Ready-to-Drink (RTD) Beverages Market Size, Share, Trends and Analysis by Region, Product, Pack Size, Material and Segment Forecast to 2028

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘RTD Beverages’ report can help you:

- Understand various stakeholders across different stages of the entire value chain and make informed business decisions.

- Identify potential regions for mergers & acquisitions and venture financing activities.

- Identify competitors’ capabilities to stay ahead in the

- Identify segments and understand market trends, drivers, challenges, and opportunities for business growth.

- Anticipate changes in demand and adjust the business development

How is our ‘RTD Beverages’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 20 countries, including historical and forecast analysis for 2018-28.

- Detailed segmentation by:

- Product Type – Alcoholic Beverages and Non-Alcoholic Beverages

- Pack size type – 25cl, 33cl, 33.5cl, 50cl, and Others

- Pack material type – PET, Glass, Metal, Paper & Board, and Others

- The report covers key market trends, along with driving and challenges factors impacting the RTD Beverages Market.

- The report further analyzes the key consumer trends impacting the market growth to help stakeholders align their product portfolio in line with the latest developments.

- The report analyzes the entire value chain to help stakeholders improve their processes and adopt emerging technologies to enhance productivity and cost-effectiveness.

- The competitive landscape includes competitive positioning of leading companies and company share analysis in the IoT market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

We recommend this valuable source of information to:

- Soft Drinks Manufacturing Companies

- Breweries

- Startups

- Head of Market Intelligence

- Management Consultants

- Food & Beverages Technology Companies

- Equity Partners

- Venture Capital firm

Get a Snapshot of the RTD Beverages Market, Download a Free Report Sample

Ready-to-Drink Beverages Market Report Overview

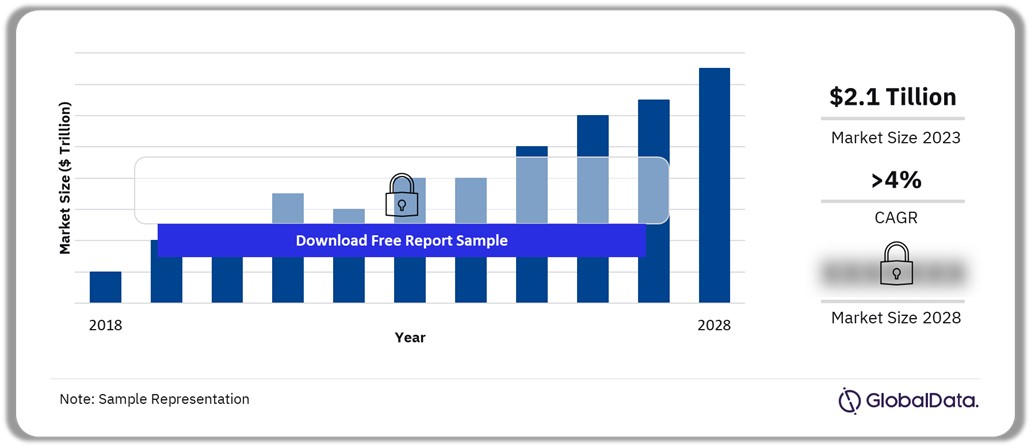

The ready-to-drink beverages market was valued at $2.1 trillion in 2023 and will grow at a compound annual growth rate (CAGR) of more than 4% over the forecast period. The market comprises both alcoholic and non-alcoholic beverages that are available in single-serve containers, requiring no additional mixing, dilution, or preparation. Busy lifestyles of urban consumers, increasingly seeking RTD beverages for convenience of consumption on the go,without compromising on taste or quality. The products available in the RTD beverages market effectively address this demand by offering quick and convenient options for refreshment, hydration, and enjoyment.

Ready-to-Drink Beverages Market Outlook, 2018-2028 ($ Trillion)

Buy the Full Report for Additional Insights on the RTD Beverages Market Forecast, Download a Free Report Sample

The increasing focus on health and wellness, catapulted due to the COVID-19 pandemic, is a significant factor driving the growth of the RTD beverages market. Consumers are actively seeking healthier beverage choices, such as low-sugar, natural, and functional drinks. In response to this trend, manufacturers are introducing a wide range of healthier RTD options, including natural fruit and vegetable juices, plant-based beverages, and functional drinks fortified with vitamins, minerals, and antioxidants.

The enhanced consumer access to RTD beverages across multiple distribution channels, including supermarkets, convenience stores, online retailers, and vending machines, has also played a pivotal role in the market’s growth.

Strong marketing and branding strategies have been instrumental in propelling the RTD beverages market. Companies are allocating significant resources to advertising, social media, and other promotional endeavors to enhance brand recognition and entice consumers. Robust branding is essential for distinguishing products in a highly competitive market and fostering customer loyalty.

Furthermore, the rising disposable income of consumers, especially in emerging economies, is driving the demand for convenient and high-quality RTD beverages. Manufacturers are consistently monitoring and adapting to the evolving consumer preferences with product innovations. This dynamic environment reflects significant growth potential for the market.

| Market Size (2023) | $2.1 trillion |

| CAGR (2024 – 2028) | >4% |

| Quantitative Units | Revenue in $ Million/Billion; Packaging Volume in Million Pack Units and CAGR 8 |

| Forecast Period | 2024 – 2028 |

| Historic Period | 2018 – 2022 |

| Report Scope & Coverage | Revenue Forecast, Packaging Volume Forecast, Competitive Landscape, and Growth Trends |

| RTD beverages Product Type | Alcoholic Beverages and Non-Alcoholic Beverages |

| RTD beverages Pack Size Type | 25cl, 35.5cl, 33cl, 50cl, and Others |

| RTD beverages Pack Material Type | PET, Glass, Metal, Paper & Boards, and Others |

| Key Companies | The Coca-Cola Company; AB InBev; PepsiCo, Inc.; Heineken; Molson Coors; Carlsberg Group; Asahi Group Holdings, Ltd.; Nestle; Keurig Dr. Pepper Inc.; and Danone Group |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

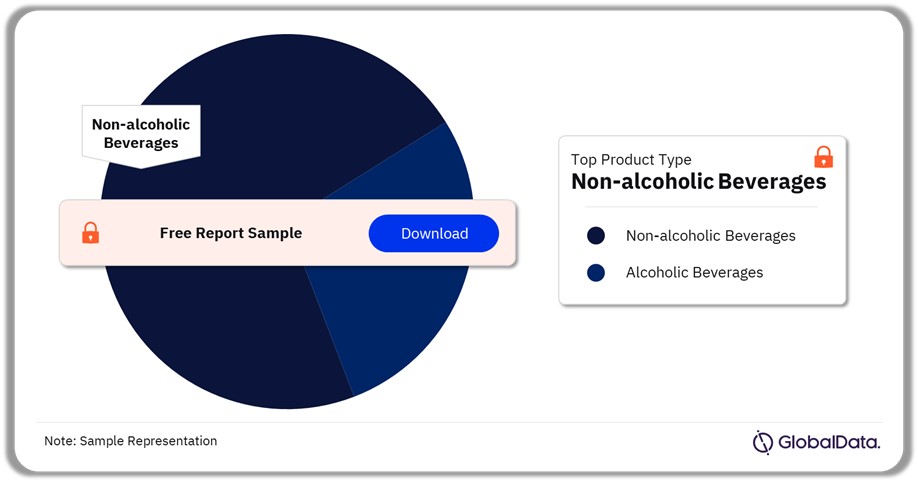

Ready-to-Drink Beverages Market Segmentation by Product Type

The RTD beverages market has been classified into alcoholic beverages and non-alcoholic beverages. In 2023, the non-alcoholic beverage products accounted for the highest revenue share of the market. The non-alcoholic beverages include, carbonated soft drinks, dairy milk, energy drinks, still drinks, iced/RTD coffee drinks, and iced/RTD tea drinks. Furthermore, the rises in incidences of lactose intolerance has contributed to the increasing demand for plant-based beverages. Also, growing concerns about animal welfare and a rising focus on health consciousness are prompting consumers to opt for dairy-free alternatives in the market, offering functional benefits such as added vitamins and minerals, high protein, and low fat.

The alcoholic beverages category features beer and flavored alcoholic beverages, with beer accounting for a higher revenue share in 2023.

Ready-to-Drink Beverages Market Share by Product Type, 2023 (%)

Buy the Full Report for Ready-to-Drink Beverages Product Type Insights, Download a Free Report Sample

In terms of growth, the alcoholic beverages segment is expected to register faster growth than the non-alcoholic beverages segment. This growth will be driven by dynamic consumer behavior, as individuals seek premium products due to increased disposable income and a desire for sophisticated, high-quality experiences. Additionally, companies are continuously introducing new flavors, blends, and packaging formats, enhancing the appeal of RTD alcoholic beverages for consumers in search of unique and enjoyable drinking experiences.

However, the alcoholic beverages segment will witness a marginal decline in response to a growing trend of health-conscious consumers refraining from alcohol consumption. To counteract this, alcoholic beverage manufacturers are increasingly introducing alcohol-free beer and spirits in RTD pack formats.

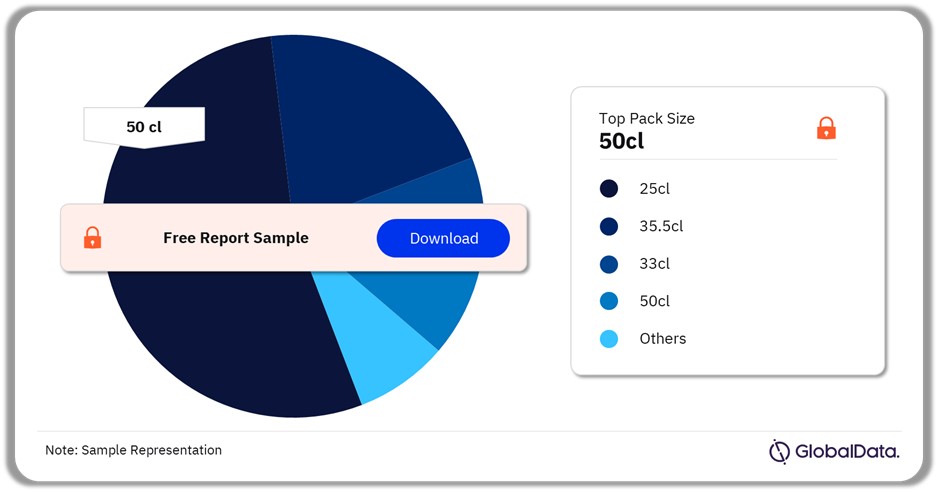

Ready-to-Drink Beverages Market Segmentation by Pack Size Type

The RTD beverages are catered in various convenient and single-serve format pack sizes that are easier to consume. In pack size type, 50cl pack size was leading the global RTD Beverages Market in 2023. The use of 50cl pack size was high across beverages, including beer, packaged water, carbonates, and iced/RTD tea drinks, amongst others. Other leading pack sizes that witnessed the highest usage include, 33cl, 33.5cl, and 25cl in 2023.

Ready-to-Drink Beverages Market Share by Pack Size Type, 2023 (%)

Buy the Full Report for More Insights into the Ready-to-Drink Beverages Pack Size Type, Download a Free Report Sample

25cl pack size is expected to register the fastest growth among the other pack sizes. Smaller packs allow consumers to sample a variety of flavors or brands without needing to purchase a larger pack. Health-conscious working consumers mostly prefer the 25cl pack size as it offers a controlled portion coupled with convenience while on the go. Also, 25cl packs are commonly priced lower than larger pack sizes, thereby increasing accessibility to a broader range of consumers.

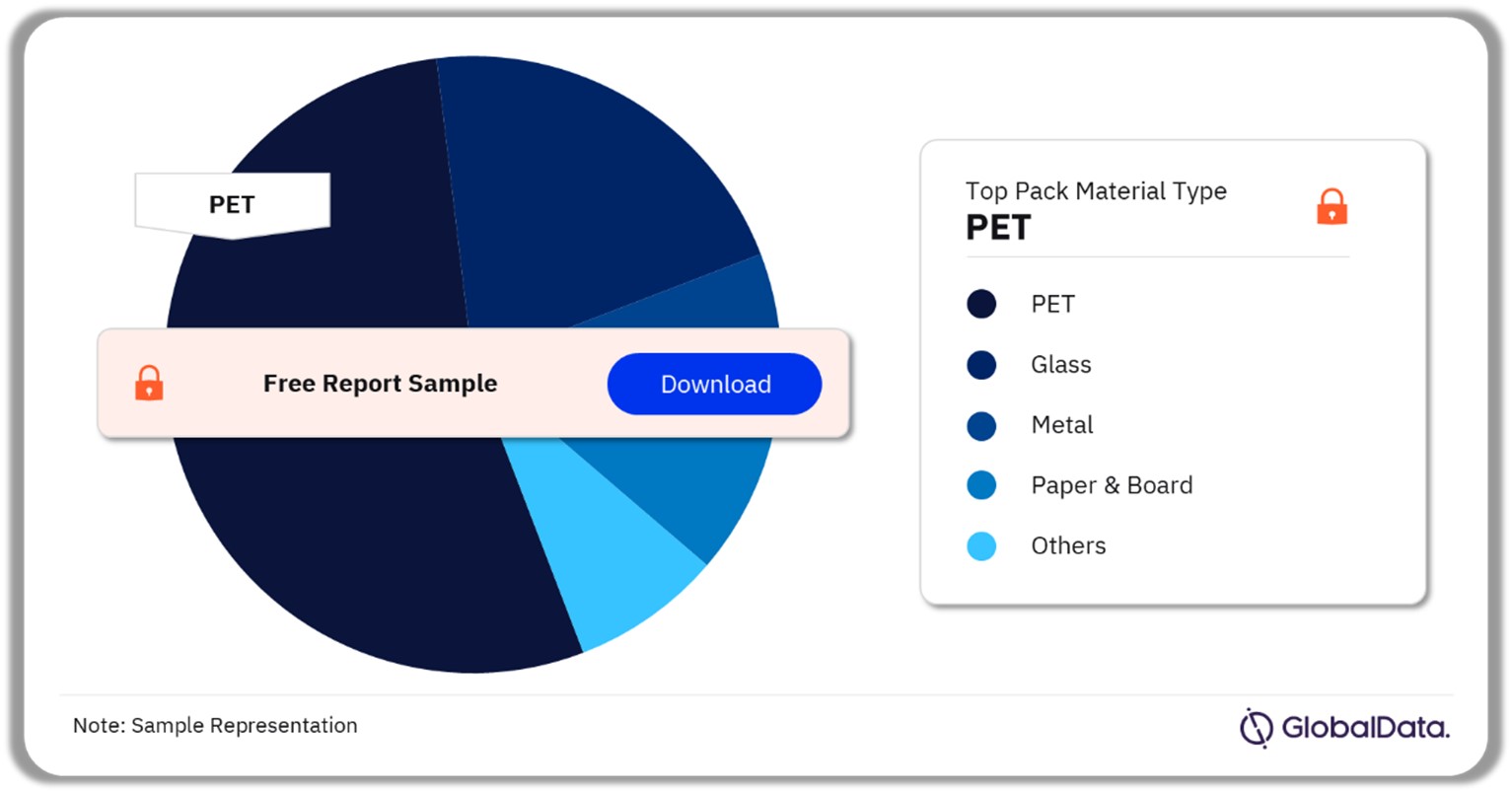

Ready-to-Drink Beverages Market Segmentation by Pack Material Type

The key pack materials type in the RTD beverages market are PET, glass, metal, and paper & board. In 2023, the PET pack material segment held the largest volume share in the market. This is attributed to its lightweight nature, which makes the beverage bottles easy to carry. Additionally, PET bottles’ transparency and clarity allow consumers to see the beverage inside, creating visual appeal and enabling them to assess the product’s quality before purchase.

Ready-to-Drink Beverages Market Share by Pack Material Type, 2023 (%)

Buy the Full Report for More Insights into the RTD Beverages Pack Material Type, Download a Free Report Sample

Amongst the pack material types, the PET segment is expected to register the fastest growth over the forecast period. The growth can be attributed to its high recyclability, appealing to consumers who prioritize ethical consumption and sustainable packaging solutions. Additionally, PET is a cost-effective packaging material compared to metal and glass, helping to reduce production costs and the price of the product.

RTD Beverages Market Segmentation by Region

The global RTD beverages market was led by the Asia-Pacific region in 2023, which is expected to remain the largest market over the forecast period. The region includes emerging economies such as India, Vietnam, and Indonesia, where urbanization rates are on the rise. Busier, fast-paced lifestyles among urban dwellers, are resulting in a growing demand for RTD beverages, as they offer convenience and ease of consumption. Additionally, the region has been undergoing rapid economic development, resulting in a growing middle-class population with higher disposable incomes. This has enabled consumers to spend on convenient and premium RTD beverages.

RTD Beverages Market Share by Region, 2023 (%)

Buy the Full Report for More Regional Insights into the RTD Beverages Market, Download a Free Report Sample

The ready-to-drink beverages market in Asia Pacific is expected to witness the fastest revenue growth over the forecast period. Within the region, China dominates the market, holding the largest revenue share. This is attributed to its large population base with high disposable incomes, which allows consumers to seek premium RTD beverages made with high-quality ingredients. In addition, beverage manufacturers in China have been making significant investments in product innovation and marketing campaigns to build brand awareness and attract consumers.

On the other hand, India is set to outpace other countries in the regional RTD Beverages Market over the forecast period. This is primarily due to the influence of Western culture on India’s large young population, impacting lifestyle trends and beverage consumption habits. India’s large and diverse population has varied taste preferences, motivating manufacturers to offer a wide range of flavors in RTD beverages, thus contributing to market growth. In addition, the hot weather conditions in India foster a favorable environment for the RTD Beverages Market to thrive, as consumers look for convenient, refreshing, and hydrating options to cope with the heat.

Ready-to-Drink Beverages Market - Competitive Landscape

Ready-to-Drink Beverages Market – Competitive Landscape

The RTD beverages market is fragmented, with many companies operating across various product types. While private labels compete with established brands in the non-alcoholic beverages segment in terms of both price and quality, their presence in the alcoholic beverages segment is minimal. Companies in the market have a strong foothold in their respective product offerings. For instance, The Coca-Cola Company dominates the RTD non-alcoholic beverages sector, followed by PepsiCo, Inc., and Nestle, whereas the RTD alcoholic beverages are led by AB InBev, Heineken, and Molson Coors.

Leading Companies in the Ready-to-Drink Beverages Market

- The Coca-Cola Company

- AB InBev

- PepsiCo, Inc.

- Heineken

- Molson Coors

- Carlsberg Group

- Asahi Group Holdings, Ltd.

- Nestle

- Keurig Dr. Pepper Inc.

- Danone Group

Other Ready-to-Drink Beverages Market Companies Mentioned

Kirin Group, Yili Group, Constellation Brands, Suntory Holdings Ltd., Monster Beverage Corporation, Red Bull GmbH, China Mengniu Dairy Co., Ltd., BlueTriton Brands, Diageo plc, Starbucks, Unilever, Groupe Lactalis SA, Thai Beverage Company.

Buy the Full Report to Know More About Leading Companies in the RTD Beverages Market

Download a Free Report Sample

RTD Beverages Market Scope

GlobalData Plc has segmented the RTD Beverages Market report by product type, packaging type, and region:

RTD Beverages Market Product Type Outlook (Revenue, $ Million, 2018-2028)

- Alcoholic Beverages

- Non-Alcoholic Beverages

RTD Beverages Market Pack Size Type Outlook (Volume, Pack Units Million, 2018-2028)

- 25cl

- 5cl

- 33cl

- 50cl

- Others

RTD Beverages Market Pack Material Type Outlook (Volume, Pack Units Million, 2018-2028)

- PET

- Glass

- Metal

- Paper & Board

- Others

RTD Beverages Market Regional Outlook (Revenue, $ Million, 2018-2028)

- North America

- US

- Canada

- Europe

- Germany

- UK

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- South & Central America

- Brazil

- Mexico

- Colombia

- Rest of South & Central America

- Middle East & Africa

- South Africa

- Nigeria

- Ethiopia

- Rest of Middle East & Africa

Key Players

The Coca-Cola CompanyA-BInBev

PepsiCo, Inc.

Heineken

Molson Coors

Carlsberg Group

Asahi Group Holdings, Ltd.

Nestle

Keurig Dr. Pepper Inc.

Danone Group

Table of Contents

Table

Figures

Frequently asked questions

-

What was the RTD beverages market size in 2023?

The global RTD beverages market was valued at $2.1 trillion in 2023.

-

What is the estimated RTD beverages market growth rate during the forecast period?

The RTD beverages market is expected to grow at a CAGR of more than 4% over the forecast period.

-

What is the estimated RTD beverages market growth rate during the forecast period?

The RTD beverages market is expected to grow at a CAGR of 4.8% during the forecast period (2023-2027).

-

What are the key RTD beverages market drivers?

Convenience, value-for-money options, increasing health consciousness, and a rise in investment and product innovation are anticipated to drive the RTD beverages market.

-

Which was the leading product type in the RTD beverages market in 2023?

Non-alcoholic beverages was the leading product type in the RTD beverages market in 2023.

-

Which was the leading pack size type in the RTD beverages market in 2023?

The 50cl pack type accounted for the highest share of the RTD beverages market in 2023.

-

Which was the leading pack material type in the RTD beverages market in 2023?

PET was the leading pack material type in the RTD beverages market in 2023.

-

Which are the leading RTD beverages companies?

The leading RTD beverages companies are The Coca-Cola Company, AB InBev, PepsiCo, Inc., Heineken, Molson Coors, Carlsberg Group, Asahi Group Holdings, Ltd., Nestle, Keurig Dr. Pepper Inc., and Danone Group.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.