Vietnam OTC Healthcare Market Opportunities, Trends, Growth Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Vietnam OTC Healthcare Market Report Overview

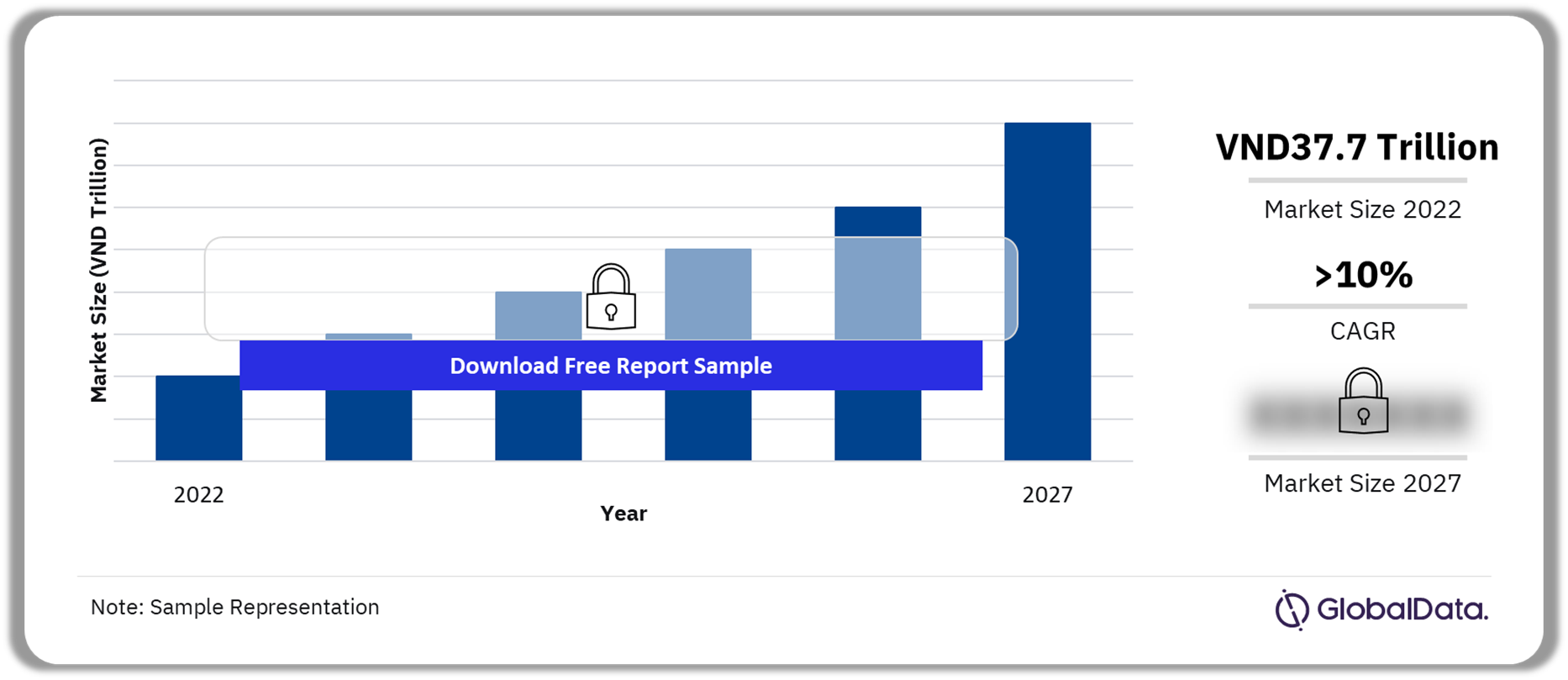

The Vietnamese OTC healthcare market size was estimated at VND37.7 trillion in 2022 and is likely to grow at a CAGR of more than 10% from 2022 to 2027.

Vietnam OTC Healthcare Market Outlook 2022-2027 (VND Trillion)

Buy the Full Report for Vietnam OTC Healthcare Market Forecasts

Download a Free Sample Report

The Vietnam OTC healthcare market research report includes country overview analysis, category and segment coverage, distribution channel insights, macroeconomic analysis, and competitive landscape.

| Market Size (2022) | VND37.7 trillion |

| CAGR (2022-2027) | >10% |

| Historic Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Categories | • Traditional Medicines

• Weight Management • Cough, Cold, and Allergy Preparations • Analgesics • Medicated Skin Products |

| Key Distribution Channels | • Parapharmacies/Drugstores

• Chemists/Pharmacies • E-retailers • Direct Sellers • Hypermarkets & Supermarkets |

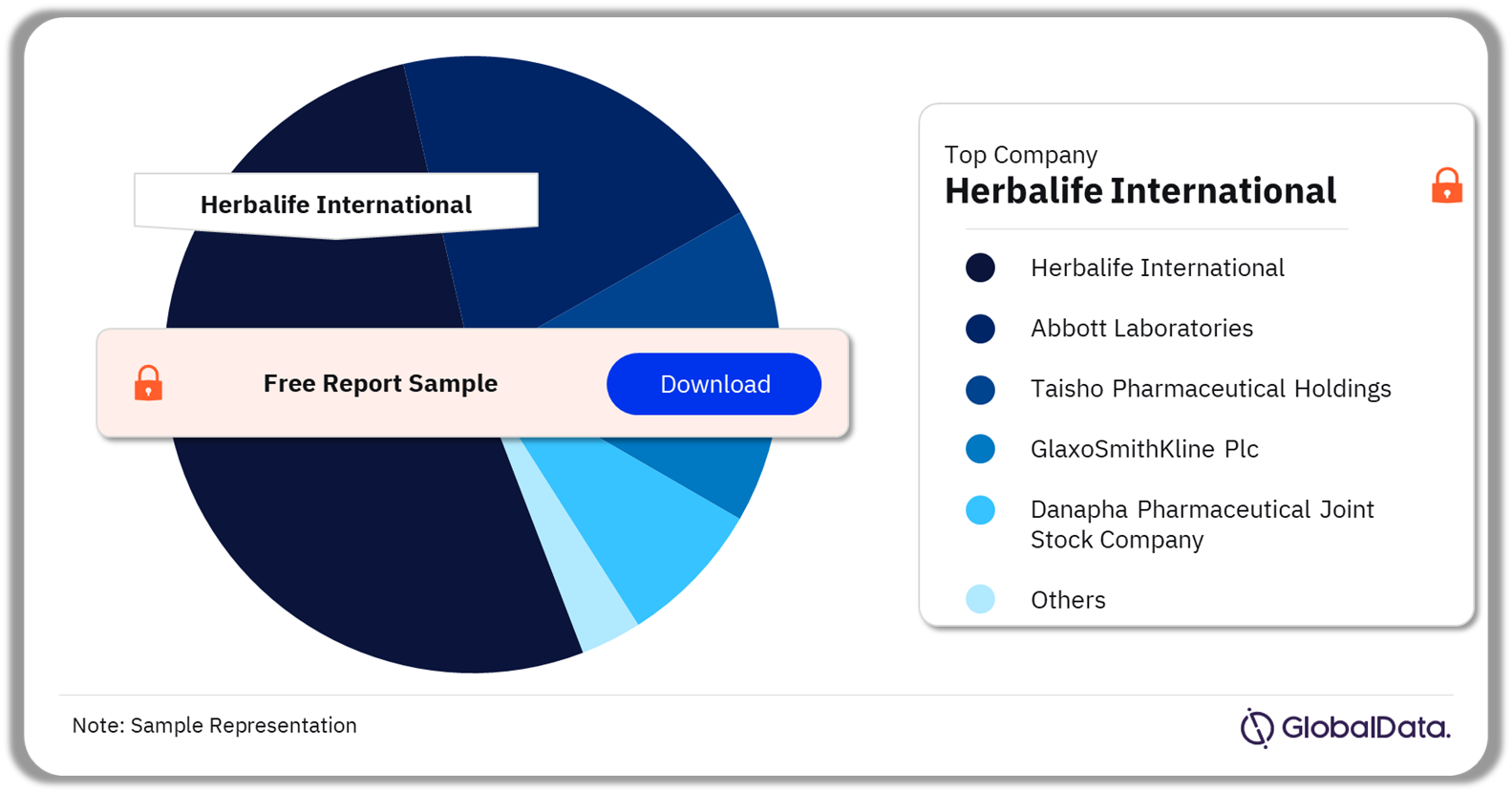

| Leading Companies | • Herbalife International

• Abbott Laboratories • Taisho Pharmaceutical Holdings, • GlaxoSmithKline Plc • Danapha Pharmaceutical Joint Stock Company |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

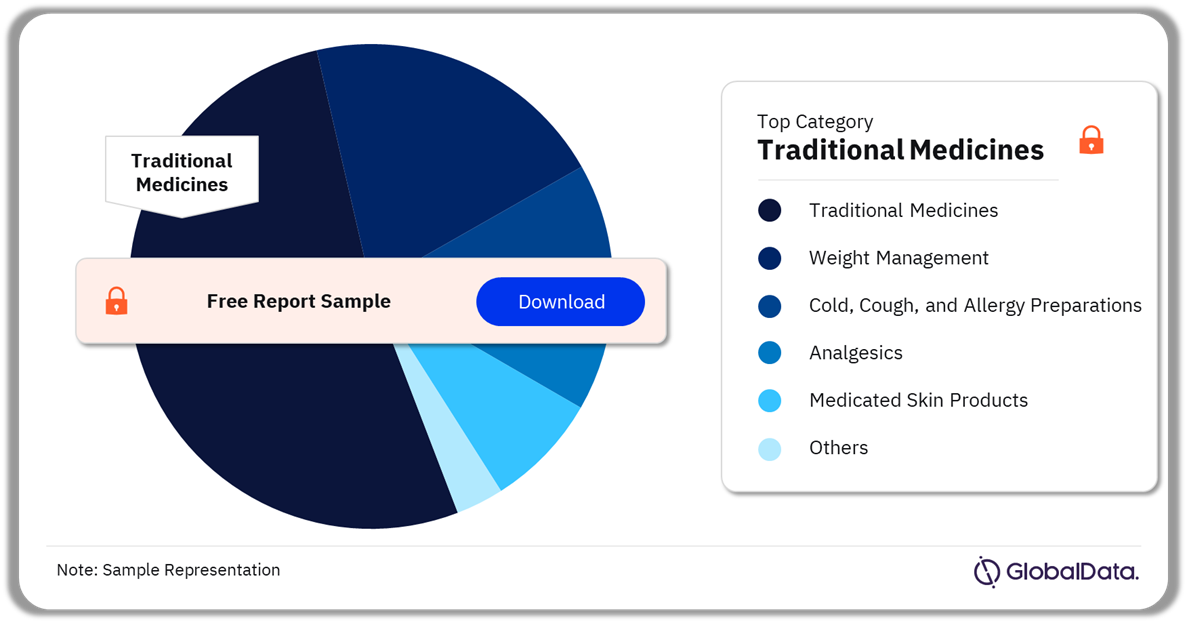

Vietnam OTC Healthcare Market Segmentation by Category

The key categories in the Vietnamese OTC healthcare market are traditional medicines, weight management, cough, cold and allergy preparations, analgesics, and medicated skin products among others. In 2022, traditional medicines were the largest category with the highest value sales. This category will also account for the fastest growth followed by the weight management category.

Vietnam OTC Healthcare Market Analysis by Category, 2022 (%)

Buy the Full Report for Category-Wise Vietnam OTC Healthcare Market Insights

Download a Free Sample Report

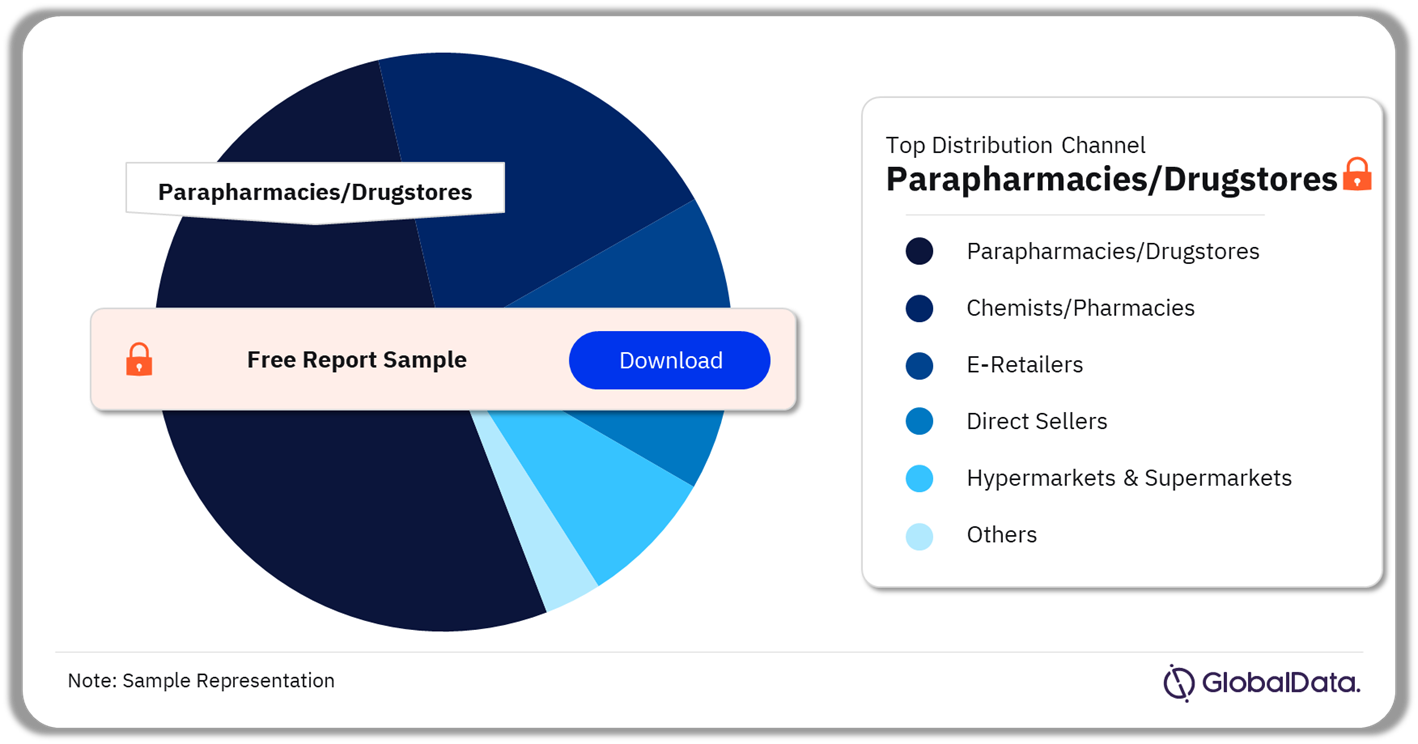

Vietnam OTC Healthcare Market Segmentation by Distribution Channel

The key distribution channels in the Vietnamese OTC healthcare market are parapharmacies/drugstores, chemists/pharmacies, eretailers, direct sellers, and hypermarkets & supermarkets among others. In 2022, Parapharmacies/drugstores were the largest distribution channel in the Vietnamese OTC healthcare sector, followed by chemists/pharmacies, and e-retailers.

Vietnam OTC Healthcare Market Analysis by Distribution Channel, 2022 (%)

Buy the Full Report for Distribution Channel-Wise Vietnam OTC Healthcare Market Insights

Download a Free Sample Report

Vietnam OTC Healthcare Market – Competitive Landscape

The key companies in the Vietnamese OTC healthcare market are Herbalife International, Abbott Laboratories, Taisho Pharmaceutical Holdings, GlaxoSmithKline Plc, and Danapha Pharmaceutical joint stock company among others. In 2022, Herbalife International, with its brand Herbalife Nutrition emerged as the market leader.

Vietnam OTC Healthcare Market Analysis by Companies, 2022 (%)

Buy the Full Report for Company-Wise Vietnam OTC Healthcare Market Insights

Download a Free Sample Report

Key Segments Covered in this Report.

Vietnam OTC Healthcare Category Outlook (Value, VND Trillion, 2017-2027)

- Traditional Medicines

- Weight Management

- Cough, Cold, and Allergy Preparations

- Analgesics

- Medicated Skin Products

- Others

Vietnam OTC Healthcare Distribution Channel Outlook (Value, VND Trillion, 2017-2027)

- Parapharmacies/Drugstores

- Chemists/Pharmacies

- E-retailers

- Direct Sellers

- Hypermarkets & Supermarkets

- Others

Scope

• Per capita expenditure of OTC healthcare sector was lower in Vietnam than the global levels, but higher than the regional levels in 2022

• Parapharmacies/drugstores was the largest distribution channel in the Vietnamese OTC healthcare sector. It was the leading distribution channel in the Vietnam OTC healthcare sector, with a value share of 47.7% in 2022

• Traditional medicines was the largest category with value sales of VND13,966.2 billion ($603.2 million) in 2022.

Key Highlights

- Per capita expenditure of the OTC healthcare sector was lower in Vietnam than the global levels, but higher than the regional levels in 2022.

- Prepharmacies/drugstores was the largest distribution channel in the Vietnamese OTC healthcare sector. It was the leading distribution channel in the Vietnam OTC healthcare sector.

- Traditional medicines were the largest category with value sales in 2022.

Reasons to Buy

- Identify high-potential categories and explore further market opportunities based on detailed value analysis.

- Existing and new players can analyze key distribution channels to identify and evaluate trends and opportunities.

- Gain an understanding of the total competitive landscape based on detailed company share analysis to plan effective market positioning.

- Our team of analysts has placed a significant emphasis on changes expected in the market that will provide a clear picture of the opportunities that can be tapped over the next five years, resulting in revenue expansion.

- Analysis of key macroeconomic indicators such as real GDP, nominal GDP, consumer price index, household consumption expenditure, population (by age group, gender, rural-urban split, and employed people and unemployment rate. It also includes an economic summary of the country along with labor market and demographic trends.

Abbott Laboratories

Taisho Pharmaceutical Holdings Co. Ltd.

GlaxoSmithKline Plc

Danapha pharmaceutical joint stock company

Bareorganics Llc

Kyoto Nin Jiom General Factory Co. Ltd.

Engelhard Arzneimittel GmbH & Co. KG

Fito Pharma

Imexpharm Corporation

Haw Par Corporation Limited

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Vietnam OTC healthcare market size in 2022?

The Vietnamese OTC healthcare market size was estimated at VND37.7 trillion in 2022.

-

What is the CAGR growth rate of the Vietnam OTC healthcare market during 2022-2027?

The OTC healthcare sector in Vietnam is likely to grow at a CAGR of more than 10% from 2022 to 2027.

-

Which was the leading category in the Vietnam OTC healthcare market in 2022?

The traditional medicines category led the Vietnam OTC healthcare market in 2022.

-

Which was the dominant distribution channel in the Vietnam OTC healthcare market in 2022?

The parapharmacies/drugstores emerged as the leading distribution channel in the Vietnam OTC healthcare market in 2022.

-

Which are the key companies in the Vietnam OTC healthcare market?

The key companies in the Vietnamese OTC healthcare market are Herbalife International, Abbott Laboratories, Taisho Pharmaceutical Holdings, GlaxoSmithKline Plc, and Danapha Pharmaceutical joint stock company among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.