Automotive DECODED

Previous edition: 16 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

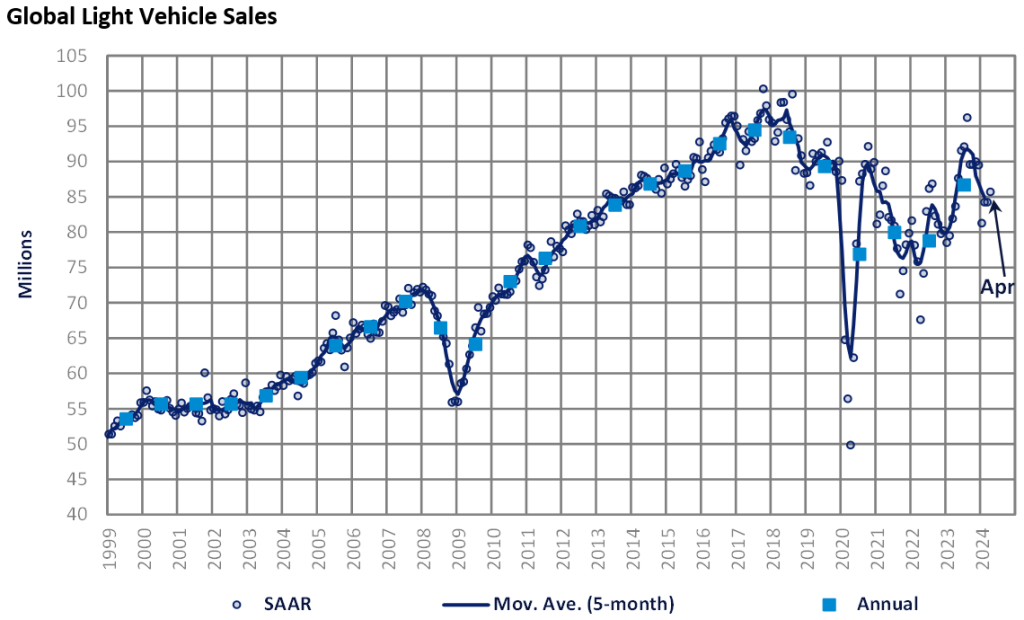

Global light vehicle sales improve slightly in April

The global light vehicle market shows a modest improvement in April, according GlobalData

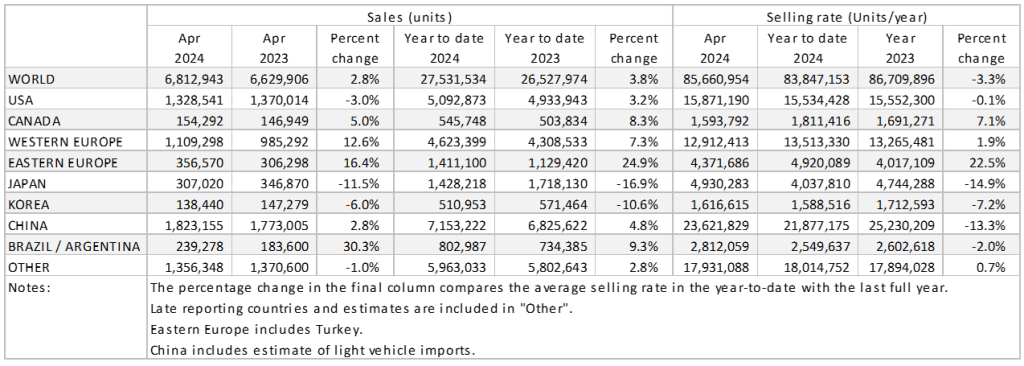

The Global Light Vehicle (LV) selling rate stood at 86 million units/year in April, a modest improvement on the previous month. With 6.8 million vehicles were sold last month, this was a 2.8% improvement year-on-year (YoY), with year-to-date (YTD) sales up 3.8%.

At the regional level, selling rates continued to see mixed results. In the US, the selling rate grew month-on-month (MoM). China’s selling rate eased despite the continuation of the price war. Meanwhile, Europe also saw a moderate contraction in the selling rate in April versus that of March. In Japan, sales bounced back after production disruption at key brands.

North America

The US Light Vehicle market saw its first YoY decline of 2024, as sales slowed in April 2024 by 3.0% YoY, with sales dropping to 1.33 million units. However, this was due to the loss of a selling day as compared to April 2023, and the selling rate slightly increased in April to 15.9 million units/year, up from the 15.6 million units/year reported in March. Changeovers to 2025 model year vehicles caused transaction prices to rise by US$670 MoM in April, the first increase this year, to US$44,879. Incentives continued to exceed the US$2,000 level for a sixth consecutive month, at US$2,607.

In April, Canadian Light Vehicle sales reached 154.3k units, growing by 5.0% YoY. While sales continued to expand through economic uncertainty, the selling rate has gradually slowed in 2024, with the rate further dropping in April to 1.59 million units/year, down from 1.71 million units/year in March. Looking at Mexico, sales grew by a strong 15.9% YoY in April, to 112.7k units. With the Mexican economy showing signs of stability, allowing for LV sales to grow, the selling rate expanded in April 2024 to 1.50 million units/year, up from 1.46 million units/year in March.

Europe

The Western Europe LV selling rate stood at just under 13 million units/year in April, broadly in line with March, although raw sales were up 12.6% YoY, driven by strong growth in Spain and Germany. April’s selling rate remains 20% below-pre pandemic April 2019’s result. While the economic backdrop remains challenging, the market is still expected to grow for the full year 2024, supported by some easing of vehicle prices and monetary loosening projected for the second half of the year. However, geopolitical risks still have the potential to undermine the forecast.

The Eastern European LV selling rate declined again in April, to 4.4 million units, while raw sales increased 16.4% YoY. Despite this decline in selling rate, YTD sales were up 24.9% YoY. This result was supported by robust recovery in Ukraine and Russia. While the Turkish market contracted this month, strong growth earlier in the year kept its YTD sales growth strong at +11.4%.

China

Advance data indicates that China’s domestic automotive market continued to struggle to gain strong momentum. The April selling rate of 23.6 million units/year (and March’s 24 million units/year) were an improvement from an average of only 20 million units/year in January and February. That was, however, a lacklustre rate compared to the Q4 2023 average of 26 million units/year. In YoY terms, domestic sales (i.e., wholesales) increased by 2.8% in April and 4.8% YTD due to a low year-ago base, but that contrasts to booming Passenger Vehicle exports, which expanded by 35% YoY, YTD.

Earlier this year, the central government instructed local governments to introduce financial support for replacing old vehicles with new ones. So far, Shanghai launched a cash subsidy program for trade-ins, but it appears that other cities and provinces are slow to follow suit and/or have not been able to provide substantial subsidies that would make a big boost in new vehicle sales. The price war is only intensifying, with OEMs continuing to cut prices and launching new entry-level NEVs. Yet, consumers are not responding. In fact, there are reports that they are tightening spending in the face of a sluggish job market, the debt crisis in the property sector, and an uncertain economic outlook.

As expected, sales in Japan improved in April, as Daihatsu and Toyota started to normalize their deliveries after the scandals forced them to suspend production temporarily. The selling rate surged to 4.9 mm units/year in April, up nearly 45% from a weak March. Nonetheless, the YTD selling rate barely reached 4 million units/year due to the supply disruptions at the two OEMs. Demand remains buoyant, thanks to the recent substantial pay hikes across industries and rising asset prices. Yet, consumer confidence edged down in April in the face of sticky inflation and a record-low yen.

In Korea, the April selling rate reached a solid 1.62 million units/year, as supply increased after Hyundai resumed production at its Asan plant, which had been temporarily shut down for retooling. In YoY terms, however, sales declined by 6% in April and nearly 11% YTD due to the payback of the temporary tax cut last year and high financing rates. All Korean brands recorded YoY falls, while sales of imports expanded, boosted by strong deliveries by Tesla and Mercedes. The country’s large export and manufacturing sectors have turned around, thanks to rising demand for AI chips, which bodes well for the sales outlook.

South America

Brazilian Light Vehicle sales exploded in April 2024 by 37.6% YoY, breaking past the 200k unit level for the first time 2024 at 208.1k units. With the strong boost in sales in April, the result bumped the selling rate to 2.36 million units/year, up from the 2.12 million units/year reported in March. With strong levels of production, inventory levels expanded in April to 243k units, up from 222k units in March. With the large boom in production and inventory in March, dealerships had to manage a large influx of inventory, as days’ supply increased by 3 days on a month-over-month basis, to 33 days.

In Argentina, Light Vehicle sales landed at 31.0k units, dropping by 4.2% YoY. The country’s neighbor Brazil, saw strong level of production in April, which seems to have carried into Argentina as certain models produced in Brazil saw healthy levels of sales expansion in Argentina. Imported vehicles have remained at a solid level since the removal of the import restrictions imposed by the government, and with strong domestic sales, the selling rate saw a strong jump in April to 404k units/year, marking it as the highest rate of 2024 so far.

Latest news

2024 future product report: Ford

Ford has hit the reset button on global electrification, so where does that leave its future model plans?

Honda cutting jobs in China

Honda is scaling down its full-time production workforce in China, with around 1,700 employees voluntarily agreeing to leave one of its JV vehicle manufacturing operations there.

Alphabet's Waymo faces self-driving probe

Due to robotaxis’ "unexpected” driving behaviour

FAW-VW to build new SUVs in Tianjin

One of Volkswagen Group’s main joint ventures in China, FAW-Volkswagen Automobile, plans to invest CNY2.3bn (US$324m) to introduce three new SUV models at its assembly plant in Tianjin, according to local reports.

Volklec to make EV batteries in the UK

A new UK manufacturing start-up making batteries for electric vehicles, called Volklec, has launched.

Chinese auto battery makers invest in Morocco

Planning combined investments of over $900m

Canada welcomes Asahi Kasei battery component plant

Following an earlier announcement, Canadian federal and provincial government officials have "welcomed" Asahi Kasei Corporation's investment of approximately C$1.6bn to build an EV battery separator plant in Port Colborne, Ontario.

CAS Q1 sales down but profit up

China Automotive Systems, the power steering components and systems supplier, said Q1 sales were down 2% to US$139.4m, gross profit increased 11.6% to $24.1m with a gross margin of 17.3% (versus 15.2% a year ago) and operating income increased 26% to $9.7m.

APAC automotive active and passive safety systems market to expand at 2.6% CAGR over 2023-28

Increased automation in the automotive sector via electronic devices are driving the automotive sensors market

In our previous edition

Automotive Decoded

VinFast pushing hard to grow global sales

15 May 2024

Automotive Decoded

Lightstate CEO: “We need to entice people into the new green world”

14 May 2024

Automotive Decoded

New Volkswagen Tiguan - class leader?

13 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Medical Devices

Oil & Gas

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer