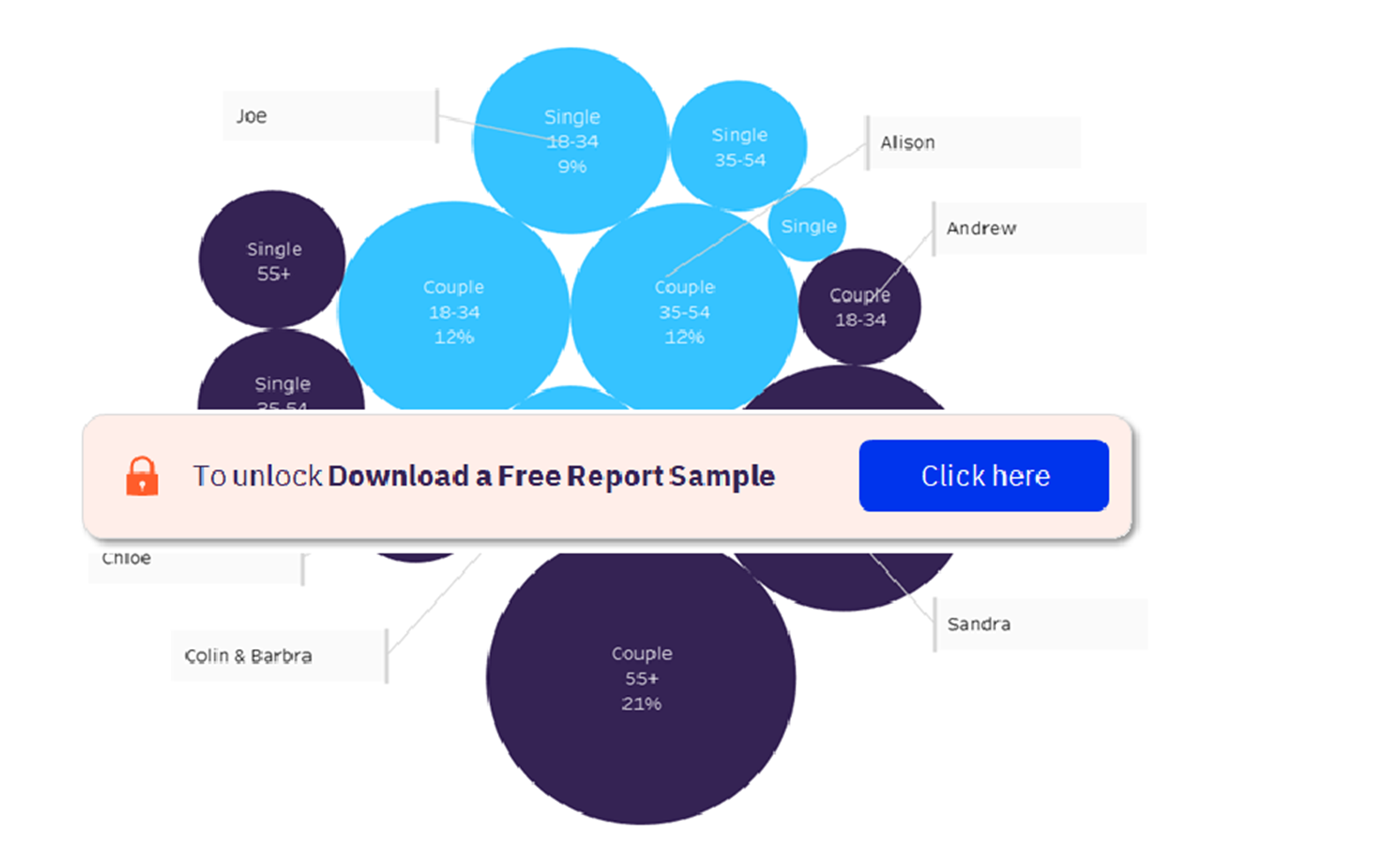

A few personas have been created through a cluster analysis (Calinski-Harabasz criterion) of GlobalData’s 2022 Financial Services Consumer Survey, to understand Swedish survey respondents and their attitudes, preferences, and unmet needs. The personas have been created using three core attributes: age, marital status, and their preferred financial services (FS) provider type (i.e., traditional banks and credit unions or alternative providers such as digital challenger banks, Big Tech, fintech, digital wallets, and retailers).

The UK retail banking analysis looks at six different customer personas in the UK market. It offers a deep dive into their financial goals, unmet needs, and banking preferences while providing actionable steps for financial providers to take to achieve high levels of retention and cross-sell effectively and accordingly.

GlobalData Personas

To know more about the customer personas in the UK retail banking market, download a free report sample

UK Retail Banking - Customer Personas

The key customer personas in the UK retail banking sector are Older Generation Z, Younger Millennial, Older Millennial, Generation X, Boomers, and Millennial.

Older Generation Z: Older Generation Z is the youngest customer persona. He prefers alternative providers, but he has not yet found a provider that is suitable for him. Despite being with a traditional provider, he is unhappy with them and would prefer to use digital alternatives. He believes digital-only banks offer better rates and online security than traditional banks. Mobile banking is his most frequently used channel, and he believes the functionality that alternative providers offer here is significantly better than traditional banks.

Younger Millennial: Younger Millennial has no dependents and is not in a relationship, but she has experienced some financial difficulty over the past two years. She prefers to bank with traditional providers, having an exclusively strong preference for their services. Despite her view that alternatives will offer better online functionality and more competitive rates, she does not want to use a bank without an established reputation or any branches.

Older Millennial: Older Millennial’s banking preference is currently with alternative providers instead of traditional banks. Although she would prefer a bank with an established reputation, she believes that alternative banks offer a more customer-based service along with better rates. She feels this will allow her to pay off her mortgage as fast as possible, which is her main financial goal.

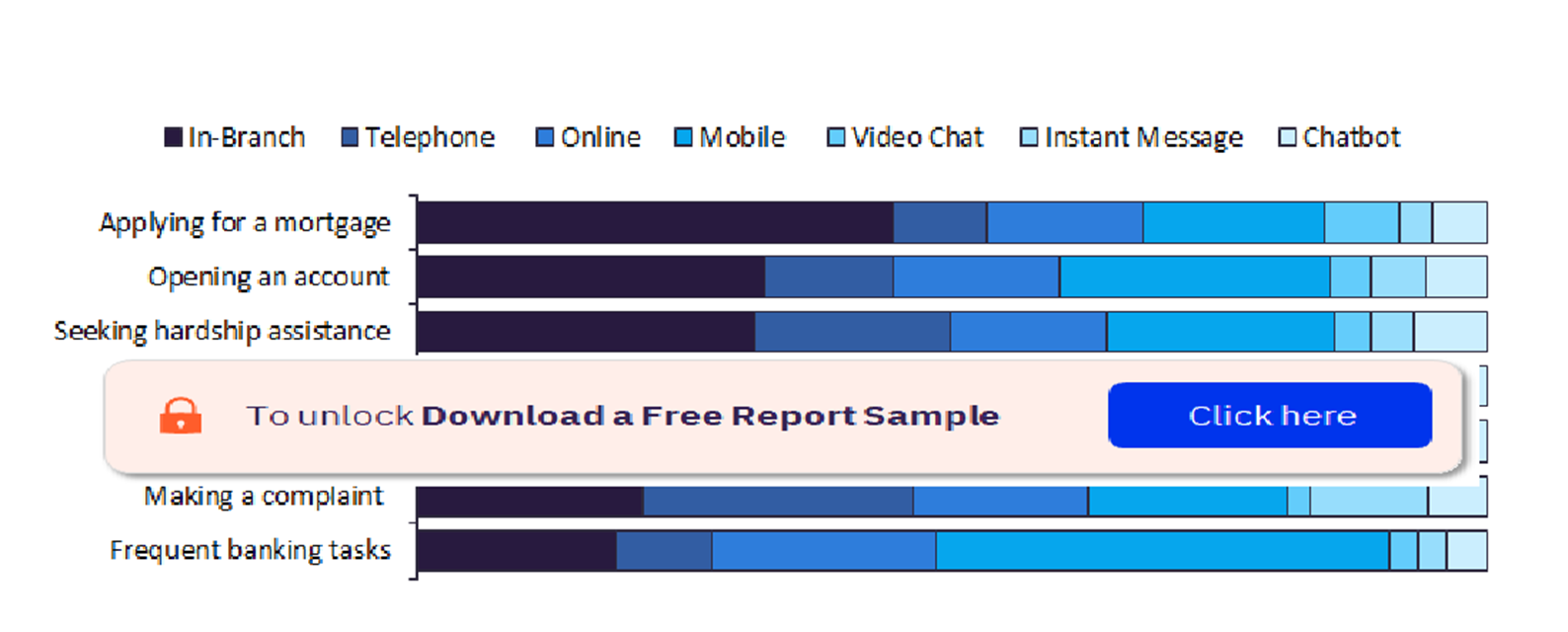

UK Retail Banking – Channel Preferences for Banking Activities

The key channel preferences in the retail banking market in the UK are in-branch, telephone, online, mobile, video chat, instant message, and chatbot. For all banking activities, primarily makes use of mobile and online channels, though for more complex needs, such as mortgage applications or opening an account, he relies on branch services. While branch services may be valued for these types of activities, an omnichannel integration approach that can resolve some of these more complex banking issues will likely drive a decline in branch preference.

UK Retail Banking Market Analysis, by Channel Preferences of Older Generation Z

To know more about the channel preferences of older generation Z in the UK retail banking market, download a free report sample

UK Retail Banking Market Report Overview

| Customer Personas | Older Generation Z, Younger Millennial, Older Millennial, Generation X, Boomers, and Millennial |

| Channel Preferences | In-Branch, Telephone, Online, Mobile, Video Chat, Instant Message, and Chatbot |

Segments Covered in the Report

Customer Personas

- Older Generation Z

- Younger Millennial

- Older Millennial

- Generation X

- Boomers

- Millennial

Reasons to Buy

- Understand how preferences vary between different types of consumers.

- Access the latest consumer survey data on channel behavior, provider preferences, and product holdings.

- Identify the areas for improvement that matter to particular consumers.

- Benefit from the provision of actionable steps that can help your business target specific customer profiles.

Table of Contents

Frequently asked questions

-

Why does the Older Generation Z prefer to use digital alternatives?

The Older Generation Z prefer to use digital alternatives as he believes that digital-only banks offer better rates and online security than traditional banks.

-

What are the key customer personas in the UK retail banking sector?

The key customer personas in the UK retail banking sector are Older Generation Z, Younger Millennial, Older Millennial, Generation X, Boomers, and Millennial.

-

What are the key channel preferences in the retail banking market?

The key channel preferences in the retail banking market in UK are in-branch, telephone, online, mobile, video chat, instant message, and chatbot.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports