Metaverse in Banking – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Metaverse in Banking Market Analysis Report Overview

The metaverse is a virtual world where users share experiences and interact in real-time within simulated scenarios. The metaverse brings together a range of next-generation technologies, from cloud computing to artificial intelligence (AI), blockchain, cryptocurrencies, augmented reality (AR), virtual reality (VR), and digital twins.

The ability to build new virtual worlds has empowered metaverse developers to shape their platforms’ ethos, economics, and transactional mechanisms. Therefore, banking, payment, and insurance companies have a unique opportunity to develop systems and infrastructures that capture a portion of the value flowing through metaverse economies.

The metaverse in banking thematic report takes an in-depth look at the impact of the metaverse in the banking industry. It identifies major challenges faced by banks and how the metaverse can help address them. Key players in the space are highlighted, including case study examples of metaverse implementations within the industry. An impact assessment details the areas of the metaverse where banking companies should focus their investments, while the data analysis section provides market size and growth forecasts.

| Metaverse Market Size (2020) | $36 Billion |

| CAGR (2020-2030) | >32% |

| Key Value Chain Components | Foundation Layer, Tools Layer, User Interface Layer, and Experience Layer |

| Leading Metaverse Adopters in Banking | CaixaBank, Citigroup, DBS, Deutsche Bank, Fidelity, Hana Bank, HSBC, and JPMorgan Chase |

| Leading Metaverse Vendors | Alibaba, Google, Apple, Epic Games, Meta, Microsoft, Naver’s Zepeto, and Niantic |

| Specialist Metaverse Vendors in Banking | ConsenSys, Developcoins, Security Tokenizer, TerraZero, Transak, and Xsolla |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Insights on the Metaverse’s impact on Banking Industry Download a Free Sample Report

Metaverse in Banking Value Chain Analysis

The key value chain components in the metaverse theme are the foundation layer, tools layer, user interface layer, and experience layer.

Foundation Layer: The foundation layer sets out the primary building blocks of the metaverse, which include semiconductors, components, connectivity, data management, and blockchain.

Metaverse Value Chain Analysis

Buy the Full Report for Additional Insights on the Metaverse Value Chain

Metaverse in Banking Industry Analysis

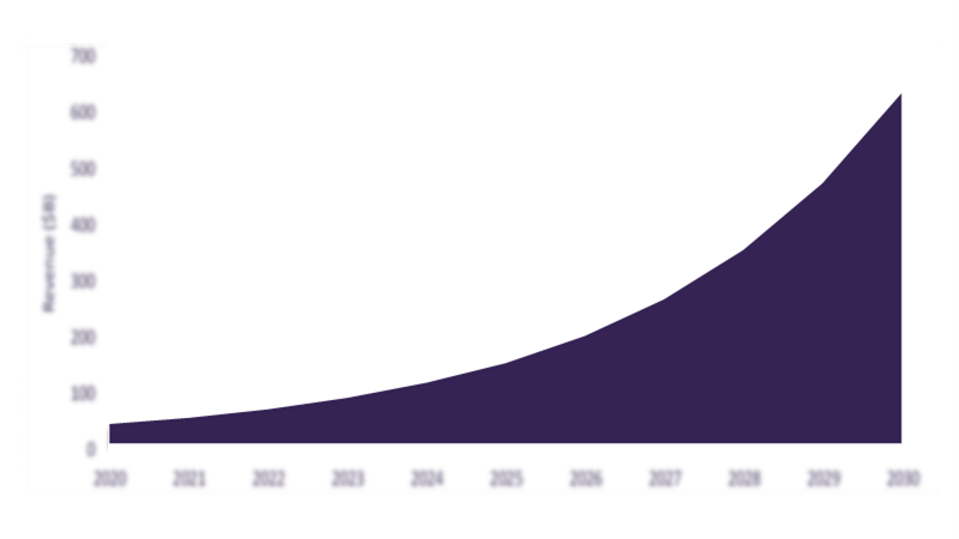

The metaverse market was valued at $36 billion in 2020 and is expected to grow at a CAGR of over 32% between 2020-2030. The banking sector’s adoption of cryptocurrency and blockchain has increased significantly in recent years and will account for 4% and 4.5% of metaverse revenue in 2025, respectively. Although these subsectors are a small proportion of metaverse growth, they will play an important role as more cryptocurrency payment frameworks and blockchain-based metaverse worlds are developed.

Metaverse Market Revenue 2020-2030 ($ Billion)

The metaverse in banking industry analysis also covers –

- Mergers and acquisitions

- Patent trends

- Company filings trends

- Hiring trends

- Social media trends

- Metaverse timeline

Buy The Full Report for Additional Metaverse Market Forecasts and Industry Analysis

Metaverse in Banking – Competitive Landscape

The key companies in the metaverse in banking theme are often classified as:

Leading Metaverse Adopters in Banking: CaixaBank, Citigroup, DBS, Deutsche Bank, Fidelity, Hana Bank, HSBC, and JPMorgan Chase among others are some of the leading metaverse adopters in the banking industry.

Leading Metaverse Vendors: Alibaba, Google, Apple, Epic Games, Meta, Microsoft, Naver’s Zepeto, and Niantic among others are the leading metaverse vendors.

Specialist Metaverse Vendors in Banking: ConsenSys, Developcoins, Security Tokenizer, TerraZero, Transak, and Xsolla among others are some of the leading specialist metaverse vendors in the banking theme.

Download A Free Sample Report or Buy the Full Report For More Insights on the Leading Companies

Metaverse in Banking – Scorecard Analysis

The scorecard approach is used to predict tomorrow’s leading companies within each sector using three screens including a thematic screen, a valuation screen, and a risk screen. The Metaverse in Banking thematic report offers scorecards for key sectors including the payments sector, retail banking sector, and wealth management sector.

Retail Banking Sector Scorecard Analysis

Buy the Full Report for Additional Insights on the Retail Banking Sector Scorecard

Scope

• One of the biggest challenges that banks face is channel shift. The metaverse can be viewed as a new channel where banks can facilitate virtual transactions through effective financial services.

• The banking industry’s adoption of cryptocurrency and blockchain has increased significantly in recent years and will account for 4% and 4.5% of metaverse revenue in 2025.

• US companies dominate metaverse-related patent publications in the banking industry, publishing 1,663 patents from January 2017 to July 2023.

Key Highlights

- One of the biggest challenges that banks face is channel shift. The metaverse can be viewed as a new channel where banks can facilitate virtual transactions through effective financial services.

- The banking industry’s adoption of cryptocurrency and blockchain has increased significantly in recent years and will account for 4% and 4.5% of metaverse revenue in 2025.

- US companies dominate metaverse-related patent publications in the banking industry, publishing 1,663 patents from January 2017 to July 2023.

Reasons to Buy

- Access market size and growth forecasts for the metaverse in banking.

- Identify metaverse leaders and laggards across payments, retail banking, and wealth management.

- Understand the key challenges facing the banking industry, and how the metaverse addresses these challenges.

- Access case study examples of metaverse vendors and investments within the banking industry.

- Understand metaverse adoption using alternative datasets and analysis showing M&A activity, mentions of metaverse technologies in company filings, and metaverse hiring trends in the banking industry.

ConsenSys

DBS

Deutsche Bank

Developcoins

Fidelity

HSBC

ING Groep

JPMorgan Chase

KEB Hana Bank

Klarna

La Caixa

Mastercard

NatWest Group

OCBC

Security Tokenizer

Standard Chartered

TerraZero

Transak

Worldline

Xsolla

Table of Contents

Frequently asked questions

-

What was the metaverse market size in 2020?

The metaverse market size was $36 billion in 2020.

-

What will be the CAGR in the metaverse market during 2020-2030?

The market is expected to grow at a CAGR of over 32% between 2020-2030.

-

Which are the main value chain components in the metaverse theme?

The key value chain components in the metaverse theme are the foundation layer, tools layer, user interface layer, and experience layer.

-

Who are the leading metaverse adopters in the banking industry?

CaixaBank, Citigroup, DBS, Deutsche Bank, Fidelity, Hana Bank, HSBC, and JPMorgan Chase among others are some of the leading metaverse adopters in the banking industry.

-

Who are the leading metaverse vendors?

Alibaba, Google, Apple, Epic Games, Meta, Microsoft, Naver’s Zepeto, and Niantic among others are the leading metaverse vendors.

-

Who are the specialist metaverse vendors in the banking sector?

ConsenSys, Developcoins, Security Tokenizer, TerraZero, Transak, and Xsolla among others are some of the leading specialist metaverse vendors in the banking theme.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Retail Banking and Lending reports