Soups Market Opportunities, Trends, Growth Analysis and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Soup Market Report Overview

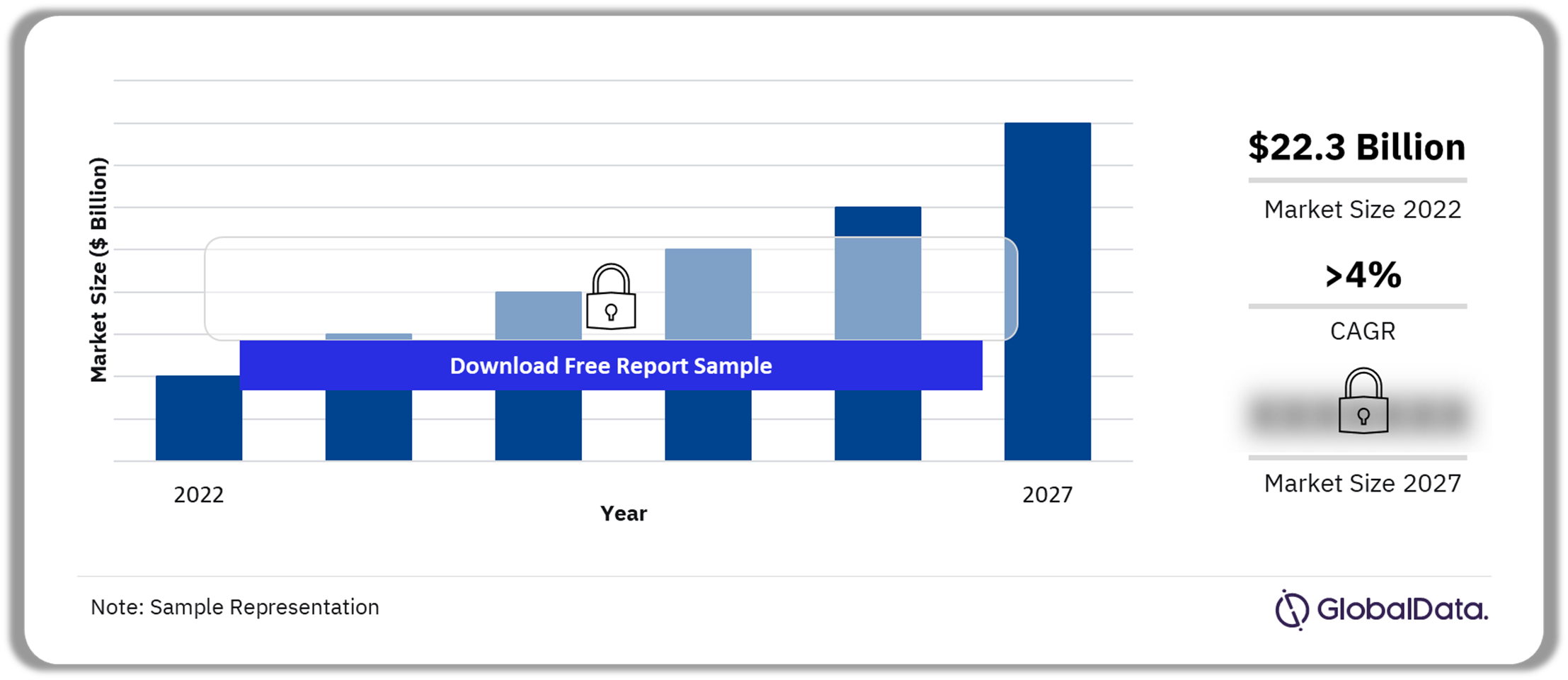

The soup market size was estimated at $22.3 billion in 2022 and is likely to grow at a CAGR of more than 4% from 2022 to 2027. The rise in consumers’ purchasing power and investments by leading manufacturers in capacity expansion will enable the sector’s growth in the future.

Soup Market Outlook 2022-2027 ($ Billion)

Buy the Full Report for Soup Market Forecasts

The soup market research report covers a comprehensive overview of consumption of various soups by category, for the period 2017-2027. To help market players understand future market opportunities, the report covers high-potential countries based on key factors such as economic development, governance, socio-demography, and technological infrastructure.

