Automotive DECODED

Previous edition: 16 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

APAC automotive active and passive safety systems market to expand at 2.6% CAGR over 2023-28

Increased automation in the automotive sector via electronic devices are driving the automotive sensors market

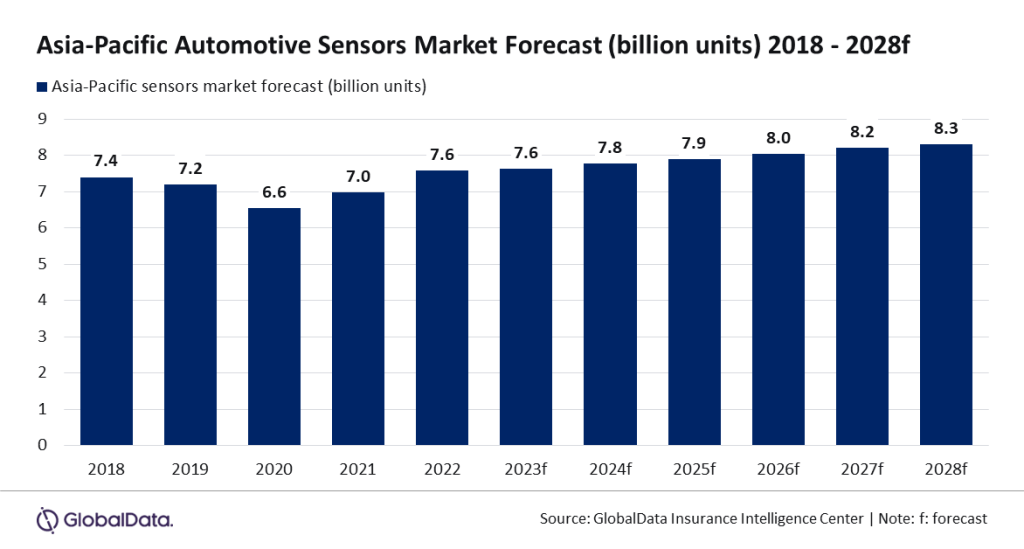

Vehicle electrification and hybridization, alliances and collaborations among industry players, and rising consumer disposable income have indirectly stimulated the demand for automotive sensors. In addition, the intensified use of electronics in cars and an increase in the number of innovative product launches are also driving the automotive sensor market. Against this backdrop, the Asia-Pacific (APAC) automotive sensors market is forecast to register a compound annual growth rate (CAGR) of 1.7% over 2023-28, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report “Global Sector Overview & Forecast – Sensors,” reveals that the APAC automotive sensors market is estimated to reach 7.6 billion units in 2023 and 8.3 billion units in 2028. The key proponents of sensors are parking assistance, interior technologies, gasoline direct injection (GDI), anti-lock braking system (ABS) adaptive cruise control (ACC), electronic stability control (ESC), crash, safety and body control, powertrain, and emission control. Both advanced driving assistance systems (ADAS) and global positioning systems (GPS) also require sensors.

Lucy Tripathi, Senior Automotive Analyst at GlobalData, comments: “Intelligent sensors are being used to control and process coolant levels, temperature, and oil pressure in vehicles. Increased electronic market competitiveness, ongoing device improvements, and increased automation in the automotive sector via electronic devices are anticipated to drive the automotive sensors market.”

The APAC region, particularly China, is making a substantial contribution to the expansion of the global automotive sensors industry. China is also home to some of the biggest automakers in the world, which is expected to advance its automotive sensors market in the upcoming years.

Tripathi continues: “China is expected to dominate the APAC automotive sensors market in the coming years. Lane departure warning, parking assistance, ACC, blind spot recognition, and forward collision warning are significantly boosting market growth. Due to their low cost, China has been able to deploy advanced sensors and semiconductors at an even faster rate than other countries in the region.”

Safety & body control and powertrain & emission control sensors are expected to garner the largest share among all the sensors, primarily owing to the increased focus on driver assistance systems and fuel efficiency. For example, Cipia’s driver monitoring system (DMS) employs computer vision and artificial intelligence (AI) to track the driver for signs of inattentiveness and fatigue while they are behind the wheel, making roads safer. To watch out for potentially dangerous situations, the organization monitors crucial indications, including gaze direction, blink rate, and eye openness. Additionally, it has the ability to detect smoking, precisely monitor the driver while a face mask is worn, and ensure that seat belts are worn.

Tripathi concludes: “Car buyers in APAC are increasingly interested in high-tech features like ACC, parking assistance, and accident avoidance. The rising use of automotive sensors is supported by large-scale production facilities and adherence to international quality standards, which is encouraging market expansion.”

Latest news

2024 future product report: Ford

Ford has hit the reset button on global electrification, so where does that leave its future model plans?

Honda cutting jobs in China

Honda is scaling down its full-time production workforce in China, with around 1,700 employees voluntarily agreeing to leave one of its JV vehicle manufacturing operations there.

Global light vehicle sales improve slightly in April

The global light vehicle market shows a modest improvement in April, according GlobalData

Alphabet's Waymo faces self-driving probe

Due to robotaxis’ "unexpected” driving behaviour

FAW-VW to build new SUVs in Tianjin

One of Volkswagen Group’s main joint ventures in China, FAW-Volkswagen Automobile, plans to invest CNY2.3bn (US$324m) to introduce three new SUV models at its assembly plant in Tianjin, according to local reports.

Volklec to make EV batteries in the UK

A new UK manufacturing start-up making batteries for electric vehicles, called Volklec, has launched.

Chinese auto battery makers invest in Morocco

Planning combined investments of over $900m

Canada welcomes Asahi Kasei battery component plant

Following an earlier announcement, Canadian federal and provincial government officials have "welcomed" Asahi Kasei Corporation's investment of approximately C$1.6bn to build an EV battery separator plant in Port Colborne, Ontario.

CAS Q1 sales down but profit up

China Automotive Systems, the power steering components and systems supplier, said Q1 sales were down 2% to US$139.4m, gross profit increased 11.6% to $24.1m with a gross margin of 17.3% (versus 15.2% a year ago) and operating income increased 26% to $9.7m.

In our previous edition

Automotive Decoded

VinFast pushing hard to grow global sales

15 May 2024

Automotive Decoded

Lightstate CEO: “We need to entice people into the new green world”

14 May 2024

Automotive Decoded

New Volkswagen Tiguan - class leader?

13 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Medical Devices

Oil & Gas

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer