Banking & Payments DECODED

Previous edition: 10 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Customer satisfaction with US online-only banks declines

Driven by the prospect of higher interest rates and lower fees, new customers continue to flock to online-only direct banks. For the most part, the direct banks delivered on their end of the bargain. However, struggles with customer service and timely problem resolution dragged down overall satisfaction scores in the 8th annual JD Power US Direct Banking Satisfaction Study.

“Customers of online-only direct banks have higher levels of satisfaction than customers of traditional banks. But satisfaction among direct bank customers declined this year. This is particularly the case with checking accounts,” said Paul McAdam, senior director banking and payments intelligence, JD Power.

“Despite significant increases in deposit interest rates for both checking and savings accounts—but decreases in the proportion of customers who had to pay a fee or experienced a problem—overall satisfaction still declined. That’s because customers who experienced problems had a very tough time resolving them in a timely manner. This causes satisfaction with the ease of problem resolution to decline sharply.”

JD Power 2024 US Direct Banking Satisfaction Study key findings

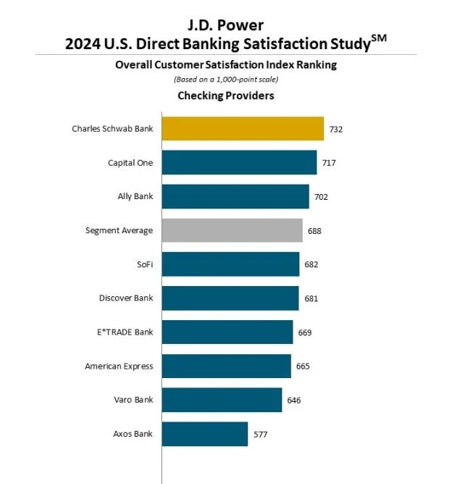

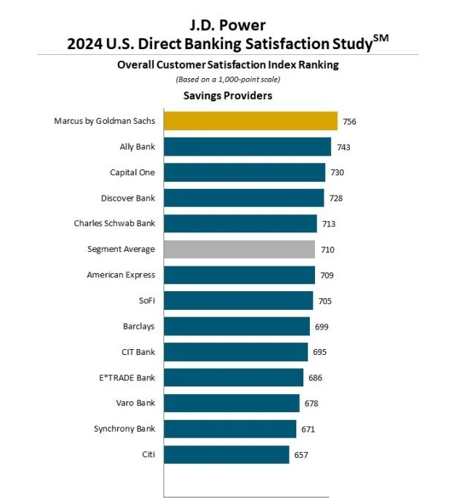

Satisfaction declines year over year, but the scores are still higher than traditional banks. The overall customer satisfaction score for direct bank current accounts is 688 (on a 1,000-point scale). This is down 27 points from 2023. Overall satisfaction for direct bank savings accounts is 710, down 8 points from 2023.

Problem resolution is dragging down customer satisfaction. While fewer problems were cited in this year’s study, the problems customers did experience were more complicated and took longer to resolve. This causes satisfaction with the problem resolution process to fall 67 points. The total amount of time required to resolve a problem grew to 2.6 days in 2024, up from 1.9 days in 2023.

Problems with debit cards and fraud are mounting. The most significant declines in problem resolution satisfaction are focused on problems with debit cards, fraud and unauthorised account activity and problems with interest rate paid on a deposit account. The number of customers indicating that it was convenient to reach and interact with live phone representatives declines 3 percentage points.

Mobile apps and websites need a refresh. Use of mobile app and website features also declines this year. Even among customers who have not experienced a problem with their direct bank, the visual appeal, the range of services that can be performed and clarity of information provided via digital channels had significant declines.

Study Rankings

Charles Schwab Bank ranks highest in overall satisfaction among current account providers with a score of 732. This marks the sixth consecutive year of the bank being top ranked in the study. Capital One (717) ranks second and Ally Bank (702) ranks third.

Marcus by Goldman Sachs ranks highest in overall satisfaction among savings providers with a score of 756. Ally Bank (743) ranks second and Capital One (730) ranks third.

Latest news

AI could create a turning point for financial inclusion in Africa

It’s difficult to imagine a time before the widespread adoption of mobile technology in Africa – particularly where financial services are concerned. For millions of unbanked people, transactions were limited to cash, postal services or even the barter system. Now, in much the same way as mobile payments completely disrupted the status quo,

Mastercard JV switches first domestic transaction in China

Mastercard NetsUnion has started to process payments made in China with Mastercard cards issued by the country’s banks. In addition, Mastercard-branded cards will now be accepted for both domestic and international purchases.

O3 Capital, Amex issue four new American Express Cards in Nigeria

O3 Capital, Nigeria’s first non-bank credit card issuer has agreed a deal to issue four new Amex credit cards.

Zeta eyes 50% of the $1trn Credit Line on UPI banking tech opportunity by 2030

Next-gen banking technology vendor, Zeta, has launched its Digital Credit as a Service offering.

Continental Finance purchases Today Card portfolio

Continental Finance has acquired the Today Card Portfolio, a card portfolio previously held by Elevate Credit & Capital Community Bank.

Avenue Capital Group fund secures $1bn

Avenue Capital Group has completed the final closing of its Avenue Europe Special Situations Fund V. The Avenue Europe Fund has received approximately $1bn in commitments from a diverse spectrum of existing and new investors, including public and corporate pension plans, sovereign wealth funds, asset managers, and family offices.

Payment cards continue to lead e-commerce payments in South Korea with 54% share, reveals GlobalData

Payment cards remain the most preferred payment tool for e-commerce purchases in South Korea, collectively accounting for over half (54%) of the total e-commerce payments in 2023, signifying a strong preference for secure and convenient transactions among the online shoppers, finds GlobalData, publishers of EPI.

In our previous edition

Banking & Payments Decoded

Artificial Intelligence - humanity's sidekick in tackling financial crime

09 May 2024

Banking & Payments Decoded

The secret to success in emerging markets

08 May 2024

Banking & Payments Decoded

Interview: Arbuthnot Latham on why the wealthy in the UK are worried and moving abroad

07 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer