Insurance DECODED

Previous edition: 15 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

India general insurance sector to touch $57.3bn by 2028

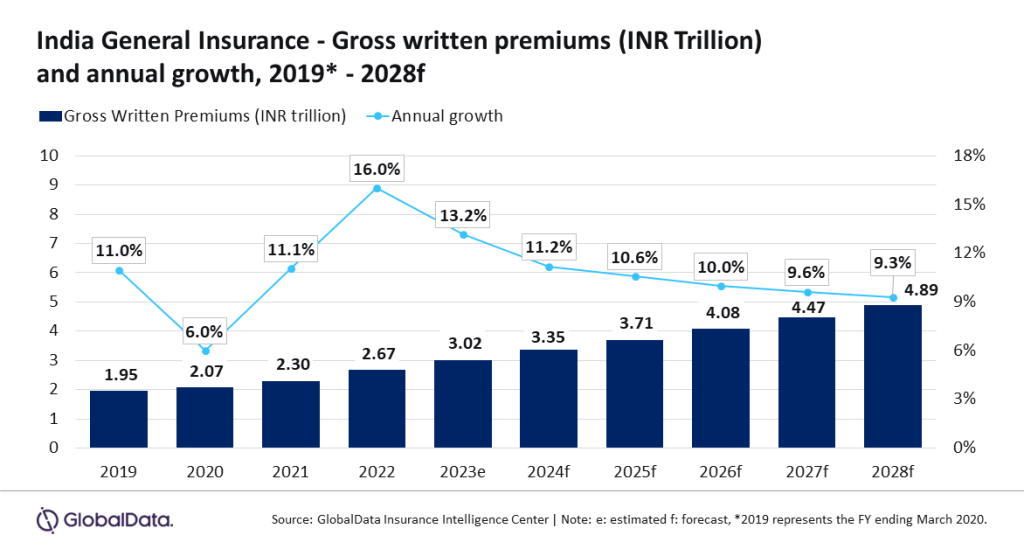

The general insurance industry in India is set to grow at a CAGR of 9.9% from INR3.35trn ($40.36bn) in 2024 to INR4.89trn ($57.3bn) in 2028, in terms of gross written premiums (GWP).

This is according to GlobalData, which also predicted that general insurance in India will grow by 11.2% in 2024. The rise will be driven by personal accident and health (PA&H), motor, and property insurance lines which totalled 93% of general insurance premiums in 2023.

Swetansha Chauhan, insurance analyst at GlobalData, said: “The general insurance industry in India continued its high growth trend and grew by 13.2% in 2023, driven by economic growth and rising disposable income. Rising consumer awareness of health and other general insurance products and robust regulatory reforms also supported India’s general insurance industry growth. The trend is expected to continue in 2024 and 2025.”

PA&H insurance is huge in India, accounting for 39.5% of the sector in 2024. It is also expected to grow by 14.5% in 2024, driven by increased health awareness following the Covid-19 pandemic and rising medical inflation.

Motor insurance is the second largest line in general insurance as GlobalData estimates it takes 31.1% of the industry.

Furthermore, it is expected to grow by 10.4% in 2024 due to rising vehicle sales.

Chauhan added: "The growth in vehicle sales was also fueled by the government's vehicle scrapping policy, which came into effect on April 1, 2023. The policy requires private vehicles older than 20 years and commercial vehicles older than fifteen years to be scrapped. Motor insurance is expected to grow at a CAGR of 7.9% during 2024-28."

Chauhan continued: “Recovery in the economy and rising disposable income will continue to support the growth of India’s general insurance industry during the next five years. Initiatives from the government and favorable regulatory reforms will help in increasing the insurance penetration rate in India (0.98%), which was lower as compared to other Asian markets such as Japan (1.75%), South Korea (1.46%), Hong Kong (1.65%) and China (1.26%) in 2023.”

Latest news

UK insurance group Jensten announces business restructuring

Jensten, a UK-based insurance broking and underwriting company, has unveiled a restructuring plan designed to foster growth and enhance the integration of its acquisitions.

Arch launches parametric event insurance cover

Arch Insurance International, a division of Arch Capital Group, has introduced a parametric event insurance solution.

Everest Insurance starts operations in Australia

Everest Insurance, part of the Bermuda-based Everest Group, has initiated its Australian operations following approval from the Australian Prudential Regulation Authority.

AXA, UPU partner to deliver insurance to underserved communities

AXA and the Universal Postal Union (UPU), a UN-backed specialist agency, have teamed up to expand inclusive insurance through postal networks.

DWF signs insurance AI Code of Conduct

Provider of integrated legal and business services DWF has signed onto the AI Code of Conduct for the insurance claims sector.

Tata AIG introduces insurance for Indian space industry

Indian general insurer Tata AIG has unveiled a Satellite In-Orbit Third-Party Liability Insurance policy to address the demands of the country’s rapidly expanding space industry.

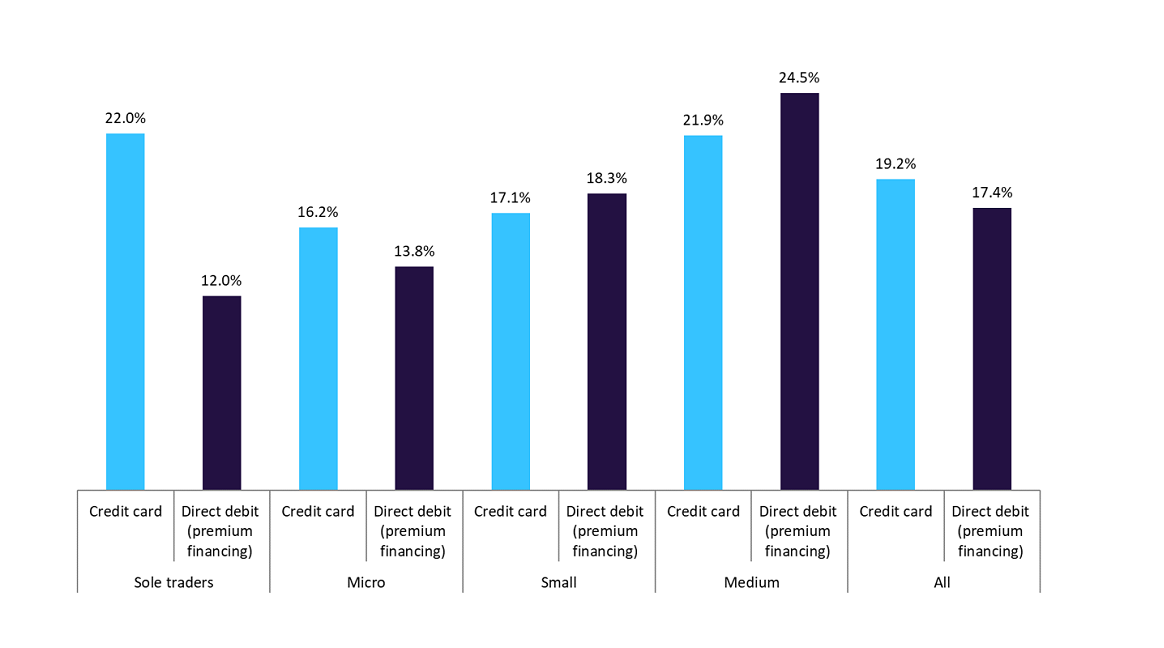

Larger-sized SMEs are more inclined to leverage credit for insurance purchases

GlobalData surveying has found that larger-sized SMEs are more likely to use credit to pay for their insurance purchases. Meanwhile, research from Premium Credit has found that the number of SMEs using credit to purchase insurance is growing.

Digital Transformation in Insurance Conference 2024

Applied Digital Corporation, a designer, builder and operator of next-generation digital infrastructure designed for High-Performance Computing applications, announced that, in light of a scheduling issue, has moved its fiscal third quarter 2024 earnings conference call to Thursday, April 11, 2024, at 5:00 p.m. Eastern time.

In our previous edition

Insurance Decoded

SunCar Technology teams up with Xiaomi's insurance affiliate

14 May 2024

Insurance Decoded

Blackstone announces plans to take I'rom Group private

13 May 2024

Insurance Decoded

Aurora partners AXA to launch new management liability policy

10 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer