Ecommerce in Consumer Goods, Foodservice and Packaging – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Ecommerce in Consumer Goods, Foodservice and Packaging Report Overview

Ecommerce allows companies to sell their products or services without needing a physical presence. Increased rents, exacerbated by high interest rates, have made online real estate increasingly attractive. In response to the ecommerce trend, grocery stores are investing in more digital-first methods such as quick-commerce warehouses and direct-consumer channels. Foodservice providers are also looking into food delivery solutions and virtual kitchens. Packaging brands are also specializing in ecommerce with robust sustainable solutions. As increasing number of sellers go online, the ecommerce landscape will continue to evolve to provide for the ever-expanding range of goods on offer.

The ecommerce in consumer goods, foodservice and packaging thematic intelligence report covers industry and trend analysis impacting the industries. The report also provides value chain insights and key signals highlighting the M&A trends, venture financing trends, hiring trends, patent trends, and social media trends. This thematic study further enlists the leading public tech companies and private tech companies. Furthermore, leading ecommerce adopters are listed in the consumer goods, foodservice, and packaging industry.

| Market Size (2022) | $5.9 trillion |

| Key Trends | • Technology Trends

• Macroeconomic Trends • Industry Trends • Regulatory Trends |

| Key Value Chain Components | • Ecommerce as a Service

• Marketing • Customer Interface • Order Management • Transaction Processing • Fulfilment • After-Sales Service |

| Key Companies | • Public Tech Companies

• Private Tech Companies • Leading Ecommerce Adopters in Consumer Goods • Leading Ecommerce Adopters in Foodservice • Leading Ecommerce Adopters in Packaging |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Ecommerce in Consumer Goods, Foodservice and Packaging – Key Trends

The key trends that will shape the ecommerce theme in the consumer goods, foodservice and packaging industry during the next 12 to 24 months are classified into technology trends, macroeconomic trends, industry trends, and regulatory trends.

Technology Trends: The internet super-monopoly, subscription-based services, social commerce, mobile commerce, conversational commerce, quick commerce, and streaming are a few of the key technology trends likely to influence the theme.

Macroeconomic Trends: M&A, online to offline (O2O), ESG, inflation, and demography are the key macroeconomic trends that are expected to impact the market.

Industry Trends: Direct-to-consumer (D2C), cocooning, next-generation shopping, ghost kitchens, and advanced materials are the leading industry trends expected to drive the market.

Regulatory Trends: Fintech regulation, tax avoidance, data privacy, and ESG are the regulatory trends expected to influence the market.

Buy the Full Report for Additional Information on the Key Trends Impacting the Ecommerce in Consumer Goods, Foodservice and Packaging Theme, Download a Free Sample Report

Ecommerce in Consumer Goods, Foodservice and Packaging Industry Analysis

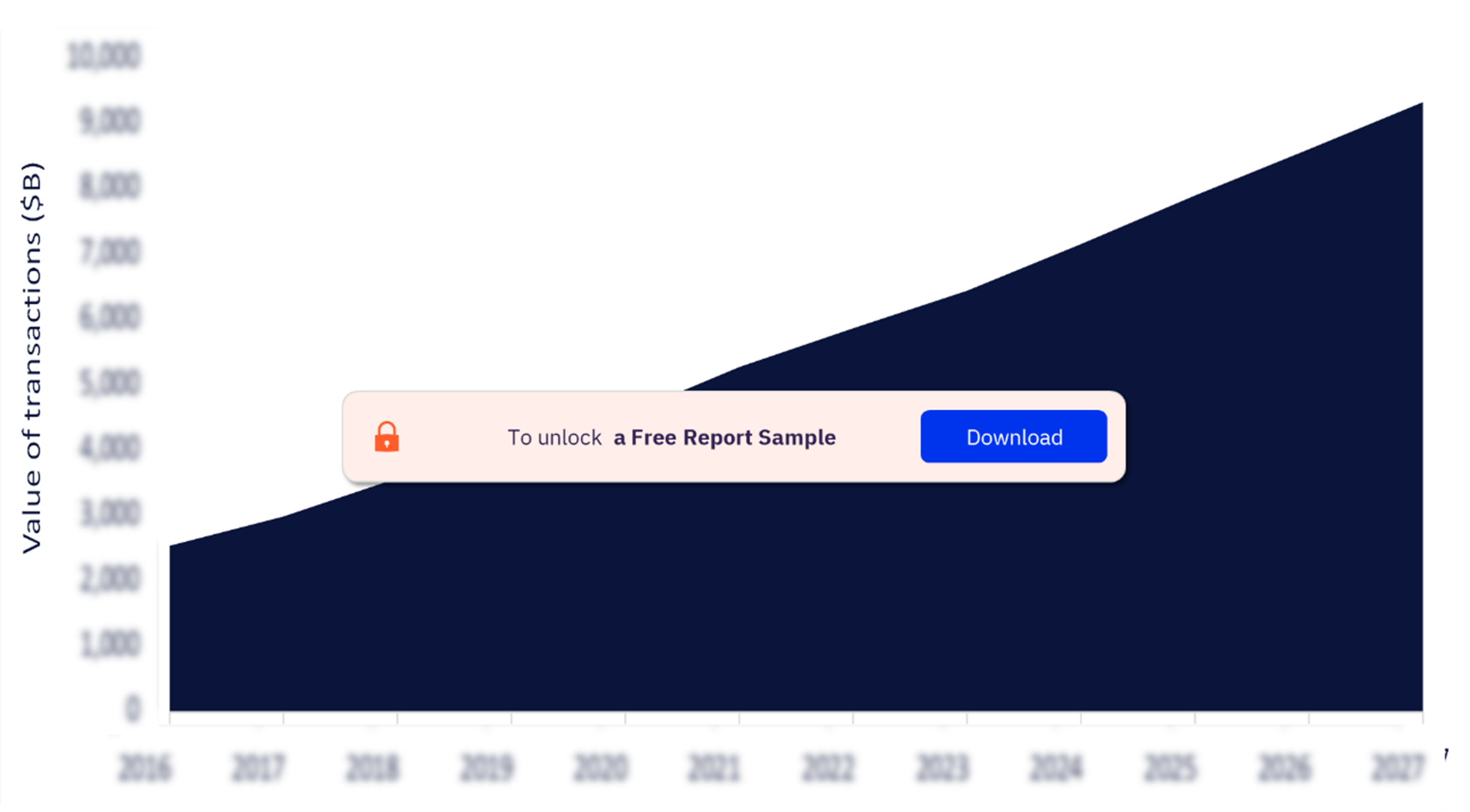

The global value of transactions for the ecommerce market was $5.9 trillion in 2022. The market is expected to grow at a CAGR of more than 9% over the forecast period. The high growth rates during the COVID-19 pandemic occurred as global lockdowns prevented consumers from shopping in stores. The expected growth of the ecommerce industry between 2022 and 2027 will be driven by improved technology and delivery services and wider internet adoption.

Ecommerce in Consumer Goods, Foodservice and Packaging Industry Analysis

Buy the Full Report for More Information in the Ecommerce in Consumer Goods, Foodservice and Packaging Industry Analysis, Download a Free Sample Report

Ecommerce Key Value Chain Components

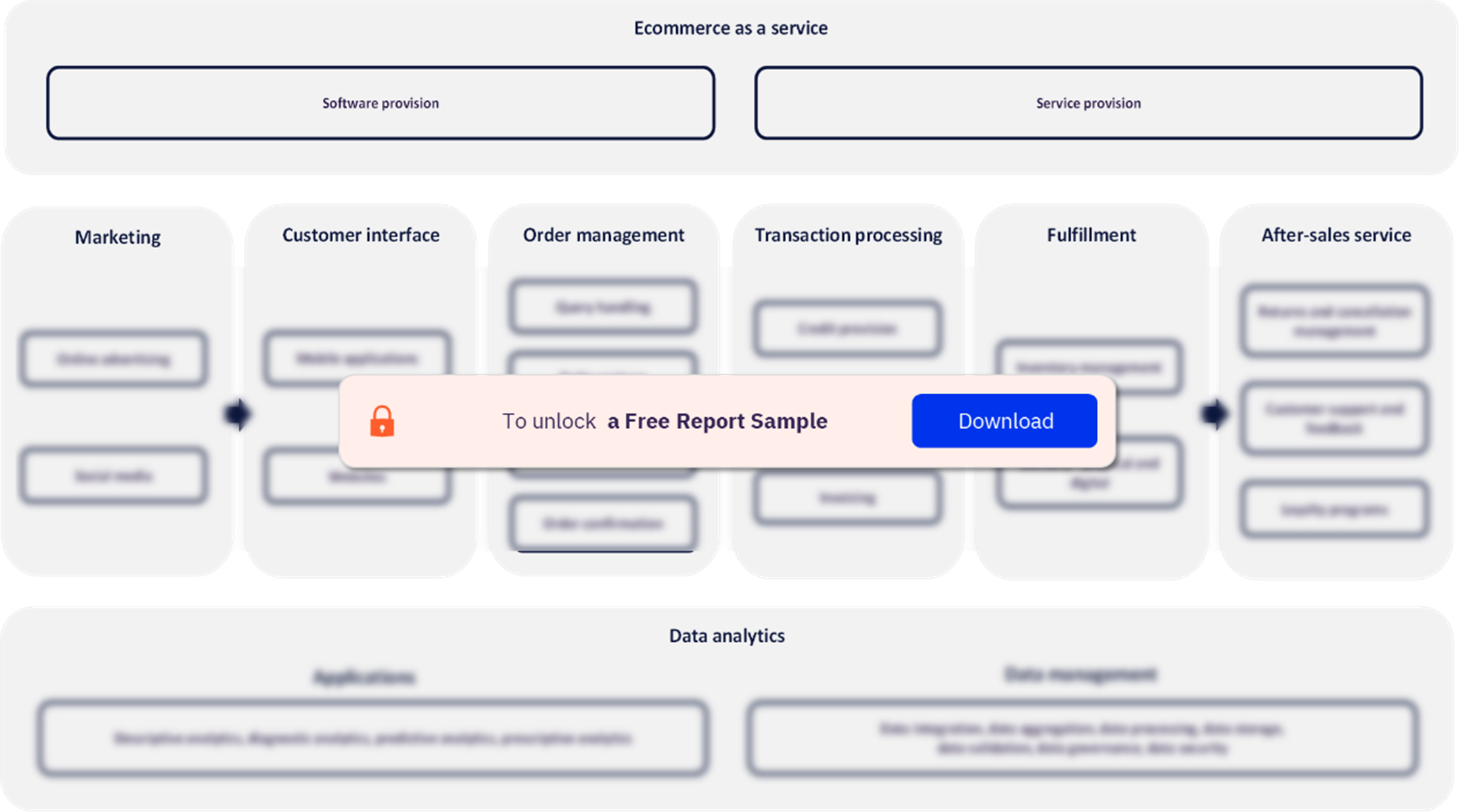

The ecommerce value chain comprises several discrete layers: ecommerce as a service, marketing, customer interface, order management, transaction processing, fulfillment, and after-sales service. These layers are underpinned by data analytics, which provides the backbone for all successful ecommerce operations.

Ecommerce as a Service: Ecommerce as a service describes companies that provide software and services to help brands operate online. The most popular example is Shopify, which allows users to set up storefronts and sell products without the need to code, build a website, or download software. Ecommerce as a service companies operate on a subscription basis, with tiered levels based on numerous factors such as the services included in the plan or the website’s size.

Ecommerce in Consumer Goods, Foodservice and Packaging Value Chain Insights

Buy the Full Report for Additional Value Chain Insights in the Ecommerce in Consumer Goods, Foodservice and Packaging Theme, Download a Free Sample Report

Ecommerce in Consumer Goods, Foodservice and Packaging – Competitive Landscape

The key companies that will make their mark within the ecommerce theme are:

Public Tech Companies: Alibaba, Alphabet (parent company of Google), Amazon, Apple, Meta, Microsoft, Shopify, Tencent, Uber, and Walmart are the key leading public tech companies.

Private Tech Companies: ByteDance, Epic Games, Klarna, and Shein are the key leading private tech companies.

Leading Ecommerce Adopters in Consumer Goods: Kraft Heinz, L’Oréal, Nestlé, and Reckitt are the leading ecommerce adopters in consumer goods industry.

Leading Ecommerce Adopters in Foodservice: Chipotle, Yoshinoya, Domino’s, and McDonald’s are the leading ecommerce adopters in the foodservice industry.

Leading Ecommerce Adopters in Packaging: Avery Dennison, Smurfit Kappa, Tetra Laval, and Westrock are the leading ecommerce adopters in the packaging industry.

Leading Ecommerce in Consumer Goods, Foodservice and Packaging Companies

Buy the Full Report for Additional Company-Wise Insights in the Ecommerce in Consumer Goods, Foodservice and Packaging Theme, Download a Free Sample Report

Sector Scorecard Analysis

The sector scorecard approach is used to predict tomorrow’s leading companies within each sector using a thematic screen, a valuation screen, and a risk screen.

Consumer Sector Scorecard

Buy the Full Report for Additional Sector Scorecard Analysis in the Ecommerce in Consumer Goods, Foodservice and Packaging Theme, Download a Free Sample Report

Scope

1) Ecommerce allows companies to sell their products or services without needing a physical presence. Increased rents, exacerbated by high interest rates, have made online real estate increasingly attractive.

2) In response to the ecommerce trend, grocery stores are investing in more digital-first methods such as quick-commerce warehouses and direct-to-consumer channels.

3) Foodservice providers are looking into food delivery solutions and virtual kitchens. Packaging brands are also specializing in ecommerce with robust sustainable solutions.

4) As more and more sellers go online, the ecommerce landscape will continue to evolve to provide for the ever-expanding range of goods on offer.

Key Highlights

- Ecommerce allows companies to sell their products or services without needing a physical presence. Increased rents, exacerbated by high-interest rates, have made online real estate increasingly attractive.

- In response to the e-commerce trend, grocery stores are investing in more digital-first methods such as quick-commerce warehouses and direct-to-consumer channels.

- Foodservice providers are considering food delivery solutions and virtual kitchens. Packaging brands are also specializing in ecommerce with robust sustainable solutions.

- As more and more sellers go online, the e-commerce landscape will continue to evolve to provide for the ever-expanding range of goods on offer.

Reasons to Buy

- Gain insight into the latest ecommerce trends in FMCG and who are the leading companies in the theme.

- Identify emerging digital sales strategies to help better position your company.

- Discover how rapid enforced changes over the past year will influence consumer reactions.

Alphabet

Amazon

Apple

Meta

Microsoft

Shopify

Tencent

Uber

Walmart

ByteDance

Epic Games

Klarna

Shein

Kraft Heinz

Nestle

Reckitt

Chipotle

Yoshinoya

Domino's

McDonald's

Avery Dennison

Smurfit Kappa

Tetra

Laval

Westrock

Swiggy

TikTok

CommerceHub

HungerStation

Zomato

Table of Contents

Frequently asked questions

-

What was the total value of transactions for the ecommerce market in 2022?

The global value of transactions for the ecommerce market was $5.9 trillion in 2022.

-

What will the total CAGR in the ecommerce market be from 2022 to 2027?

The market is expected to grow at a CAGR of more than 9% over the forecast period.

-

What are the key trends in the ecommerce in consumer goods, foodservice, and packaging theme?

The key trends that will shape the ecommerce theme in the consumer goods, foodservice, and packaging industry during the next 12 to 24 months are classified into technology trends, macroeconomic trends, industry trends, and regulatory trends.

-

Which are the leading public tech companies in ecommerce in consumer goods, foodservice, and packaging theme?

Alibaba, Alphabet (parent company of Google), Amazon, Apple, Meta, Microsoft, Shopify, Tencent, Uber, and Walmart are the key leading public tech companies.

-

Which are the leading private tech companies in the ecommerce in consumer goods, foodservice and packaging theme?

ByteDance, Epic Games, Klarna, and Shein are the key leading private tech companies.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.