Mining DECODED

Previous edition: 08 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

BHP / Anglo American merger could result in $200bn mining major

If the deal goes through, BHP will gain access to four of the world’s largest copper mines

As part of its strategy to expand its copper assets, BHP intends to acquire Anglo American, recognising the significant growth potential for copper in the future, as momentum shifts towards replacing conventional fossil fuels with the increasing adoption of electric vehicles (EVs) and growing demand for its usage in construction and renewable energy projects.

The deal will also strengthen BHP’s iron ore market and provide exposure to diamond markets. Additionally, the acquisition will help BHP to access the mining industry in South America, where the company currently does not have significant presence. - Collahuasi (with ownership of 44%), Los Bronces (50.1%), El Soldado (50.1%) and Quellaveco (60%).

Why Anglo American?

Anglo American became a potential target for BHP as the former continued to post a weak top-line, even as its total debt kept increasing since 2021 as a result of the poor performance of platinum group metals (PGMs) and diamonds due to price fluctuations, geopolitical and economic situations, and other operational constraints. Amidst this, the company has reported a growth of 31.5% in copper sales from $5,599mn in 2022 to $7,360mn in 2023.

Also, at the end of Q1 2024, Anglo American’s copper production increased by 11% to 198,100 tonnes, driven by a 21% increase in output from its Quellaveco site in Peru and a 6% increase in production from Chile.

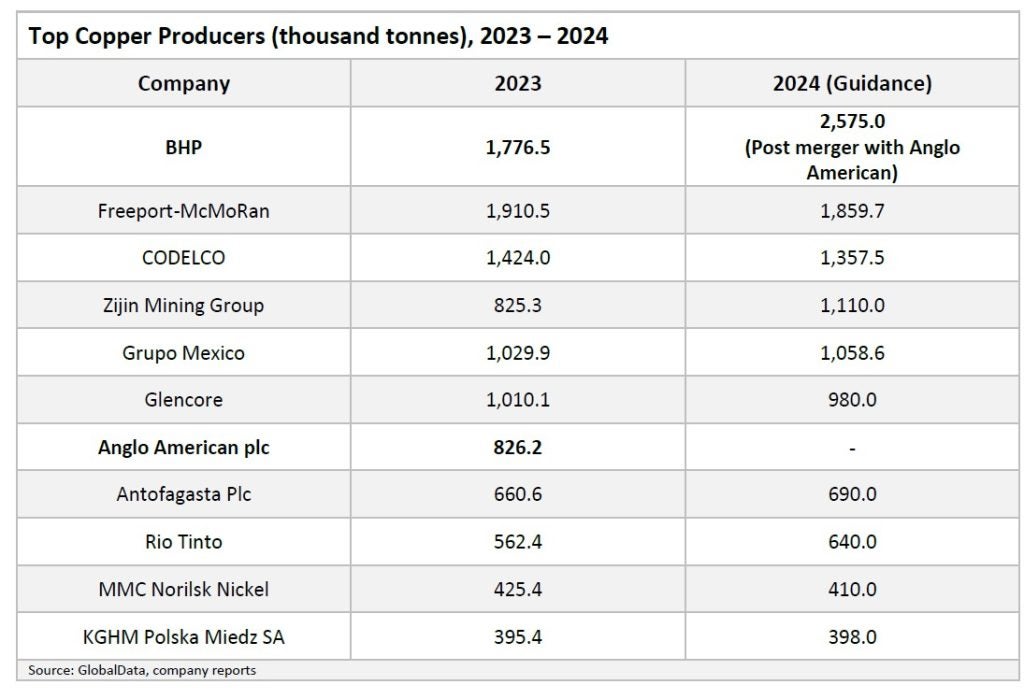

BHP will climb the rankings

Operationally, the combined entity could have a top line of more than $84bn, EBITDA of more than $34bn, and a workforce of close to 100,000, reinforcing its position as one the largest global players in the mining sector.

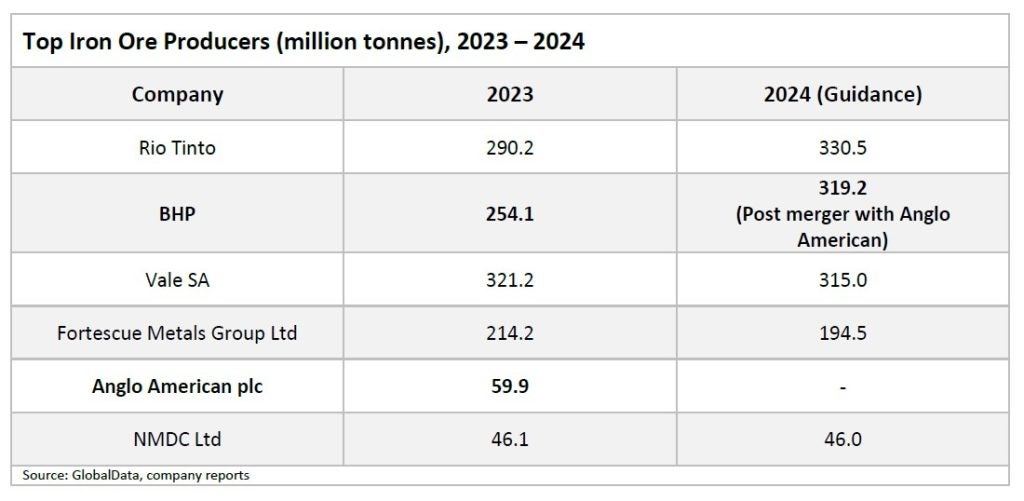

In terms of production, the combined entity has an expected output of 2.6 million tonnes of copper in 2024, ranking it first and representing 11% of global mined copper.

In iron ore it would lift BHP’s ranking from third to second, after Rio Tinto, with a share of 12% of global output, and the combined nickel production would account for 3.2% of global production, placing BHP third after MMC Norilsk Nickel and Vale SA.

Latest news

Piedmont gets state regulator permit for North Carolina lithium mine

The permit, issued after Piedmont Lithium posted a $1m reclamation bond, allows the company to develop an open-pit mine.

Bushveld to offload Vanchem asset to allay financial concerns

The proceeds from the deal will address Bushveld's immediate working capital requirements and ensure its ongoing operations.

Eramine Sudamerica to open lithium carbonate plant in Argentina

The plant is expected to produce 3,000 tonnes (t) of lithium carbonate this year, with plans to increase production to 24,000t by 2025.

Theta Gold Mines to raise $10m in share placement

The company will raise the amount via a private placement from Hong Kong Ruihua Investment Management.

Panthera Resources restructures ownership interests in Mali and Nigerian gold projects

After the restructuring, Panthera will own 100% of Maniger, increasing its stake in the Kalaka Project in Mali from 40% to 80%.

Mabel starts 2024 Bonanza Project exploration, drilling programme

Mabel has the option to acquire a 51% stake in the Bonanza project under a deal signed with Abitibi Metals last year.

St Barbara plans Simberi mine gold output increase after using AI

The company aims to increase gold output to between 70,000oz and 75,000oz for fiscal year 2025 (FY25) to FY27.

In our previous edition

Mining Decoded

Bonterra Resources raises $8.54m in private placement

07 May 2024

Mining Decoded

Mining sector to play pivotal role in Saudi Arabia's economic diversification efforts

06 May 2024

Mining Decoded

IG Asia seals deal to buy 75% stake in Kazakhstan copper deposit

03 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer