22 Oct, 2021 BMO Capital Markets top M&A financial adviser in metals & mining sector for Q1-Q3 2021, finds GlobalData

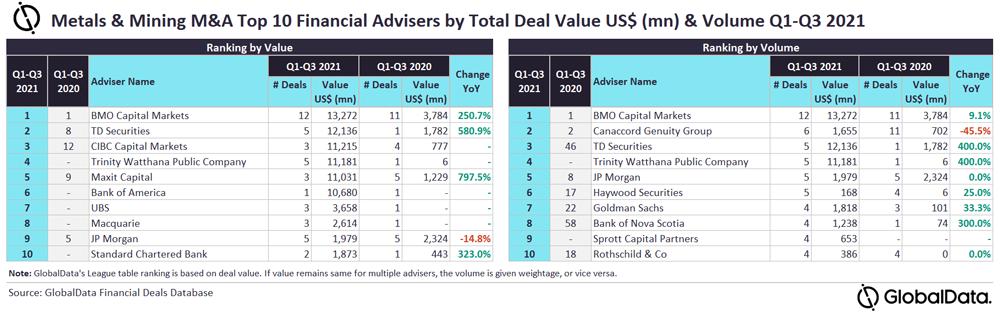

Posted in Business FundamentalsBMO Capital Markets has emerged as the top financial adviser for mergers and acquisitions (M&A) by both value and volume in the metals & mining sector for Q1-Q3 2021, having advised on 12 deals worth US$13.3bn. A total of 1,116 M&A deals were announced in the sector during Q1-Q3 2021, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and Metals & Mining M&A Report Financial Adviser League Tables Q1-Q3 2021’, deal value for the sector increased by 64.7% from $34bn during Q1-Q3 2020 to $56bn during Q1-Q3 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “BMO Capital Markets witnessed significant improvement in deal value in Q1-Q3 2021 compared to Q1-Q3 2020. It also witnessed growth in deal volume.

“The firm had tough competition from TD Securities for the top spot in terms of value, however, BMO Capital Markets managed to beat its competitors to the top spot due to its involvement in greater volume.”

TD Securities secured the second position in terms of value with five deals worth $12.1bn, followed by CIBC Capital Markets with three deals worth $11.2bn, Trinity Watthana Public Company with five deals worth $11.2bn and Maxit Capital with three deals worth $11bn.

Canaccord Genuity Group occupied the second position in terms of volume with six deals worth $1.7bn, followed by TD Securities and Trinity Watthana Public Company. JP Morgan occupied the fifth position by volume with five deals worth $2bn.