Top Trends in the Apparel Market for 2024

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Top Trends in Apparel Market Overview

The Top Trends in the Apparel Market for 2024 report includes an analysis of key factors impacting the global apparel market in 2024. The major trends in the apparel market are inflation, mergers and acquisitions, the outperformance of online channels, the importance of value for money, and market polarization among others.

| Top Trends | · Inflation

· Mergers and Acquisitions · The Outperformance of Online Channels · Importance of Value for Money · Market Polarization |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Top Trends in Apparel Market

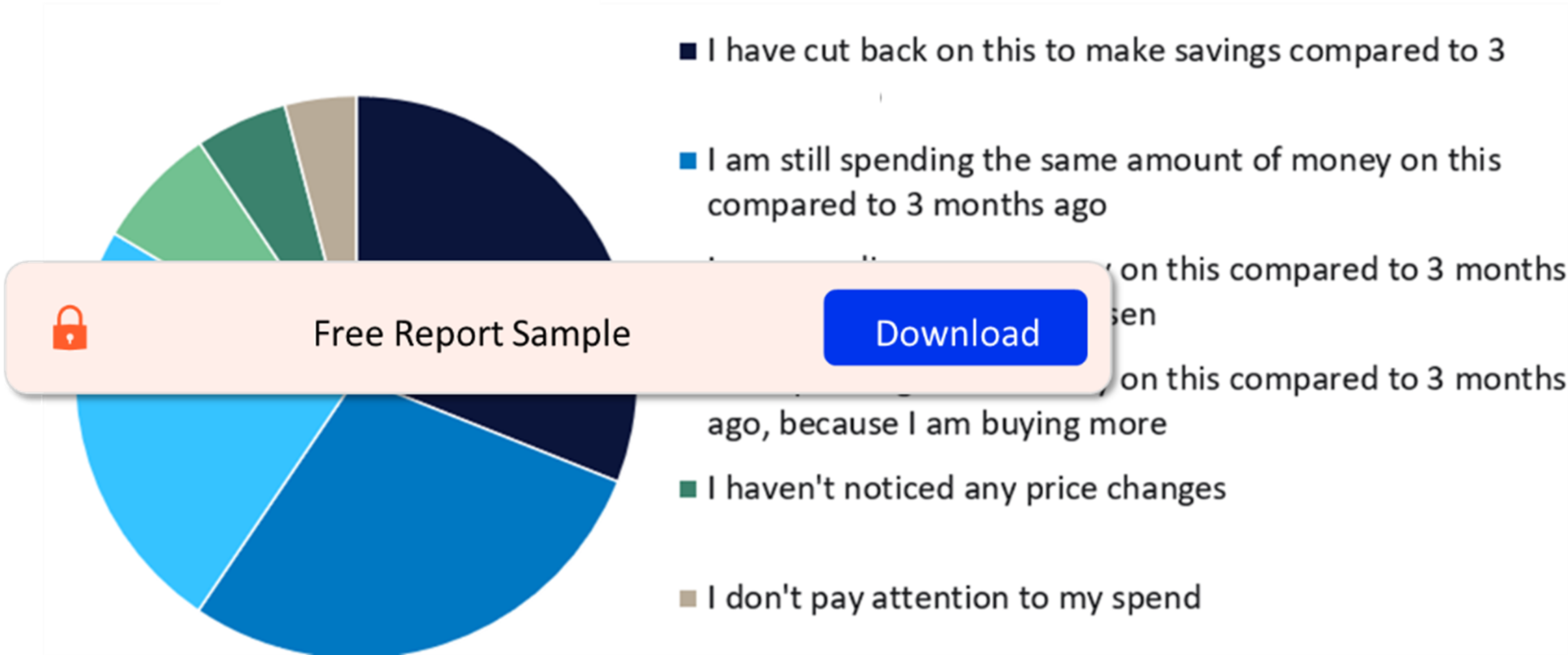

Inflation: Inflation will continue to fall in 2024. However, the cumulative impact of higher prices for essential goods implies that discretionary incomes will remain squeezed. This is particularly true in North America and Europe. Many consumers in these regions stated in Q4 2023 that they had cut back on apparel purchases in the three months prior. Asia Pacific, Latin America the Middle East, and Africa have been much more stable. This is attributed to their stronger economies and growing middle-class population.

How Consumers in Europe are Changing Their Shopping Habits for Clothing & Footwear Due to Rising Costs

Buy the Full Report for More Insights into the Trends in the Apparel Market Market

Mergers & Acquisitions Activities: Reduced consumer spending and increased costs squeezed the revenues and profits of companies in the last year. Thus, causing many companies to fall into financial distress. Those companies that have done well over the past few years and have ample cash reserves will be able to snap up struggling rivals for low prices. For instance, ASOS is reportedly mulling a sale of Topshop after its acquisition in 2021, with potential buyers including Authentic Brands Group, Frasers Group, and JD Sports.

Buy the Full Report for More Insights into the Trends in the Apparel Market Market

The Outperformance of Online Channels: The online penetration dropped slightly in 2023 as the switch back to stores post-pandemic continued. However, it will rise again from 2024, with sales growing by more than 6%. Between 2023 and 2028, the online market will grow rapidly accounting for a significant share of total apparel spend by 2028.

Brands will continue to prioritize investments in their digital propositions, through advancements such as personalization, AI, and improved fulfillment among others. This will also aid in creating a smoother shopping experience in the online channel.

Buy the Full Report for More Insights into the Trends in the Apparel Market Market

Key Highlights

Though inflation will continue to fall in 2024, the cumulative impact of higher prices for essential goods means that discretionary incomes will remain squeezed.

As companies’ revenues and profits are squeezed by reduced consumer spending and increased costs, many will fall into financial distress. Those that have done well over the past few years and have ample cash reserves will be able to snap up struggling rivals for low prices.

Inflation has led to a deprioritization of sustainability and ethics among apparel shoppers, with consumers citing these significantly less important to them than factors like value for money and price. This disparity will continue at least until consumers’ discretionary incomes rise.

The resale market is forecast to grow by 16.3% in 2024, only a marginal slowdown from 2023, as consumers seek out cheaper options to save money and more players enter the market.

Reasons to Buy

- Understand the preferences of consumers in different markets, to allow you to identify your priorities.

- Identify the strategies retailers and brands are utilizing to drive growth, to help your company remain competitive.

- Find out how different segments of the apparel market are performing, to enable you to maximize customer.

AEFFE

Alo Yoga

ASOS

Banana Republic

Bershka

Browns

Champion

Coach

Dr Martens

Farfetch

Fear of God

Hermès

Hugo Boss

John Lewis

Karen Millen

Kering

Kurt Geiger

Lululemon

LVMH

Macy’s

Marks & Spencer

Matches

New Balance

New Look

Nike

Nordstrom

Pangaia

Prada

PrettyLittleThing

Puma

Richemont

Selfridges

Shein

SportScheck

Superdry

thredUP

Tommy Hilfiger

Topshop

Under Armour

Uniqlo

Vans

Vinted

Zalando

Zara

Table of Contents

Table

Figures

Frequently asked questions

-

What are the major trends in the apparel market for 2024?

The major trends in the apparel market for 2024 are inflation, mergers and acquisitions, the outperformance of online channels, the importance of value for money, and market polarization among others.

-

Where will brands invest to create a smoother shopping experience in the online channel?

Brands will continue to prioritize investments in their digital propositions, through advancements such as personalization, AI, and improved fulfillment among others. This will all help to create a smoother shopping experience in the online channel.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.