United Kingdom (UK) Accessories Market Analysis, Trends, Consumer Preferences and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Accessories Market Report Overview

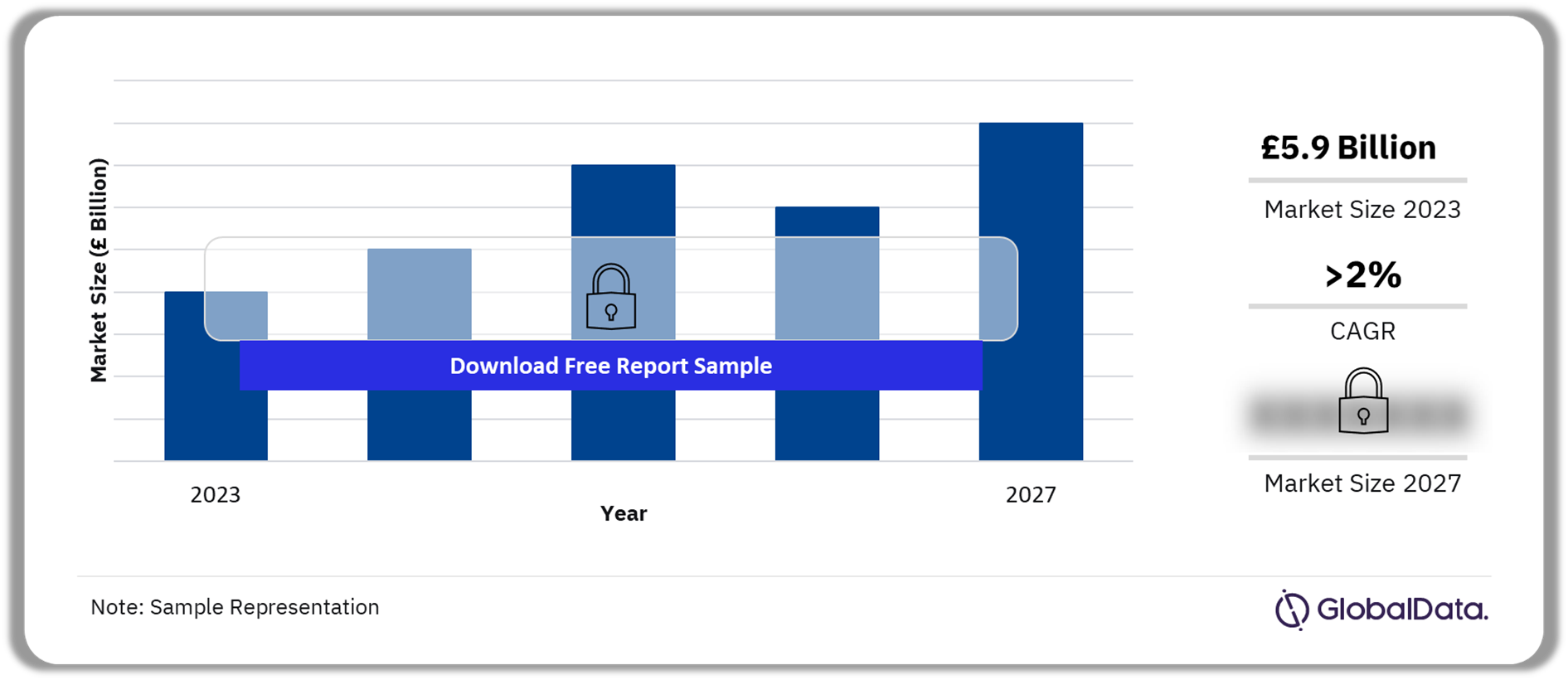

The United Kingdom (UK) accessories market size was £5.9 billion in 2023. The market is expected to grow at a CAGR of more than 2% during 2023-2027. Even though inflationary pressures led consumers to cut back on fashion spend due to higher prices and less discretionary income, the high presence of luxury goods within the fashion sector allowed accessories to achieve slightly stronger growth than clothing and footwear.

UK Accessories Market Outlook, 2023-2027 (£ Billion)

Buy the Full Report for More Insights into the UK Accessories Market Forecast

The UK Accessories market research report offers a comprehensive insight into the dynamics and spending habits of the UK consumers for accessories. The report analyzes the major players, the main trends, and consumer attitudes to identify the target audience and create smart business goals.

| Market Size | £5.9 Billion |

| CAGR (2023-2027) | >2% |

| Historical Period | 2017-2022 |

| Forecast Period | 2023-2027 |

| Key Categories | · Accessories

· Clothing · Footwear |

| Key Channels | · Instore

· Online · Mail Order/Catalog |

| Leading Retailers | · Next

· Louis Vuitton · Primark · Marks & Spencer · JD Sports |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Accessories Market Drivers

- The UK consumers have reduced discretionary spending as they are continuing to be hit by the ongoing cost-of-living crisis. However, the low price points of some accessory categories, such as fashion jewelry and hair accessories, offer shoppers an affordable way to style their looks.

- Luxury retailers and brands are driving sales for a high proportion of handbags. The outperformance of the luxury sector will aid the UK accessories market as well. Luxury shoppers will be more resilient amid the macroeconomic challenges in the UK. However, the scrapping of tax-free shopping for tourists will hinder the potential benefits from this, as some spending is diverted to other major European destinations.

UK Accessories Market Trends

A few of the key trends in the UK accessories market are the resale market, the presence of exclusive collections and experiences in department stores, and collaborations.

Accessories Resale Market: The UK accessories resale market has witnessed strong growth in recent years and will continue to do so. The majority of customers prefer secondhand accessories to save money as well as to be more sustainable. The rise in demand for secondhand luxury accessories could put brand-new retail sales at risk. In addition, accessories retailers have begun launching their resale propositions or partnering with existing platforms to benefit.

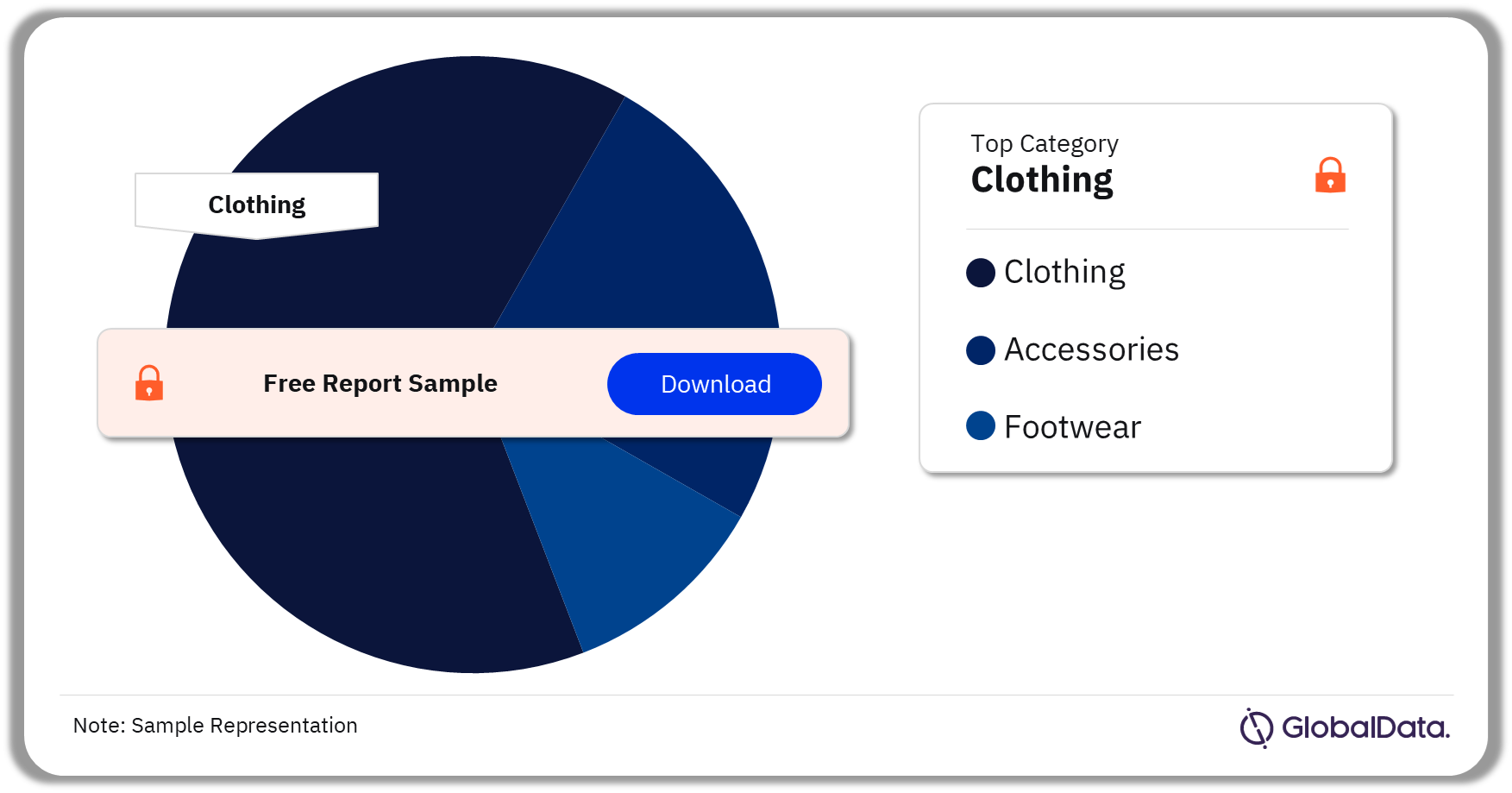

UK Accessories Market Segmentation by Categories

The key categories in the UK accessories market are accessories, clothing, and footwear. In 2023, the clothing category dominated the UK accessories market.

UK Accessories Market Analysis by Categories, 2023 (%)

Buy the Full Report for More Category Insights into the UK Accessories Market

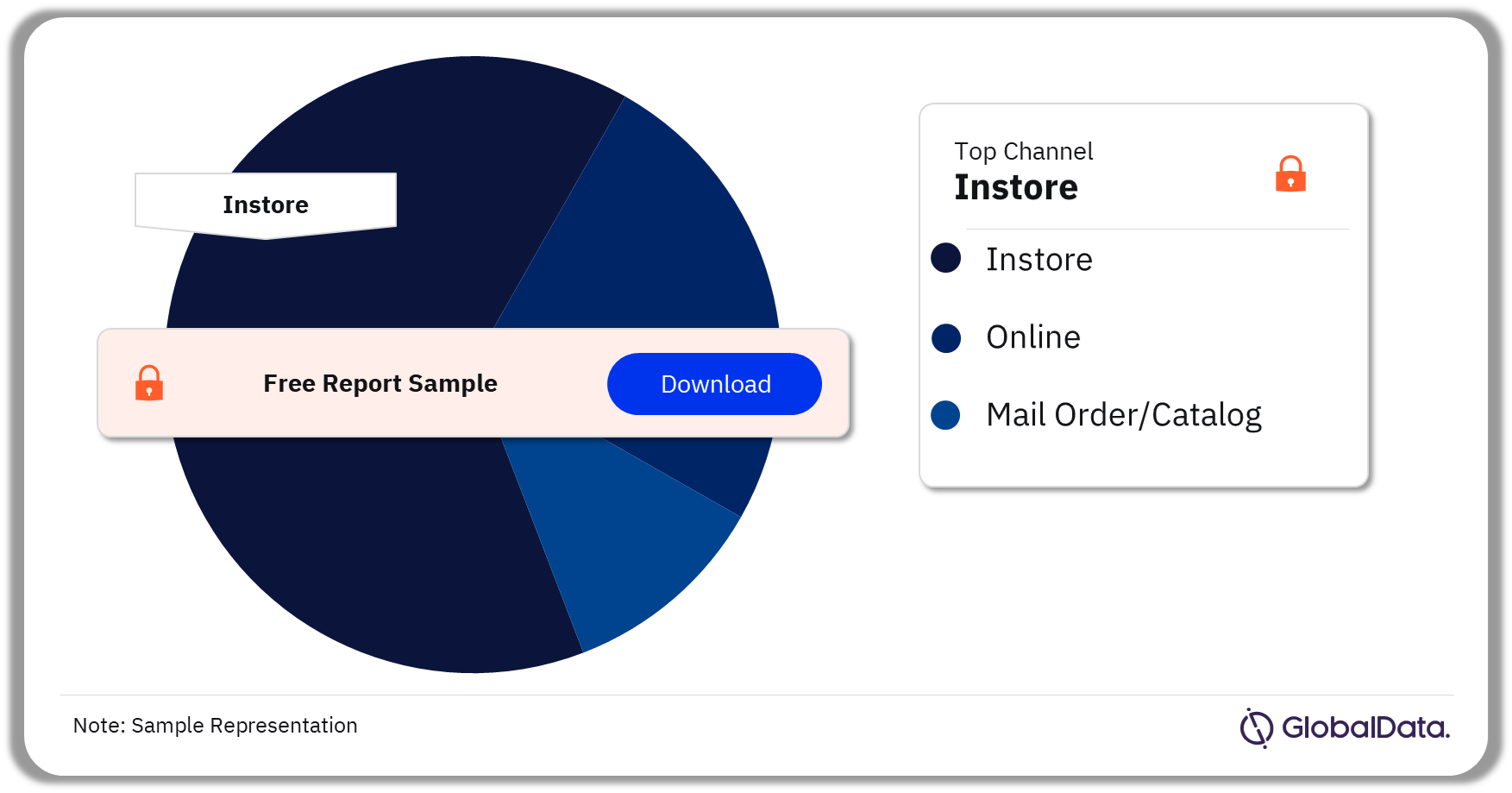

UK Accessories Market Segmentation by Channels

The key channels in the UK accessories market are instore, online, and mail order/catalog. Instore was the most popular channel for accessories purchases in 2023. Lower-priced items were often impulse buys that did not justify online delivery fees. Multichannel retailers such as Next and M&S continued to benefit from digital enhancements, leading the online channel to slightly outperform the offline channel.

UK Accessories Market Analysis by Channels, 2023 (%)

Buy the Full Report for More Channel Insights into the UK Accessories Market

UK Accessories Market – Competitive Landscape

A few of the leading retailers in the UK accessories market are:

- Next

- Louis Vuitton

- Primark

- Marks & Spencer

- JD Sports

In 2023, Next accounted for the highest share in the UK accessories market, followed by Louis Vuitton.

UK Accessories Market Analysis by Retailers, 2023 (%)

Buy the Full Report for Retailer Insights into the UK Accessories Market

UK Accessories Market – Latest Developments

- In October 2022, Ted Baker was purchased by Authentic Brands Group that appointed retail management business AARC to run the company’s stores and website in the UK and Europe, providing it with a short-term loan that led to the axing of 200 head office jobs.

- Burberry has been undergoing an overhaul under new creative director Daniel Lee, whose first collection launched in its 21 physical UK stores and online in September 2023. Burberry hopes to make customers regain interest in the brand through better quality, higher-priced pieces. To raise awareness of this, it has invested heavily in marketing campaigns such as the renaming of Bond Street station to ‘Burberry Street’ during London Fashion Week in September 2023.

Segments Covered in the Report

UK Accessories Market Categories Outlook (Value, £ Billion, 2017-2027)

- Accessories

- Clothing

- Footwear

UK Accessories Market Channels Outlook (Value, £ Billion, 2017-2027)

- Instore

- Online

- Mail Order/Catalog

Key Highlights

- In 2023, the accessories market grew marginally, as inflationary pressures led consumers to cut back on fashion spend due to higher prices and less discretionary income. However, the high presence of luxury goods within the sector allowed accessories to achieve slightly stronger growth than clothing and footwear.

- The online UK accessories market grew marginally in 2023, as pureplays such as ASOS and Boohoo witnessed a slowdown in demand due to the shift back to stores.

- Luxury players like Louis Vuitton and Chanel won market share in 2023 thanks to wealthy shoppers’ resilience amid economic challenges, while value players like Primark are also supported by consumers’ trading down.

- As tourist numbers normalize following the pandemic, the UK accessories market is losing out due to the UK government’s decision to remove tax-free shopping in January 2021, as international tourists divert spend to other European shopping destinations where tax-free shopping is still available.

Reasons to Buy

- Understand where the demand lies within the UK accessories market across various price positionings, categories, and retailers, to allow you to maximize customer acquisition.

- Learn how continued inflationary challenges will impact the UK accessories market, and which players are most at threat from changing consumer habits.

- Identify the key approaches retailers are taking to stand out in the UK accessories market, and how you can adapt these to fit your own business.

Adidas

Amazon

Anya Hindmarch

ASDA

ASOS

Bershka

Bulgari

Burberry

Chanel

Claire's Accessories

Cocoon

Dior

Ebay

Fendi

Givenchy

Gucci

H&M

Harrods

Hey Harper

John Lewis & Partners

Loewe

Longchamp

Louis Vuitton

Marks & Spencer

Marni

Matalan

Mulberry

New Look

Next

Oliver Bonas

Peter Jones

Polène

Prada

Primark

Rains

Rebelle

Sainsbury's

Selfridges

Shein

Skims

Stubble & Co

Supreme

Swarovski

Ted Baker

Tesco

Tiffany & Co

Timex

TK Maxx

Uniqlo

Urban Outfitters

Valentino

Versace

Vestiaire Collective

Weinsato

Zara

Table of Contents

Table

Figures

Frequently asked questions

-

What was the accessories market size in the UK in 2023?

The UK accessories market size was £5.9 billion in 2023.

-

What will the UK accessories market growth rate be during the forecast period?

The UK accessories market is expected to grow at a CAGR of more than 2% during 2023-2027.

-

Which category dominated the UK accessories market in 2023?

In 2023, the clothing category dominated the UK accessories market.

-

Which are the leading retailers in the UK accessories market?

A few of the leading retailers in the UK accessories market are Next, Louis Vuitton, Primark, Marks & Spencer, and JD Sports, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.