The actionable insights, through our elaborate soup profiling and company market share details, help gain a competitive advantage and get familiarized with offerings by leading brands. Furthermore, our analysts have reviewed the distribution channels and the packaging materials based on volume sales of soups, to identify better avenues for market reach and soup exposure.

| Market Size (2022) | $22.3 Billion |

| CAGR (2022-2027) | >4% |

| Historic Period | 2017-2021 |

| Forecast Period | 2022-2027 |

| Key Categories | • Ambient Soup

• Dried Soup (mixes) • UHT Soup • Chilled Soup • Frozen Soup |

| Key Regions | • Asia-Pacific

• Middle East and Africa • The Americas • Western Europe • Eastern Europe |

| Key Distribution Channels | • Hypermarkets & Supermarkets

• Convenience Stores • Dollar Stores • E-retailers • Others |

| Key Packaging Types | • Flexible Packaging

• Paper & Board • Rigid Plastics • Rigid Metal • Glass |

| Leading Companies | • Unilever

• Campbell Soup Company • Nestlé • General Mills • Continental Foods |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

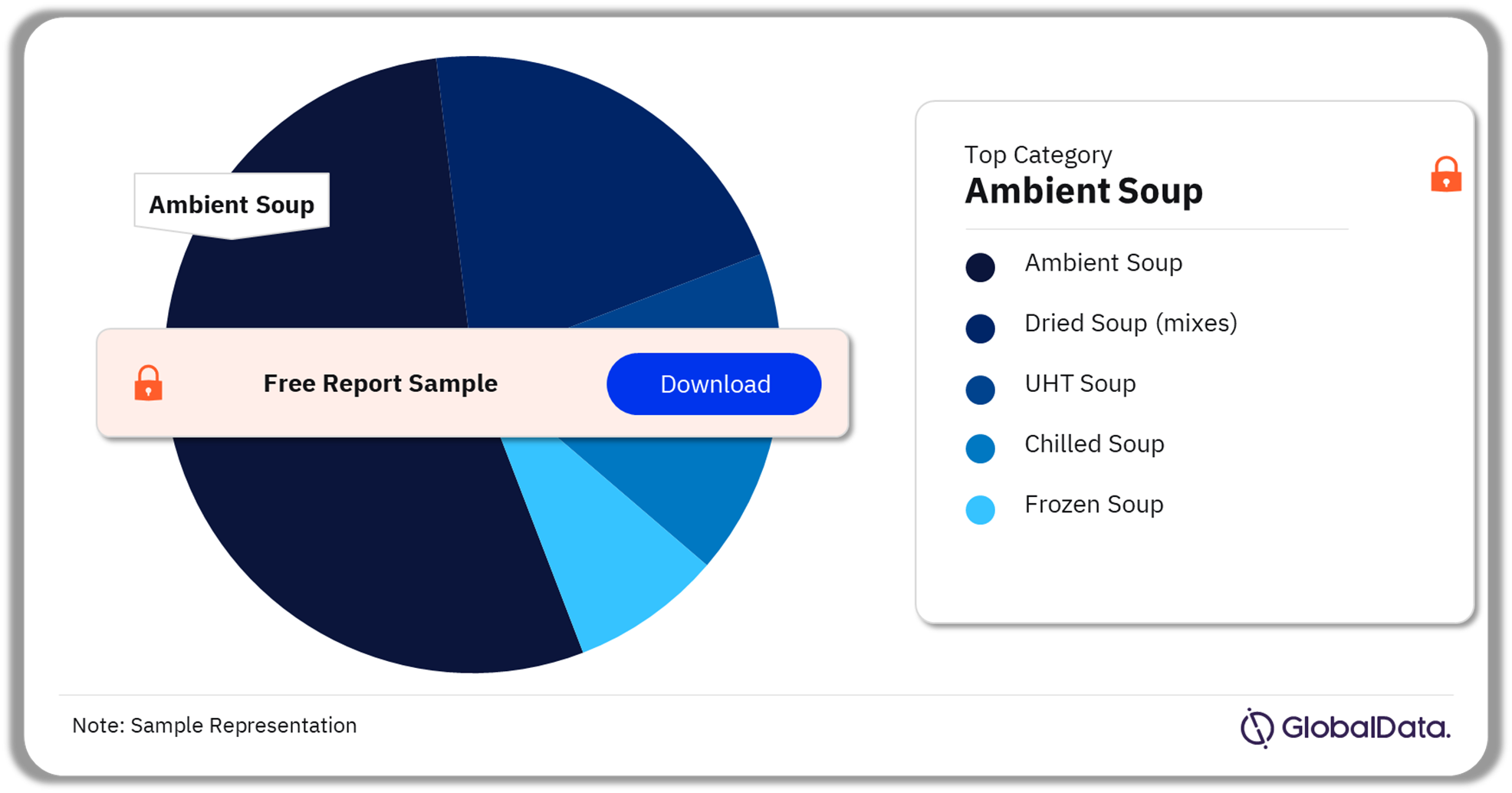

Soup Market Segmentation by Category

The key categories in the soup market are ambient soup, dried soup (mixes), UHT soup, chilled soup, and frozen soup. In 2022, the ambient soup category accounted for the highest value sales. Factors such as investments in innovation by leading manufacturers and growing health awareness will positively impact the demand for soup products around the world in the future.

Soup Market Analysis by Category, 2022 (%)

Buy the Full Report for Information on the Soup Categories

Download a Free Sample Report

Soup Market Segmentation by Regions

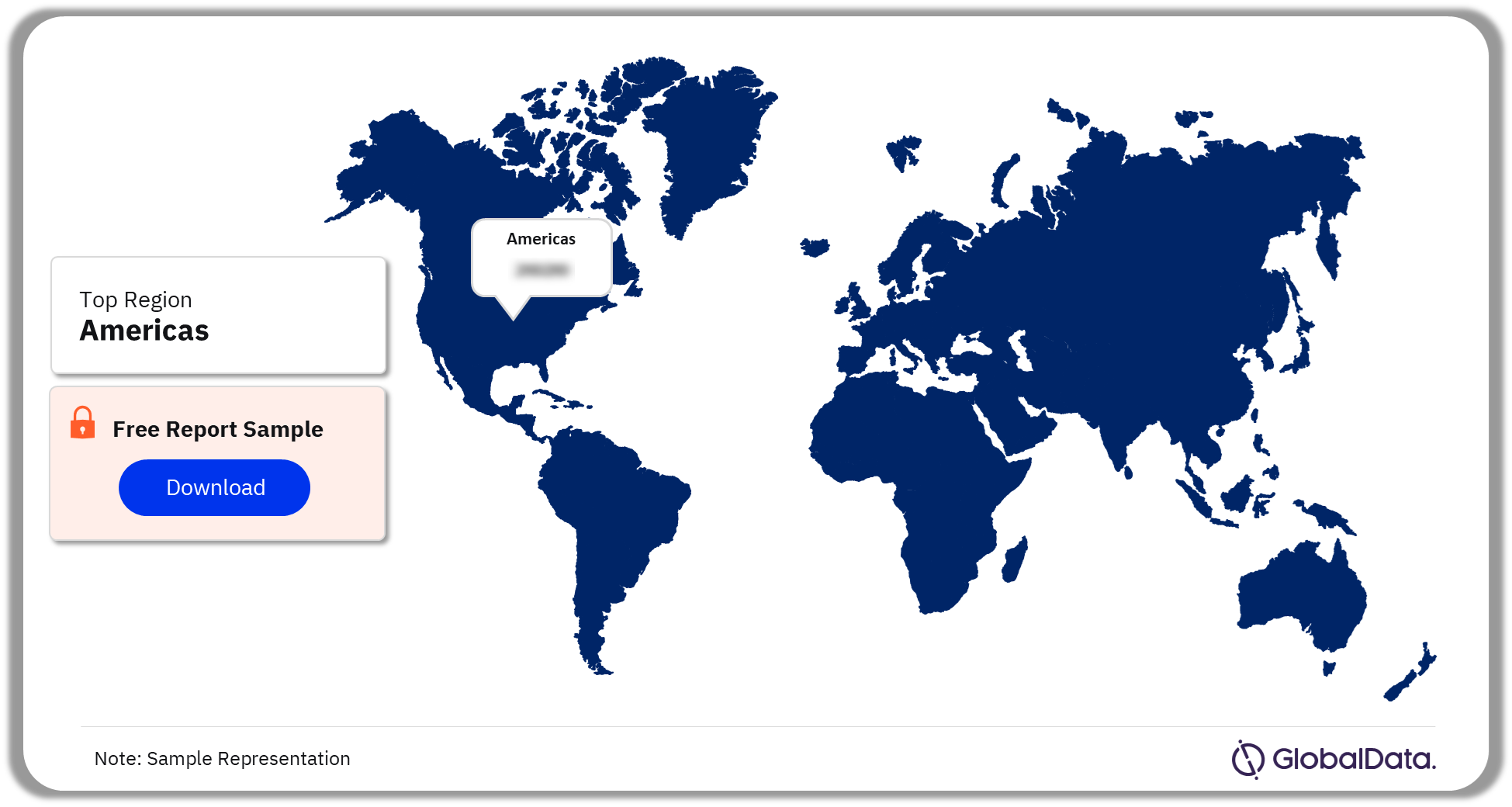

The key regions in the soup market are Asia-Pacific, the Middle East and Africa, the Americas, Western Europe, and Eastern Europe. The Americas was the largest soup market in the world in terms of revenue contribution in 2022. Factors such as the rising popularity of online channels and new product launches will play an important role in fueling the sector’s growth in the future. Additionally, growth in the tourism and hospitality sectors will also be instrumental in pushing up the sector’s value in the future.

