Explorer DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Analysis: Could UK self-driving unicorn Wayve overtake its competitors?

UK-based autonomous vehicle (AV) technology startup Wayve announced on Tuesday (7 May) that it had raised $1.05bn in a funding round led by SoftBank Group. The funding will be used to boost the development of its Embodied AI technology, which Wayve has claimed can learn from human behaviour.

The Series C funding round also included Nvidia as a new investor and returning investor Microsoft.

Wayve’s latest funding efforts bring its total raised to over $1.3bn, the largest of any UK AI focused startup.

The UK unicorn, founded in 2017, said its AI autonomous driving technology will eventually allow vehicles to “navigate situations that do not follow strict patterns or rules, such as unexpected actions by drivers, pedestrians, or environmental elements."

In an interview with Reuters, Wayve CEO Alex Kendall said: "This will enable automakers and fleets to accelerate their transition from assisted to autonomous driving.”

Wayve's AI-powered technology is currently being used in six vehicle platforms’ advanced driver systems, including Jaguar’s electric I-PACE and Ford Mustang MachE.

“This round of financing, the single largest ever into a European AI company, will allow Wayve to build on its existing lead in Embodied AI and deliver autonomous vehicles on our roads," said Suranga Chandratillake, general partner at Balderton and early an investor in Wayve.

Can Wayve overtake its struggling competitors?

The promise of such self-driving vehicles was once great. Market leaders hyped the technology as being able to bring mobility to sections of the market that have never before had access, such as children, the disabled, or those otherwise unable to drive themselves.

As well as this, the technology has lent itself to the vision of new exciting business models, such as ride-hailing services using robotaxis, on-demand freight logistics services, mobile retail, in-car content provision, and servicing to be brought directly to the customer.

However, hype from investors and automakers has slowed down considerably as the market faces real challenges. Self-driving companies are facing a myriad of problems, the main one being that it is just a whole lot harder to create autonomous driving software than companies first imagined.

According to research company GlobalData’s report, Thematic Intelligence: Autonomous Vehicles (2023), the leap from Level 1 autonomy to Level 2 has proven minor compared with the jump in complexity needed for Level 3 ‘eyes-off’ AV operation.

Level 3 autonomy is defined as when the human driver may completely disengage from the dynamic driving task under certain conditions.

“Moving to Level 4 from Level 3 will be a bigger jump still,” according to the report. “Even Level 3 vehicles will appear simple in comparison with the higher levels and capabilities demanded by truly self-driving Level 4 and Level 5 models, both of which might not include controls for human drivers.”

However, Wayve said that its AI-powered driving software could learn to assess risk quickly and learn from other human behaviours on the road – reacting to unexpected accidents.

The AI-powered technology is "built to generalise its driving knowledge from one scenario to another... because it's nearly impossible to imagine every situation that a self-driving car needs to reliably handle,” Wayve President Erez Dagan told Reuters.

"By leveraging the raw power of AI, we can build an Embodied AI system that's learned from real-world and synthetic data how to handle edge cases at a rate that surpasses human programming," he said.

Wayve's huge financial backing and technology partnerships also puts the company at an advantage over other AV startups.

Each new AV needs around $700 worth of AI chips, along with a huge amount of sensors, cameras and other technology – making it an incredibly expensive process to build, according to GlobalData's report.

"Wayve now has significant financial resources to advance its technology, scale operations, and overcome technical hurdles that have impeded other firms," John Ellmore, editor and spokesperson for Electric Car Guide, told Verdict.

"Support from tech giants like Microsoft and Nvidia, as well as the backing from SoftBank, provides capital and strategic technological alliances," he said.

Ellmore added that Wayve's partnership with Nvidia, a leader in AI and GPU technology, will be a huge boost for the company as the technology is crucial for developing Wayve's AI-driven systems.

The UK and AV regulation

Following a tragic fatal collision during an Uber AV test drive in Arizona and another fatal crash in a Tesla Model X, both in March 2018, there has been more focus from regulators on establishing rules for self-driving vehicles.

This has placed some uncertainty on whether the technology will be able to actually operate on roads. As well as concerns from safety experts and consumers who fear that the technology is not yet safe.

Regulatory progress has been patchy in the US. The National Highway Traffic Safety Administration changed safety regulations to permit the provision of vehicles without human controls, but a national approach has been more elusive since earlier

attempts failed to pass into law.

However, the UK and Europe are making proactive pushes for getting AVs onto roads with safety at the forefront, which could give Wayve an advantage.

In November 2023, the UK government rolled out new rules which it said placed safety at the forefront of regulation in self-driving technology.

The long-awaited AVs Bill will provide the sector with the confidence it needs to develop the technology in the UK, the government said at the time.

Following the bill, Defence Secretary Mark Harper told the BBC that driverless cars could be on some UK roads by the end of 2026.

"The legislation is going through parliament at the moment, so hopefully we'll get that through parliament by the end of 2024," he said.

"Probably by as early as 2026 people will start seeing some elements of these cars that have full self-driving capabilities being rolled out, he added.

According to GlobalData, the EU’s long-standing approach continues to be firmly targeted at reducing collisions and fatalities, something that a large consensus continues to expect will be strongly supported by the wider adoption of self-driving technologies.

Latest news

UK retail sales drop 4% in April 2024 amid poor weather

The decline contrasts with the 5.1% growth seen in April 2023 and falls below the three-month average growth of 0.5%.

Piedmont gets state regulator permit for North Carolina lithium mine

The permit, issued after Piedmont Lithium posted a $1m reclamation bond, allows the company to develop an open-pit mine.

AI-powered insurance solutions provider Simplifai garners funding

Simplifai, a company that specialises in AI automation solutions for the insurance and banking sectors, has completed an investment round with Idékapital as the lead investor.

Aramco Q1 net income slumps more than 14% to $27.27bn

Revenue fell to $107.21bn (SR402.1bn) from $111.32bn in the first quarter (Q1) of 2023.

Arbuthnot Latham bolsters international banking team

Private and commercial bank Arbuthnot Latham has named Amit Modha as head of the Middle East and a director in the international banking division.

In data: Trends and trajectories in US defence spending

Insights into the dynamic landscape of US defence spending and technological advancements.

Gordian reveals construction cost trend analysis tool

Gordian, a data-driven solutions provider for all phases of the building life cycle, has unveiled its new offering, Data Insights - Cost Trends.

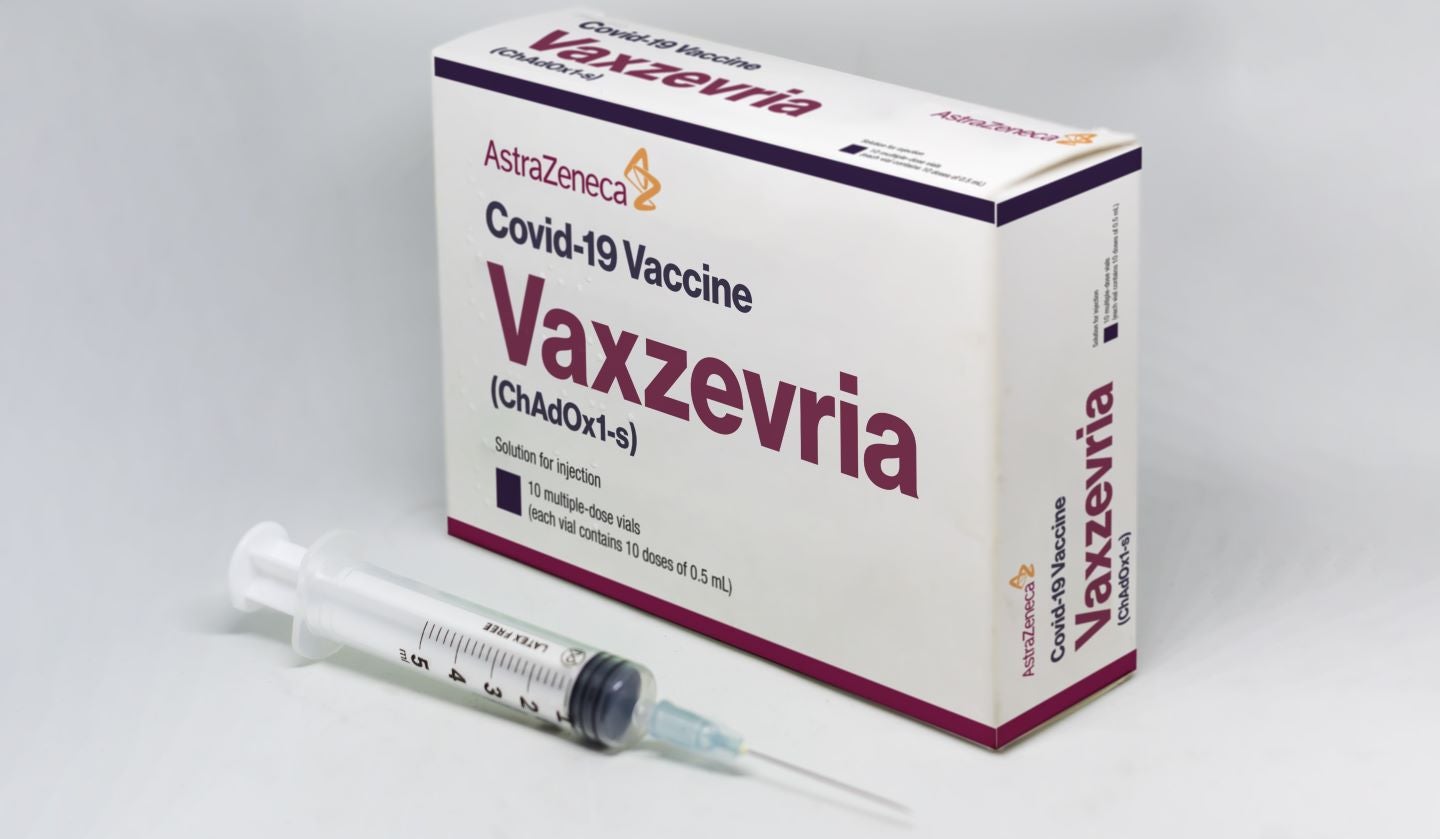

AstraZeneca to withdraw Covid-19 vaccine globally

Countries such as Australia have already ceased the supply of Vaxzevria, with its use discontinued since March 2023.

2024 future product report: Lincoln

A new CEO in the US last year and more recently a fresh leader for China have paused a formerly planned big push into EVs or at least tweaked and delayed the strategy.

Campari's “steady” Q1s - key takeaways

Campari’s Q1s represented the first set of quarterly numbers presented by new CEO Matteo Fantacchiotti. He faced questions on the US, Europe and Courvoisier.

In our previous edition

Explorer Decoded

In data: defence M&A deals up 55% in Q1 2024

03 May 2024

Explorer Decoded

Global real-time payments growth ‘sustainable' as new use cases push transactions to record highs: ACI Worldwide

01 May 2024

Explorer Decoded

1 in 3 UK BNPL users struggle as payments spiral

29 Apr 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer