Apparel DECODED

Previous edition: 14 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

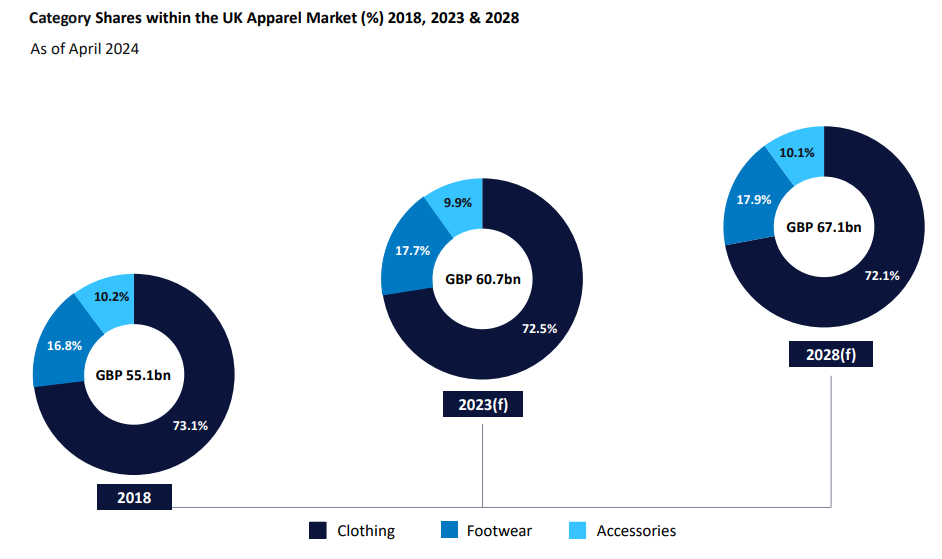

In Data: Accessories, footwear to dominate UK apparel market

Fashion accessories and footwear are poised to claim the largest market share of the UK apparel market by 2028 with consumers continuing to invest in new pairs of trainers despite the cost-of-living crisis.

The Apparel Market in the UK to 2028 report published by GlobalData observed that the fashion accessories segment is expected to record the strongest growth between 2023 and 2028, rising 12.7% to £6.7bn ($8.4bn).

The fashion accessories market share is expected to rise 0.2ppts to 10.1%, however, it will remain below 2018 levels as it is considered less essential than clothing and footwear so more susceptible to consumer cutbacks.

Footwear is expected to outperform between 2023 and 2028, with its share rising by 0.2ppts to 17.9%. The report noted that growth in the sector has been supported by the continued popularity of trainers, as consumers' interest in health and wellness remains strong post-pandemic. Plus, trainers continue to be regarded as superior value for money.

In contrast, clothing will see its overall share fall by 0.4ppts to 72.1% between 2023 and 2028, as consumers invest in capsule wardrobes and become less receptive to the latest trends. Clothing spend also continues to be diverted into the secondhand market.

UK apparel market drivers

- Engagement in ultra-fast fashion: The success of ultra-fast fashion players such as Shein and Cider has been supercharged by the emergence of ever-evolving fashion trends on Instagram and TikTok, influencing Gen Z shoppers in the UK to continually buy into the newest styles. Despite rising awareness of the effects of overconsumption, Gen Zs continue to prioritise price and trends over sustainability and ethics.

- Brands’ investments in new technology: With the UK online market anticipated to outperform again from 2025 onwards, brands will continue to invest in the latest technology to enhance their digital propositions. For instance, players like UK department store John Lewis, Swedish fashion brand H&M and Inditex's Bershka brand are introducing virtual try-on features to alleviate online returns rates and make it easier for shoppers to choose the correct size. Meanwhile, UK fashion brand Primark, has been enhancing its omnichannel proposition, announcing the rollout of its click & collect service across all stores in the UK in April 2024.

- Outperformance of premium brands: The UK premium market is expected to be the best-performing price segment in the coming years, with its share rising by 1.4ppts to 21.7% between 2023 and 2028. The market will continue to benefit from shifting consumer purchasing habits, with many prioritising versatile, high-quality pieces over trend-led items as the economic outlook remains weak and budgets stay squeezed. Other players are therefore homing in on this preference, with UK department store Marks & Spencer launching several capsule wardrobe edits, while value brands PrettyLittleThing and George have introduced premium collections.

Clothing brands that have traditionally targeted adults, such as Phase Eight are now capitalising on the growth opportunity presented by childrenswear with a report suggesting the segment will be worth $225.6bn by 2028.

Latest news

Explainer: Pros and cons of Shein ‘mulling' London float over NY listing

Fast fashion giant Shein remains tight-lipped on speculation it could list on the London Stock Exchange as soon as this month, with one industry onlooker saying the perks might not be as great as its preferred option to float in New York.

Cambodia to phase out ‘unsafe' garment worker trucks by 2027

A senior National Social Security Fund (NSSF) official has revealed plans to replace flatbed trucks commonly used to transport factory workers with safer, purpose-built passenger vehicles like buses by 2027.

Under Armour rolls out first product made with Neolast spandex-alternative

Athletic performance apparel brand Under Armour has launched its first product to contain an elastane alternative -Neolast in its Vanish Pro Training Tee.

Woodspin Spinnova fibre earns sustainable forestry certification

Woodspin, the exclusive manufacturer of the innovative wood-based Spinnova textile fibre, has achieved a Forest Stewardship Council (FSC) Chain of Custody certification which ensures that the wood sourced by Woodspin for its fibre production can be fully traced from its origin through to the final product.

Asics Q1 sales boosted by running gear demand

Japanese sportswear brand Asics enjoyed double-digit sales growth in Japan, South & Southeast Asia, Greater China and North America in its first quarter (Q1) ended 31 March 2024.

In our previous edition

Apparel Decoded

Explainer: Is France's fast-fashion tax idea about to create a domino effect?

13 May 2024

Apparel Decoded

Explainer: Fashion firms face cost spike as Red Sea crisis ‘widens'

10 May 2024

Apparel Decoded

Explainer: From Kanye to Rishi Sunak, the cost to Adidas' brand image

09 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Banking & Payments

Construction

Foodservice

Medical Devices

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer