Food Packaging Industry Trends, Opportunities, Growth Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore actionable market insights from the ‘Food Packaging Industry’ report provides:

- Multiple data sources forming a comprehensive overview of Packaging within the Food Industry.

- An outline of the usage of different packaging materials across different industries in terms of the number of units, packaging share, and growth rates during 2017–27, in addition to key packaging innovations for key industries in each of the categories analyzed.

- Synopsis of the shift in the utilization of various pack materials across the key sectors in the food packaging market are dairy & soy food, bakery and cereals, dried food, savory snacks, and others.

- Data and analysis including the number of units (millions) and growth rates for five-pack materials viz. rigid plastics, rigid metal, glass, paper & board, flexible packaging, and others.

- Pack sub-type, pack type, closure material, closure type, primary outer material, and primary outer type.

How is the ‘Food Packaging Industry’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the report today for valuable insights that will help you to make strategic decisions.

- Manufacturers and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the industry globally.

- The report provides a detailed analysis of the countries in specific regions, covering the key challenges, and future growth opportunities that can help companies gain insight into the country/region-specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

We recommend this valuable source of information to anyone involved in:

- Food Safety Organizations/ Flexible Packaging Agencies

- Raw Material Manufacturers & Suppliers

- Packaging Recyclers /Packaging Agencies, Associations & Organizations

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Food Packaging Industry Report, Download a Free Report Sample

Explore actionable market insights from the ‘Food Packaging Industry’ report provides:

- Multiple data sources forming a comprehensive overview of Packaging within the Food Industry.

- An outline of the usage of different packaging materials across different industries in terms of the number of units, packaging share, and growth rates during 2017–27, in addition to key packaging innovations for key industries in each of the categories analyzed.

- Synopsis of the shift in the utilization of various pack materials across the key sectors in the food packaging market are dairy & soy food, bakery and cereals, dried food, savory snacks, and others.

- Data and analysis including the number of units (millions) and growth rates for five-pack materials viz. rigid plastics, rigid metal, glass, paper & board, flexible packaging, and others.

- Pack sub-type, pack type, closure material, closure type, primary outer material, and primary outer type.

How is the ‘Food Packaging Industry’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the report today for valuable insights that will help you to make strategic decisions.

- Manufacturers and retailers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the industry globally.

- The report provides a detailed analysis of the countries in specific regions, covering the key challenges, and future growth opportunities that can help companies gain insight into the country/region-specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

We recommend this valuable source of information to anyone involved in:

- Food Safety Organizations/ Flexible Packaging Agencies

- Raw Material Manufacturers & Suppliers

- Packaging Recyclers /Packaging Agencies, Associations & Organizations

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To Get a Snapshot of the Food Packaging Industry Report, Download a Free Report Sample

Food Packaging Industry Report Overview

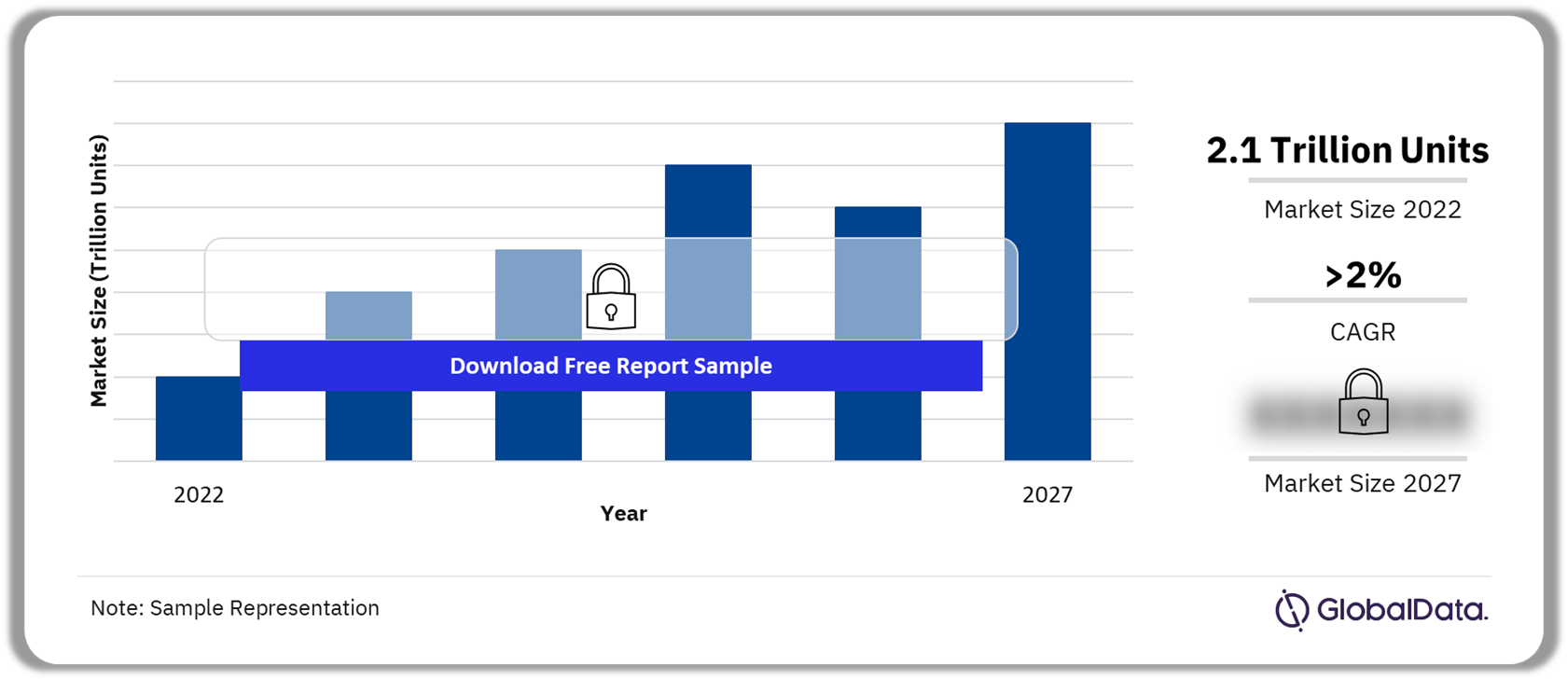

The food packaging market size was valued at 2.1 trillion units in 2022 and the market is anticipated to witness a growth at a CAGR of more than 2% during 2022-2027. The global food packaging industry volumes were led by the dairy & soy food sector, followed by bakery and cereals in 2022. The prepared meals sector is forecast to register the fastest growth during 2022–27.

Food packaging was majorly influenced by sustainability and personalization. The demand for eco-friendly packaging is on the rise, stimulated by consumers’ increasing focus on sustainability. This encourages producers to adopt recycled and reusable packaging materials. Major food industry manufacturers such as Nestlé, Unilever, and Danone Group have taken initiatives to reduce the impact on the environment during the production process. These brands are also highlighting the recycling process on their product labels with QR codes to educate consumers and become 100% transparent about their carbon footprints. For instance, in January 2023, Nestlé launched its popular KitKat chocolate bars in paper-wrapped packaging in Australia to achieve their sustainability goals.

Food Packaging Industry Outlook 2022-2027 (Trillion Units)

Buy the Full Report for More Insights on the Food Packaging Market Forecasts, Download a Free Sample Report

The food packaging market report brings together multiple data sources to provide a comprehensive overview of the food packaging industry. The report provides an overview of packaging industry at global level. The analysis also provides a regional overview across five regions—Asia-Pacific, Middle East & Africa, the Americas, Western Europe, and Eastern Europe—highlighting key sectors and growth drivers. Furthermore, the report offers an overview of the usage of different pack materials across food industry in terms of the number of units, packaging share and growth rates during 2017–27, in addition to key packaging innovations for pack materials analyzed. The report also provides an overview of the shift in the utilization of various pack materials across sectors during 2022–27.

| Market Size (2022) | 2.1 trillion units |

| CAGR (2022-2027) | >2% |

| Key Segments | · Dairy & Soy Food

· Bakery and Cereals · Dried Food · Savory Snacks · Others |

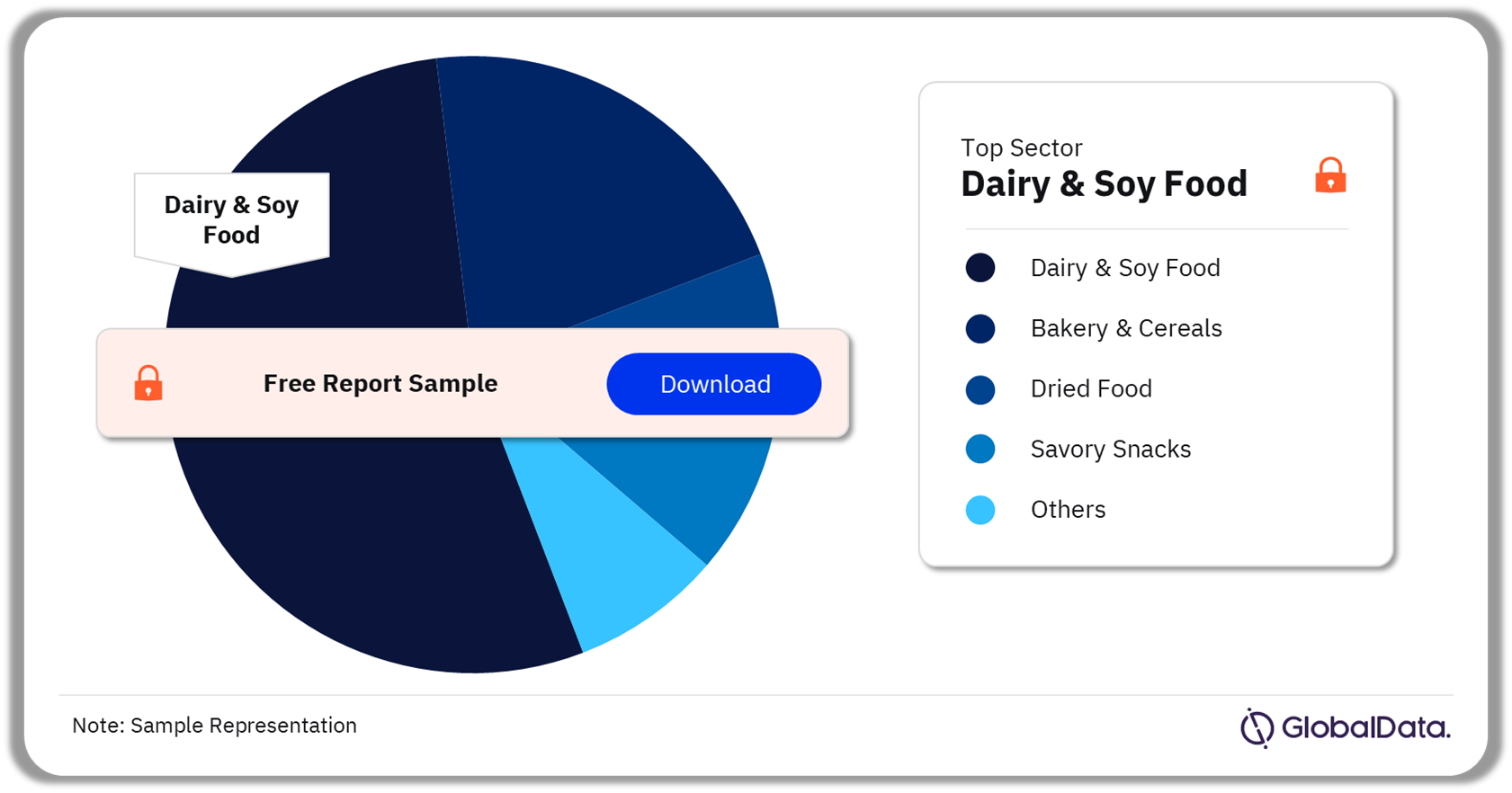

Food Packaging Market Segmentation by Sectors

The key sector in the food packaging market are dairy & soy food, bakery and cereals, dried food, savory snacks, and others. In 2022, the dairy & soy food segment held the largest food packaging market share, followed by bakery and cereals.

Food Packaging Market Analysis by Sector, 2022 (%)

Buy the Full Report for Sector-Wise Food Packaging Market Insights, Download a Free Sample Report

Food Packaging Market Segmentation by Regions

The key regions in the food packaging market are Asia-Pacific, Middle East & Africa, the Americas, Western Europe, and Eastern Europe. In 2022, the Asia-Pacific was the largest region in terms of food packaging, followed by the Americas.

Food Packaging Market Analysis by Regions, 2022 (%)

Buy the Full Report for the Regional Food Packaging Market Outlook, Download A Free Sample Report

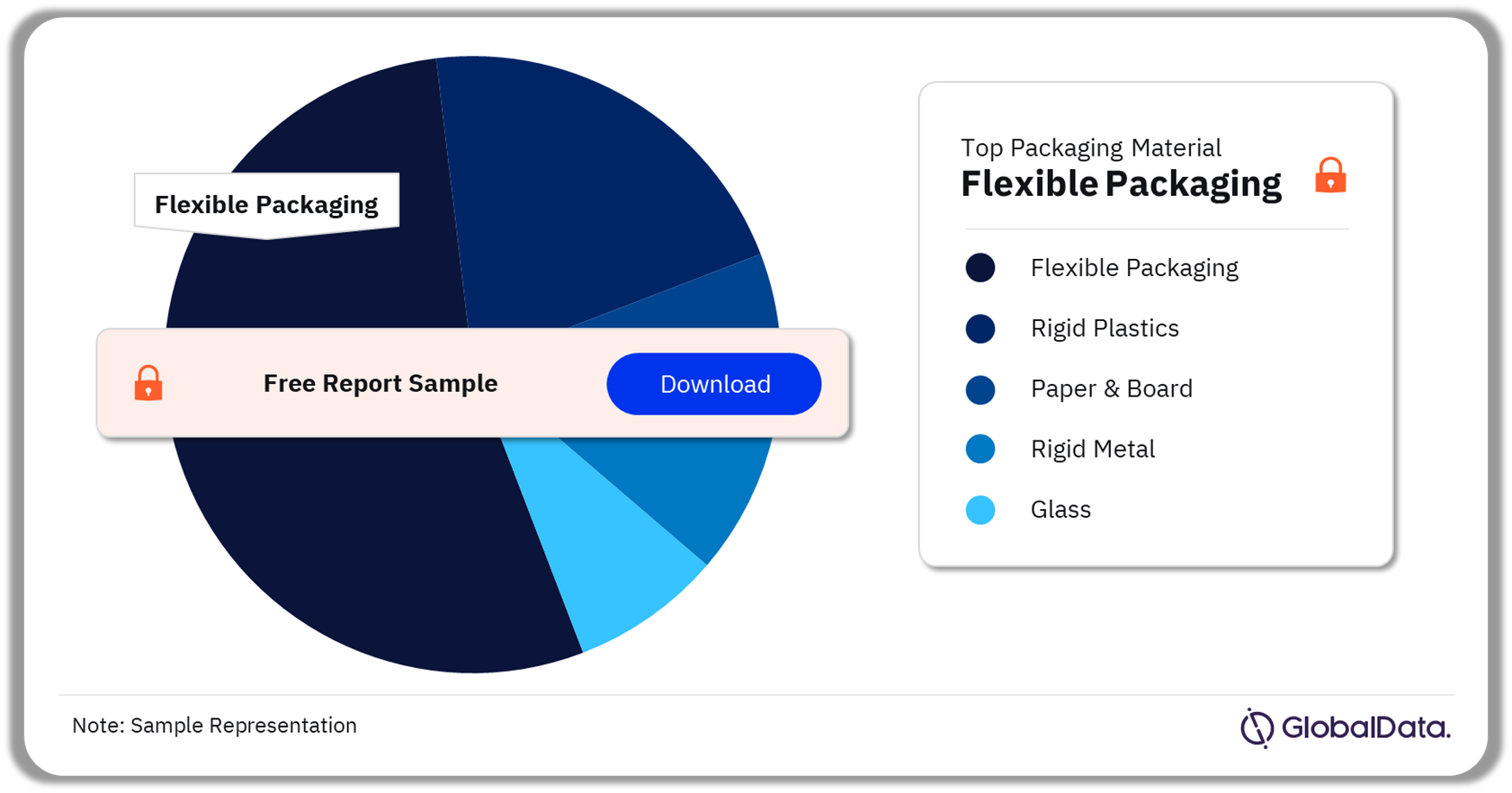

Food Packaging Market Segmentation by Packaging Materials

The key packaging materials in the food packaging market are flexible packaging, rigid plastics, paper & board, rigid metal, and glass. In 2022, the flexible packaging market was the most consumed pack material, followed by rigid plastics. Furthermore, flexible packaging is anticipated to record the fastest CAGR during 2022–27, followed by glass.

Food Packaging Market Analysis by Packaging Materials, 2022 (%)

Buy the Full Report for More Packaging Material Insights on the Food Packaging Market, Download a Free Sample Report

Latest News

- In January 2023, Nestlé launched its popular KitKat chocolate bars in a paper-wrapped packaging in Australia to achieve their sustainability goals.

- In September 2022, GFS GmbH, Chovi company launched a 150ml Chovi Allioli branded dip/sauce in Germany. The plastic-pot shaped packaging mimics a traditional ceramic mortar that the sauce would be made in, delivering a visually appealing effect at retail stores and creating a recognizable brand identity.

Key Segments Covered in this Report

Food Packaging Market Packaging Materials Outlook (2017-2027)

- Flexible Packaging

- Rigid Plastics

- Paper & Board

- Rigid Metal

- Glass

Food Packaging Market Sector Outlook (2017-2027)

- Dairy & Soy Food

- Bakery And Cereals

- Dried Food

- Savory Snacks

- Others

Food Packaging Market Regional Outlook (2017-2027)

- Asia-Pacific

- Middle East & Africa

- The Americas

- Western Europe

- Eastern Europe

Scope

This report provides:

- Multiple data sources to provide a comprehensive overview of the Packaging industry in Food.

- Overview of the usage of different packaging materials across different industries in terms of the number of units, packaging share and growth rates during 2017–27, in addition to key packaging innovations for key industries in each of the categories analyzed.

- Overview of the shift in the utilization of various pack materials across sectors.

- Data and analysis including the number of units (millions) and growth rates for five pack materials viz. rigid plastics, rigid metal, glass, paper & board, flexible packaging, and others.

- Pack sub-type, pack type, closure material, closure type, primary outer material, and primary outer type.

Key Highlights

- Manufacturing and retailers seek latest information on how the market is evolving to formulate their sales and marketing strategies. There is also demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities of growth within the industry

- The report provides a detailed analysis of the countries in the region, covering the key challenges and growth analysis, that can help companies gain insight into the country specific nuances

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, than can help companies in revenue expansion

Reasons to Buy

- Manufacturers and retailers seek latest information on how the market is evolving to formulate their sales and marketing strategies. There is also demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities of growth within the industry globally.

- The report provides a detailed analysis of the countries in specific regions, covering the key challenges, and future growth opportunities that can help companies gain insight into the country/region specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the food packaging market size in 2022?

The food packaging market size was valued at 2.1 trillion units in 2022.

-

What is the food packaging market growth rate during 2022-2027?

The food packaging market will register a CAGR of more than 2% during 2022-2027.

-

Which segment accounted for the largest food packaging market share in 2022?

In 2022, the flexible packaging segment dominated the food packaging market share.

-

Which sector dominated the food packaging market in 2022?

The dairy & soy sector dominated the food packaging market in 2022.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.