Apparel DECODED

Previous edition: 16 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

In Data: Tapestry struggles to stay financially afloat amid merger troubles

Tapestry saw revenues slump by 1.8% in its third quarter for fiscal 2024, which an industry onlooker described as its "worst" financial performance, indicating the keenness for the Capri merger.

Luxury conglomerate Tapestry, which owns brands including Coach, Kate Spade and Stuart Weitzman, was relying on its merger with rival luxury group Capri Holdings to fuel "a new growth story," according to data analytics company GlobalData.

However, in April, the US Federal Trade Commission (FTC) sued to block the merger, alleging that Tapestry’s acquisition of Capri would "eliminate fierce competition between the two companies."

With the deal in doubt, GlobalData noted that Tapestry is "more exposed" thanks to softer demand dragging down its numbers. Moreover, the weak outlook makes winning the battle with the FTC crucial.

Tapestry's Q3 2024 results in-brief

- The group's net sales declined from $1.51bn to $1.48bn.

- Operating income fell from $226.3m to $204.3m.

- Net income was $139.4m as opposed to last year's $186.7m.

GlobalData believes this quarter's soft results from Tapestry underline why the group is so keen to acquire Capri.

The company said: "After a run of reasonable performance, the business is running out of steam and its ability to punch out strong results is becoming increasingly inconsistent. Bringing on board Capri provides Tapestry with more levers it can pull to engineer better numbers. There is nothing wrong with this approach, even if the price offered for Capri is very toppy, but the intervention of the FTC into the case has thrown something of a wrench into the works.

GlobalData views the 1.8% revenue slump as Tapestry's "worst sales performance" in a year, indicating increased pressure on the company and that not all its brands are pulling their weight in the more challenging market environment.

However, it highlighted that while currency fluctuations have contributed to some of the decline, even after adjusting for these factors, group revenue did not grow compared to the previous year.

M&A dwindles after 2022

Companies in the apparel sector have historically relied on Mergers & Acquisitions (M&A) for driving growth, navigating inflationary environments and supply chain pressures amid muted demand for fashion.

Ed Bradley, founder and CEO of European dropshipping platform Virtualstock, told Just Style that M&A activity focused on fortifying supply chains should be a key tool in the arsenal of fashion executives going into 2024.

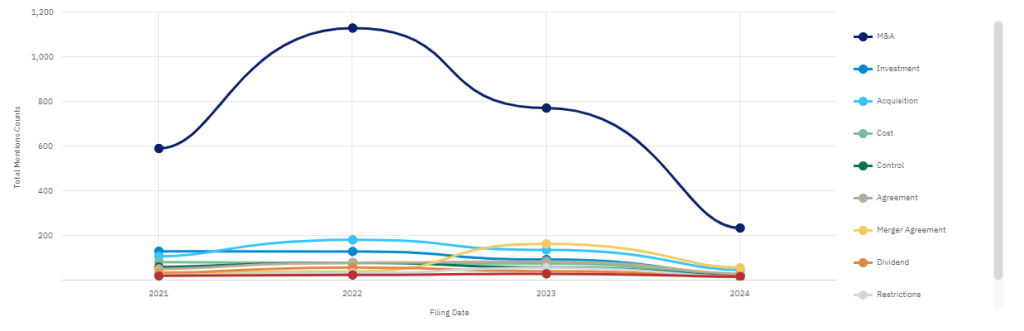

According to GlobalData's company filings data from May 2021 to 2024, mentions of M&A peaked in 2022 with the keyword being used 1,130 times before it dwindled to just 235 mentions in 2024.

Other keywords that followed were Merger Agreement and Acquisition with 57 and 47 mentions in 2024 so far, respectively. This illustrates a broader trend of lower M&A activity in the apparel sector currently.

Latest news

Explainer: Time to introduce Digital Product Passports in fashion?

As the requirement for textile products sold in the EU to have Digital Product Passports (DPPs) approaches, one expert tells Just Style that it is ‘time for action’.

Esprit puts German subsidiaries into administration on financial challenges

Esprit has filed for bankruptcy with a German court for its European subsidiaries, citing poor finances on the back of increased costs following the Covid-19 pandemic and international conflicts.

US April retail sales show consumers ‘willing to spend' despite high inflation

The NRF has cited data from the US Census Bureau to show retail sales moderated in April as consumers remain willing to spend despite 'stubbornly high inflation'.

SBTi seeks revamp of Corporate Net-Zero Standard

The Science Based Targets Initiative (SBTI) has announced a revision to the Corporate Net-Zero Standard.

Nike is most sought after brand on resale sites

Nike has topped the list of most sought after goods on resale sites according to a new survey from Depop which revealed over 1.1m listings on eBay and Depop.

In our previous edition

Apparel Decoded

Explainer: US fashion sector reels as tariffs on China imports stay in place

15 May 2024

Apparel Decoded

Explainer: Pros and cons of Shein ‘mulling' London float over NY listing

14 May 2024

Apparel Decoded

Explainer: Is France's fast-fashion tax idea about to create a domino effect?

13 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Medical Devices

Oil & Gas

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer