Oil & Gas DECODED

Previous edition: 15 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Equinor and Petoro agree on Haltenbanken area asset swap

This deal will see Equinor increase its stakes in the Heidrun field and Noatun discovery, while reducing its ownership in other fields.

Norwegian state-owned energy company Equinor has announced a value-neutral asset swap with Petoro, focusing on the Haltenbanken area of the Norwegian Continental Shelf (NCS).

The deal will see Equinor increase its stakes in the Heidrun field and Noatun discovery, while reducing its ownership in the Tyrihans field, the Castberg field, and the Carmen and Beta discoveries.

Heidrun and Tyrihans are reputed to be among the largest producing fields in the Halten area of the Norwegian Sea, with Heidrun noted for its long remaining life on the NCS.

Equinor currently holds a 13% interest in Heidrun, contrasted with Petoro's 57.8%.

In the Tyrihans field, Equinor has a 58.8% ownership, while Petoro has no equity.

Upon completion of this transaction, Equinor's ownership will adjust to 34.4% of Heidrun and 36.3% of Tyrihans.

Petoro's new stakes will be 36.4% in Heidrun and 22.5% in Tyrihans. Additionally, Equinor's share in Johan Castberg will stand at 46.3%.

Equinor executive vice-president for exploration and production Norway Kjetil Hove said: “We have a strategy to continue the development and the value creation on the Norwegian Continental Shelf and expect to maintain a high production with lower emissions towards 2035. Alignment of ownership around the larger production hubs are important enablers for long-term value creation.

“Although this is a value-neutral swap, this alignment of ownership will add more value to all parties from the Halten-area over time. Balanced partnerships will simplify commercial agreements, lower operating costs and accelerate new developments with added production at a lower cost,” Hove continued.

The asset swap is contingent on various regulatory approvals and must be approved by the Norwegian Parliament.

Last month, Equinor finalised an agreement with EQT, a US natural gas producer, to trade its operated assets in the state of Ohio for a share in the Northern Marcellus formation.

This exchange will result in Equinor divesting its full interest and operatorship in the Appalachian Basin assets in south-eastern Ohio, in exchange for a 40% non-operated working interest in EQT's assets in Pennsylvania.

To equalise the value of the transaction, Equinor will provide EQT with a cash consideration of $500m (Nkr5.5bn).

Latest news

ADNOC Drilling secures $1.7bn unconventional wells drilling contract in UAE

To explore future opportunities in unconventional resources, ADNOC Drilling has launched a new company, Turnwell Industries.

Petrobras disputes Amazon drilling impact study

Brazilian environmental agency Ibama has insisted on these studies before it will consider Petrobras' appeal for a drilling licence.

Spanish oil company Repsol in talks for renewable energy unit stake sale

The move is aimed at funding the company’s growth plan through 2027 and diversifying its operations.

How Norway's oil and gas tax fuelled an EV boom

Despite being a major oil and gas producer, Norway is known as one of the cleanest nations thanks to a huge appetite for electric vehicles (EVs). How has the country used fossil fuel money to drive an EV revolution?

Emirates launches SAF operations at London Heathrow Airport

Emirates Airlines has started operating with sustainable aviation fuel (SAF) at London’s Heathrow Airport (LHR), with plans to use up to 155,000 tonnes (t) of SAF until the end of summer 2024.

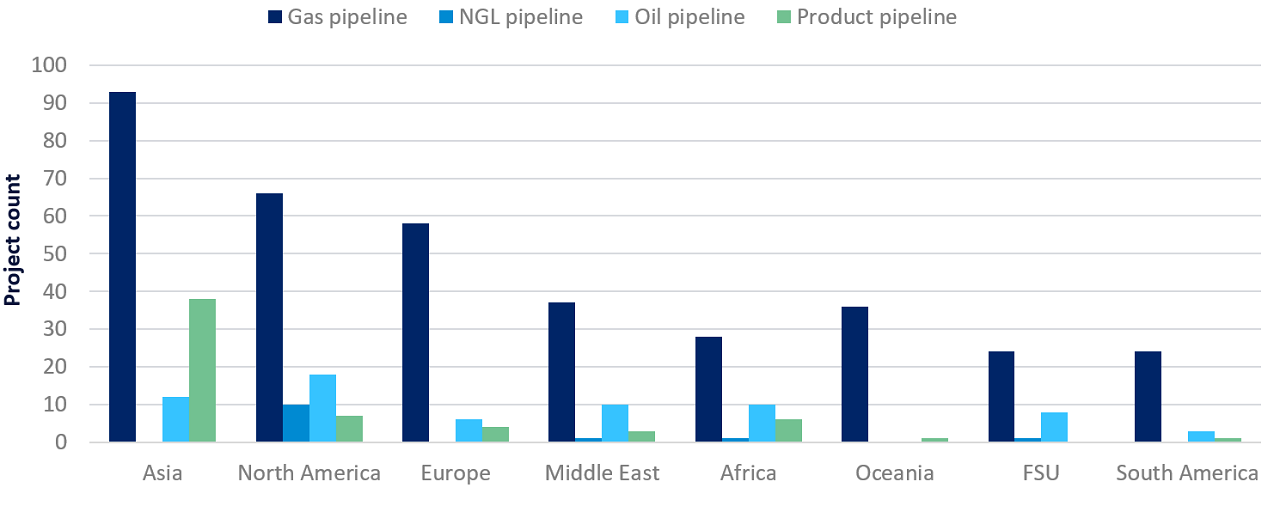

Gas pipelines underpin global transmission pipelines projects growth by 2028

Globally, Asia dominates both in terms of pipeline project count and length by 2028.

In our previous edition

Oil & Gas Decoded

UK MoD: Russia-Ukraine war a factor in Gazprom's massive 2023 loss

14 May 2024

Oil & Gas Decoded

Fossil fuels generated less than a quarter of EU's electricity for first time in April

13 May 2024

Oil & Gas Decoded

Paraguay pushes for $1.5bn gas pipeline with Argentina and Brazil

10 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer