Insurance DECODED

Previous edition: 03 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

AXA and Athora scrap €660m German closed life portfolio deal

AXA and Athora have mutually agreed to terminate their agreement regarding the sale of a closed life and pensions portfolio, nearly two years after its announcement.

This €660m ($709.09m) deal, announced in July 2022, involved the purchase of the DBV-Winterthur Life portfolio from AXA Germany by Athora Deutschland.

The DWL portfolio, with around €19bn in assets under administration, comprises traditional savings policies and has not been open to new business since 2013.

AXA has decided to retain this well-capitalised and duration-matched portfolio, along with its associated earnings.

This move is not expected to affect AXA's financial targets as outlined in its strategic plan entitled Unlock the Future.

Athora has stated that the termination aligns with the sale agreement's terms and is a response to significant changes in financial market conditions since the deal's signing.

Despite this, Athora remains focused on expanding its presence in the German savings and retirement services market, with €2.2bn in undrawn equity capital available for European growth.

Concurrently, AXA announced a reinsurance agreement between its subsidiary AXA Life Europe and New Reinsurance Company.

This agreement, covering approximately €3bn of variable annuity reserves, transfers all risks except for portfolio management expenses and longevity risk during the decumulation phase.

AXA Life Europe, an Irish entity, manages these variable annuity products, which have been closed to new business since 2017.

New Reinsurance Company is part of the Munich Re Group.

The reinsurance transaction is anticipated to reduce AXA's underlying earnings by around €20m annually from 2024.

To counteract this earnings dilution, AXA plans a €0.2bn share buyback, to be completed by the end of the year.

The overall impact of the transaction and share buyback is expected to result in a roughly -1 point effect on AXA's Solvency II ratio.

Latest news

Marsh McLennan Agency acquires ACRMto enhance commercial lines offerings

The Marsh McLennan Agency, a subsidiary of the global insurance broking and risk advisory services provider Marsh, has announced the acquisition of AC Risk Management (ACRM).

Origami Risk to launch Generative AI solutions for risk managers

Origami Risk, a technology company specialising in insurance software-as-a-service (SaaS), has announced plans to introduce its new suite of GenAI solutions for risk managers.

Alternative asset manager Third Point launches Malibu Life Re in Cayman Islands

Third Point, a US-based alternative asset manager, has announced the establishment of Malibu Life Re, a new life and annuity reinsurer located in the Cayman Islands.

Aon unveils new suite of risk analyser tools for brokers and risk managers

UK insurance company Aon has rolled out a suite of risk analyser tools to assist brokers and risk managers in making informed decisions on risk management.

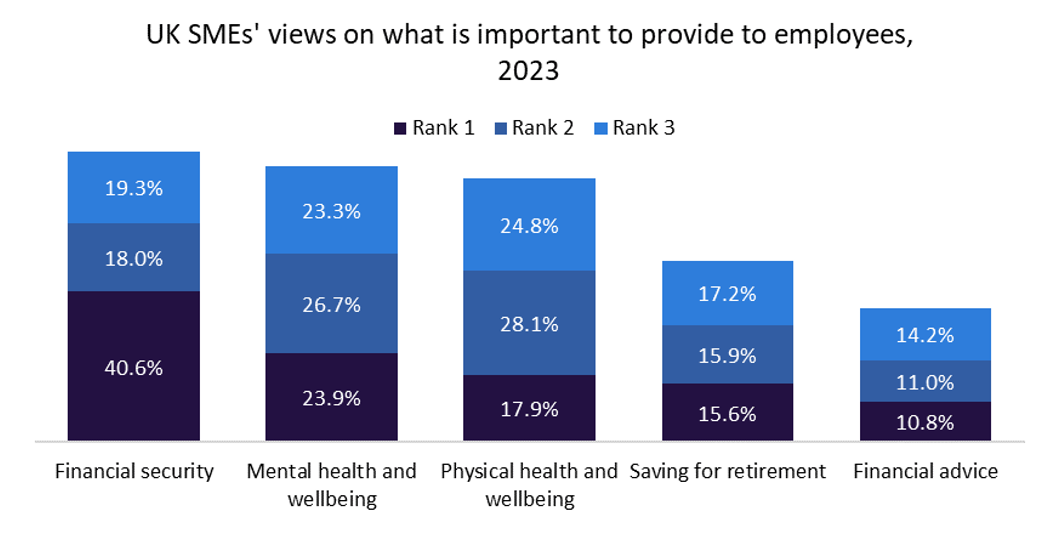

UK SMEs increasingly offer well-being apps to engage their workforce

The prevalence of well-being apps or platforms as employee benefits is increasing in the UK, with a third of SMEs currently providing them to support employee well-being, according to GlobalData. This shift underscores the growing emphasis on well-being among employers, highlighting the heightened awareness of and need for support in this domain.

In our previous edition

Insurance Decoded

BMS launches global healthcare liability division

02 May 2024

Insurance Decoded

QBE North America launches healthcare liability practice

01 May 2024

Insurance Decoded

Insurtech MGA Loadsure launches operations in Europe

30 Apr 2024

Newsletters in other sectors

Aerospace, Defence & Security

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer