25 Apr, 2022 UK has the most thriving oncology-focused startup and venture capital ecosystem in Europe, says GlobalData

Posted in PharmaVenture capital (VC) plays a critical role in the identification and commercialization of promising intellectual property, facilitating new therapy development, says GlobalData. The leading data and analytics company notes that the UK has a thriving oncology-focused startup and VC scene, producing successful healthtech startups such as BenevolentAI and Exscientia, both of which have achieved unicorn status*.

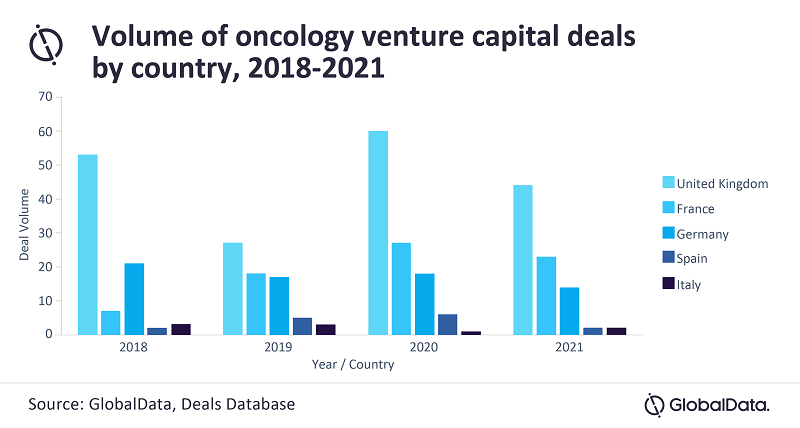

According to GlobalData, the volume of oncology VC deals in the UK over the last five years has towered over other members of the five European major markets (5EU MM**), indicating a far larger number of startup companies and a thriving oncology-focused VC scene in the UK. In 2021, there were 44 oncology-focused deals in the UK, nearly double that of the next highest volume with 23 deals in France.

Sam Warburton, Oncology and Hematology Analyst at GlobalData, comments: “Most oncology VC deals take place in the preclinical and discovery stages, but there are also frequent financing rounds in the clinical stages of development. From an investor’s perspective, there needs to be the right balance of risk vs reward when investing in an oncology-focused startup. In the drug lifecycle, attrition rates are at the highest in the preclinical phase, therefore risk is at its peak and so investors are typically compensated with higher equity, allowing higher returns upon successful exit. In Phase II, the risks are significantly lower as there is data available regarding the drug’s safety and efficacy, but at this stage there is less equity available to be compensated.”

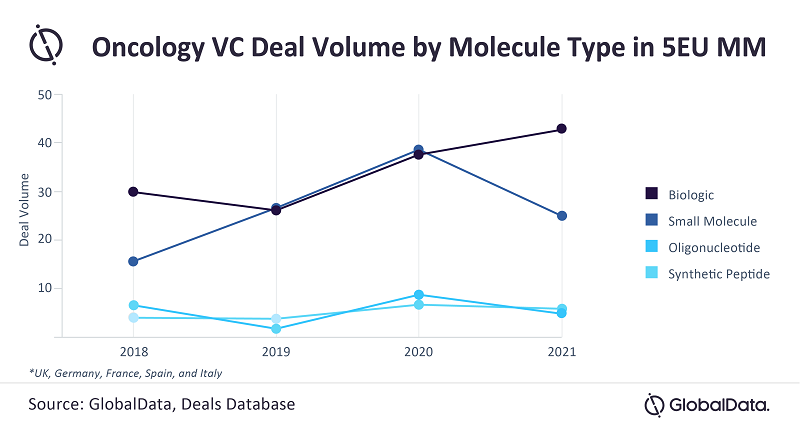

There was a renewed interest in investing in biologics in 2021, which, by deal volume, have surpassed small molecules in oncology VC, according to GlobalData.

Warburton adds: “Biologics are becoming increasingly attractive to invest in for several reasons, both clinical and commercial. Clinically, biologics are typically believed to have higher specificity than small molecules, which tend to be quite promiscuous, therefore the potential for side-effects is lower for biologics. Commercially, biologics typically experience less fierce competition upon patent expiry as they are significantly more complex than small molecules and harder to copy to produce biosimilars. Since it takes more time and resources for the competition to capture market share from the original biologic, sales erode more slowly.”

*Valued at above $1 billion

**UK, Germany, France, Spain, and Italy