Indian Low-Cost Airlines Case Study – Analysis of Indian Low-Cost Airlines and their Evolution Including Key Trends, Industry Leaders and SWOT Analysis

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

This case study looks at the Indian low-cost airlines and their evolution including key trends, industry leaders and SWOT analysis.

Indian Low-Cost Airlines – Evolution

The emergence and growth of low-cost carriers (LCCs) in India have undeniably been a momentous voyage.

The 1990s liberalization and policy changes paved the way for low-cost carriers in India. Air Deccan’s 2003 launch marked a turning point for India’s low-cost airlines. It revolutionized Indian aviation by offering low prices to price-sensitive customers. A couple of years down the line, IndiGo, a prominent airline established in 2006, revolutionized the aviation industry in India by introducing the highly successful low-cost carrier model. By 2013, several low-cost carriers such as SpiceJet, GoAir, AirAsia India, and Vistara entered the market.

Furthermore, the Indian government’s 2016 Ude Desh Ka Aam Nagrik (UDAN) initiative subsidized flights to underserved and unserved airports to improve regional connectivity. Gradually, as the market matured, the airlines charged ancillary fees for baggage, seat selection, onboard food, and other services to diversify revenue.

Since then, Indian low-cost carriers have grown and expanded their domestic and international networks. They have introduced new routes, increased aircraft frequency, and entered international markets to give Indian travelers affordable oversees travel.

Indian Low-Cost Airlines - Trends and Business Models

Affordability and accessibility are the key trends impacting the Indian low-cost carrier industry. For instance, one of the key distinguishing factors between low-cost carriers (LCCs) and full-service carriers lies in the former’s dedication to providing affordable airfares. The central focus of their business models lies in providing affordable options, allowing airlines to effectively serve budget-conscious travelers and broaden their clientele. Low-cost carriers (LCCs) can achieve their cost-effective operations through the implementation of various strategies. These include adopting measures to reduce expenses and optimizing their operational efficiency among others.

The operational framework or business model of Indian LCCs has been strategically crafted to provide cost-effective air travel alternatives to a diverse spectrum of travelers. The focus of these airlines lies in prioritizing cost efficiency, operational excellence, and streamlining processes. This strategic approach allows them to offer competitive fares to customers while still ensuring profitability.

Indian Low-Cost Airlines - Industry Leaders and New Entrants

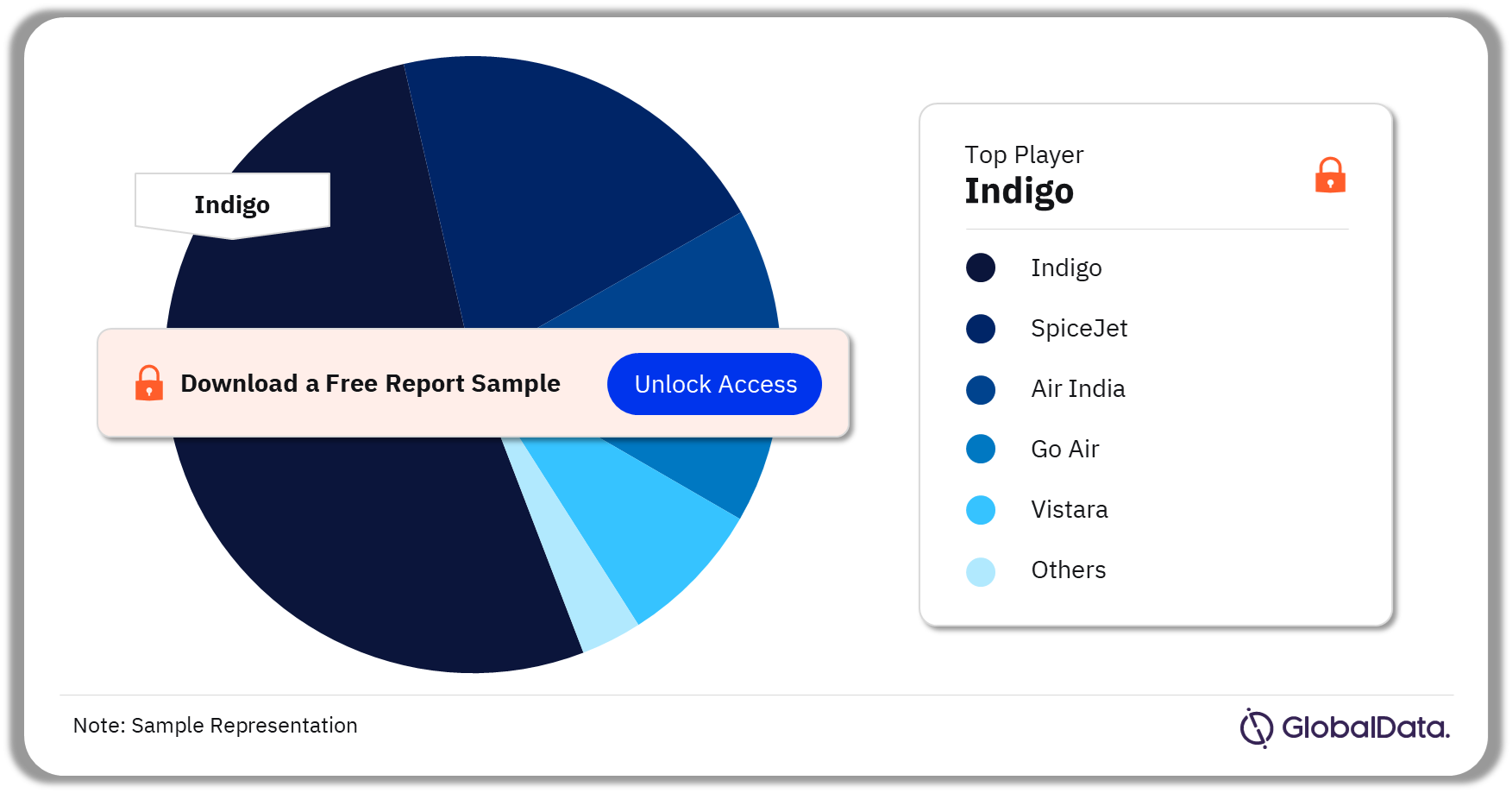

The key leaders in the Indian airlines sector are Indigo, SpiceJet, Air India, Go Air, Vistara, and Air Arabia among others. IndiGo leads the market with more than 50% market share which can be attributed to the airlines fleet of modern and highly fuel-efficient aircraft, ensuring a sustainable and environmentally friendly travel experience. Moreover, the airline places a strong emphasis on cost reduction strategies, particularly in key areas such as fuel consumption, maintenance, labor, and distribution.

Akasa Air is a newly established low-cost airline that emerged on the aviation scene in 2021.In July 2022, Akasa Air was granted its air operator’s certificate (AOC) by the Indian government, marking a significant milestone for the airline. Shortly after, on August 7, 2022, the airline commenced its commercial operations, offering a range of services to eager travelers.

Indian Airlines Analysis, by Number of Seats Sold, 2021 (%)

To know more about players in the Indian airlines’ sector, download a free report sample

Indian Low-Cost Airlines - SWOT Analysis

The presence of a substantial and expanding market for LCCs is evident due to the rapidly growing middle-class in the country. Low labor costs plays a crucial role in maintaining affordable prices for low-cost carriers (LCCs). Also, the growth of LCCs in India has received significant support from the government. The establishment of a favorable regulatory environment for Low-Cost Carriers (LCCs) has played a significant role in facilitating their growth and development.

The burgeoning e-commerce industry in India is paving the way for exciting prospects in the realm of Low-Cost Carriers (LCCs). They have the potential to form strategic alliances with e-commerce companies, thereby enabling them to provide enticing discounts and a range of promotional offers to online shoppers. Nevertheless, the intensification of competition within the market can potentially trigger price wars, resulting in a decline in profit margins.

Key Highlights

The 1990s liberalization and policy changes paved the way for low-cost carriers in India. The Indian government progressively allowed commercial airlines to compete with Air India. These reforms favored LCC expansion.

Indian low-cost carriers (LCCs) place a strong emphasis on operational efficiency, employing various strategies to maximize their performance. These include carefully planning flight schedules to ensure optimal utilization of resources, effectively managing crew members to maximize their productivity, and strategically planning routes to minimize costs and improve overall efficiency.

Akasa Air is a new entry as a budget-friendly airline that offers competitive fares, providing travelers with a cost-effective alternative to conventional carriers. The airline strategically implements cost reduction measures in various aspects, thereby effectively optimizing operational expenses. The company’s business model is similar to any to its competitors in India.

Reasons to Buy

Gain an understanding of Indian LCCs.

Recognize the potential of Indian LCCs.

Gain an understanding of business models of LCCs.

Akasa

Air India

Deccan air

SpiceJet

Indian Airlines

GoAir

AirAsia

Vistara

Table of Contents

Frequently asked questions

-

What are the key trends in the LCC market of India?

Affordability and accessibility are some of the key trends in the LCC market of India.

-

What is the main focus of LCCs in India?

The central focus of LCCs business models lies in providing affordable options, allowing airlines to effectively serve budget-conscious travelers and broaden their clientele.

-

What are the key players operating in the Indian airline sector?

The key players in the Indian airlines sector are Indigo, SpiceJet, Air India, Go Air, Vistara, and Air Arabia among others.

-

Which player leads the Indian airline sector?

IndiGo leads the market with more than 50% market share.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Airlines reports