In 2022, the high-potential countries in the soup market identified were Japan, India, Canada, Mexico, and Lebanon among others.

Soup Market Analysis by Regions, 2022 (%)

Buy the Full Report for More Regional Insights on the Soup Market

Download a Free Sample Report

Soup Market Segmentation by Distribution Channel

The key distribution channels in the soup market are hypermarkets & supermarkets, convenience stores, dollar stores, and e-retailers among others. In 2022, the hypermarkets & supermarkets channel accounted for the highest share of the soup sector, followed by convenience stores.

Soup Market Analysis by Distribution Channel, 2022 (%)

Buy the Full Report for Distribution Channel Insights into the Soup Market

Soup Market Segmentation by Packaging Material

The key packaging materials in the soup market are flexible packaging, paper & board, rigid plastics, rigid metal, and glass. Flexible packaging was the most used pack material in the soup industry in 2022. Additionally, the bag/sachet pack type was the most used in the soup industry in the same year.

Soup Market Analysis by Packaging Material, 2022 (%)

Buy the Full Report for Packaging Insights into the Soup Market

Download a Free Sample Report

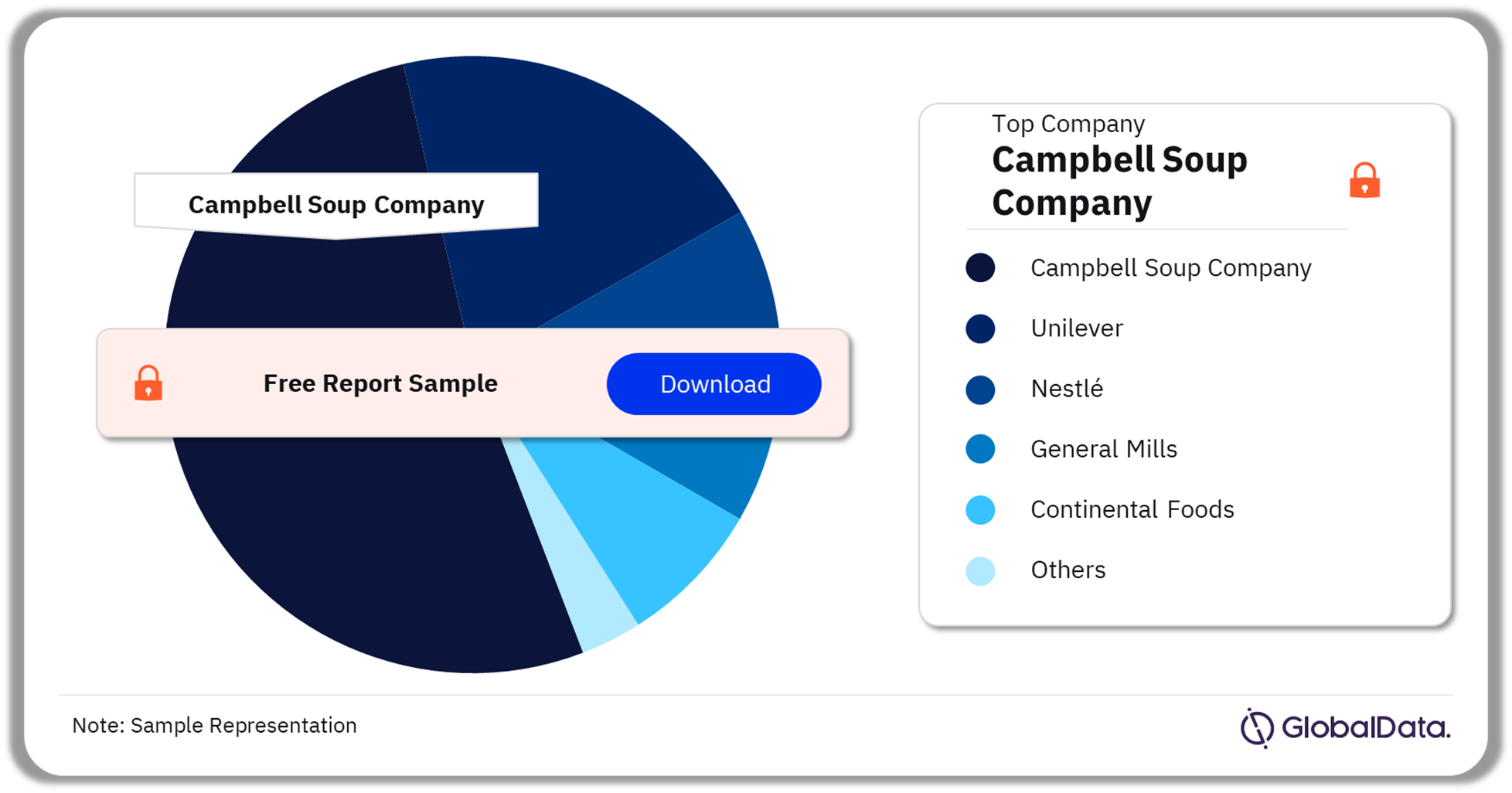

Soup Market – Competitive Landscape

The key companies in the Soup market are Campbell Soup Company, Unilever, Nestlé, General Mills, and Continental Foods among others. In 2022, Campbell Soup Company emerged as the market leader. A few of the key brands of Campbell Soup Company are Campbell’s, Habitant, Healthy Request, and Lacroix among others.

Soup Market Analysis by Companies, 2022 (%)

Buy the Full Report for Company-Wise Soup Market Insights

Download a Free Sample Report

Key Segments Covered in this Report.

Soup Category Outlook (Value, $ Billion, 2017-2027)

- Ambient Soup

- Dried Soup (mixes)

- UHT Soup

- Chilled Soup

- Frozen Soup

Soup Regional Outlook (Value, $ Billion, 2017-2027)

- Asia-Pacific

- Middle East and Africa

- The Americas

- Western Europe

- Eastern Europe

Soup Distribution Channel Outlook (Value, $ Billion, 2017-2027)

- Hypermarkets & Supermarkets

- Convenience Stores

- Dollar Stores

- E-retailers

- Others

Soup Packaging Outlook (Value, $ Billion, 2017-2027)

- Flexible Packaging

- Paper & Board

- Rigid Plastics

- Rigid Metal

- Glass

Scope

This report brings together multiple data sources and provides:

- A comprehensive overview of the global soup sector, analyzing data from 107 countries.

- Sector overview: Provides an overview of the current sector scenarios in terms of ingredients, manufacturer claims, labeling, and packaging.

- Regional overview: Provides an overview of five regions-the Asia-Pacific, the Middle East and Africa, the Americas, Western Europe, and Eastern Europe-highlighting sector size, growth drivers, the latest developments, and future challenges for each region.

- Change in consumption: Provides an overview of changes in the consumption of soup over 2017-2027, at global and regional levels.

- High-potential countries: Provides risk-reward analysis of the top two high-potential countries in each region based on market assessment, economic development, governance indicators, socio-demographic factors, and technological infrastructure.

Reasons to Buy

- Get the latest information on how the market is evolving to formulate sales and marketing strategies. The report offers authentic market data with a high level of detail.

- Get up-to-date information and analysis to uncover emerging opportunities for growth within the soup sector.

- Get a detailed analysis of the countries in the region, covering the key challenges, competitive landscape, and demographic analysis, which can help companies gain insight into the country-specific nuances.

- Understand the key trends that drive consumer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

- Gain competitive intelligence about leading brands in the sector in the region with information about their market share and growth rates.

Unilever

Nestlé

General Mills

Continental Foods

Pokka Corporation

Nagatanien

Premier Foods

Mars

Amadeh Laziz

Hormel Foods

The Kraft Heinz

Findus Group

Podravka

Orkla

Ajinomoto

Table of Contents

Table

Figures

Frequently asked questions

-

What was the soup market size in 2022?

The soup market size was estimated at $22.3 billion in 2022.

-

What will the soup market growth rate be during 2022-2027?

The soup sector is likely to grow at a CAGR of more than 4% from 2022 to 2027.

-

Which was the leading category in the soup market in 2022?

In 2022, the ambient soup category accounted for the highest value sales.

-

Which was the dominant distribution channel in the soup market in 2022?

The hypermarkets & supermarkets emerged as the leading distribution channel in the soup market in 2022.

-

Which was the most preferred packaging type in the soup market in 2022?

Flexible packaging was the most used pack material in the soup industry in 2022.

-

Which are the key companies in the soup market?

The key companies in the Soup market are Campbell Soup Company, Unilever, Nestlé, General Mills, and Continental Foods among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.