Insurance DECODED

Previous edition: 15 May 2024

Share article

Get the full version straight to your inbox.

Exclusive access to our best-in-class data & intelligence

Subscribe now

Larger-sized SMEs are more inclined to leverage credit for insurance purchases

GlobalData surveying has found that larger-sized SMEs are more likely to use credit to pay for their insurance purchases. Meanwhile, research from Premium Credit has found that the number of SMEs using credit to purchase insurance is growing.

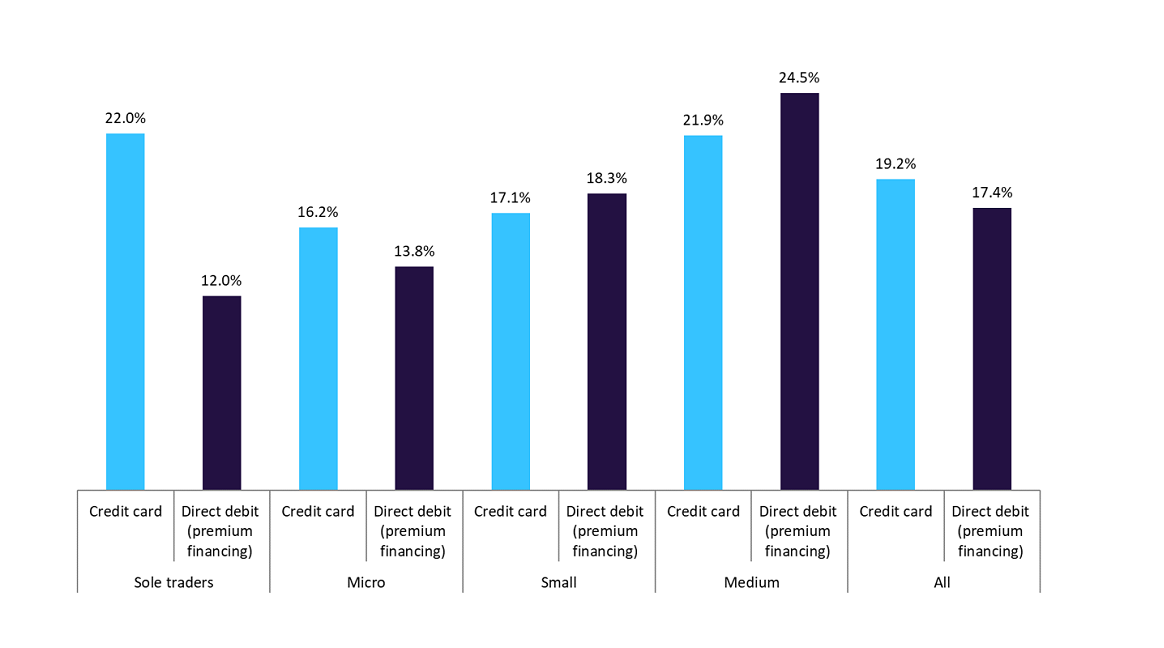

GlobalData’s 2023 UK SME Insurance Survey has found that medium-sized SMEs are more likely to utilise credit to manage their insurance expenses, with 21.9% opting for credit card payments and 24.5% choosing direct debit (premium financing). Conversely, smaller-sized businesses, such as sole traders or micro-sized firms, exhibit a lower propensity to use credit for insurance. For example, 16.2% of micro-sized businesses utilized credit card payments while 13.8% engaged in monthly direct debit (premium financing). This suggests that larger SMEs are more inclined to leverage credit options (credit card or premium financing) for insurance payments compared to smaller-sized businesses, indicating potential differences in financial strategies and risk management practices across various SME segments.

Medium-sized SMEs, with potentially larger revenue streams and more complex operational structures, may find it more feasible to leverage credit options such as credit card payments to manage insurance expenses. In contrast, smaller businesses, such as sole traders or micro-sized firms, may operate on tighter budgets and prefer alternative, less credit-dependent methods for insurance payments, reflecting their cautious approach to financial management and risk mitigation.

Meanwhile, research from Premium Credit has found that the number of SMEs using credit to pay for their insurance has increased in the past year, with nearly one in five of them increasing the amount they borrow. Premium Credit’s Insurance Index, which monitors insurance buying and how it is financed, shows 55% of SMEs now use some form of credit to pay for insurance. This represents a four-percentage-point increase when compared to the prior year.

The rise of SMEs resorting to credit for insurance payments can be attributed to the broader economic trend of increasing costs and premiums. Insurers often adjust their premiums to account for higher operational costs and potential increases in claim payouts due to inflationary pressures. As a result, businesses may find it challenging to manage these rising insurance expenses within their existing budgets. Consequently, they may turn to credit as a means to bridge the financial gap between their immediate cash flow and the mounting costs of insurance coverage. This reliance on credit enables SMEs to remain protected while mitigating the strain caused by inflation-induced premium hikes on their finances.

Insurers can assist SMEs facing rising costs and premiums by offering flexible payment options, such as instalment plans or deferred payment arrangements, to alleviate immediate financial strain. They can also provide tailored insurance packages that align with SMEs’ specific needs, optimising coverage while minimizing costs.

Latest news

UK insurance group Jensten announces business restructuring

Jensten, a UK-based insurance broking and underwriting company, has unveiled a restructuring plan designed to foster growth and enhance the integration of its acquisitions.

Arch launches parametric event insurance cover

Arch Insurance International, a division of Arch Capital Group, has introduced a parametric event insurance solution.

India general insurance sector to touch $57.3bn by 2028

The general insurance industry in India is set to grow at a CAGR of 9.9% from INR3.35trn ($40.36bn) in 2024 to INR4.89trn ($57.3bn) in 2028, in terms of gross written premiums (GWP).

Everest Insurance starts operations in Australia

Everest Insurance, part of the Bermuda-based Everest Group, has initiated its Australian operations following approval from the Australian Prudential Regulation Authority.

AXA, UPU partner to deliver insurance to underserved communities

AXA and the Universal Postal Union (UPU), a UN-backed specialist agency, have teamed up to expand inclusive insurance through postal networks.

DWF signs insurance AI Code of Conduct

Provider of integrated legal and business services DWF has signed onto the AI Code of Conduct for the insurance claims sector.

Tata AIG introduces insurance for Indian space industry

Indian general insurer Tata AIG has unveiled a Satellite In-Orbit Third-Party Liability Insurance policy to address the demands of the country’s rapidly expanding space industry.

Digital Transformation in Insurance Conference 2024

Applied Digital Corporation, a designer, builder and operator of next-generation digital infrastructure designed for High-Performance Computing applications, announced that, in light of a scheduling issue, has moved its fiscal third quarter 2024 earnings conference call to Thursday, April 11, 2024, at 5:00 p.m. Eastern time.

In our previous edition

Insurance Decoded

SunCar Technology teams up with Xiaomi's insurance affiliate

14 May 2024

Insurance Decoded

Blackstone announces plans to take I'rom Group private

13 May 2024

Insurance Decoded

Aurora partners AXA to launch new management liability policy

10 May 2024

Newsletters in other sectors

Aerospace, Defence & Security

Automotive

Banking & Payments

Travel and Tourism

Search companies, themes, reports, as well as actionable data & insights spanning 22 global industries

Access more premium companies when you subscribe to Explorer