Wearable Tech – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore trends and insights from the following data in our ‘Wearable Tech’ thematic report:

- This report provides an overview of the wearable tech theme.

- It identifies the key trends impacting the growth of the sector over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends.

- It includes a comprehensive industry analysis, outlining the key growth areas and potential use cases.

- It identifies the best-positioned players in the wearable tech industry, across all segments of the value chain.

- The report includes a timeline charting the development of the wearable tech theme.

How is the ‘Wearable Tech’ thematic report different from other reports in the market?

- The report is an invaluable guide to this disruptive theme, that includes a breakdown of the wearable tech value chain and profiles of leading vendors.

- This report provides insights on the leading private players (Alphabet, Apple, and Garmin among others) disrupting the industry.

- The report reviews the segment trends of the IoT value chain to help market players to invest, explore, or ignore

- It offers a wearable tech timeline and use cases for a better understanding of the theme.

- It highlights key M&A deals, patent trends, hiring trends, and other important information that you might need to gain a competitive edge.

We recommend this valuable source of information to anyone involved in:

- Technology Leaders and Startups

- Strategy, Marketing, and Business Development

- Market Intelligence and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A and Investment Consultants

- Management Consultants and Consulting Firms

To Get a Snapshot of the Wearable Tech Thematic Report, Download a Free Report Sample

Wearable Tech Report Overview

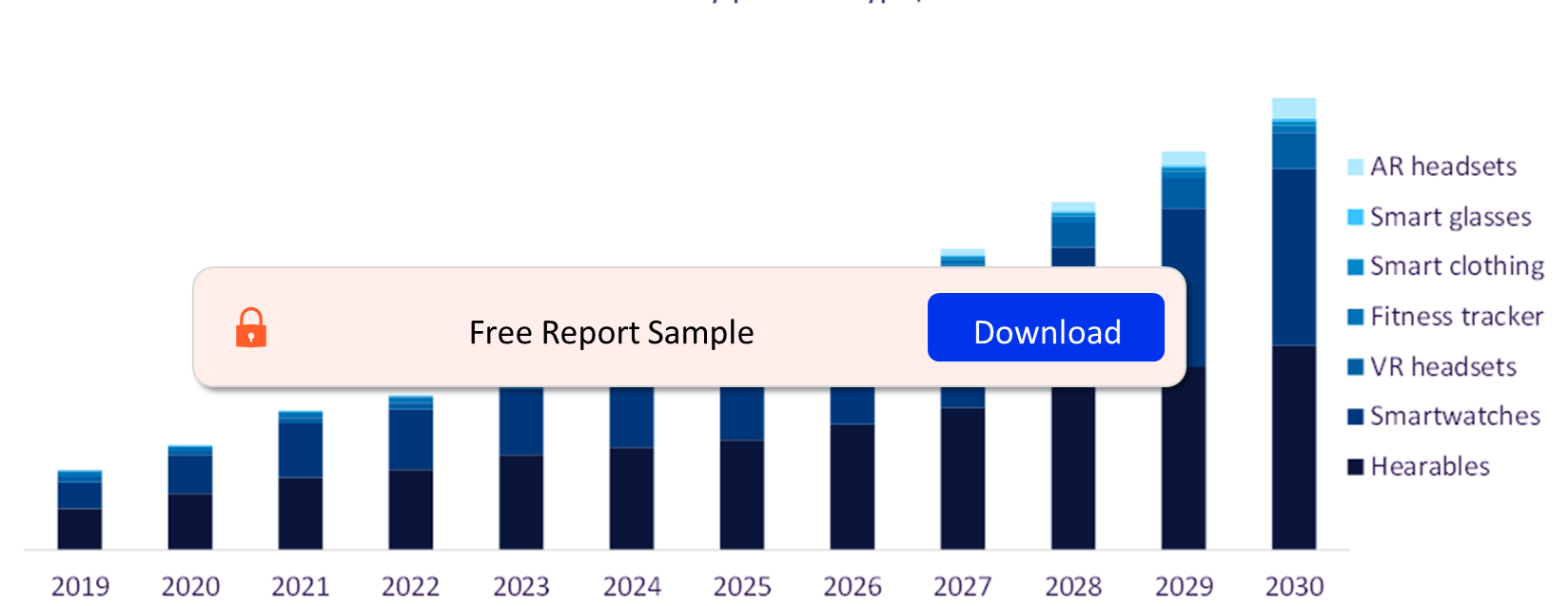

The wearable tech industry was worth $99.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of more than 14% between 2022 and 2030 driven by growing demand for hearables and smartwatches. Furthermore, the integration of artificial intelligence (AI) in wearable devices will offer improved user experiences, designed for greater comfort, provide longer battery life, and feature immersive spatial audio, health monitoring, and AI-based communication.

The Wearable Tech thematic report provides an overview of the wearable tech theme. It identifies the key trends impacting the growth of the sector over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends. It includes a comprehensive industry analysis, outlining the key growth areas and potential use cases.

| Total Pages | 61 |

| Market Size (2022) | $99.5 Billion |

| CAGR (2022-2030) | >14% |

| Key Value Chain Components | · Physical Layer

· Connectivity Layer · Data Layer · App Layer · Services Layer. |

| Leading Private Players | · Alphabet (parent company of Google)

· Apple · Garmin · Huawei |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Wearable Tech Market Trends

The main trends shaping the wearable theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: Some of the key technology trends gaining traction in the wearable tech market include the rising demand for smartwatches, Augmented reality (AR) smart glasses, smart earwear or hearables, hearing aid devices, and smart clothing.

Macroeconomic Trends: The impact of the COVID-19 pandemic, the supply chain disruptions caused by the pandemic, and product differentiation are the key macroeconomic trends impacting wearable the tech market.

Regulatory Trends: EU regulations, US Food and Drug Administration (FDA) approvals of new wearables, and concerns about ransomware attacks are the prominent regulatory trends influencing the wearable tech market.

Buy the Full Report for More Insights on Wearable Tech Trends in Tech

Wearable Tech - Industry Analysis

The wearable tech industry was worth $99.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of more than 14% between 2022 and 2030. Hearables is the largest segment of the wearable tech market, followed by smartwatches.

However, the wearable tech industry has become a victim of its own hype as wearables such as smart glasses and AR and VR headsets failed to become mainstream due to a lack of appealing use cases and slow technical development. In 2023, several big players struggled to create compelling products and meet the inflated expectations they had created.

Microsoft, a leader in the AR headsets market, has struggled to find buyers for its HoloLens headset due to its high cost and limited use cases. The departure of the chief architect of HoloLens, Alex Kipman, in June 2022 made the device’s future uncertain. This uncertainty was compounded by mass layoffs announced by Microsoft in January 2023 that impacted teams working on HoloLens and mixed reality projects.

The wearable tech industry analysis also comprises –

- Use Cases

- Timeline

- M&A trends

- Patent trends

- Hiring trends

- Social media trends

Global Wearable Tech Revenue, by Product Type, 2019-2030 ($ Billion)

Buy Full Report for More Insights on Industry Analysis in Wearable Tech

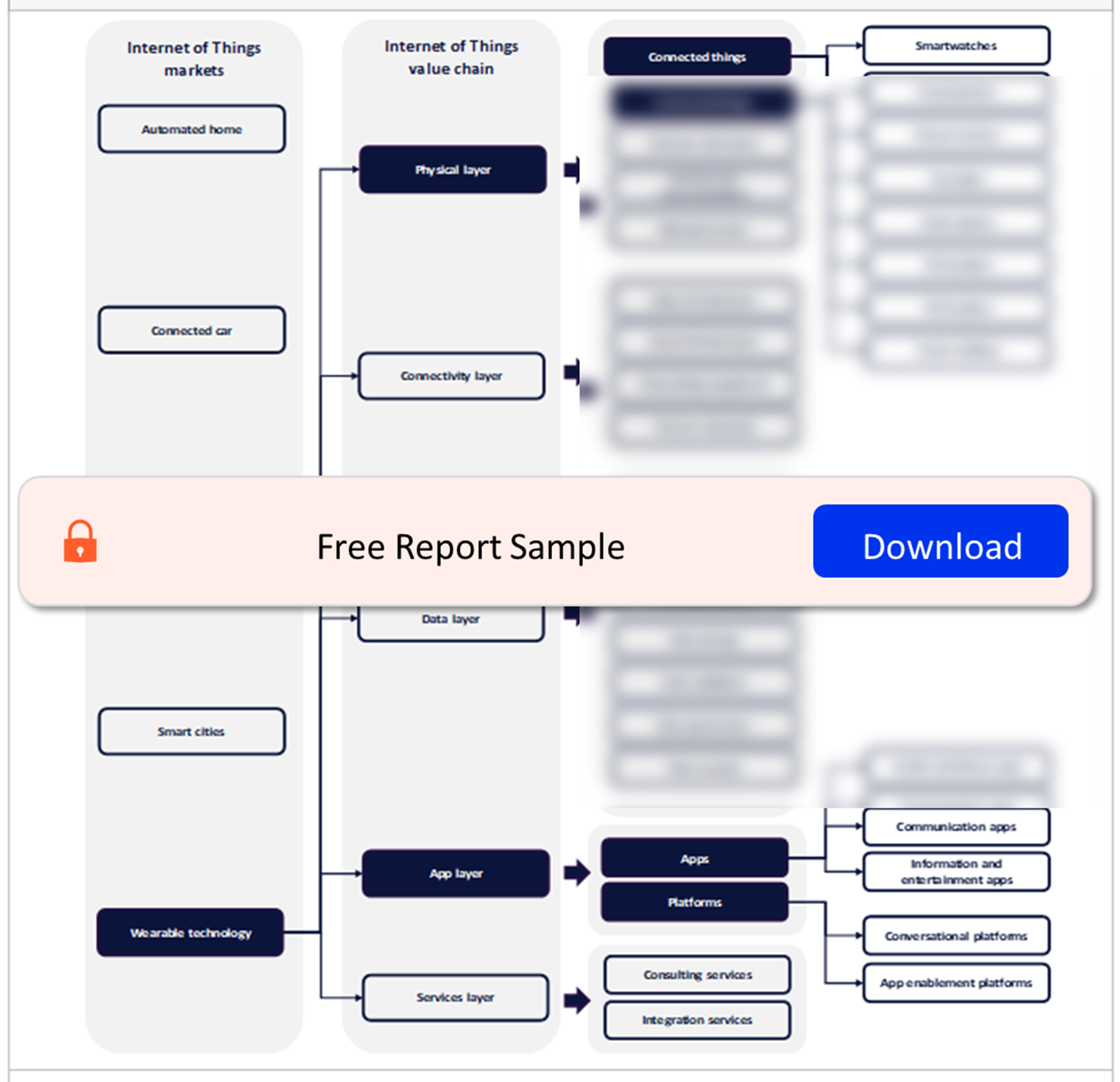

Wearable Tech Value Chain Insights

Wearable technology is part of the Internet of Things (IoT) value chain. IoT is classified into five distinct markets: automated homes, connected cars, Industrial Internet, smart cities, and wearable technology. Each of the five IoT markets has a common value chain, which can, in turn, be split into five layers: the physical layer, the connectivity layer, the data layer, the app layer, and the services layer.

Services layer: IoT services have become a necessary addition to the IoT value chain over the last decade. In the enterprise IoT market, many IoT adopters lack the design, technical integration, or data analysis skills to deliver a successful IoT implementation. Integrating both IT and operational technology (OT) requires the input of external consulting services companies, especially in the growing use case of predictive maintenance. Due to the nascent technological nature of certain IoT services and their dependency on the data and app layers, this section will cover the leading actors in integration and consulting services.

The IoT Value Chain Analysis

Buy Full Report for More Insights on Value Chain in Wearable Tech and IoT

Wearable Tech Industry – Competitive Landscape

The report highlights the key companies involved in the wearable tech market–

- Alphabet (parent company of Google)

- Apple

- Garmin

- Huawei

Buy Full Report for More Insights on leading players in Wearable Tech

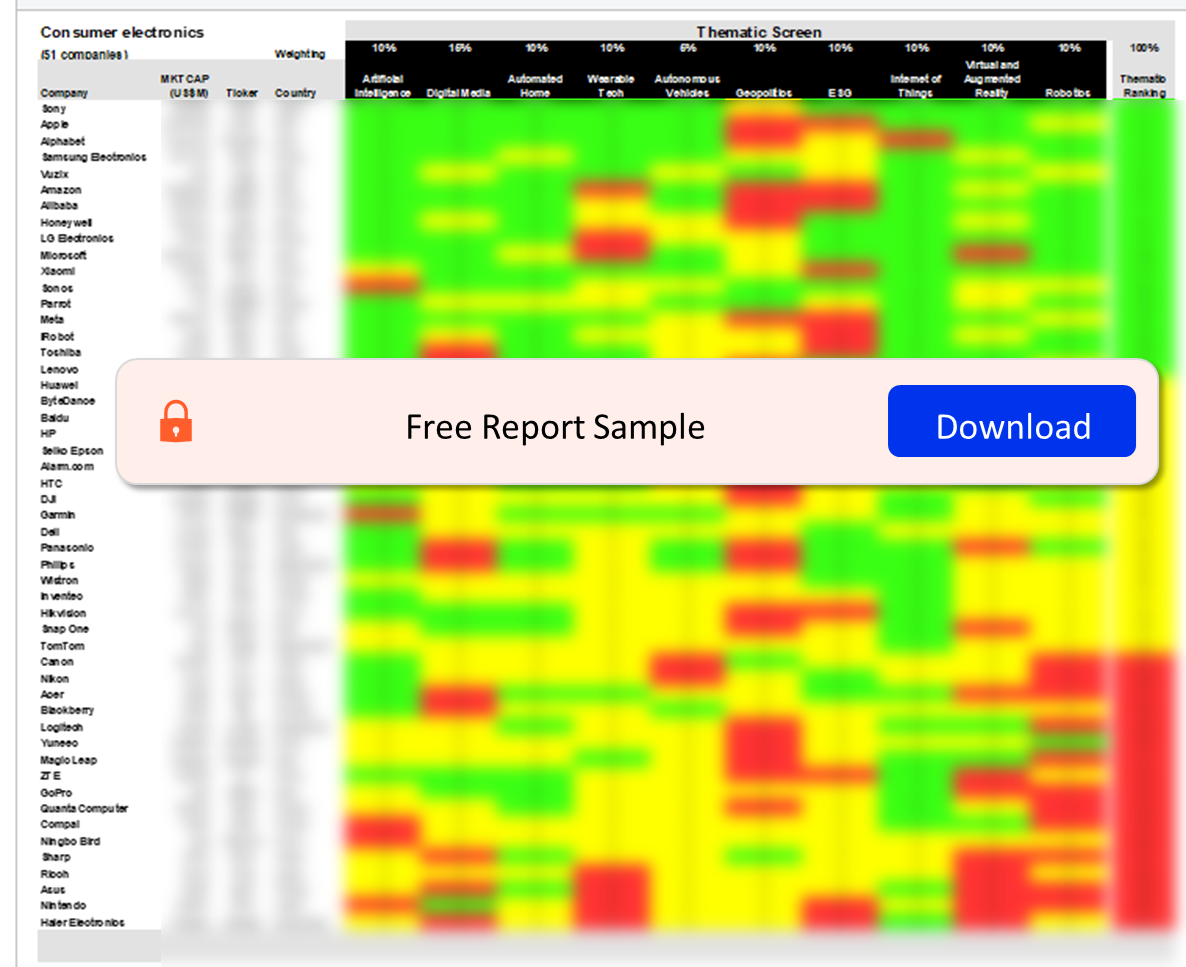

Consumer Electronics Sector Scorecard

The three screens in the industry scorecard comprise of –

Thematic Screen: The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

Valuation Screen: The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

Risk Screen: The risk screen ranks companies within a particular sector based on overall investment risk.

Consumer Electronics Sector Scorecard Analysis

For Additional Insights on the Sector Scorecard Analysis

Key Highlights

- Enterprises will be a key market for wearable tech devices over the next three years, outpacing the consumer segment. Wearable tech devices are currently deployed across logistics, defense, manufacturing, travel and tourism, and healthcare, primarily for training and remote support. Healthcare, particularly patient monitoring, remote training and support, and telehealth services, holds significant promise. Creating devices that can be used for longer, are lightweight, and have practical use cases will help companies generate demand and revenue.

- The growth of the smartwatch market is driven by consumer interest in health and fitness tracking. With health monitoring features and capabilities advancing beyond just recording activity, smartwatches will continue to challenge the relevance of fitness trackers.

- Smart glasses and virtual reality (VR) headsets have been around for some time but have not become mainstream due to a dearth of compelling use cases, high prices, and privacy concerns. Companies that can find a niche and create compelling use cases will have the best chance of succeeding.

Reasons to Buy

- Wearable tech is a key market in the broader Internet of Things industry. It has garnered significant attention and hype in the last decade, thanks to the popularity of devices such as Fitbit fitness bands and Apple Watches. As the underlying technologies advance, wearables could potentially transform how we interact, monitor health and well-being, and consume digital content in immersive environments.

- The report is an invaluable guide to this disruptive theme, including a breakdown of the wearable tech value chain and profiles of leading vendors.

Alphabet

Amazon

Apple

Aryzon

Asus

AT&T

Atheer

Athos

Autodesk

BBK Electronics

Bose

ByteDance

Capri Holdings

Casio

Catapult Sports

Cisco

CNN

Coros

Coursera

CuteCircuit

Deutsche Telekom

DPVR

EssilorLuxottica

Everysight

Eyelights

Fire-Boltt

Fossil Group

Garmin

GN Group

GoerTek

GOQii

Hexoskin

HP

HTC

Huawei

IBM

Imagine Marketing (BoAT)

Imoo

Intel

Iristick

Jarvish

Katana XR

Komodo Technologies

Lenovo

Levi

LG Electronics

Logitech

Lolë

Mad Gaze

Magic Leap

Meta

Microsoft

Mobvoi

Moticon ReGo

Movesense (Supa)

NBA

Netflix

Nike

Noise

NTT DoCoMo

Nuheara

Orange

Owlet Baby Care

Panasonic

Philips

Pimax

PTC

PVH

Qualcomm

Ralph Lauren

Razer

Realmax

RealWear

RE'FLEKT

Robert Bosch

Rokid

Samsung Electronics

Seiko Epson

Sennheiser

Sensoria

Shadow Creator

Siren Care

Snap

Solos

Sony

Spotify

Strava

Swatch

TAG Heuer

TCL

TeamViewer

Telefonica

Tencent

ThirdEye

Toshiba

Under Armour

Valve

Varjo

Vodafone

Vue

Vuzix

Withings

Xiaomi

Xloong

Xreal

Zepp Health (Amazfit)

Zoom

Table of Contents

Frequently asked questions

-

What was the size of the wearable tech industry in 2022?

The wearable tech industry was worth $99.5 billion in 2022.

-

What is the wearable tech industry's growth rate?

The wearable tech industry is expected to expand at a compound annual growth rate (CAGR) of more than 14% between 2022 and 2030.

-

What are the key wearable tech industry trends?

The key wearable tech industry trends are technology, regulatory, and macroeconomic trends.

-

What are the main value chain components of the wearable tech industry?

The wearable tech value chain includes the physical layer, the connectivity layer, the data layer, the app layer, and the services layer.

-

Who are the leading players associated with wearable tech theme?

Alphabet (parent company of Google), Apple, Garmin, and Huawei among others are some of the leading players associated with wearable theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.