Automotive DECODED

Previous edition: 25 Mar 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

China's auto exports usher in high growth

China overtook Japan as the world's largest auto exporter for the first time in 2023

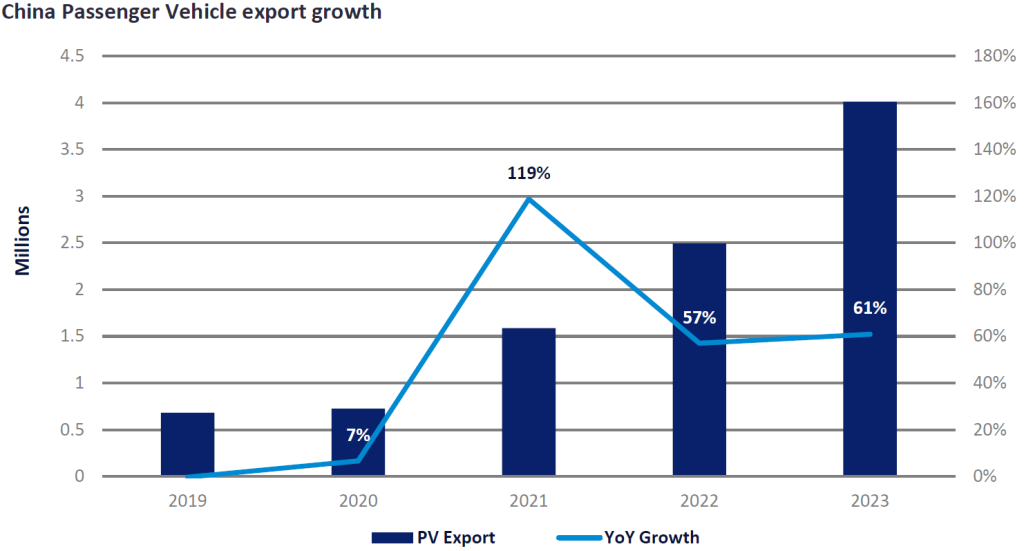

China’s Passenger Vehicle (PV) exports maintained a volume of around 700k units per year before 2020. However, in 2021, exports suddenly entered a period of explosive growth; PV export volume reached almost 1.59 million units, a 119% year-on-year (YoY) growth rate. In fact, as early as 2019, the global supply chain was already showing signs of facing various challenges and global auto production suffered a 6% YoY decline with this number rising to an 18% decline in 2021 versus 2018. Relying on the vigorous development of the New Energy Vehicle (NEV) sector, good economic resilience and a stable supply chain, Chinese OEMs overcame many challenges during the years 2019 and 2020, recovering faster than the rest of the world and ushering in the export boom in 2021. In 2022, China’s Passenger Vehicle export volume reached 2.49 million units, a 57% YoY growth rate, to become the second largest exporter in the world. In 2023, Passenger Vehicle export volume exceeded 4 million units, achieving 61% YoY growth. Also, in 2023, China’s auto exports surpassed Japan’s enabling it to become the world’s largest exporter for the first time.

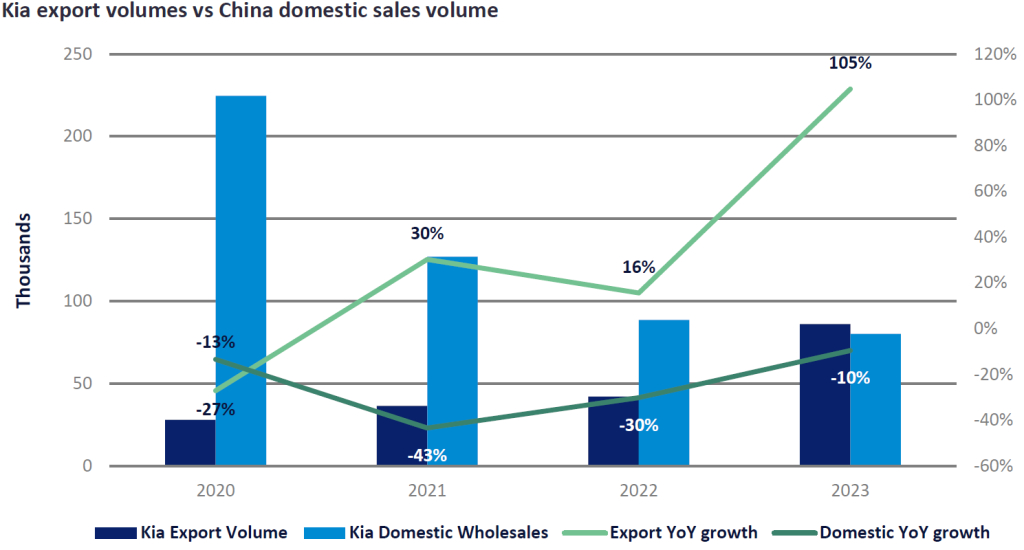

The high growth of China’s exports is composed of two parts: Chinese brands and foreign brands. For Chinese brands, the development of electrified vehicles and intelligent applications, as well as the improvement of product quality after verification in the Chinese market, has led to overseas expansion of Chinese brands as they are recognised and accepted by more consumers from different markets. In addition, for foreign brands like Tesla, efficient and high-quality production with a stable supply chain has ensured cost-effective production capacity for its expansion into international markets. Efficient production capacity and growing exports have also brought new opportunities to Japanese and Korean brands. As the product strength of Chinese brands continues to improve, Japanese and Korean brands’ market share of the Chinese domestic market has declined significantly. Hence, Kia is utilising its existing Chinese production capacity to help supply its global market demand. As we can see from the chart below, Kia’s export volume first exceeded its Chinese market domestic sales in 2023. In January 2024, Kia exported over 9k units, achieving 178% YoY growth.

In 2024, Kia plans to continue increasing exports, and the destination markets will increase from the current fifty to more than eighty countries. Also, the company plans to change its Yancheng factory into Kia's global export base and expand the scale of annual exports to more than 200k units by 2026. Nissan has also stated that it will start to rely on China's complete industrial chain as an export base to cope with overcapacity for Internal Combustion Engine (ICE) vehicles and to supply global demand.

In the future, we believe that growth in China’s automotive exports will be a win-win situation for both Chinese and foreign brands. With healthy competition, both Chinese OEMs and those from other countries will usher in new developments.

Kevin Zeng, Light Vehicle Market Analyst, GlobalData

Latest news

Nissan launches new business plan

Nissan Motor launched a new three year business plan, The Arc, aiming to reduce operating costs and improve competitiveness worldwide.

Autonomous underestimated, China still rising, ASEAN down - the week

Just Auto weekly review of choice features and news

VinFast in India, supplier jobs lost, global sales up, diesel flatlining - the week in data

A snapshot of the week’s news and analysis on Just Auto, as seen through key data

Xiaomi CEO reveals pricing aims for first EV

Xiaomi’s CEO Lei Jun has given some early pricing details on the company’s first EV, the SU7 (‘Speed Ultra 7’).

First Hydrogen reports record distances for FCEV trials

With Wales & West Utilities in UK

EcoPro acquires stake in nickel processor

South Korean electric vehicle (EV) battery raw materials supplier EcoPro said it had invested US$11m for a 9% stake in a nickel smelting factory in Indonesia to secure further supplies of a key battery cell raw material.

Nissan GB names new MD

Nissan has appointed Diana Torres managing director of NMGB, heading sales and marketing operations in the automaker's largest European market.

Tata Motors inaugurates fifth vehicle scrapping facility

Facility has annual capacity to scrap 18,000 end-of-life vehicles

Light vehicle sales in India poised to reach record 4.9 million in 2024

India's light vehicles (LV) market is on the cusp of a record-breaking year, with a confluence of economic, political, and market factors aligning to drive growth. Robust economic expansion, the government’s fiscal stimulus, sustained demand for SUVs, and new model activity are expected to drive wholesales to a record-high of 4.9 million vehicles in 2024, forecasts GlobalData, a leading data and analytics company.

In our previous edition

Automotive Decoded

Innovation in green hydrogen driving surge in investment

22 Mar 2024

Automotive Decoded

Explainer: when will we have driverless vehicles?

21 Mar 2024

Automotive Decoded

Will VinFast's gamble on India pay off?

20 Mar 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer