Cryptocurrencies in Consumer Goods -Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cryptocurrencies in Consumer Goods Report Overview

Cryptocurrencies benefit consumer goods companies that want to diversify the payment options they offer. NFTs are also an increasingly important element of a consumer goods company’s advertising strategy. Many leading consumer goods companies are embracing wider Web3 applications, such as non-fungible tokens (NFTs) and the metaverse. Brands including Nestlé, L’Oréal, Estee Lauder, Unilever, PepsiCo, and Coca-Cola have prominently featured NFTs in their advertising campaigns.

The impact of cryptocurrencies on the consumer goods sector remains limited, although some segments have embraced crypto more than others.

The Cryptocurrencies in Consumer Goods Thematic Intelligence report examines the growing impact of cryptocurrencies and crypto tokens on the consumer goods industry. It identifies the companies and industry segments that are leading adoption and explores a range of use cases.

| Market Size (2022) | $33 billion |

| CAGR (2022-2030) | >54% |

| Key Value Chain Components | · Infrastructure Layer

· Blockchain Layer · Application Layer · Centralized Applications |

| Leading Cryptocurrency Adopters in Consumer Goods | · Kering

· L’Oréal · LVMH · Starbucks · Unilever |

| Leading Cryptocurrency Tech Vendors | · Binance

· Bitfinex · Chainalysis · Circle · Coinbase · ConsenSys |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Cryptocurrencies on Consumer Goods – Impact Analysis

The area of the consumer goods business model that cryptocurrencies have the greatest potential to disrupt is payments. This disruption is predominantly observed in retail settings, both physical and online. As a result, the integration of cryptocurrencies into the purchase and sale of consumer goods will be driven primarily by retail companies and e-commerce platforms. Companies with a greater portion of sales from directly operated retail channels are more likely to accept cryptocurrency payments. This is why food service outlets and luxury goods companies are leading the consumer goods industry in crypto adoption—typically, they directly operate a large percentage of their sales channels.

Consumer goods companies are increasingly shifting towards direct-to-consumer sales through channels they directly operate. In 2021, Nestlé announced plans to increase its e-commerce sales from 13% in 2020 to 25% by 2025. Similarly, in 2022, e-commerce represented 6% of Mondelez’s revenues, up from 3% in 2019. E-commerce is part of Mondelez’s broader ‘channel expansion’ strategy, which involves opening brand-specific direct-to-consumer shops. Such a trend will strengthen the adoption of cryptocurrency payments in the consumer goods industry.

Buy the Full Report for More Insights on the Impact of Cryptocurrencies in the Consumer Goods Industry, Download a Free Sample Report

Cryptocurrencies – Industry Analysis

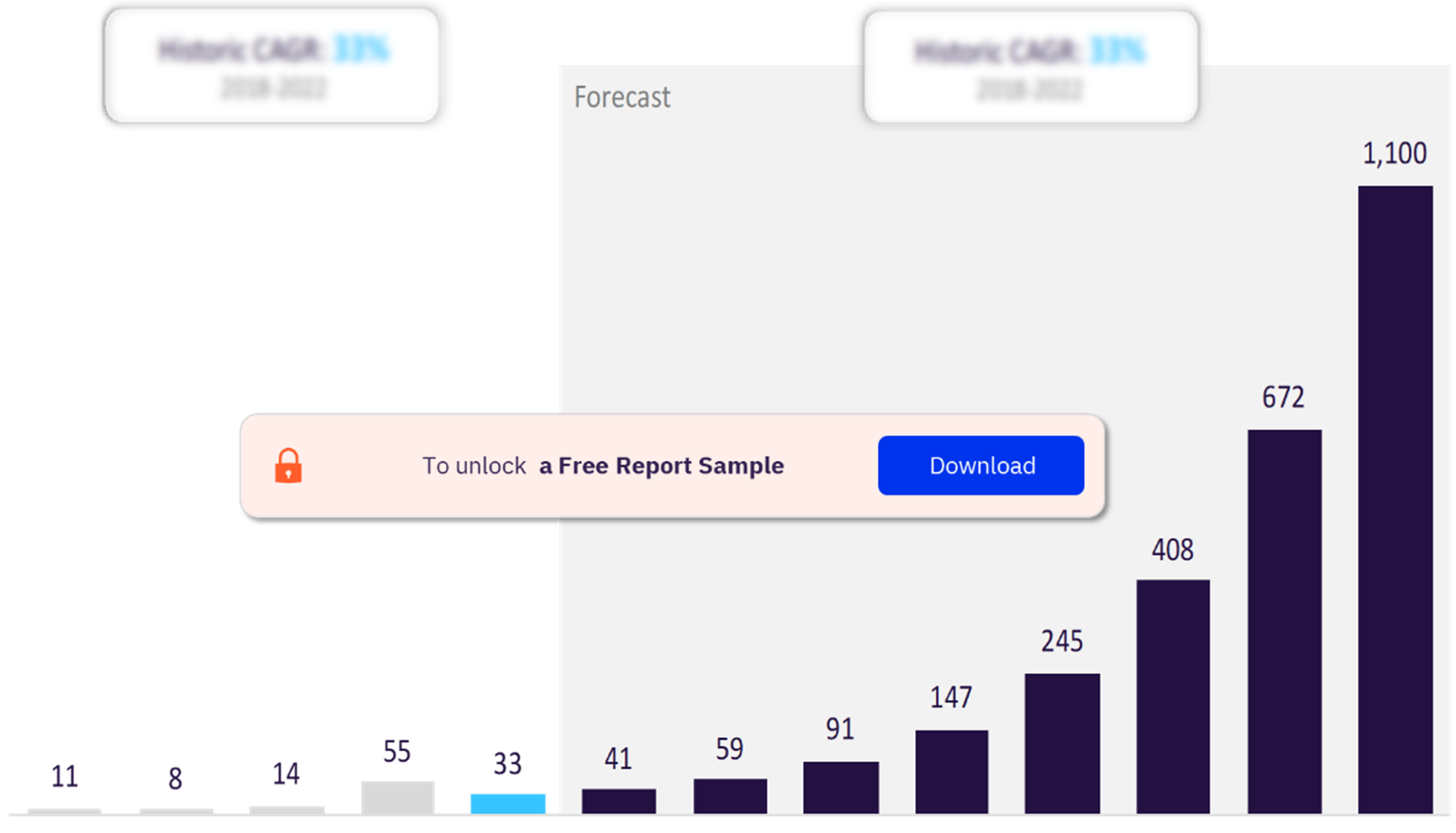

The global cryptocurrency hardware, software, and services market was worth $33 billion in 2022. Total spending on cryptocurrency is difficult to estimate. The crypto market’s volatility means the growth trajectory is unlikely to be linear. Additionally, financial disclosure by most cryptocurrency companies is limited. Cryptocurrency is also intertwined with other emerging technologies like the metaverse and NFTs, making it challenging to identify revenue explicitly generated by cryptocurrency. The market, however, is likely to grow at a CAGR of more than 54% during 2022-2030.

The Cryptocurrencies Industry Analysis also covers –

- Signals

- M&A Trends

- Venture Financing Trends

- Company Filing Trends

- Hiring Trends

- Social Media Trends

Cryptocurrencies Industry Analysis

Buy the Full Report for Additional Cryptocurrencies in Consumer Goods Industry Analysis, Download a Free Sample Report

Buy the Full Report for Additional Cryptocurrencies in Consumer Goods Industry Analysis, Download a Free Sample Report

Cryptocurrency – Value Chain Analysis

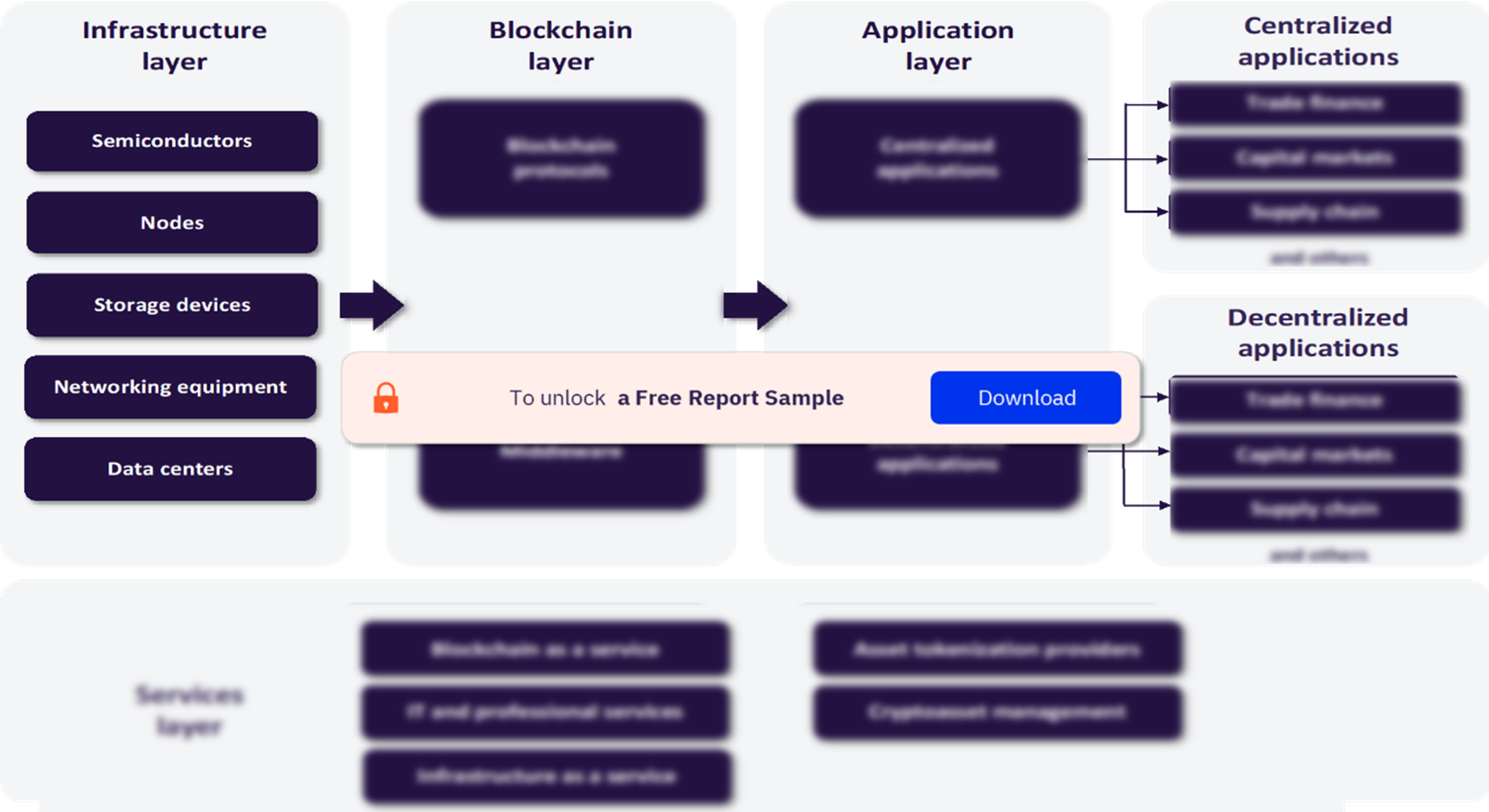

The cryptocurrency value chain consists of four layers including infrastructure, blockchain, application, and services, each with multiple sub-categories. Since blockchain is the underlying technology on which cryptocurrencies are built, the value chain is the same for both technologies. However, their differences make certain segments more relevant to one than the other. Similarly, decentralized applications, such as DeFi and NFTs, will be covered in our upcoming Web3 report.

Infrastructure Layer: The infrastructure layer focuses exclusively on the categories related to cryptocurrency mining, including mining rigs, mining software, application-specific integrated circuits (ASICs), and cryptocurrency mining farms. The other categories of the infrastructure layer are covered in our blockchain report, including traditional server hardware, plug-and-play nodes, client software, central processing units (CPUs), graphics processing units (GPUs), field-programmable gate arrays (FPGAs), hard disk drives (HDD), solid-state drives (SSD), on-premise data centers, and centralized cloud infrastructure.

Cryptocurrency Value Chain Insights

Buy the Full Report for Cryptocurrency Value Chain Analysis, Download a Free Sample Report

Buy the Full Report for Cryptocurrency Value Chain Analysis, Download a Free Sample Report

Cryptocurrencies in Consumer Goods – Competitive Landscape

Some of the leading cryptocurrency adopters in consumer goods are –

- Kering

- L’Oréal

- LVMS

- Starbucks

- Unilever

Some of the leading cryptocurrency tech vendors are –

- Binance

- Bitfinex

- Chainalysis

- Circle

- Coinbase

- ConsenSys

Buy the Full Report for More Information on the Leading Players in the Cryptocurrencies in Consumer Goods Industry, Download a Free Sample Report

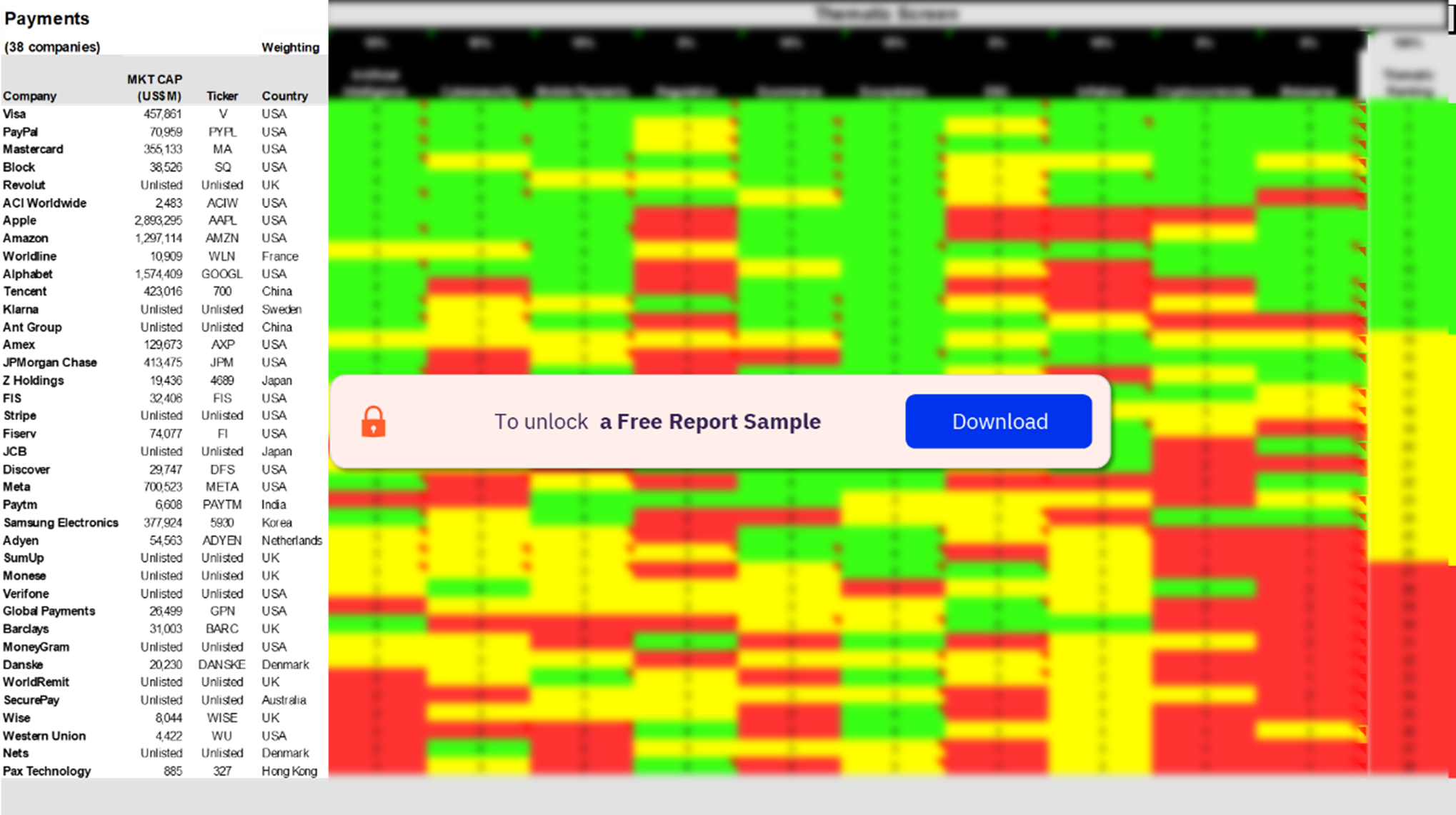

Payments Sector Scorecard Analysis

A scorecard approach to predict tomorrow’s leading companies within each sector. The payment sector scorecards have three screens including a thematic screen, a valuation screen, and a risk screen.

Payments Sector Scorecard Analysis

Buy the Full Report for More Insights on the Payment Sector Scorecard Analysis, Download the Free Sample

Buy the Full Report for More Insights on the Payment Sector Scorecard Analysis, Download the Free Sample

Scope

• Crypto payment gateways and NFTs are the areas of the cryptocurrencies value chain that can add the most value to consumer goods companies.

• The foodservice and luxury goods sectors lead crypto adoption because companies within these sectors often see a significant percentage of their total sales come via retail outlets that they directly operate, meaning these companies oversee a significant percentage of the payments for their goods and services.

Key Highlights

- Crypto payment gateways and NFTs are the areas of the cryptocurrency value chain that can add the most value to consumer goods companies.

- The food service and luxury goods sectors lead crypto adoption because companies within these sectors often see a significant percentage of their total sales come via retail outlets that they directly operate, meaning these companies oversee a significant percentage of the payments for their goods and services.

Reasons to Buy

- Understand which elements of cryptocurrencies are relevant to your business and which are not.

- Identify the leading adopters of cryptocurrencies within the consumer goods sector.

- Access case studies showcasing how cryptocurrencies can be used by consumer goods companies profitably.

Kering

Unilever

PepsiCo

Nestle

Coca-Cola

L'Oreal

Starbucks

Subway

British American Tobacco

Imperial Brands

Philip Morris

Cxolgate Palmolive

Reckitt Benckiser

Table of Contents

Frequently asked questions

-

What was the cryptocurrency market size in 2022?

The cryptocurrency revenue was $33 billion in 2022.

-

What will be the cryptocurrency market CAGR during 2022-2030?

The market is likely to grow at a CAGR of more than 54% during 2022-2030.

-

Which are the key value chain components in the cryptocurrency market?

The cryptocurrency value chain consists of four layers including infrastructure, blockchain, application, and services, each with multiple sub-categories.

-

Which are the leading cryptocurrency adopters in the consumer goods market?

LVMH, Kering, Unilever, PepsiCo, Nestlé, L’Oréal, Starbucks, and Subway are some of the leading cryptocurrency adopters in the consumer goods market.

-

Which are the leading cryptocurrency tech vendors?

Binance, Bitfinex, Chainalysis, Circle, Coinbase, and ConsenSys are some of the leading cryptocurrency tech vendors.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.